false

--12-31

0000890394

0000890394

2023-12-15

2023-12-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event Reported):

December 15, 2023

PERASO INC.

(Exact Name of Registrant as Specified in Charter)

000-32929

(Commission File Number)

| Delaware |

|

77-0291941 |

(State or Other Jurisdiction

of Incorporation) |

|

(I.R.S. Employer

Identification Number) |

2309 Bering Dr.

San Jose, California 95131

(Address of principal executive offices, with zip

code)

(408) 418-7500

(Registrant’s telephone number, including area

code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

PRSO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by

Item 3.03 of Form 8-K, the information regarding the Reverse Stock Split (as defined below) contained in Item 5.03 of this Current Report

on Form 8-K is incorporated by reference herein.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

On December 15, 2023, Peraso

Inc. (the “Company”) filed an amendment to its Second Amended and Restated Certificate of Incorporation (as amended, the “Amended

and Restated Certificate of Incorporation”) (the “Charter Amendment”), with the Secretary of State of Delaware to implement

a 1-for-40 reverse stock split, such that every forty shares of the Company’s common stock, par value $0.001 per share (the “Common

Stock”), will be combined into one issued and outstanding share of Common Stock, with no change in the $0.001 par value per share

(the “Reverse Stock Split”).

The Reverse Stock Split and

Charter Amendment will be effective at 4:01 p.m., Eastern Time, on January 2, 2024. The Company expects that upon the opening of trading

on January 3, 2024, the Common Stock will begin trading on a post-split basis under CUSIP number 71360T200.

All equity awards outstanding

and Common Stock reserved for issuance under the Company’s equity incentive plans and warrants outstanding immediately prior to

the Reverse Stock Split will be appropriately adjusted by dividing the number of affected shares of Common Stock by 40 and, as applicable,

multiplying the exercise price by 40, as a result of the Reverse Stock Split. Exchangeable shares, which can be converted to Common Stock at any time by their respective holders, will also be adjusted to reflect the

Reverse Stock Split.

No fractional shares will

be outstanding following the Reverse Stock Split. Holders of fractional shares will be entitled to receive, in lieu of any fractional

share, the number of shares rounded up to the next whole number.

The foregoing description

of the Charter Amendment is not complete and is subject to, and qualified in its entirety by, the complete text of the Charter Amendment,

which is filed as Exhibit 3.1 to this Current Report on Form 8-K, and incorporated by reference herein.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 15, 2023, the

Company held its 2023 annual meeting of stockholders (the “Annual Meeting”), and a quorum for the transaction of business

was present in person virtually or represented by proxy, which represented approximately 33.55% of the voting power of the Company’s

outstanding shares of voting stock entitled to vote at the Annual Meeting. The Company’s stockholders voted on six proposals, which

are described in more detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on November

20, 2023, as supplemented on November 22, 2023 and December 12, 2023.

Summarized below are the final

voting results for each proposal submitted to a vote of the stockholders at the Annual Meeting:

| ● |

Proposal 1 - Election of directors to serve until the next annual meeting of stockholders. |

| |

|

For |

|

Withheld |

|

Broker Non-Vote |

| Ronald Glibbery |

|

6,996,507 |

|

606,725 |

|

2,002,760 |

| Daniel Lewis |

|

7,009,453 |

|

593,779 |

|

2,002,760 |

| Ian McWalter |

|

7,035,009 |

|

568,223 |

|

2,002,760 |

| Andreas Melder |

|

7,034,950 |

|

568,282 |

|

2,002,760 |

| Robert Y. Newell |

|

6,998,060 |

|

605,172 |

|

2,002,760 |

All of the foregoing candidates

were elected to serve as directors until the next annual meeting of stockholders and until the election and qualification of his successor

or his earlier resignation or removal.

| ● | Proposal 2 – Ratification

of the audit committee’s appointment of Weinberg & Company, P.A. as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2023. |

| For |

|

Against |

|

Abstain |

|

Broker Non-Vote |

| 9,292,090 |

|

234,223 |

|

79,679 |

|

- |

The foregoing proposal was approved.

| ● |

Proposal 3 – Amendment of the Amended and Restated Certificate

of Incorporation to effect a reverse stock split of the Common Stock at a ratio to be determined by the Company’s board of directors

(the “Board”) within one year of the date of the Annual Meeting. |

| For |

|

Against |

|

Abstain |

|

Broker Non-Vote |

| 8,690,660 |

|

826,936 |

|

88,396 |

|

- |

The foregoing proposal was approved.

| ● |

Proposal 4 – Approval, on an advisory basis, of the executive

compensation of the Company’s named executive officers. |

| For |

|

Against |

|

Abstain |

|

Broker Non-Vote |

| 6,180,810 |

|

1,345,323 |

|

77,099 |

|

2,002,760 |

The foregoing non-binding proposal was approved.

| ● |

Proposal 5 – Advisory vote on the frequency of future stockholder non-binding votes on compensation of the Company’s named executive officers. |

| One Year |

|

Two Years |

|

Three Years |

|

Abstentions |

| 1,948,497 |

|

38,040 |

|

5,369,247 |

|

247,448 |

Consistent with the Board’s

recommendation, the Company’s stockholders, on an advisory basis, voted in favor of a three-year frequency of future advisory votes

to approve the compensation of the Company’s named executive officers.

| ● |

Proposal 6 – Approval of one or more adjournments of the Annual Meeting. |

| For |

|

Against |

|

Abstain |

|

Broker Non-Vote |

| 8,250,860 |

|

1,159,644 |

|

195,488 |

|

- |

The foregoing proposal was approved.

