UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission File Number 000-27115

PCTEL, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

| Delaware |

|

77-0364943 |

| (State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

|

|

| 471 Brighton Drive,

Bloomingdale IL |

|

60108 |

| (Address of Principal Executive Office) |

|

(Zip Code) |

(630) 372-6800

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class |

|

Name of each exchange on which registered |

| Common Stock, $.001 Par Value Per Share |

|

The NASDAQ Select Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by

check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on the Company’s website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T ((§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was acquired to submit and post such files)

). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is

not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of

the Exchange Act.:

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Act). Yes ¨ No x

As of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, there were 18,448,137

shares of the registrant’s common stock outstanding, and the aggregate market value of such shares held by non-affiliates of the registrant (based upon the closing sale price of such shares on the NASDAQ Global Select Market on June 30,

2014) was approximately $149,245,428. Shares of the registrant’s common stock held by each executive officer and director and by each entity that owns 5% or more of the registrant’s outstanding common stock have been excluded because such

persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purposes.

18,696,090 shares of common stock were issued and outstanding as of March 9, 2015.

Documents Incorporated by Reference

Certain sections of the registrant’s definitive proxy statement relating to its 2015 Annual Stockholders’ Meeting to be held on June 11, 2015

are incorporated by reference into Part III of this Annual Report on Form 10-K. The Company intends to file its proxy statement within 120 days after the end of its fiscal year end to which this report relates.

PCTEL, Inc.

Form 10-K

For the Fiscal

Year Ended December 31, 2014

TABLE OF CONTENTS

2

PART I

This Annual Report on Form 10-K contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, among other things,

statements concerning our future operations, financial condition and prospects, and business strategies. The words “believe”, “expect”, “anticipate” and other similar expressions generally identify forward-looking

statements. Investors in our common stock are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are subject to substantial risks and uncertainties that could cause our future business,

financial condition, or results of operations to differ materially from the historical results or currently anticipated results. Investors should carefully review the information contained in Item 1A. Risk Factors and elsewhere in, or

incorporated by reference into, this Annual Report on Form 10-K. Other factors not currently anticipated may also materially and adversely affect our results of operations, cash flows and financial position. There can be no assurance that future

results will meet expectations. While we believe that the forward-looking statements in this Annual Report on Form 10-K are reasonable, investors should not place undue reliance on any forward-looking statements. In addition, these statements speak

only as of the date made. We do not undertake, and expressly disclaim any obligation to update or alter any statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Overview

PCTEL, Inc. (“PCTEL”, the

“Company”, “we”, “ours”, and “us”) delivers Performance Critical Telecom solutions. PCTEL RF Solutions™ develops and provides test equipment, software and engineering services for

wireless networks. The industry relies upon PCTEL to benchmark network performance, analyze trends, and optimize wireless networks. PCTEL Connected Solutions™ designs and delivers performance critical antennas and site solutions for wireless

networks globally. Our antennas support evolving wireless standards for cellular, private, and broadband networks. PCTEL antennas and site solutions support networks worldwide, including SCADA for oil, gas and utilities, fleet management, industrial

operations, health care, small cell and network timing deployment, defense, public safety, education, and broadband access.

PCTEL was incorporated in

California in 1994 and reincorporated in Delaware in 1998. Our principal executive offices are located at 471 Brighton Drive, Bloomingdale, Illinois 60108. Our telephone number at that address is (630) 372-6800 and our website is

www.pctel.com. The information within, or that can be accessed through, our website, is not part of this report.

Segment Reporting

Effective January 1, 2013, PCTEL operates in two segments for reporting purposes, RF Solutions and Connected Solutions. As of January 1,

2013, our chief operating decision maker uses the profit and loss results through operating profit and identified assets for the Connected Solutions and RF Solutions segments to make operating decisions. Each segment has its own segment manager as

well as its own engineering, sales and marketing, and operational general and administrative functions. All of our accounting and finance, human resources, IT and legal functions are provided on a centralized basis through the corporate function. We

manage the balance sheet and cash flows centrally at the corporate level, with the exception of trade accounts receivable and inventory which is managed at the segment level. Each of the segment managers reports to and maintains regular contact with

the chief operating decision maker to discuss operating activities, financial results, forecasts, or plans for the segment. The 2012 segment information presented in the financial statements have been presented on a retrospective basis reflecting

the Connected Solutions and RF Solutions segments on a consistent basis with the current period.

For the fiscal year ended December 31, 2012, PCTEL

operated in two different segments, PCTEL Secure, and the rest of the Company. Our chief operating decision maker used the profit and loss results and the assets for those two segments to make operating decisions in 2012. On April 30, 2013, we

divested all material assets associated with PCTEL Secure’s ProsettaCore™ technology to Redwall Technologies, LLC (“Redwall”), a development organization that specializes in mobile security, military and defense projects and

systems, and critical national infrastructure. See Footnote 3 of the consolidated financial statements for more information on the sale of PCTEL Secure.

Connected Solutions Segment

Connected Solutions designs

and delivers performance critical antennas and site solutions for wireless networks globally. Our antennas and site solutions support networks worldwide, including SCADA (“Supervisory Control and Data Acquisition”) for oil, gas and

utilities, fleet management, industrial operations, health care, small cell and network timing deployment, defense, public safety,

3

education, and broadband access. PCTEL’s performance critical MAXRAD® and Bluewave™ antenna solutions include high rejection and

high performance GPS and GNSS products, the industry leading Yagi portfolio, mobile and indoor LTE, broadband, and LMR antennas and PIM-rated antennas for transit, in-building, and small cell applications. We provide performance critical mobile

towers for demanding emergency and oil and gas network applications and leverage our design, logistics, and support capabilities to deliver performance critical site solutions into carrier, railroad, and utility applications. Revenue growth for

antenna and site solutions is primarily driven by the increased use of wireless communications in these vertical markets. PCTEL’s antenna and site solution products are primarily sold through distributors, value-added resellers, and original

equipment manufacturer (“OEM”) providers. The current antenna and site solutions product portfolio and expansion into these vertical markets resulted from organic growth and a series of six acquisitions, the most recent being the

acquisition of certain assets of TelWorx Communications LLC, TelWorx U.K. Limited, TowerWorx LLC, and TowerWorx International, Inc. (collectively “TelWorx”), in July 2012.

