UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

RULE 13e-3 TRANSACTION STATEMENT

PURSUANT TO SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

Pardes

Biosciences, Inc.

(Name of the Issuer)

Pardes

Biosciences, Inc.

(Name of Person(s) Filing Statement)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

69945Q 105

(CUSIP Number

of Common Stock)

Thomas G. Wiggans

Chief Executive Officer

Pardes Biosciences, Inc.

2173 Salk Avenue, Suite 250

PMB#052

Carlsbad,

California 92008

(415) 649-8758

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Person(s) Filing Statement)

With copies to:

|

|

|

| Douglas N. Cogen, Esq.

Ethan A. Skerry, Esq. Ran

D. Ben-Tzur, Esq. Jennifer J. Hitchcock, Esq.

Michael S. Pilo, Esq.

Fenwick & West LLP

555 California Street, 12th Floor

San Francisco, California 94104

(415) 875-2300 |

|

Elizabeth H. Lacy

General Counsel and Corporate Secretary

Pardes Biosciences, Inc.

2173 Salk Avenue, Suite 250

PMB#052 Carlsbad,

California 92008 (415) 649-8758 |

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

| a. |

|

☐ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. |

|

☐ |

|

The filing of a registration statement under the Securities Act of 1933. |

| c. |

|

☒ |

|

A tender offer. |

| d. |

|

☐ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are

preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the

transaction: ☐

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS

TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS SCHEDULE 13E-3. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

INTRODUCTION

This Amendment No. 1 (“Amendment No. 1”), together with the attached exhibits (this

“Statement”) amends and restates the Rule 13e-3 Transaction Statement filed with the United States Securities and Exchange Commission (“SEC”) on

July 28, 2023 on Schedule 13E-3. This Statement is being filed by Pardes Biosciences, Inc. (“Pardes” or the “Company”) and relates to the offer

(the “Offer”) to purchase by MediPacific Sub, Inc., a Delaware corporation (“Purchaser”), and wholly owned subsidiary of MediPacific, Inc. (“Parent”), all of the issued and

outstanding shares of common stock, par value $0.0001 per share, of Pardes (the “Common Stock”) that is the subject of the Rule 13e-3 transaction described below (the

“Shares”) (other than (i) Shares held in the treasury of Pardes immediately prior to the effective time of the Merger (as defined below), (ii) Shares owned, directly or indirectly, by the Foresite Stockholders (as

defined in that certain Agreement and Plan of Merger, dated as of July 16, 2023, by and among Pardes, Purchaser and Parent (the “Merger Agreement”)), Parent, Purchaser or any other subsidiary of Parent at the

commencement of the Offer and that are owned by Parent, Purchaser or any other subsidiary of Parent immediately prior to the effective time of the Merger), for a price of (i) $2.02 per Share (the “Base Price Per Share”), (ii)

an additional amount of cash of up to $0.17 per Share (such amount as finally determined pursuant to Section 2.01(d) of the Merger Agreement, the “Additional Price Per Share,” and together with the Base Price Per

Share, the “Cash Amount”), and (iii) one non-transferable contingent value right per Share (each a “CVR”) (such amount, or any different amount per share

paid pursuant to the Offer (as defined below) to the extent permitted under the Merger Agreement, being the “CVR Amount”), and, together with the Cash Amount, the “Offer Price”), upon the terms and

subject to the conditions set forth in the Offer to Purchase dated July 28, 2023 (as amended and restated on August 17, 2023, and as may be further amended or supplemented from time to time, the “Offer to Purchase”),

which is annexed to and filed with this Statement as Exhibit (a)(1)(A) and in the related Letter of Transmittal, which is annexed to and filed with this Statement as Exhibit (a)(1)(B), which, together with any amendments or supplements thereto,

collectively constitute the “Offer.” The Offer is being made pursuant to the Merger Agreement. Pursuant to the terms of the Merger Agreement, the Company, Parent and Purchaser calculated the Additional Price Per Share on

August 17, 2023, based on the Company’s expected Closing Net Cash (as defined in the Merger Agreement) as of immediately prior to the Expiration Date of approximately $132.31 million and determined that the Additional Price Per Share will be

$0.11 Per Share. As a result, the total Cash Amount is $2.13 as determined in accordance with Section 2.01(d) of the Merger Agreement. The Merger Agreement provides, among other things, for the terms and conditions of the Offer and the

subsequent merger of Purchaser with and into Pardes (the “Merger”) in accordance with Section 251(h) of the Delaware General Corporation Law (the “DGCL”).

The information contained in the Tender Offer Statement filed under cover of Schedule TO by Parent with the SEC on July 28, 2023 (as amended and restated

on August 17, 2023, and as may be further amended or supplemented from time to time, the “Schedule TO”), including the Offer to Purchase, and the Solicitation/Recommendation Statement on Schedule 14D-9 filed by Pardes with the SEC on July 28, 2023 (as amended and restated on August 17, 2023, and as may be further amended or supplemented from time to time, the “Schedule 14D-9”), attached hereto as Exhibit (a)(1)(F) and is incorporated herein by reference and, except as described below, the responses to each item in this Statement are qualified in their entirety by the

information contained in the Schedule TO, the Offer to Purchase and the Schedule 14D-9. The cross references identified herein are being supplied pursuant to General Instruction G to Schedule 13E-3 and indicate the location in the Schedule TO and Schedule 14D-9 of the information required to be included in response to the respective Items of this

Statement.

Concurrently with the execution of the Merger Agreement, and as a condition and inducement to Pardes’ willingness to enter into the

Merger Agreement and the CVR Agreement (as defined below), Foresite Capital Opportunity Fund V, L.P., Foresite Capital Fund V, L.P. and FS Development Holdings II, LLC (collectively, the “Guarantors”), affiliates of Parent,

have duly executed and delivered to Pardes a limited guaranty (the “Limited Guaranty”), dated as of the date of the Merger Agreement, in favor of Pardes and the holders of CVRs, in respect of certain of Parent’s and

Purchaser’s obligations arising under, or in connection with, the Merger Agreement and the Contingent Value Rights Agreement (the “CVR Agreement”) that Pardes expects to enter into with a rights agent and a

representative, agent and attorney in-fact of the holders of the CVR. The Guarantors’

obligations under the Limited Guaranty are subject to a cap of $7.5 million with respect to obligations

to Pardes arising under or in connection with the Merger Agreement and $400,000 with respect to obligations to the holders of the CVRs arising under or in connection with the CVR Agreement.