Item 8.01 Other Events.

On December 19, 2023, the

Company issued a press release announcing the Reverse Stock Split. A copy of the press release is attached as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PERASO INC. |

| |

|

| Date: December 19, 2023 |

By: |

/s/ James Sullivan |

| |

|

James Sullivan

Chief Financial Officer |

4

Exhibit 3.1

CERTIFICATE OF AMENDMENT OF

RESTATED CERTIFICATE OF INCORPORATION OF PERASO

INC.

Peraso Inc. (the “Corporation”),

a corporation duly organized and existing under the General Corporation Law of the State of Delaware, does hereby certify that:

1. The Restated Certificate

of Incorporation of the Corporation, filed with the Secretary of State of the State of Delaware on November 12, 2010, as amended

on February 14, 2017, August 27, 2019 and December 15, 2021 (collectively referred to as the “Amended Restated Certificate”),

is hereby amended by deleting paragraph (A) of Article IV of the Amended Restated Certificate in its entirety and substituting

the following in lieu thereof:

“The Corporation shall

be authorized to issue 140,000,000 shares of capital stock, of which 120,000,000 shares shall be shares of Common Stock, $0.001

par value (“Common Stock”) and 20,000,000 shares shall be shares of Preferred Stock, $0.01 par value (“Preferred

Stock”) of which one (1) share, par value $0.01 per share, are designated “Series A Special Voting Preferred Stock”

pursuant to the certificate of designation that created such series filed with the Secretary of State of the State of Delaware. Upon this

Certificate of Amendment to the Restated Certificate of Incorporation of the Corporation becoming effective pursuant to the General Corporation

Law of the State of Delaware (the “Effective Time”), every forty (40) shares of the Corporation’s common stock, par

value $0.001 per share (the “Old Common Stock”), issued and outstanding immediately prior to the Effective Time, will

be automatically reclassified as and converted into one (1) share of common stock, par value $0.001 per share, of the Corporation (the “New

Common Stock”).

Notwithstanding the immediately

preceding sentence, no fractional interest in a share of New Common Stock shall be issued to the holders of record of Old Common Stock

in connection with the foregoing reclassification of shares of Old Common Stock, all of which shares of New Common Stock shall be rounded

up to the nearest whole number of such shares. No stockholders will receive cash in lieu of fractional shares.

Each stock certificate that,

immediately prior to the Effective Time, represented shares of Old Common Stock shall, from and after the Effective Time, automatically

and without the necessity of presenting the same for exchange, represent that number of whole shares of New Common Stock into which the

shares of Old Common Stock represented by such certificate shall have been reclassified (after giving effect to the rounding of fractional

shares as set forth in the immediately preceding paragraph), provided, however, that each holder of record of a certificate that represented

shares of Old Common Stock shall receive, upon surrender of such certificate, a new certificate representing the number of whole shares

of New Common Stock into which the shares of Old Common Stock represented by such certificate shall have been reclassified.”

2. The foregoing amendment

was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

3. This Certificate of Amendment

shall become effective as of January 2, 2024 at 4:01 p.m. Eastern Time.

* * * *

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be signed by its officer thereunto duly authorized this day of December 15, 2023.

| |

PERASO INC. |

| |

|

|

| |

By: |

/s/ Ronald Glibbery |

| |

Name: |

Ronald Glibbery |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Peraso Announces 1-for-40 Reverse Stock Split

SAN JOSE, Calif., December 19, 2023 –

Peraso Inc. (NASDAQ: PRSO) (“Peraso” or the “Company”), a leader in mmWave technology, today announced that

it will effect a 1-for-40 reverse stock split of its outstanding common stock. The reverse stock split will become effective at 4:01pm

ET on January 2, 2024. The common stock is expected to begin trading on a split-adjusted basis on the Nasdaq Capital Market (“Nasdaq”)

under the same symbol “PRSO” when the market opens on January 3, 2024, with the new CUSIP number 71360T200.

The reverse stock split was approved by the Company’s

stockholders at the Company’s 2023 Annual Meeting, held on December 15, 2023. The reverse stock split is intended to increase the

per share trading price of the Company’s common stock to satisfy the $1.00 minimum bid price requirement for continued listing on

Nasdaq. The reverse stock split will reduce the number of outstanding shares of the Company’s common stock and exchangeable

shares from approximately 30.7 million shares pre-reverse split to approximately 767,000 shares post-reverse split. The exchangeable shares

can be converted to common stock at any time by their respective holders.

The number of authorized shares of common stock

and the par value per share will remain unchanged. As a result of the reverse stock split, every 40 shares of the Company’s pre-reverse

split common stock or exchangeable shares will be combined and reclassified into one share of common stock or exchangeable share, as applicable.