There are many competitors for antenna products, as the market is highly fragmented. Competitors include Laird (Cushcraft, Centurion, and Antennex brands),

Mobile Mark, Radiall/Larsen, Comtelco, Wilson, Commscope (Andrew products), Kathrein, among others. We seek out product applications that command a premium for product performance and customer service, and avoid commodity markets.

PCTEL maintains expertise in several technology areas in order to be competitive in the antenna engineered site solutions market. These include radio

frequency engineering, mobile antenna design and manufacturing, mechanical engineering, product quality and testing, and wireless network engineering.

RF Solutions Segment

RF Solutions develops and provides

performance critical test equipment, software, and engineering services for wireless networks. The industry relies upon PCTEL to benchmark network performance, analyze trends, and optimize wireless networks. SeeGull® scanning receivers are used around the world for indoor and drive test applications, including baseline testing, acceptance testing, competitive benchmarking, spectrum clearing, troubleshooting,

and network optimization. SeeGull scanning receivers provide high quality real-world RF measurements needed to build, tune, troubleshoot, and expand commercial wireless networks. Our highly-trained engineering services team uses state-of-the-art

test, measurement, and design tools to provide engineering services for in-building and outdoor networks. Our engineering services team (“NES”), which commenced in 2011 with the acquisition of certain assets from Envision Wireless Inc.

(“Envision”), provides wireless network testing, optimization, design, integration, and consulting services, with an emphasis on in-building distributed antenna systems (“DAS”). Revenue growth for the segment’s products and

services is driven by the deployment of products based on new wireless technology and the need for wireless networks to be tuned and reconfigured on a regular basis. Our scanning receiver products are sold primarily through test and measurement

value-added resellers and to a lesser extent directly to network operators. Competitors for these products are OEMs such as JDS Uniphase, Rohde and Schwarz, Anritsu, Digital Receiver Technology, and Berkley Varitronics.

On February 27, 2015, PCTEL, Inc. acquired substantially all of the assets of, and assumed certain specified liabilities of, Nexgen Wireless, Inc., an

Illinois corporation (“Nexgen”), pursuant to an Asset Purchase Agreement dated as of February 27, 2015 (the “Acquisition Agreement”) among PCTEL, Nexgen, Bhumika Thakkar 2012 Irrevocable Trust Number One, Bhumika Thakkar

2012 Irrevocable Trust Number Two, and Jigar Thakkar, and Bhumika Thakkar.

The business of Nexgen is based in Schaumburg, Illinois. Nexgen provides

Meridian™, a network analysis tool portfolio, and engineering services. Nexgen’s Meridian software product portfolio translates real-time network performance data into engineering actions to optimize operator performance. Meridian, with

its modules of Network IQ™, Subscriber IQ™, and Map IQ™, supports crowd-based, cloud-based data analysis to enhance network performance. Nexgen provides performance engineering, specialized staffing, and trend analysis for carriers,

infrastructure vendors, and neutral hosts for 2G, 3G, 4G, and LTE networks. Refer to footnote 17 of the financial statements related to subsequent events for more information on the Nexgen acquisition.

PCTEL maintains expertise in several technology areas in order to be competitive in the scanning receiver and related engineering services market. These

include radio frequency engineering, DSP engineering, manufacturing, mechanical engineering, product quality and testing, and wireless network engineering.

Major Customers

There were no customers that accounted

for 10% or greater of revenues or accounts receivable during the fiscal years ended December 31, 2014, 2013, or 2012, respectively.

4

International Activities

The following table shows the percentage of revenues from domestic and foreign sales of our operations during the last three fiscal years:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| Region |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Europe, Middle East, & Africa |

|

|

11 |

% |

|

|

13 |

% |

|

|

13 |

% |

| Asia Pacific |

|

|

11 |

% |

|

|

10 |

% |

|

|

10 |

% |

| Other Americas |

|

|

5 |

% |

|

|

6 |

% |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Foreign sales |

|

|

27 |

% |

|

|

29 |

% |

|

|

30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Domestic sales |

|

|

73 |

% |

|

|

71 |

% |

|

|

70 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog

Sales of our

products are generally made pursuant to standard purchase orders, which are officially acknowledged according to standard terms and conditions. The backlog, while useful for scheduling production, is not a meaningful indicator of future revenues as

the order to ship cycle is extremely short.

Research and Development

We recognize that a strong technology base is essential to our long-term success and we have made a substantial investment in engineering and research and

development. We will continue to devote substantial resources to product development and patent submissions. The patent submissions are primarily for defensive purposes, rather than for potential license revenue generation. We monitor changing

customer needs and work closely with our customers, consultants and market research organizations to track changes in the marketplace, including emerging industry standards.

Research and development expenses include costs for hardware and related software development, prototyping, certification and pre-production costs. We spent

approximately $11.7 million, $11.1 million, and $9.3 million in the fiscal years 2014, 2013, and 2012, respectively, in research and development.

Sales, Marketing and Support

We supply our products to

public and private carriers, wireless infrastructure providers, wireless equipment distributors, value added resellers (“VARs”) and OEMs. PCTEL’s direct sales force is technologically sophisticated and sales executives have

strong industry domain knowledge. Our direct sales force supports the sales efforts of our distributors and OEM resellers.

Our marketing strategy is

focused on building market awareness and acceptance of our new products. The marketing organization also provides a wide range of programs, materials and events to support the sales organization. We spent approximately $13.0 million, $12.1

million, and $11.3 million in fiscal years 2014, 2013, and 2012, respectively, for sales and marketing support.

Manufacturing

We do final assembly of most of our antenna products and all of our OEM receiver and interference management product lines. We also have arrangements with

several contract manufacturers but are not dependent on any one. If any of our contract manufacturers are unable to provide satisfactory services for us, other contract manufacturers are available, although engaging a new contract manufacturer could

cause unwanted delays and additional costs. We have no material guaranteed supply contracts or long-term agreements with any of our suppliers. We do have open purchase orders with our suppliers. See the contractual obligations and commercial

commitments section of Item 7 for information on purchase commitments.