Any information contained in the documents incorporated herein by reference shall be deemed modified or superseded for purposes of this Statement to the

extent that any information contained herein modifies or supersedes such information. All information contained in this Statement concerning Purchaser, Parent or their affiliates has been provided by such person and not by any other person.

| ITEM 1. |

SUMMARY TERM SHEET |

The information set forth in the section of the Offer to Purchase entitled “Summary Term Sheet” is incorporated herein by reference.

| ITEM 2. |

SUBJECT COMPANY INFORMATION |

The information set forth in the Schedule 14D-9 under the heading “Item 1. Subject Company

Information—Name and Address” is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the heading “Item 1. Subject Company

Information—Securities” is incorporated herein by reference.

| |

(c) |

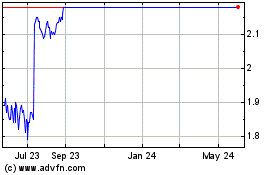

Trading Market and Price |

The information set forth in the Offer to Purchase under the heading “Special Factors—Section 5. Price Range of Shares;

Dividends” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Special Factors—Section 5. Price Range of

Shares; Dividends” and “The Tender Offer—Section 10. Dividends and Distributions” is incorporated herein by reference.

| |

(e) |

Prior Public Offerings |

Not applicable.

| |

(f) |

Prior Stock Purchases |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—Past Contacts,

Transactions, Negotiations and Agreements—Arrangements with Parent and Purchaser and Their Affiliates” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the heading “The Tender Offer—Section 6. Certain Information

Concerning Parent and Purchaser” is incorporated herein by reference.

| ITEM 3. |

IDENTITY AND BACKGROUND OF FILING PERSON |

The filing person and subject company is Pardes Biosciences, Inc. The business address of Pardes is 2173 Salk Avenue, Suite 250, PMB #052, Carlsbad, California

92008, and Pardes’ telephone number is (415)-649-8758.

The

information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes, Alternatives, Reasons and Effects—Identity and Background of Filing Person,” “Item

1. Subject Company Information” and “Annex 1. Business and Background of the Company’s Directors and Executive Officers” is incorporated herein by reference.

The information in the Offer to Purchase under the headings “The Tender Offer–Section 6. Certain Information Concerning Parent

and Purchaser” and “Schedule A–Information Concerning Members of the Boards of Directors and the Executive Officers of Purchaser, Parent and the Guarantors” is incorporated herein by reference.

| |

(b) |

Business and Background of Entities |

The information set forth in the Schedule 14D-9 under the headings “Special Factors–Purposes,

Alternatives, Reasons and Effects–Identity and Background of Filing Person–Business and Background of the Company’s Directors and Executive Officers,” “Item 1. Subject Company Information” and “Annex

1. Business and Background of the Company’s Directors and Executive Officers” is incorporated herein by reference.

The information set

forth in the Offer to Purchase under the headings “The Tender Offer–Section 6. Certain Information Concerning Parent and Purchaser” and “Schedule A–Information Concerning Members of the Boards of

Directors and the Executive Officers of Purchaser, Parent and the Guarantors” is incorporated herein by reference.

| |

(c) |

Business and Background of Natural Persons |

The information set forth in the Schedule 14D-9 under the headings “Special Factors–Purposes,

Alternatives, Reasons and Effects–Identity and Background of Filing Person–Business and Background of the Company’s Directors and Executive Officers,” “Item 1–Subject Company Information”

and “Annex 1. Business and Background of the Company’s Directors and Executive Officers” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Tender Offer–Section 6. Certain Information

Concerning Parent and Purchaser” and “Schedule A–Information Concerning Members of the Boards of Directors and the Executive Officers of Purchaser, Parent and the Guarantors” is incorporated herein by reference.

| ITEM 4. |

TERMS OF THE TRANSACTION |

The information set forth in the Schedule 14D-9 under the headings “Special Factors–Purposes,

Alternatives, Reasons and Effects–Identity and Background of Filing Person–Tender Offer and Merger,” “Special Factors–Past Contacts, Transactions, Negotiations and Agreements,”

“Special Factors–The Solicitation or Recommendation,” “Special Factors–Purposes of the Transaction and Plans or Proposals,” “Special Factors–Additional Information–Named Executive

Officer Golden Parachute Compensation; Appraisal Rights” and “Item 1. Subject Company Information–Securities” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “Special Factors—

Section 2. Purpose of the Offer and Plans for Pardes,” “Special Factors—Section 7. Certain U.S. Federal Income Tax Consequences of the Offer and the Merger,” “The

Tender Offer–Section 1. Terms of the Offer,” “The Tender Offer–Section 2. Acceptance for Payment and Payment for Shares,” “The Tender

Offer—Section 3. Procedures for Tendering Shares,” “The Tender Offer—Section 4. Withdrawal Rights,” and “The Tender Offer—Section 7. Summary of the Merger

Agreement and Certain Other Agreements” is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes,

Alternatives, Reasons and Effects–Identity and Background of Filing Person–Tender Offer and Merger, “Special Factors—Past Contacts, Transactions, Negotiations and Agreements and “Special Factors—Additional

Information” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term

Sheet,” “Special Factors—Section 1. Background of the Offer; Contacts with Pardes,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,”

“The Tender Offer—Section 6. Certain Information Concerning Parent and Purchaser,” “The Tender Offer—Section 7. Summary of the Merger Agreement and Certain Other

Agreements” and “The Tender Offer–Section 13. Interests of Certain Pardes Directors and Executive Officers in the Offer and the Merger” is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the heading “Special Factors–Additional

Information—Appraisal Rights” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the heading

“The Tender Offer—Section 11. Certain Legal Matters; Regulatory Approvals—Takeover Laws; Appraisal Rights” is incorporated herein by reference.

| |

(e) |

Provisions for Unaffiliated Security Holders |

The filing person has not made any provision in connection with the transaction to grant unaffiliated security holders access to the corporate files of the

filing person or to obtain counsel or appraisal services at the expense of the filing person.

| |

(f) |

Eligibility for Listing or Trading |

Not applicable.

| ITEM 5. |

PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

The information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes

Alternatives, Reasons and Effects–Identity and Background of Filing Person—Tender Offer and Merger” and “Special Factors—Past Contacts, Transactions, Negotiations and Agreements” is

incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,”

“Special Factors—Section 1. Background of the Offer; Contacts with Pardes” “The Tender Offer—Section 6. Certain Information Concerning Parent and Purchaser,” and

“The Tender Offer—Section 13. Interests of Certain Pardes Directors and Executive Officers in the Offer and the Merger” is incorporated herein by reference.

| |

(b)-(c) |

Significant Corporate Events; Negotiations or Contacts |

The information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes,

Alternatives, Reasons and Effects–Identity and Background of Filing Person—Tender Offer and Merger,” “Special Factors— Past Contacts, Transactions, Negotiations and Agreements” and “Special

Factors—The Solicitation or Recommendation” is incorporated herein by reference.

The information set forth in the Offer to Purchase under

the headings “Summary Term Sheet,” “Special Factors—Section 1. Background of the Offer; Contacts with Pardes,” “Special Factors—Section 2. Purpose of the Offer

and Plans for Pardes,” “The Tender Offer—Section 6. Certain Information Concerning Parent and Purchaser,” “The Tender Offer—Section 7. Summary of the Merger

Agreement and Certain Other Agreements” and “The Tender Offer—Section 13. Interests of Certain Pardes Directors and Executive Officers in the Offer and the Merger” is incorporated herein by

reference.

| |

(e) |

Agreements Involving the Subject Company’s Securities |

The information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes,

Alternatives, Reasons and Effects—Identity and Background of Filing Person–Tender Offer and Merger,” “Special Factors— Past Contacts, Transactions, Negotiations and Agreements” and “Special

Factors—The Solicitation or Recommendation” is incorporated herein by reference.