Proportionate voting rights and other rights of such holders will not be affected by the reverse stock split. Holders of fractional shares

will be entitled to receive the number of shares rounded up to the next whole number.

All equity awards outstanding and common stock

reserved for issuance under the Company’s equity incentive plans and warrants outstanding immediately prior to the reverse stock

split will be appropriately adjusted by dividing the number of affected shares of common stock by 40 and, as applicable, multiplying the

exercise price by 40, as a result of the reverse stock split.

The Company’s transfer agent, Equiniti Trust

Company, is acting as exchange agent for the reverse stock split and will send instructions to stockholders of record regarding the exchange

of certificates for common stock for uncertificated shares of common stock. Stockholders owning shares via a broker or other nominee will

have their positions automatically adjusted to reflect the reverse stock split, subject to the brokers’ particular processes, and

will not be required to take any action in connection with the reverse stock split.

Additional information about the reverse stock

split can be found in the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission (SEC) on November

20, 2023, as supplemented on November 22, 2023 and December 12, 2023. The Proxy Statement is available at www.sec.gov or at

the Company’s website at www.perasoinc.com. Additional information regarding this reverse stock split can be found in the Company’s

Form 8-K to be filed with the SEC on or about December 19, 2023.

Forward-Looking Statements

This press release may contain forward-looking

statements about the Company, including, without limitation, the Company’s expectations regarding anticipated compliance with Nasdaq’s

minimum bid price rules. Forward-looking statements are based on certain assumptions and expectations of future events that are subject

to risks and uncertainties. Actual results and trends may differ materially from historical results or those projected in any such forward-looking

statements depending on a variety of factors. These factors

include, but are not limited, to the following:

| ● | our

ability to continue as a going concern; |

| | | |

| ● | our

ability to raise additional capital to fund our operations; |

| | | |

| ● | our

ability to continue to meet Nasdaq’s listing standards; |

| | | |

| ● | the

process in which we engage to evaluate strategic alternatives; |

| | | |

| ● | the

terms, timing, structure, benefits and costs of any strategic transaction and whether one

will be consummated at all; |

| | | |

| ● | the

impact of any strategic transaction on the Company; |

| | | |

| ● | annual

expense savings expected from the Company’s cost reduction initiatives; |

| | | |

| ● | the

timing of customer orders and product shipments; |

| | | |

| ● | risks

related to the lasting effects of the COVID-19 pandemic that may have an adverse impact on

the Company’s business and financial results and result in component shortages and

increased lead times that may negatively impact the Company’s ability to ship its products; |

| | | |

| ● | customer

concentrations and length of billing and collection cycles, which may be impacted in the

event of a global recession or economic downturn; |

| | | |

| ● | our

ability to enhance our existing proprietary technologies and develop new technologies; |

| | | |

| ● | achieving

additional design wins for our products through the acceptance and adoption of our technology

by potential customers and their suppliers; |

| | | |

| ● | difficulties

and delays in the production, testing and marketing of our products; |

| | | |

| ● | reliance

on our manufacturing partners to assist successfully with the fabrication of our and production

of our products; |

| ● | impacts

of the end-of-life of our memory products; |

| | | |

| ● | availability

of quantities of our products supplied by our manufacturing partners at a competitive cost; |

| | | |

| ● | level

of intellectual property protection provided by our patents, the expenses and other consequences

of litigation, including intellectual property infringement litigation, to which we may be

or may become a party from time to time; |

| | | |

| ● | vigor

and growth of markets served by our customers and our operations; and |

| | | |

| ● | other

risks identified in the Company’s public filings it makes with the SEC. |

Peraso

does not intend to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes

available or other events occur in the future.

About Peraso Inc.

Peraso Inc. (NASDAQ: PRSO) is a pioneer in high

performance 60 GHz unlicensed and 5G mmWave wireless technology, offering chipsets, antenna modules, software and IP. Peraso supports

a variety of applications, including fixed wireless access, immersive video and factory automation. In addition, Peraso’s solutions

for data and telecom networks focus on Accelerating Data Intelligence and Multi-Access Edge Computing, providing end-to-end solutions

from the edge to the centralized core and into the cloud. For additional information, please visit www.perasoinc.com.

Company Contact:

Jim Sullivan, CFO

Peraso Inc.

P: 408-418-7500

E: jsullivan@perasoinc.com

Investor Relations Contacts:

Shelton Group

Brett L. Perry | Leanne K. Sievers

P: 214-272-0070| 949-224-3874

E: sheltonir@sheltongroup.com

3

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

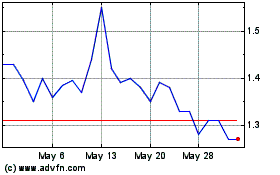

Peraso (NASDAQ:PRSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

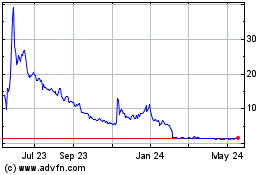

Peraso (NASDAQ:PRSO)

Historical Stock Chart

From Apr 2023 to Apr 2024