5

Employees

As of December 31, 2014, we had 465 full-time equivalent employees, consisting of 300 in operations, 65 in sales and marketing, 57 in research and

development, and 43 in general and administrative functions. Total full-time equivalent employees were 449 and 467 at December 31, 2013 and 2012, respectively. Headcount increased by 16 at December 31, 2014 from December 31, 2013

primarily due to increases in production personnel. None of our employees are represented by a labor union. We consider employee relations to be good.

Available Information

Our annual reports on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports, are available free of charge through our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the

United States Securities and Exchange Commission (the “SEC”). Our website is located at the following address: www.pctel.com. The information within, or that can be accessed through, our website, is not part of this Annual Report on

Form 10-K. Further, any materials we file with the SEC may be read and copied by the public at the SEC’s Public Reference Room, located at 100 F Street, N.E., Room 1580, Washington D.C. 20549. Information regarding the operation of the Public

Reference Room can be obtained by calling the SEC at 1(800) SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov.

Factors That May Affect Our Business, Financial Condition and Future Operations

Risks Related to Our Business

Competition within the wireless product industry is intense and is expected to increase significantly. Our failure to compete successfully could materially

harm our prospects and financial results.

The antenna market is highly fragmented and is served by many local product providers. We may not be able

to displace established competitors from their customer base with our products.

Many of our present and potential competitors have substantially greater

financial, marketing, technical and other resources with which to pursue engineering, manufacturing, marketing, and distribution of their products. These competitors may succeed in establishing technology standards or strategic alliances in the

connectivity products markets, obtain more rapid market acceptance for their products, or otherwise gain a competitive advantage. We can offer no assurance that we will succeed in developing products or technologies that are more effective than

those developed by our competitors. We can offer no assurance that we will be able to compete successfully against existing and new competitors as the connectivity wireless markets evolve and the level of competition increases.

Our wireless business is dependent upon the continued growth and evolution of the wireless industry.

Our future success is dependent upon the continued growth and evolution of the wireless industry. The growth in demand for wireless products and services may

not continue at its current rate or at all. Any decrease in the growth of the wireless industry could have a material adverse effect on the results of our operations.

Our future success depends on our ability to develop and successfully introduce new and enhanced products for the wireless market that meet the needs of

our customers.

Our revenue depends on our ability to anticipate our existing and prospective customers’ needs and develop products that address

those needs. Our future success will depend on our ability to introduce new products for the wireless market, anticipate improvements and enhancements in wireless technology and wireless standards, and to develop products that are competitive in the

rapidly changing wireless industry. Introduction of new products and product enhancements will require coordination of our efforts with those of our customers, suppliers, and manufacturers to rapidly achieve volume production. If we fail to

coordinate these efforts, develop product enhancements or introduce new products that meet the needs of our customers as scheduled, our operating results will be materially and adversely affected and our business and prospects will be harmed. We

cannot assure that product introductions will meet the anticipated release schedules or that our wireless products will be competitive in the market. Furthermore, given the emerging nature of the wireless market, there can be no assurance our

products and technology will not be rendered obsolete by alternative or competing technologies.

6

We may experience integration or other problems with potential acquisitions, which could have an adverse

effect on our business or results of operations. New acquisitions could dilute the interests of existing stockholders, and the announcement of new acquisitions could result in a decline in the price of our common stock.

We may in the future make acquisitions of, or large investments in, businesses that offer products, services, and technologies that we believe would

complement our products or services, including wireless products and technology. We may also make acquisitions of or investments in, businesses that we believe could expand our distribution channels. Even if we were to announce an acquisition, we

may not be able to complete it. Additionally, any future acquisition or substantial investment would present numerous risks, including:

| |

• |

|

difficulty in integrating the technology, operations, internal accounting controls or work force of the acquired business with our existing business, |

| |

• |

|

disruption of our on-going business, |

| |

• |

|

difficulty in realizing the potential financial or strategic benefits of the transaction, |

| |

• |

|

difficulty in maintaining uniform standards, controls, procedures and policies, |

| |

• |

|

dealing with tax, employment, logistics, and other related issues unique to international organizations and assets we acquire, |

| |

• |

|

possible impairment of relationships with employees and customers as a result of integration of new businesses and management personnel, and |

| |

• |

|

impairment of assets related to resulting goodwill, and reductions in our future operating results from amortization of intangible assets. |

We expect that future acquisitions could provide for consideration to be paid in cash, shares of our common stock, or a combination of cash and our common

stock. If consideration for a transaction is paid in common stock, this would further dilute our existing stockholders. We may also incur debt to pay for an acquisition.

Our gross profit may vary based on the mix of sales of our products, and these variations may cause our net income to decline.

Depending on the mix of our products and services sold, our gross profit could vary significantly from quarter to quarter. Generally, antenna products and

engineering services have a lower profit margin than scanning receiver products creating the variance in gross profits related to profit mix. In addition, due in part to the competitive pricing pressures that affect our products and in part to

increasing component and manufacturing costs, we expect gross profit from both existing and future products to decrease over time. A variance or decrease of our gross profit could have a negative impact on our financial results and cause our net

income to decline.

Any delays in our sales cycles could result in customers canceling purchases of our products.

Sales cycles for our products with major customers can be lengthy, often lasting nine months or longer. In addition, it can take an additional nine months or

more before a customer commences volume production of equipment that incorporates our products. Sales cycles with our major customers are lengthy for a number of reasons, including:

| |

• |

|

our OEM customers and carriers usually complete a lengthy technical evaluation of our products, over which we have no control, before placing a purchase order, |

| |

• |

|

the development and commercial introduction of products incorporating new technologies frequently are delayed. |

A significant portion of our operating expenses is relatively fixed and is based in large part on our forecasts of volume and timing of orders. The lengthy

sales cycles make forecasting the volume and timing of product orders difficult. In addition, the delays inherent in lengthy sales cycles raise additional risks of customer decisions to cancel or change product phases. If customer cancellations or

product changes were to occur, this could result in the loss of anticipated sales without sufficient time for us to reduce our operating expenses.

We

generally rely on independent companies to manufacture, assemble and test our products. If these companies do not meet their commitments to us, or if our own assembly operations are impaired, our ability to sell products to our customers would be

impaired.