The information set forth in the Offer to Purchase under

the headings “Summary Term Sheet,” “Special Factors— Section 1. Background of the Offer; Contacts with Pardes,” “Special Factors—Section 2. Purpose of the

Offer and Plans for Pardes,” “The Tender Offer— Section 6. Certain Information Concerning Parent and Purchaser” and “The Tender Offer—Section 7. Summary of the Merger

Agreement and Certain Other Agreements” is incorporated herein by reference.

| ITEM 6. |

PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS |

| |

(b) |

Use of Securities Acquired |

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “Special

Factors–Section 6. Possible Effects of the Offer on the Market for the Shares; Nasdaq Listing; Exchange Act Registration and Margin Regulations,” “Special

Factors–Section 2. Purpose of the Offer and Plans for Pardes,” “The Tender Offer–Section 7. Summary of the Merger Agreement and Certain Other Agreements” and “The

Tender Offer–Section 11. Certain Legal Matters; Regulatory Matters–Appraisal Rights” is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the headings “Special

Factors—Purposes, Alternatives, Reasons and Effects—Identity and Background of Filing Person–Tender Offer and Merger,” “Special Factors—Past Contacts, Transactions, Negotiations and

Agreements,” “Special Factors—The Solicitation or Recommendation” and “Special Factors—Purposes of the Transaction and Plans or Proposals” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “Special

Factors—Section 1. Background of the Offer; Contacts with Pardes,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,” “Special

Factors—Section 6. Possible Effects of the Offer on the Market for the Shares; Nasdaq Listing; Exchange Act Registration and Margin Regulations,” “The Tender Offer—Section 7. Summary

of the Merger Agreement and Certain Other Agreements,” “The Tender Offer—Section 8. Source and Amount of Funds” and “The Tender Offer—Section 13. Interests of Certain

Pardes Directors and Executive Officers in the Offer and the Merger” is incorporated herein by reference.

| ITEM 7. |

PURPOSES, ALTERNATIVES, REASONS AND EFFECTS |

The information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes,

Alternatives, Reasons and Effects—Identity and Background of Filing Person—Tender Offer and Merger,” “Special Factors— Past Contacts, Transactions, Negotiations and Agreements—Arrangements with Parent and

Purchaser and Their Affiliates,” “Special Factors—The Solicitation or Recommendation—Reasons for the Recommendation; Fairness of the Offer and Merger” and “Special Factors—Purposes of the Transaction

and Plans or Proposals” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings

“Summary Term Sheet,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,” “Special Factors—Section 6. Possible of Effects of the Offer on the Market for the

Shares; Nasdaq Listing; Exchange Act Registration and Margin Regulations,” “The Tender Offer–Section 6. Certain Information Concerning Parent and Purchaser” and “The Tender

Offer—Section 7. Summary of the Merger Agreement and Certain Other Agreements” is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the headings “Special Factors—The Solicitation or

Recommendation—Background of the Offer and the Merger; Reasons for the Recommendation; Fairness of the Offer and Merger” and “Special Factors—Purposes of the Transaction and Plans or Proposals” is incorporated

herein by reference.

The information set forth in the Offer to Purchase under the headings “Special Factors—Section 1.

Background of the Offer; Contacts with Pardes,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes” and “The Tender Offer—Section 7. Summary

of the Merger Agreement and Certain Other Agreements” is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the heading “Special Factors—The Solicitation or

Recommendation—Background of the Offer and the Merger; Reasons for the Recommendation; Fairness of the Offer and Merger” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “Special

Factors—Section 1. Background of the Offer; Contacts with Pardes,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,” “Special

Factors—Section 3. Position of Parent and Purchaser Regarding Fairness of the Offer and the Merger” and “The Tender Offer—Section 7. Summary of the Merger Agreement and Certain Other

Agreements” is incorporated herein by reference.

The information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes,

Alternatives, Reasons and Effects–Identity and Background of Filing Person–Tender Offer and Merger,” “Special Factors— Past Contacts, Transactions, Negotiations and Agreements,” “Special

Factors—The Solicitation or Recommendation,” “Special Factors— Persons/Assets Retained, Employed, Compensated or Used,” “Special Factors— Purposes of the Transaction and Plans or

Proposals” and “Special Factors—Additional Information” is incorporated herein by reference.

The information set forth in

the Offer to Purchase under the headings “Summary Term Sheet,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,” “Special

Factors—Section 6. Possible Effects of the Offer on the Market for the Shares; Nasdaq Listing; Exchange Act Registration and Margin Regulations,” “Special Factors–Section 7. Certain

U.S. Federal Income Tax Consequences of the Offer and the Merger,” “The Tender Offer— Section 1. Terms of the Offer,” “The Tender Offer—Section 7. Summary of

the Merger Agreement and Certain Other Agreements,” “The Tender Offer—Section 8. Source and Amount of Funds,” “The Tender Offer—Section 10. Dividends and

Distributions,” “The Tender Offer—Section 11. Certain Legal Matters; Regulatory Approvals—Appraisal Rights,” “The Tender Offer—Section 12. Fees and

Expenses,” and “The Tender Offer—Section 13. Interests of Certain Pardes Directors and Executive Officers in the Offer and the Merger” is incorporated herein by reference.

| ITEM 8. |

FAIRNESS OF THE TRANSACTION |

The information set forth in the Schedule 14D-9 under the headings “Special Factors—The Solicitation or

Recommendation,” “Special Factors–Persons/Assets Retained, Employed, Compensated or Used” and “Special Factors—Additional Information” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Special Factors—Section 1. Background of the Offer;

Contacts with Pardes,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,” “Special Factors—Section 3. Position of Parent and Purchaser Regarding

Fairness of the Offer and the Merger” and “The Tender Offer—Section 7. Summary of the Merger Agreement and Certain Other Agreements” is incorporated herein by reference.

| |

(b) |

Factors Considered in Determining Fairness |

The information set forth in the Schedule 14D-9 under the headings “Special Factors—The Solicitation or

Recommendation,” “Special Factors— Persons/Assets Retained, Employed, Compensated or Used,” “Special Factors—Additional Information” and “Annex 2: Opinion of Financial

Advisor” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Special

Factors—Section 1. Background of the Offer; Contacts with Pardes,” “Special Factors—2. Purpose of the Offer and Plans for Pardes,” “Special

Factors—Section 3. Position of Parent and Purchaser Regarding Fairness of the Offer and the Merger” and “The Tender

Offer—Section 7. Summary of the Merger Agreement and Certain Other Agreements” is incorporated herein by reference.

The

information set forth in Exhibits (c)(1)-(c)(9) is incorporated herein by reference.

| |

(c) |

Approval of Security Holders |

The information set forth in the Schedule 14D-9 under the headings “Special Factors—Purposes,

Alternatives, Reasons and Effects—Identity and Background of Filing Person–Tender Offer and Merger” and “Special Factors—Additional Information—Stockholder Approval of the Merger Not

Required” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term

Sheet,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes” and “The Tender Offer—Section 7. Summary of the Merger Agreement and

Certain Other Agreements” is incorporated herein by reference.

| |

(d) |

Unaffiliated Representative |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—The Solicitation or

Recommendation” is incorporated herein by reference.

No unaffiliated representative has been retained by a majority of directors who are not

employees of the subject company to act solely on behalf of unaffiliated security holders for purposes of negotiating the terms of this transaction and/or preparing a report concerning the fairness of the transaction.

| |

(e) |

Approval of Directors |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—The Solicitation or

Recommendation” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Special

Factors—Section 2. Purpose of the Offer and Plans for Pardes,” and “The Tender Offer—Section 7. Summary of the Merger Agreement and Certain Other Agreements; Summary of the

Merger Agreement and Certain Other Agreements—Pardes Board Recommendation and Special Committee Recommendation” is incorporated herein by reference.