7

We have limited manufacturing capability. For some product lines we outsource the manufacturing, assembly, and

testing of printed circuit board subsystems. For other product lines, we purchase completed hardware platforms and add our proprietary software. While there is no unique capability with these suppliers, any failure by these suppliers to meet

delivery commitments would cause us to delay shipments and potentially be unable to accept new orders for product.

In addition, in the event that these

suppliers discontinued the manufacture of materials used in our products, we would be forced to incur the time and expense of finding a new supplier or to modify our products in such a way that such materials were not necessary. Either of these

alternatives could result in increased manufacturing costs and increased prices of our products.

We assemble our antenna products in our facilities

located in Illinois and China. We may experience delays, disruptions, capacity constraints or quality control problems at our assembly facilities, which could result in lower yields or delays of product shipments to our customers. In addition, we

are having a number of our antenna products manufactured in China via contract manufacturers. Any disruption of our own or contract manufacturers’ operations could cause us to delay product shipments, which would negatively impact our sales,

competitive reputation and position. In addition, if we do not accurately forecast demand for our products, we will have excess or insufficient parts to build our products, either of which could seriously affect our operating results.

In order for us to operate at a profitable level and continue to introduce and develop new products for emerging markets, we must attract and retain our

executive officers and qualified technical, sales, support and other administrative personnel.

Our performance is substantially dependent on the

performance of our current executive officers and certain key engineering, sales, marketing, financial, technical and customer support personnel. If we lose the services of our executives or key employees, replacements could be difficult to recruit

and, as a result, we may not be able to grow our business.

Competition for personnel, especially qualified engineering personnel, is intense. We are

particularly dependent on our ability to identify, attract, motivate and retain qualified engineers with the requisite education, background and industry experience. As of December 31, 2014, we employed a total of 57 people in our research and

development department. If we lose the services of one or more of our key engineering personnel, our ability to continue to develop products and technologies responsive to our markets may be impaired.

We may be subject to litigation regarding intellectual property associated with our wireless business and this could be costly to defend and could prevent

us from using or selling the challenged technology.

In recent years, there has been significant litigation in the United States involving

intellectual property rights. We expect potential claims in the future, including with respect to our wireless business. Intellectual property claims against us, and any resulting lawsuits, may result in our incurring significant expenses and could

subject us to significant liability for damages and invalidate what we currently believe are our proprietary rights. These claims, regardless of their merits or outcome, would likely be time-consuming and expensive to resolve and could divert

management’s time and attention. This could have a material and adverse effect on our business, results of operation, financial condition and prospects. Any intellectual property litigation disputes related to our wireless business could also

force us to do one or more of the following:

| |

• |

|

cease selling, incorporating or using technology, products or services that incorporate the disputed intellectual property, |

| |

• |

|

obtain from the holder of the disputed intellectual property a license to sell or use the relevant technology, which license may not be available on acceptable terms, if at all, or |

| |

• |

|

redesign those products or services that incorporate the disputed intellectual property, which could result in substantial unanticipated development expenses. |

If we are subject to a successful claim of infringement related to our wireless intellectual property and we fail to develop non-infringing intellectual

property or license the infringed intellectual property on acceptable terms and on a timely basis, operating results could decline, and our ability to grow and sustain our wireless business could be materially and adversely affected. As a result,

our business, financial condition, results of operation and prospects could be impaired.

We may in the future initiate claims or litigation against third

parties for infringement of our intellectual property rights or to determine the scope and validity of our proprietary rights or the proprietary rights of our competitors. These claims could also result in significant expense and the diversion of

technical and management personnel’s attention.

8

Undetected failures found in new products may result in a loss of customers or a delay in market acceptance of

our products.

To date, we have not been made aware of any significant failures in our products. However, despite testing by us and by current and

potential customers, errors may be found in new products after commencement of commercial shipments, which could result in loss of revenue, loss of customers or delay in market acceptance, any of which could adversely affect our business, operating

results, and financial condition. We cannot assure that our efforts to monitor, develop, modify and implement appropriate test and manufacturing processes for our products will be sufficient to avoid failures in our products that result in delays in

product shipment, replacement costs or potential damage to our reputation, any of which could harm our business, operating results and financial condition.

Conducting business in foreign countries involve additional risks.

A substantial portion of our manufacturing, research and development, and marketing activities is conducted outside the United States, including the United

Kingdom, Israel, Hong Kong, and China. There are a number of risks inherent in doing business in foreign countries, including: unfavorable political or economic factors; unexpected legal or regulatory changes; lack of sufficient protection for

intellectual property rights; difficulties in recruiting and retaining personnel and managing international operations; and less developed infrastructure. If we are unable to manage successfully these and other risks pertaining to our international

activities, our operating results, cash flows and financial position could be materially and adversely affected.

Our financial position and results of

operations may be adversely affected if tax authorities challenge us and the tax challenges result in unfavorable outcomes.

We currently have

international subsidiaries located in China, United Kingdom, and Israel as well as an international branch office located in Hong Kong. The complexities resulting from operating in several different tax jurisdictions increase our exposure to

worldwide tax challenges. In the event a review of our tax filings results in unfavorable adjustments to our tax returns, our operating results, cash flows and financial position could be materially and adversely affected.

Conducting business in international markets involves foreign exchange rate exposure that may lead to reduced profitability.

We currently have operations in United Kingdom, Israel, Hong Kong, and China. Fluctuations in the value of the U.S. dollar relative to other currencies may

impact our revenues, cost of revenues and operating margins and may result in foreign currency translation gains and losses.

Risks Related to Our

Industry

Challenging economic conditions worldwide have from time to time contributed, and may continue to contribute, to slowdowns in the

wireless industry at large, resulting in:

| |

• |

|

reduced demand for our products as a result of continued constraints on corporate and government spending by our customers, |

| |

• |

|

increased price competition for our products, |

| |

• |

|

risk of excess and obsolete inventory, |

| |

• |

|

risk of supply constraints, |

| |

• |

|

risk of excess facilities and manufacturing capacity, and |

| |

• |

|

higher costs as a percentage of revenue and higher interest expense. |

Our industry is characterized by

rapidly changing technologies and rapidly changing competitive environments. If we are not successful in responding to these changes, our products may become obsolete and we may not be able to compete effectively.