The Merger Agreement and Offer were approved by a majority of the directors of Pardes who are not employees of Pardes.

The information set forth in the Schedule 14D-9 under the heading “Special Factors—The Solicitation or

Recommendation—Background of the Offer and the Merger; Reasons for the Recommendation; Fairness of the Offer and Merger” is incorporated herein by reference.

| ITEM 9. |

REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS |

| |

(a) - (b) |

Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal

|

The information set forth in the Schedule 14D-9 under the headings “Special

Factors—The Solicitation or Recommendation,” “Special Factors— Persons/Assets Retained, Employed, Compensated or Used” and “Annex 2— Opinion of Financial Advisor,” and the information set

forth as Exhibits (c)(1)-(c)(9) is incorporated herein by reference. Leerink Partners LLC has consented to the inclusion of its opinion and discussion materials in their entirety as Exhibits (c)(1)-(c)(9) to this Schedule 13E-3.

The information set forth in the Offer to Purchase under the headings “Special

Factors—Section 1. Background of the Offer; Contacts with Pardes” and “Special Factors—Section 4. Reports, Appraisals and Negotiations” and in Exhibits (c)(1) – (c)(9)

hereto is incorporated herein by reference.

| |

(c) |

Availability of Documents |

The reports, opinions or appraisals referenced in this Item 9 are available for inspection and copying at Foresite Capital Affiliates principal executive

offices located at 900 Larkspur Landing Circle, Suite 150, Larkspur, California 94939, during regular business hours, by any interested stockholder of Pardes or a representative of such interested stockholder who has been so designated in writing by

such interested stockholder.

| ITEM 10. |

SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION |

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Tender

Offer——Section 8. Source and Amount of Funds” is incorporated herein by reference.

Not applicable.

The information set forth in the Schedule 14D-9 under the heading “Special Factors—Persons/Assets

Retained, Employed, Compensated or Used” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the

heading “The Tender Offer—12. Fees and Expenses” is incorporated herein by reference.

Not applicable.

| ITEM 11. |

INTEREST IN SECURITIES OF THE SUBJECT COMPANY |

The information set forth in Schedule 14D-9 under the heading “Special Factors—Past Contacts,

Transactions, Negotiations, and Agreements” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the

heading “The Tender Offer—Section 6. Certain Information Concerning Parent and Purchaser” and “Schedule A—Information Concerning Members of the Boards of Directors and the Executive Officers of

Purchaser, Parent and the Guarantors—Security Ownership of Certain Beneficial Owners” is incorporated herein by reference.

| |

(b) |

Securities Transactions |

The information set forth in Schedule 14D-9 under the headings “Special Factors—Past Contacts,

Transactions, Negotiations and Agreements—Arrangements with Parent and Purchaser and Their Affiliates” and “Item 6. Interest in Securities of the Subject Company” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Tender Offer—Section 6. Certain Information

Concerning Parent and Purchaser” and “Schedule A—Information Concerning Members of the Boards of Directors and the Executive Officers of Purchaser, Parent and the Guarantors—Security Ownership of Certain Beneficial

Owners” is incorporated herein by reference.

| ITEM 12. |

THE SOLICITATION OR RECOMMENDATION |

| |

(d) |

Intent to Tender or Vote in a Going-Private Transaction |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—The Solicitation or

Recommendation—Intent to Tender” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings

“Summary Term Sheet,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,” “The Tender Offer—Section 7. Summary of the Merger Agreement and

Certain Other Agreements—Summary of the Merger Agreement and Certain Other Agreements–Pardes Board Recommendation and Special Committee Recommendation” is incorporated herein by reference.

| |

(e) |

Recommendations of Others |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—The Solicitation or

Recommendation” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term

Sheet,” “Special Factors—Section 2. Purpose of the Offer and Plans for Pardes,” “Special Factors—Section 3. Position of Parent and Purchaser Regarding Fairness

of the Offer and Merger” and “The Tender Offer—Section 7. Summary of the Merger Agreement and Certain Other Agreements—Summary of the Merger Agreement and Certain Other Agreements—Pardes Board

Recommendation and Special Committee Recommendation” is incorporated herein by reference.

| ITEM 13. |

FINANCIAL STATEMENTS |

| |

(a) |

Financial Information |

The information set forth in the Offer to Purchase under the heading “The Tender Offer—Section 5. Certain Information

Concerning Pardes” is incorporated herein by reference.

The audited financial statements of Pardes as of and for the fiscal years ended

December 31, 2022 and December 31, 2021 are incorporated herein by reference to Part II, Item 8 of Pardes’ Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with

the SEC on March 14, 2023. The unaudited condensed financial statements of Pardes for the three months ended March 31, 2023 are incorporated herein by reference to Item 1 of Pardes’ Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023, filed with the SEC on May 5, 2023.

| |

(b) |

Pro Forma Information |

Not applicable.

The information set forth in the Schedule 14D-9 under the heading “Special

Factors—Additional Information–Summary Financial Information” is herein incorporated by reference.

| ITEM 14. |

PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR USED |

| |

(a) |

Solicitations or Recommendations |

The information set forth in the Schedule 14D-9 under the heading “Special Factors–Persons/Assets

Retained, Employed, Compensated or Used” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the

heading “The Tender Offer—12. Fees and Expenses” is incorporated herein by reference.

| |

(b) |

Employees and Corporate Assets |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—Persons/Assets

Retained, Employed, Compensated or Used” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the

heading “The Tender Offer—12. Fees and Expenses” is incorporated herein by reference.

| ITEM 15. |

ADDITIONAL INFORMATION |

| |

(b) |

Golden Parachute Compensation |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—Past Contacts,

Transactions, Negotiations and Agreements—Arrangements Between Pardes and its Executive Officers, Directors and Affiliates—Golden Parachute Compensation” is incorporated herein by reference.

| |

(c) |

Other Material Information |

The information set forth in the Schedule 14D-9 under the heading “Special Factors—Additional

Information” is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “The Tender

Offer—Section 8. Source and Amount of Funds” and “The Tender Offer–Section 14. Miscellaneous” is incorporated herein by reference.

The following exhibits are filed herewith:

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1)(A) |

|

Amended and Restated Offer to Purchase, dated August 17, 2023 (incorporated herein by reference to Exhibit (a)(1)(A) to the Schedule TO). |

|

|

| (a)(1)(B) |

|

Form of Letter of Transmittal (incorporated herein by reference to Exhibit (a)(1)(B) to the Schedule TO). |

|

|

| (a)(1)(C) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated herein by reference to Exhibit (a)(1)(C) to the Schedule TO). |

|

|

| (a)(1)(D) |

|

Form of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated herein by reference to Exhibit (a)(1)(D) to the Schedule TO). |

|

|

| (a)(1)(E) |

|

Form of Summary Advertisement as published in The New York Times on July 28, 2023 (incorporated by reference to Exhibit (a)(1)(E) to the Schedule TO). |

|

|

| (a)(1)(F) |

|

Solicitation/Recommendation Statement on Schedule 14D-9 (incorporated by reference to Schedule 14D-9 filed by Pardes with the SEC on July 28, 2023,

as amended and restated on August 17, 2023). |

|

|

| (a)(1)(G) |

|

Press Release issued by Pardes on July 17, 2023 (incorporated by reference to Exhibit 99.1 to the Form 8-K filed by Pardes with the SEC on July 17, 2023). |

|

|

| (a)(1)(H) |

|

Press Release issued by Purchaser on August 17, 2023 (incorporated herein by reference to Exhibit (a)(1)(G) to the Schedule TO). |

|

|

| (b) |

|

None. |

|

|

| (c)(1) |

|

Opinion of Leerink Partners LLC, dated July 16, 2023 (incorporated by reference to Annex 2 of the Schedule 14D-9). |

|

|

| (c)(2) |

|

Materials Prepared for the Board of Directors, dated July 16, 2023, from Leerink Partners LLC. |

|

|

| (c)(3)*+ |

|

Strategic Process Update, dated June 12, 2023, from Leerink Partners LLC. |

|

|

| (c)(4)*+ |

|

Discussion Materials, dated April 13, 2023, from Leerink Partners LLC. |

|

|

| (c)(5)*+ |

|

Discussion Materials, dated May 2023, from Leerink Partners LLC. |

|

|

| (c)(6)*+ |

|

Discussion Materials, dated May 24, 2023, from Leerink Partners LLC. |

|

|

| (c)(7)*+ |

|

Discussion Materials, dated May 25, 2023, from Leerink Partners LLC. |

|

|

| (c)(8)*+ |

|

Discussion Materials, dated June 10, 2023, from Leerink Partners LLC. |

|

|

| (c)(9)*+ |

|

Discussion Materials, dated June 11, 2023, from Leerink Partners LLC. |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated as of July 16, 2023, among Pardes, Parent and Purchaser (incorporated by reference to Exhibit 2.1 to the Form 8-K, filed by Pardes with the SEC on

July 17, 2023). |

|

|

| (d)(2) |

|

Form of Contingent Value Rights Agreement, by and between Parent, Purchaser, the Rights Agent and the Representative (incorporated herein by reference to Exhibit C to Exhibit 2.1 to the

Form 8-K filed by Pardes with the SEC on July 17, 2023). |

|

|

| (d)(3) |

|

Mutual Confidentiality Agreement, dated June 13, 2023 between Pardes and Foresite Capital Management, LLC (incorporated by reference to Exhibit (d)(2) to the Schedule TO). |

|

|

| (d)(4) |

|

Limited Guaranty, dated July 16, 2023, by Pardes, FS Development Holdings II, LLC, Foresite Capital Fund V, L.P. and Foresite Capital Opportunity Fund V, L.P. (incorporated by reference to Exhibit 10.1 to the Company’s

Current Report on Form 8-K filed by Pardes with the SEC on July 17, 2023). |

|

|

|

| Exhibit No. |

|

Description |

|

|

| (d)(5) |

|

Registration Rights Agreement, dated December 23, 2021, by and among Pardes Biosciences, Inc. and the stockholders party thereto (incorporated by reference to Exhibit 10.1 on Form

8-A12B/A filed by Pardes with the SEC on December 23, 2021). |

|

|

| (d)(6) |

|

Voting Agreement, dated December 23, 2021, by and among Pardes Biosciences, Inc. and the other parties thereto (incorporated by reference to Exhibit 10.2 on Form 8-K filed by Pardes with

the SEC on December 30, 2021). |

|

|

| (d)(7) |

|

Lockup Agreement, dated December 23, 2021, by and among Pardes and the other parties thereto (incorporated by reference to Exhibit 10.3 on Form 8-K filed by Pardes with the SEC on

December 30, 2021). |

|

|

| (d)(8) |

|

Form of Indemnification Agreement for Directors of Pardes Biosciences, Inc. (incorporated by reference to Exhibit 10.6 to Form 8-K filed by Pardes with the SEC on December 30,

2021). |

|

|

| (d)(9) |

|

Form of Indemnification Agreement for Executive Officers of Pardes Biosciences, Inc. (incorporated by reference to Exhibit 10.7 to Form 8-K filed by Pardes with the SEC on December 30,

2021). |

|

|

| (d)(10) |

|

2021 Stock Option and Incentive Plan (incorporated by reference to Annex E to Pardes’ Proxy Statement/Prospectus on Form 424B3 filed by Pardes with the SEC on December 1, 2021). |

|

|

| (d)(11) |

|

Forms of Award Agreements under the 2021 Stock Option and Incentive Plan (incorporated by reference to Exhibit 10.5 on Form 8-K filed by Pardes with the SEC on December 30,

2021). |

|

|

| (d)(12) |

|

2022 Inducement Plan (incorporated by reference to Exhibit 99.3 to the Form S-8 filed by Pardes with the SEC on March 2, 2022). |

|

|

| (d)(13) |

|

Form of Award Agreements under the 2022 Inducement Plan (incorporated by reference to Exhibit 99.4 to the Form S-8 filed by Pardes with the SEC on March 2, 2022). |

|

|

| (d)(14) |

|

Amended and Restated Offer Letter, dated December 23, 2020, by and between Pardes Biosciences, Inc. and Uri A. Lopatin, M.D.

(incorporated by reference to Exhibit 10.9 on Form 8-K filed by Pardes with the SEC on December 30,

2021). |

|

|

| (d)(15) |

|

Offer Letter, dated January 20, 2021, by and between Pardes Biosciences, Inc. and Heidi Henson (incorporated by reference to Exhibit 10.10 to Form S-1 filed by Pardes with the SEC on

January 21, 2022). |

|

|

| (d)(16) |

|

Retention Bonus Agreement, dated June 2, 2023, by and between Pardes Biosciences, Inc. and Heidi Henson (incorporated by reference to Exhibit 10.1 to Form 8-K filed by Pardes with the SEC

on June 5, 2023). |

|

|

| (d)(17) |

|

Employment Agreement dated March 1, 2022, by and between Pardes Biosciences, Inc. and Thomas G. Wiggans (incorporated by reference to Exhibit 10.18 to Form 10-K filed by Pardes with the

SEC on March 29, 2022). |

|

|

| (d)(18) |

|

Letter Agreement dated July 16, 2023 with Thomas Wiggans (incorporated by reference to Exhibit 10.2 to Form 8-K filed by Pardes with the SEC on July 17, 2023). |

|

|

| (d)(19) |

|

Executive Severance Plan (incorporated by reference to Exhibit 10.13 on Form 8-K filed by Pardes with the SEC on December 30, 2021). |

|

|

| (d)(20) |

|

Senior Executive Cash Incentive Bonus Plan (incorporated by reference to Exhibit 10.13 to

Form S-1 filed by Pardes with the SEC on January 21, 2022). |

|

|

| (d)(21) |

|

Transition and Separation Agreement and General Release of Claims dated March 25, 2022, by and between Pardes Biosciences, Inc. and Uri A. Lopatin, M.D. (incorporated by reference to Exhibit 10.21 to Form 10-K filed by Pardes with the SEC on March 29, 2022). |

|

|

|

| Exhibit No. |

|

Description |

|

|

| (d)(22) |

|

Consulting Agreement dated March 25, 2022, by and between Pardes Biosciences, Inc. and Uri A. Lopatin, M.D. (incorporated by reference to Exhibit 10.22 to Form 10-K filed by Pardes with

the SEC on March 29, 2022). |

|

|

| (d)(23) |

|

Separation Agreement and General Release of Claims, dated May 15, 2023, by and between Pardes Biosciences, Inc. and Brian P. Kearney, PharmD. (incorporated by reference to Exhibit 10.1 to Form

8-K filed by Pardes with the SEC on May 18, 2023). |

|

|

| (d)(24) |

|

Consulting Agreement, executed May 15, 2023, by and between Pardes Biosciences, Inc. and Brian P. Kearney, PharmD. (incorporated by reference to Exhibit 10.2 to Form 8-K filed by Pardes

with the SEC on May 18, 2023). |

|

|

| (d)(25) |

|

Letter Agreement dated as of February 16, 2021, by and among FS Development Corp. II, FS Development Corp. II’s officers and directors, and FS Development Holdings II, LLC (incorporated by reference to Exhibit 10.4 to Form

8-K filed by Pardes with the SEC on February 19, 2021). |

|

|

| (d)(26) |

|

FS Development Corp. II Support Agreement, dated as of June 29, 2021, by and among FS Development Corp. II, Pardes Biosciences, Inc., FS Development Holdings II, LLC and certain supporting stockholders of FS Development Corp.