We must continue to evaluate, develop and introduce technologically advanced products that will position us for possible growth in the wireless market. If we

are not successful in doing so, our products may not be accepted in the market or may become obsolete and we may not be able to compete effectively.

Consolidation and vertical integration in our industry, and particularly integration of our customers with our competitors, may significantly reduce our

ability to successfully market our products to long-standing customers and may adversely affect our vertically integrated customers’ ability to choose our products even if our products are technologically superior.

9

Changes in laws or regulations, in particular future Federal Communications Commission (“FCC”)

regulations or international regulations affecting the broadband market, internet service providers, or the communications industry, could negatively affect our ability to develop new technologies or sell new products and, therefore, reduce our

profitability.

The jurisdiction of the FCC extends to the entire communications industry, including our customers and their products and services

that incorporate our products. Future FCC regulations affecting the broadband access services industry, our customers or our products may harm our business. For example, future FCC regulatory policies that affect the availability of data and

Internet services may impede our customers’ penetration into their markets or affect the prices that they are able to charge. In addition, FCC regulatory policies that affect the specifications of wireless data devices may impede certain of our

customers’ ability to manufacture their products profitably, which could, in turn, reduce demand for our products. Furthermore, international regulatory bodies are beginning to adopt standards for the communications industry. Although our

business has not been hurt by any regulations to date, in the future, delays caused by our compliance with regulatory requirements may result in order cancellations or postponements of product purchases by our customers, which would reduce our

profitability.

Risks Related to our Common Stock

The trading price of our stock price may be volatile based on a number of factors, many of which are not under our control.

The trading price of our common stock has been highly volatile. The common stock price fluctuated from a low of $7.00 to a high of $9.51 during 2014. Our

stock price could be subject to wide fluctuations in response to a variety of factors, many of which are out of our control, including:

| |

• |

|

adverse change in domestic or global economic conditions, |

| |

• |

|

new products or services offered by us or our competitors, |

| |

• |

|

actual or anticipated variations in quarterly operating results, |

| |

• |

|

changes in financial estimates by securities analysts, |

| |

• |

|

announcements of technological innovations, |

| |

• |

|

our announcement of significant acquisitions, strategic partnerships, joint ventures or capital commitments, |

| |

• |

|

conditions or trends in our industry, |

| |

• |

|

additions or departures of key personnel, |

| |

• |

|

mergers and acquisitions, and |

| |

• |

|

sales of common stock by our stockholders or us or repurchases by us. |

In addition, the NASDAQ Global Select

Market, where many publicly held telecommunications companies, including PCTEL, are traded, often experiences extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of

these companies.

Provisions in our charter documents may inhibit a change of control or a change of management, which may cause the market price for

our common stock to fall and may inhibit a takeover or change in our control that a stockholder may consider favorable.

Provisions in our charter

documents could discourage potential acquisition proposals and could delay or prevent a change in control transaction that our stockholders may favor. Specifically, our charter documents do not permit stockholders to act by written consent, do not

permit stockholders to call a stockholders meeting, and provide for a classified board of directors, which means stockholders can only elect, or remove, a limited number of our directors in any given year. These provisions could have the effect of

discouraging others from making tender offers for our shares, and as a result, these provisions may prevent the market price of our common stock

10

from reflecting the effects of actual or rumored takeover attempts and may prevent stockholders from reselling their shares at or above the price at which they purchased their shares. These

provisions may also prevent changes in our management that our stockholders may favor.

Our board of directors has the authority to issue up to 5,000,000

shares of preferred stock in one or more series. The board of directors can fix the price, rights, preferences, privileges and restrictions of this preferred stock without any further vote or action by our stockholders. The rights of the holders of

our common stock will be affected by, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. Further, the issuance of shares of preferred stock may delay or prevent a change in control

transaction without further action by our stockholders. As a result, the market price of our common stock may drop.

If we are unable to successfully

maintain processes and procedures required by the Sarbanes-Oxley Act of 2002 to achieve and maintain effective internal control over our financial reporting, our ability to provide reliable and timely financial reports could be harmed and our stock

price could be adversely affected.

We must comply with the rules promulgated under Section 404 of the Sarbanes-Oxley Act of 2002.

Section 404 requires an annual management report assessing the effectiveness of our internal control over financial reporting and a report by our independent registered public accounting firm addressing this assessment.

While we are expending significant resources in maintaining the necessary documentation and testing procedures required by Section 404, we cannot be

certain that the actions we are taking to achieve and maintain our internal control over financial reporting will be adequate. If the processes and procedures that we implement for our internal control over financial reporting are inadequate, our

ability to provide reliable and timely financial reports, and consequently our business and operating results, could be harmed. This in turn could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability

of our financial reports, which could cause the market price of our common stock to decline.

| Item 1B: |

Unresolved Staff Comments |

None

The following table lists our main facilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Lease Term |

|

|

|

| Location |

|

Square feet |

|

|

Owned/Leased |

|

|

Beginning |

|

|

Ending |

|

|

Segment |

| Bloomingdale, Illinois |

|

|

75,517 |

|

|

|

Owned |

|

|

|

N/A |

|

|

|

N/A |

|

|

Connected Solutions and Corporate |

| Tianjin, China |

|

|

22,120 |

|

|

|

Leased |

|

|

|

2012 |

|

|

|

2017 |

|

|

Connected Solutions |

| Germantown, Maryland |

|

|

20,704 |

|

|

|

Leased |

|

|

|

2012 |

|

|

|

2020 |

|

|

RF Solutions |

| Lexington, North Carolina |

|

|

5,630 |

|

|

|

Leased |

|

|

|

2013 |

|

|

|

2019 |

|

|

Connected Solutions |

| Pryor, Oklahoma |

|

|

5,500 |

|

|

|

Leased |

|

|

|

2013 |

|

|

|

2015 |

|

|

Connected Solutions |

| Beijing, China |

|

|

5,393 |

|

|

|

Leased |

|

|

|

2013 |

|

|

|

2016 |

|

|

Connected Solutions |

| San Antonio, Texas |

|

|

4,159 |

|

|

|

Leased |

|

|

|

2011 |

|

|

|

2016 |

|

|

Connected Solutions |

| Melbourne, Florida |

|

|

3,600 |

|

|

|

Leased |

|

|

|

2013 |

|

|

|

2018 |

|

|

RF Solutions |

Facility changes

In

September 2013, we entered into a new five-year lease for an office for our engineering services business in Melbourne, Florida. Under the new lease, we expanded the leased space to 3,600 square feet to meet the needs of our increased Network

Services operations. The total lease obligation pursuant to this lease was $0.3 million.