II (incorporated by reference to Exhibit 10.1 to Form 8-K filed by Pardes with the SEC on June 29, 2021). |

|

|

| (f)* |

|

Section 262 of the Delaware General Corporation Law. |

|

|

| (g) |

|

None. |

|

|

| (107)* |

|

Calculation of Filing Fee Tables. |

| + |

Certain portions of this exhibit have been redacted and separately filed with the Securities and Exchange

Commission pursuant to a request for confidential treatment. |

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

|

|

|

|

|

|

|

| Dated: August 17, 2023 |

|

|

|

PARDES BIOSCIENCES, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Thomas G. Wiggans |

|

|

|

|

|

|

Name: Thomas G. Wiggans |

|

|

|

|

|

|

Title: Chief Executive Officer and

Chair of the Board of Directors |

CERTAIN CONFIDENTIAL PORTIONS OF THIS EXHIBIT HAVE BEEN OMITTED AND REPLACED WITH “[ XYZ ]”. SUCH IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT (I) IS NOT MATERIAL AND (II) IS THE TYPE THAT THE REGISTRANT TREATS AS

PRIVATE OR CONFIDENTIAL.

Exhibit (c)(3)

PROJECT PACIFIC STRATEGIC PROCESS UPDATE JUNE 12, 2023 SVb Securities Confidential

“[ XYZ

]” indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and

Exchange Commission.

PROJECT PACIFIC (1):All private companies have withdrawn from the process. SUMMARY OF STRATEGIC ALTERNATIVES PROCESS AS OF JUNE 13,

2023 Following Pacific’s suspension of further clinical development of pomotrelvir, Pacific engaged SVB Securities to explore a range of strategic alternatives, including an acquisition, merger, business combination, or other transaction. SVB

Securities, management and the Pacific Special Committee considered an initial list of 133 companies and five parties with potential interest in acquiring Pacific via a cash tender offer (“financial buyers”). This list included inbound

interest from companies and financial buyers. Management and the Pacific Special Committee decided to include nine private companies and three potential financial buyers in the process, based on a determination of the potential merits of a

transaction with such party. During the initial outreach process, SVB Securities was directed to contact these parties to determine the level of interest in a potential strategic transaction with Pacific. Of the contacted private companies, eight

requested a process letter and eight submitted non-binding indications of interest (IOI). Two of the three contacted financial buyers submitted non-binding IOIs. Pacific

Special Committee selected three private companies on which to begin further detailed due diligence, including inviting them to conduct a confidential management presentation. After additional diligence and analysis, the three private companies were

provided feedback from the Pacific Special Committee that their proposals would need to include a return of capital to Pacific’s shareholders. Following additional feedback that the return of capital would need to be at least $100M, two of the

private companies withdrew from the process. One private company withdrew from the process to pursue an alternative strategic transaction. Following feedback from the Pacific Special Committee on their initial IOIs, the two financial buyers

submitted revised proposals between June 9 and June 10, 2023, and subsequently revised their proposals again on June 12, 2023. 9 / 3 8 / 2 CONSIDERED: CONTACTED: SUBMITTED IOI: 133 / 5 Companies / Financial Buyers Companies /

Financial Buyers Companies / Financial Buyers CONDUCTED MGMT. PRESENTATIONS(1)(N=3) SUBMITTED REVISED PROPOSALS (N=2)1 Confidential

“[ XYZ

]” indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and

Exchange Commission.

PROJECT PACIFIC XOMA CORPORATION’S OFFERS FOR PACIFICCURRENT 2ND OFFER 1ST OFFER Date of Offer June 12,

2023 June 9, 2023 May 30, 2023 Transaction Structure Cash tender offer “Back-end” merger to acquire any shares not tendered Requested Response Date N/A Timing 3Q23

expected close Support Agreements Certain of PACIFIC’s key shareholders Treatment of Stock Options Terminated as of closing of “back-end” merger In-the-money options cashed out for intrinsic value Exclusivity 30 days 10-day extension if initial period lapses and parties remain in negotiations unless party

provides 10-day written notice of non-renewal Cash Consideration as $ per Share $2.08 per share(1) $2.06 per share(1) $2.07 per share(2) Aggregate Consideration $128.5M

cash(3)(PACIFIC net cash minus $12.5M, assuming PACIFIC net cash at close is $141M) $127M cash(4)(PACIFIC net cash minus $14M, assuming PACIFIC net cash at close is $141M) $127M cash(5)(assumes PACIFIC net cash at close is $141M) CVR for 80% of net

proceeds from sale of PACIFIC’s assets Excess net cash at close greater than $139M will be returned to existing PACIFIC shareholders CVR for 80% of the net proceeds from the sale of PACIFIC’s legacy assets, such as

pomotrelvir, PBI-2158, the backup leads and the IP Cash Consideration as % of PACIFIC Net Cash 91%(6) 90%(6) 90%(7) Cash Consideration as a Premium to Closing Price as of 06/09/23(8) 11% 10%

11%

PROJECT PACIFIC FORESITE CAPITAL’SOFFERS FOR PACIFICCURRENT 2ND OFFER 1ST OFFER Date of

Offer June 12, 2023 June 10, 2023 June 5, 2023 Transaction Structure Cash tender offer for outstanding shares not currently owned by FORESITE Requested Response Date N/A June 12, 2023, 5pm ET (2 days from

offer date) June 8, 2023, 5pm ET (3 days from offer date) Timing N/A Support Agreements N/A Treatment of Stock Options N/A Exclusivity N/A Cash Consideration as $ per Share $2.09 per share $2.09 per share $1.93 per share Aggregate Consideration

$129M cash(1)(PACIFIC net cash minus $12M, assuming PACIFIC net cash at close is $141M) CVR for 80% of the net proceeds payable from any license or disposition involving Pomotrelvirwithin five years of closing $129M cash(1)(PACIFIC net cash minus

$12M, assuming PACIFIC net cash at close is $141M) CVR for 90% of the net proceeds payable from any license or disposition involving Pomotrelvirwithin one year of closing $119M cash(2)(assumes PACIFIC net cash at close is $141M) CVR for 80% of the

net proceeds payable from any license or disposition involving Pomotrelvirwithin one year of closing Cash Consideration as % of PACIFIC Net Cash(3) 91% 91% 84% Cash Consideration as a Premium to Closing Price as of 06/09/23(4) 12% 12% 3%

$1'5(3/$&(':,7+³>;<=@´68&+,'(17,),(',1)250$7,21

+$6%((1(;&/8'(')5207+,6(;+,%,7%(&$86(,7 , ,61270$7(5,$/$1' ,, ,67+(7<3(7+$77+(5(*,675$1775($76$635,9$7(25&21),'(17,$/ Exhibit (c)(4) &(57$,1&21),'(17,$/3257,2162)7+,6(;+,%,7+$9(%((120,77(' PROJECT PACIFIC STRATEGIC

ALTERNATIVES CONSIDERATIONS APRIL 13, 2023 Confidential

PROJECT PACIFIC SITUATION OVERVIEW • Pardes Biosciences is

evaluating its strategic options following the decision to suspend the clinical development of pomotrelvir, reduce headcount by 85% and conserve its current cash balance of ~$172 million. • Pardes’ attractive cash balance and the current

weakness in the capital markets provide Pardes with a range of strategic alternatives to optimize value for shareholders. – Merge with a private company – In-license or acquire clinical assets or new technologies – Merge with a

public company – Return capital to shareholders • Private company merger counterparties could have complementary assets and operating synergies or could be in different therapeutic areas that the board believes will create a compelling

story for new and existing investors. • In-licensing or acquiring assets should be explored but can be challenging given both the competitive intensity and funding requirements to acquire and develop high-quality, clinical-stage assets through

to value inflecting milestones. • Public-to-public mergers are rare for pre-commercial biopharma companies as public company targets with attractive assets often have financing options that are more efficient and feasible than a merger with a

cash-rich fallen angel. • The return of capital option may be more efficient than in the past given the emergence of parties willing to acquire cash-rich companies for up to 80-90% of their net cash balance plus CVRs via a tender offer that

can close in ~45 days vs the traditional dissolution process that can take up to three years to complete. • The typical private merger process can take approximately two to three months to announcement and can take up to another three to four

months to close in the event the transaction does not qualify for a sign-and-close. • Our experience as a leading strategic advisor, history of screening and sourcing select targets for a number of similarly situated clients, differentiated

knowledge resources and deep relationships with potential merger partners make us an ideal advisor for the board as it navigates options and executes potential strategic transactions. Confidential 1

PROJECT PACIFIC PUBLIC / PRIVATE MERGERS CAN WORK AS A GO PUBLIC

ALTERNATIVE FOR HIGH-QUALITY COMPANIES $ IN MILLIONS; SORTED BY ANNOUNCEMENT DATE (NEWEST TO OLDEST) RECENTLY Private Company Private Company Private Company Private Company Private Company ANNOUNCED Merger with Merger with Merger with Merger with

Merger with PUBLIC / PRIVATE MERGERS: March 2023 February 2023 December 2022 November 2022 November 2022 HIGH QUALITY COMPANIES CURRENTLY TRADING ON NASDAQ VIA A PUBLIC / PRIVATE MERGER: Private Company Private Company Private Company Private

Company Private Company Private Company Merger with Merger with Merger with Merger with Merger with Merger with Celtrix Pharmaceuticals May 2000 October 2020 October 2020 January 2018 November 2016 July 2016 • $98MM follow-on (Sep. 2021)

• $184MM follow-on (Nov. 2021) • $84MM follow-on (Jan. 2018) • $52MM follow-on (May 2017) • $144MM follow-on (Dec. 2017) • $403MM follow-on (Sep. 2017) • $450MM convertible debt • $270MM follow-on (Aug.2022)

• $121MM follow-on (May 2022) • $63MM follow-on (Nov. 2018) • $75MM follow-on (Jan. 2018) • $440MM follow-on (Jun. 2018) (Jan. 2018) • $91MM follow-on (Apr. 2019) • $46MM follow-on (Jan. 2020) • $159MM

proceeds under • $287MM follow-on (May 2019) $200M ATM (Dec. 2022) • $98MM follow-on (Dec. 2019) • $160MM follow-on (Sep. 2020) • $259MM follow-on (May 2020) • $288MM follow-on / $575MM • $299MM follow-on (Dec.

2020) • Acquisition by Ipsen (closed convertible debt (May 2021) March 2023) • Renovacor Acquisition • $275MM follow-on / $500MM (Dec. 2022) term loan/royalty (Oct. 2022) • $100MM follow-on (Oct. 2022) Acquired for Mkt. Cap:

$1.5B Mkt. Cap: $1.7B Mkt. Cap: $1.4B Mkt. Cap: $5.6B Mkt. Cap: $2.3B (1) $1.0B by Ipsen (1) Does not include $10/share CVRs. Note: Data as of 04/06/23. Recently announced transactions include private company mergers that have not yet closed.

Confidential 2 Source: FactSet, Dealogic, SEC filings and press releases.

PROJECT PACIFIC SELECTION METHODOLOGY FOR A PRIVATE COMPANY MERGER

TRANSACTION Leverage SVB Securities' relationships with high-quality private biopharma companies with stated interest in alternative go-public transactions MEDACorp knowledge resource enables diligence of potential opportunities Relationships with

100+ high quality private biopharma companies help expedite screening process Focused list of attractive target companies for Pardes to pursue Confidential 3

PROJECT PACIFIC CRITERIA FOR DETERMINING ATTRACTIVENESS OF A PRIVATE

COMPANY MERGER COUNTERPARTY ILLUSTRATIVE SCREENING CRITERIA USED BY PARDES BIOSCIENCES Attractiveness of target’s lead asset, pipeline, technology, and business case 1. 2. Near-term, value-driving catalysts within pro forma cash runway

Management, board and existing investor quality 3. 4. Readiness to be a U.S. publicly traded company Need for additional financing and commitment from private company investors to provide such 5. 6. Proposed valuation and ownership split including

premium assigned to private company over expected cash at close Fit and value assigned to public company’s programs 7. ILLUSTRATIVE SCREENING CRITERIA USED BY PRIVATE COMPANY 1. Sufficient cash on balance sheet to fund activities through key

value-driving catalysts 2. Quality of public company investor base – overlap with private company is often helpful Material litigation, liabilities or sustained operational commitments 3. Personnel with complementary domain expertise

(scientific, development, or commercial) 4. Confidential 4

PROJECT PACIFIC COMPONENTS OF VALUE IN A PRIVATE COMPANY MERGER PARDES

BIOSCIENCES PRIVATE TARGET Estimated net cash at close Base value is post-money valuation of last private financing • Primary value driver • Value may be adjusted based on market conditions • Ability to maximize cash preservation

via operational • Meaningful data generation or update since last streamlining financing could justify a value adjustment • Target valuation may be more negotiable in the absence of a high-quality institutional shareholder Valuation

supported by: Listing value Clinical programs / Intrinsic valuation Market based valuation other assets • Key analysis to inform • Crossover to IPO step- • Additional value driver • Potential for right inherent value of

future up, comparable partner to ascribe value cash flows • Dependent on equity companies analysis capital market • CVRs can be employed • Sensitive to changes in • Reference point to conditions to retain value for

assumptions inform value shareholders • Less reliable for earlier- • Dependent on market stage companies conditions Relative value, informed by the above metrics, will be determined via negotiation of the exchange ratio Confidential