Pursuant to an amendment to the asset purchase agreement

for Telworx, we terminated the facility lease in Lexington, North Carolina with Scronce Real Estate LLC effective October 2013. In July 2013, we entered into a new six-year lease for an office facility in Lexington, North Carolina with the

first year being rent-free. We also extended the lease for the assembly facility in Pryor, Oklahoma for a period of two years commencing May 2013. The total lease obligation pursuant to these leases was $0.4 million.

11

In February 2015, we entered into a new five-year lease for office space of approximately 4,800 square feet in

Englewood, Colorado that will be used for engineering services. This lease expires in 2020.

All properties are in good condition and are suitable for the

purposes for which they are used. We believe that we have adequate space for our current needs.

| Item 3: |

Legal Proceedings |

TelWorx Parties

After discovering accounting irregularities with respect to the TelWorx entities and conducting an internal investigation, we pursued restitution from the

TelWorx Parties. A legal settlement with a fair value of $5.4 million was reached with the TelWorx Parties in March 2013 as further described in Note 8 of the consolidated financial statements.

Other parties on the TelWorx acquisition

We also engaged

in efforts to seek restitution from two other parties used by the TelWorx Parties for professional services in the sale of the business to PCTEL. On September 30, 2014, we settled in cash with one party for $0.1 million and on October 10,

2014, we settled with the other party in cash for $0.8 million.

| Item 4: |

Mine Safety Disclosures |

Not applicable.

PART II

| Item 5: |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Price Range of Common Stock and Dividends

PCTEL’s

common stock has been traded on the NASDAQ Global Select Market under the symbol PCTI since our initial public offering on October 19, 1999. The following table shows the high and low sale prices of our common stock as reported by the NASDAQ

Global Select Market for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| |

|

Market Price |

|

|

|

|

|

Market Price |

|

|

|

|

| |

|

High |

|

|

Low |

|

|

Dividends per Share |

|

|

High |

|

|

Low |

|

|

Dividends per Share |

|

| Fourth Quarter |

|

$ |

8.67 |

|

|

$ |

7.18 |

|

|

$ |

0.040 |

|

|

$ |

10.07 |

|

|

$ |

8.80 |

|

|

$ |

0.035 |

|

| Third Quarter |

|

$ |

8.42 |

|

|

$ |

7.36 |

|

|

$ |

0.040 |

|

|

$ |

9.88 |

|

|

$ |

8.12 |

|

|

$ |

0.035 |

|

| Second Quarter |

|

$ |

8.83 |

|

|

$ |

7.00 |

|

|

$ |

0.040 |

|

|

$ |

8.48 |

|

|

$ |

6.32 |

|

|

$ |

0.035 |

|

| First Quarter |

|

$ |

9.51 |

|

|

$ |

7.90 |

|

|

$ |

0.040 |

|

|

$ |

7.71 |

|

|

$ |

6.66 |

|

|

$ |

0.035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.160 |

|

|

|

|

|

|

|

|

|

|

$ |

0.140 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The closing sale price of our common stock as reported on the NASDAQ Global Select Market on March 6, 2015 was $8.65 per

share. As of that date there were 38 holders of record of the common stock. A substantially greater number of holders of the common stock are in “street name” or beneficial holders, whose shares are held of record by banks, brokers, and

other financial institutions.

We raised our quarterly cash dividend to $0.05 per share effective for the quarterly cash dividend to shareholders paid on

February 13, 2015.

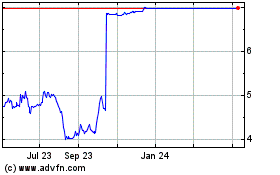

Five-Year Cumulative Total Return Comparison

The graph below compares the annual percentage change in the cumulative return to our stockholders with the cumulative return of the NASDAQ Composite Index and

the S&P Information Technology Index for the period beginning December 31, 2009 and ending December 31, 2014. Returns for the indices are weighted based on market capitalization at the beginning of each measurement point.

12

Note that historic stock price performance is not necessarily indicative of future stock price performance.

Sales of Unregistered Equity Securities

None.

Issuer Purchases of Equity Securities

All share repurchase programs are authorized by our Board of Directors and are announced publicly. During the year ended December 31, 2012, no shares of

our common stock were repurchased. On March 18, 2013, our Board of Directors approved a share repurchase program of $5.0 million. We repurchased 59,510 shares at an average price of $7.31 during the year ended December 31, 2013. On

May 6, 2014, our Board of Directors extended this stock buyback program through September 2014. We repurchased 215,650 shares at an average price of $7.66 during the nine months ended September 30, 2014 and the share repurchase program

ended. On November 13, 2014, our Board of Directors approved a share repurchase program for up to 5% of our outstanding shares. No shares were purchased during the quarter ended December 31, 2014.

| Item 6: |

Selected Consolidated Financial Data |

The following selected consolidated financial data should be read

in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the Consolidated Financial Statements and related notes and other financial information appearing elsewhere in this Annual

Report on Form 10-K. The statement of operations data for the years ended December 31, 2014, 2013, and 2012 and the balance sheet data as of December 31, 2014 and 2013 are derived from audited financial statements included elsewhere in

this Annual Report on Form 10-K. The statement of operations data for the years ended December 31, 2011 and 2010 and the balance sheet data as of December 31, 2012, 2011, and 2010 are derived from audited financial statements not included

in this Annual Report on Form 10-K.

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

(in thousands, except per share data) |

|

| Consolidated Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

107,164 |

|

|

$ |

104,253 |

|

|

$ |

88,849 |

|

|

$ |

76,844 |

|

|

$ |

69,254 |

|

| Cost of revenues |

|

|

63,577 |

|

|

|

62,493 |

|

|

|

53,029 |

|

|

|

40,982 |

|

|

|

38,142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

43,587 |

|

|

|

41,760 |

|

|

|

35,820 |

|

|

|

35,862 |

|

|

|

31,112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

11,736 |

|

|

|

11,064 |

|

|

|

9,290 |

|

|

|

10,286 |

|

|

|

11,777 |

|

| Sales and marketing |

|

|

12,961 |

|

|

|

12,121 |

|

|

|

11,343 |

|

|

|

10,359 |

|

|

|

10,095 |

|

| General and administrative |

|

|

12,819 |

|

|

|

15,623 |

|

|

|

10,982 |

|

|

|

10,752 |

|

|

|

10,224 |

|

| Amortization of intangible assets |

|

|

1,967 |

|

|

|

2,400 |

|

|

|

2,359 |

|

|

|

2,258 |

|

|

|

2,934 |

|

| Restructuring charges |

|

|

0 |

|

|

|

256 |

|

|

|

157 |

|

|

|

117 |

|

|

|

931 |

|

| Impairment of goodwill and intangible assets |

|

|

0 |

|

|

|

0 |

|

|

|

12,550 |

|

|

|

0 |

|

|

|

1,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

39,483 |

|

|

|

41,464 |

|

|

|

46,681 |

|

|

|

33,772 |

|

|

|

37,045 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) from continuing operations |

|

|

4,104 |

|

|

|

296 |

|

|

|

(10,861 |

) |

|

|

2,090 |

|

|

|

(5,933 |

) |

| Other income, net |

|

|

1,666 |

|

|

|

5,378 |

|

|

|

100 |

|

|

|

195 |

|

|

|

602 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

5,770 |

|

|

|

5,674 |

|

|

|

(10,761 |

) |

|

|

2,285 |

|

|

|

(5,331 |

) |

| Expense (benefit) for income taxes |

|

|

1,158 |

|

|

|

2,332 |

|

|

|

(4,089 |

) |

|

|

604 |

|

|

|

(1,875 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) from continuing operations |

|

|

4,612 |

|

|

|

3,342 |

|

|

|

(6,672 |

) |

|

|

1,681 |

|

|

|

(3,456 |

) |

| Net loss from discontinued operations, net of tax benefit for income taxes |

|

|

0 |

|

|

|

(91 |

) |

|

|

(2,587 |

) |

|

|

(1,497 |

) |

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

4,612 |

|

|

$ |

3,251 |

|

|

($ |

9,259 |

) |

|

$ |

184 |

|

|

($ |

3,456 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share from continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.25 |

|

|

$ |

0.19 |

|

|

$ |

(0.38 |

) |

|

$ |

0.10 |

|

|

$ |

(0.20 |

) |

| Diluted |

|

$ |

0.25 |

|

|

$ |

0.18 |

|

|

$ |

(0.38 |

) |

|

$ |

0.09 |

|

|

$ |

(0.20 |

) |

|

|

|

|

|

|

| Loss per share from discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

— |

|

|

$ |

(0.01 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.09 |

) |

|

$ |

— |

|

| Diluted |

|

$ |

— |

|

|

$ |

0.00 |

|

|

$ |

(0.15 |

) |

|

$ |

(0.08 |

) |

|

$ |

— |

|

|

|

|

|

|

|

| Earnings (loss) per share : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.25 |

|

|

$ |

0.18 |

|

|

$ |

(0.53 |

) |

|

$ |

0.01 |

|

|

$ |

(0.20 |

) |

| Diluted |

|

$ |

0.25 |

|

|

$ |

0.18 |

|

|

$ |

(0.53 |

) |

|

$ |

0.01 |

|

|

$ |

(0.20 |

) |

|

|

|

|

|

|

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

18,159 |

|

|

|

17,797 |

|

|

|

17,402 |

|

|

|

17,186 |

|

|

|

17,408 |

|

| Diluted |

|

|

18,389 |

|

|

|

18,184 |

|

|

|

17,402 |

|

|

|

17,739 |

|

|

|

17,408 |

|

|

|

|

|

|

|

| Dividends per common share |

|

$ |

0.16 |

|

|

$ |

0.14 |

|

|

$ |

0.12 |

|

|

$ |

0.03 |

|

|

$ |

0.00 |

|

|

|

|

|

|

|

| Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and short-term investments |

|

$ |

60,009 |

|

|

$ |

57,895 |

|

|

$ |

51,139 |

|

|

$ |

61,628 |

|

|

$ |

61,144 |

|

| Working capital |

|

$ |

88,573 |

|

|

$ |

83,585 |

|

|

$ |

74,486 |

|

|

$ |

80,311 |

|

|

$ |

78,860 |

|

| Total assets |

|

$ |

131,669 |

|

|

$ |

127,432 |

|

|

$ |

128,570 |

|

|

$ |

133,464 |

|

|

$ |

130,565 |

|

| Total stockholders’ equity |

|

$ |

115,515 |

|

|

$ |

112,052 |

|

|

$ |

108,145 |

|

|

$ |

116,315 |

|

|

$ |

116,655 |

|

14

| Item 7: |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The

following commentary presents a discussion and analysis of the Company’s financial condition and results of operations by its management. The review highlights the principal factors affecting earnings and the significant changes in balance

sheet items for the years 2014 and 2013. Financial information for prior years is presented when appropriate. The objective of this financial review is to enhance investors understanding of the accompanying tables and charts, the consolidated

financial statements, notes to financial statements, and financial statistics appearing elsewhere in this Annual Report on Form 10-K. Where applicable, this discussion also reflects management’s insights with respect to known events and trends

that have or may reasonably be expected to have a material effect on the Company’s operations and financial condition.

Our 2014 revenues increased

by $2.9 million, or 2.8%, compared to 2013, due to higher RF Solutions segment revenue, primarily for engineering services. We recorded operating profit of $4.1 million in 2014, compared to $0.3 million in 2013. Operating profit improved due to

higher profits within Connected Solutions and due to lower corporate general and administrative expenses.

Introduction

PCTEL delivers Performance Critical Telecom solutions. RF Solutions develops and provides test equipment, software and engineering

services for wireless networks. The industry relies upon PCTEL to benchmark network performance, analyze trends, and optimize wireless networks. Connected Solutions designs and delivers performance critical antennas and site solutions for wireless

networks globally. Our antennas support evolving wireless standards for cellular, private, and broadband networks. PCTEL antennas and site solutions support networks worldwide, including SCADA for oil, gas and utilities, fleet management, industrial

operations, health care, small cell and network timing deployment, defense, public safety, education, and broadband access.

Revenue growth for antenna

products and site solutions is driven by emerging wireless applications in the following markets: public safety, military, and government applications; supervisory control and data acquisition (“SCADA”), health care, energy, smart grid and

agricultural applications; indoor wireless, wireless backhaul, and cellular applications. Revenue growth for scanning receiver products, interference management products, and optimization services is driven by the deployment of new wireless

technology and the need for wireless networks to be tuned and reconfigured on a regular basis.

We have an intellectual property portfolio related to

antennas, the mounting of antennas, and scanning receivers. These patents are being held for defensive purposes and are not part of an active licensing program.

Effective January 1, 2013, we operate in two segments for reporting purposes. Our Connected Solutions segment includes our antenna and engineered site

solutions and our RF Solutions segment includes our scanning receivers and related RF engineering services. Each segment has its own manager as well as its own engineering, sales and marketing, and operational general and administrative functions.

All of our accounting and finance, human resources, IT and legal functions are provided on a centralized basis through the corporate function.

On

April 30, 2013, we divested all material assets associated with PCTEL Secure’s ProsettaCore™ technology to Redwall Technologies, LLC (“Redwall”), a development organization that specializes in mobile security, military and

defense projects and systems, and critical national infrastructure. Under the terms of the agreement, Redwall acquired the server and device software (the “Software”), the underlying IP, and complete development responsibility for the

security products. At the closing of the divestiture, we received no upfront cash payment, but have the right to receive a royalty of 7% of the net sale price of each future sale or license of the Software and each provision of services related to

the Software, if any. Under the agreement, royalties will not exceed $10.0 million in the aggregate. In accordance with accounting for discontinued operations, the consolidated financial statements separately reflect the results of PCTEL Secure as

discontinued operations for all periods presented. The prior period results have been restated to reflect this accounting treatment.

15

Results of Operations for Continuing Operations

Years ended December 31, 2014, 2013, and 2012

(All amounts in tables, other than percentages, are in thousands)

REVENUES BY SEGMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

$ Change |

|

|

% Change |

|

|

2013 |

|

|

$ Change |

|

|

% Change |

|

|

2012 |

|

| Connected Solutions |

|

$ |

72,333 |

|

|

($ |

1,890 |

) |

|

|

-2.5 |

% |

|

$ |

74,223 |

|

|

$ |

6,712 |

|

|

|

9.9 |

% |

|

$ |

67,511 |

|

| RF Solutions |

|

|

35,113 |

|

|

|

4,803 |

|

|

|

15.8 |

% |

|

|

30,310 |

|

|

|

8,841 |

|

|

|

41.2 |

% |

|

|

21,469 |

|

| Corporate |

|

|

(282 |

) |

|

|

(2 |

) |

|

|

not meaningful |

|

|

|

(280 |

) |

|

|

(149 |

) |

|

|

not meaningful |

|

|

|

(131 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

107,164 |

|

|

$ |

2,911 |

|

|

|

2.8 |

% |

|

$ |

104,253 |

|

|

$ |

15,404 |

|

|

|

17.3 |

% |

|

$ |

88,849 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues were approximately $107.2 million for the year ended December 31, 2014, an increase of 2.8% from the prior year.

RF Solutions segment revenue increased $4.8 million (15.8%) due to the rapid growth of in-building wireless network expansion. Connected Solutions segment revenue decreased $1.9 million, or 2.5%. Within the Connected Solutions segment, revenue

declined for antenna products, but increased for cellular kitting products.

Revenues were approximately $104.3 million for the year ended

December 31, 2013, an increase of 17.3% from the prior year. RF Solutions segment revenue increased $8.8 million (41.2%) driven by higher carrier scanning receiver spending from a low point in 2012 and the growth of in-building wireless

network expansion. Connected Solutions segment revenue increased $6.7 million, or 9.9%, of which $6.0 million, or 8.9%, is a result of having the site solutions products acquired in July 2012 for only half the year in 2012.

GROSS PROFIT BY SEGMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

% of Revenues |

|

|

2013 |

|

|

% of Revenues |

|

|

2012 |

|

|

% of Revenues |

|

| Connected Solutions |

|

$ |

22,818 |

|

|

|

31.5 |

% |

|

$ |

22,720 |

|

|

|

30.6 |

% |

|

$ |

21,037 |

|

|

|

31.2 |

% |

| RF Solutions |

|

|

20,743 |

|

|

|

59.1 |

% |

|

|

19,018 |

|

|

|

62.7 |

% |

|

|

14,744 |

|

|

|

68.7 |

% |

| Corporate |

|

|

26 |

|

|

|

not meaningful |

|

|

|

22 |

|

|

|

not meaningful |

|

|

|

39 |

|

|

|

not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

43,587 |

|

|

|

40.7 |

% |

|

$ |

41,760 |

|

|

|

40.1 |

% |

|

$ |

35,820 |

|

|

|

40.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit was 40.7% for the year ended December 31, 2014, higher by 0.6% compared to 2013. RF Solutions segment gross

profit was 59.1%, a decrease of (3.6%). The increasing revenue generated by network engineering services contributed (4.9%) of the decrease in percent of revenue. Connected Solutions gross profit was 31.5%, higher by 0.9% compared to 2013.

While the segment experienced margin pressure from fixed costs spread over lower revenue, it was more than offset by improvements made through our elimination of unprofitable site solutions products and customers, consolidating the site solutions

factory into our Bloomingdale facility, and other supply chain improvements.

Gross profit was 40.1% for the year ended December 31, 2013, lower by

0.2% compared to 2012. RF Solutions segment gross profit was 62.7%, a decrease of (6.0%). The increasing revenue generated by network engineering services contributed (5.0%) of the decrease in a percent of revenue. Connected Solutions gross

profit was 30.6%, lower by 0.6% compared to 2012.

OPERATING PROFIT BY SEGMENT

|

|

|

|

|

|

|

|

|

|

|