5

CVRS CAN BE EMPLOYED TO RETAIN VALUE FOR PROJECT PACIFIC SHAREHOLDERS

Mechanism of Special dividend to Aduro shareholders of record prior Special dividend to OncoMed shareholders of record in to merger becoming effective March 2019 CVR Issuance Terminates at earlier of: • Payment by Mereo of each milestone

eligible to be 10 years Period attained • Expiration of period for each trigger event Non-tradable Non-tradable Tradability • Celgene exercises its option to license Oncomed’s etigilimab and pays associated $35mm milestone •

Disposition or license of Aduro’s non-renal assets before 12/31/19 Trigger • Revenue resulting from ownership of subsidiary Event(s) • Mereo enters partnership or other agreement established to hold any non-renal assets regarding

navicixizumab within 18 months of the merger closing • Additional Mereo ADRs based on exchange ratio calculated by dividing the milestone received by the • Any consideration paid to Aduro with respect to the Mereo’s 10-day VWAP

following announcement disposition or license of any non-renal assets that Celgene exercised its option (subject to issuance limitation of 40% of issued share capital) • Proceeds resulting from ownership in any Payment subsidiary established

by Aduro before the six- • 70% of net proceeds of milestone payments month anniversary of the closing date to hold any received by Mereo within 5 years of merger from non-renal assets future partnership or investment transactions in relation

to navicixizumab (subject to aggregate cap of $79.7mm) Confidential 6

PROJECT PACIFIC CASE STUDY: CONCENTRA’S ACQUISITION OF JOUNCE

POST REDX MERGER ANNOUNCEMENT TIMELINE • 02/23: Jounce announced an all-stock merger with Redx Pharma (37% / 63% split, respectively) • 03/14: Concentra offered to acquire Jounce for $1.80 cash per share + a CVR • 03/27: Jounce

announced acquisition by Concentra for $1.85 cash per share + CVRs TRANSACTION DETAILS • On 04/07, Concentra will commence a tender offer to acquire all outstanding shares of Jounce for $1.85 per share + CVRs ‒ Estimated / minimum Jounce

net cash at close: $115M / $110M ‒ Upfront cash of $1.85 per share represents 61% of current net cash per share, 85% of estimated net cash at close and 89% of minimum net cash ‒ Jounce’s liquidation analysis suggested distribution

would result in proceeds of 61% of current net cash and 89% of merger minimum cash • CVRs are for proceeds from (1) a transaction for Jounce’s programs and (2) certain specified cost savings (1) 80% of proceeds from a transaction for

Jounce’s programs within two years of merger close; 10-year tail on payments (2) 100% of the potential aggregate value of certain specified potential cost savings, including: o Any reduction in the amount of the expected lease obligation o Any

increase in net working capital • Concurrent with the merger, Jounce announced an 84% RIF (compared to a 57% RIF with the Redx merger) and restructuring costs of $6.5M • Jounce’s board also recommended not moving forward with the

Redx merger, causing Redx shares to decline 11% TRADING PERFORMANCE PERFORMANCE RELATIVE TO CASH PER SHARE Share TANGCAPITALMANAGEMENT Price 03/27: Announced $3.00 acquisition by Concentra Merger (2/23) + Offer (3/14): Merger (3/27): (1) Current Net

Cash Per Share: $3.01 57% RIF $1.80 + CVR $1.85 + CVRs $2.50 T-0 +1 Day T-0 +1 Day T-0 +1 Day (2) 03/14: Announced Est. Net Cash at Close Per Share: $2.16 Concentra’s offer to acquire $2.00 Jounce Share Price $0.99 $1.10 $1.06 $1.49 $1.51

$1.83 (3) Merger Min. Net Cash Per Share: $2.07 Change 11% 41% 21% $1.50 Share Price as a % of Net Cash Share Price as % of: $1.00 (1) Latest Net Cash 33% 37% 35% 50% 50% 61% (2) Est. Net Cash at Close 46% 51% 49% 69% 70% 85% $0.50 02/23: Announced

merger 03/06: Tang Capital acquired (3) with Redx a 9.7% stake in Jounce Merger Min. Net Cash 48% 53% 51% 72% 73% 88% $0.00 1/3 1/10 1/17 1/24 1/31 2/7 2/14 2/21 2/28 3/7 3/14 3/21 (1): Net cash per share of $3.01, assuming $160M last reported net

cash and 53.1 fully diluted shares outstanding using treasury stock methodology. (2): Net cash per share of $2.16, assuming $115M net cash at close and 53.1 fully diluted shares outstanding using treasury stock methodology. Confidential 7 (3): Net

cash per share of $2.07, assuming $110M net cash at close and 53.1 fully diluted shares outstanding using treasury stock methodology.

6HFXULWLHVDQG([FKDQJH&RPPLVVLRQDPHQGHG7KHLQIRUPDWLRQKDVEHHQVXEPLWWHGVHSDUDWHOZLWKWKH

RIWKH6HFXULWLHV([FKDQJH$FWRIDV VLVRIDFRQILGHQWLDOWUHDWPHQWUHTXHVWSXUVXDQWWR5XOHE ³>;<=@´LQGLFDWHVLQIRUPDWLRQWKDWKDVEHHQRPLWWHGRQWKHED PROJECT PACIFIC ILLUSTRATIVE POTENTIAL MERGER CANDIDATES Oncology Autoimmune & Inflammation (1)

(1) (1) Vida Ventures (1) (1) (1) Portfolio Company (2) (1): Public company. (2): Highest stage of development not disclosed. Inbound Interest Source: Company websites. Confidential 8 Preclinical Phase 1 & 1/2 Phase 2 & 3

6HFXULWLHVDQG([FKDQJH&RPPLVVLRQDPHQGHG7KHLQIRUPDWLRQKDVEHHQVXEPLWWHGVHSDUDWHOZLWKWKH

RIWKH6HFXULWLHV([FKDQJH$FWRIDV VLVRIDFRQILGHQWLDOWUHDWPHQWUHTXHVWSXUVXDQWWR5XOHE ³>;<=@´LQGLFDWHVLQIRUPDWLRQWKDWKDVEHHQRPLWWHGRQWKHED PROJECT PACIFIC ILLUSTRATIVE POTENTIAL MERGER CANDIDATES (CONT.) Cardiology / X (1) (2) Cardio- CNS

Anti-Viral Genetic Medicines Rare Diseases Others metabolic (4) (3) (4) (4) Project Nuage (5) (1): Excludes oncology focused companies. (2): Other therapeutics areas includes endocrinology, gastrointestinal diseases, HCS therapies, hepatology,

ophthalmology, pulmonology, xenotransplantation, companies with multiple therapeutic areas as well as a healthcare information technology platform. (3): Commercial-stage. (4): Public company. (5): Highest stage of development not disclosed. Inbound

Interest Source: Company websites. Confidential 9 Preclinical Phase 1 & 1/2 Phase 2 & 3 or Later

PROJECT PACIFIC ILLUSTRATIVE PRIVATE COMPANY MERGER PROCESS TIMELINE

THROUGH ANNOUNCEMENT MONTH APRIL MAY JUNE JULY WEEK OF 10 17 24 1 8 15 22 29 5 12 19 26 3 10 17 24 Weekly reoccurring meeting to track process Private company target selection Formally initiate outreach to selected parties Send process letter and

receive initial proposals Evaluate proposals and advance parties to further diligence Due diligence Management presentations Receipt of final proposals Negotiate final terms and definitive documentation If Nasdaq agrees no shareholder approval is

required, the merger can close shortly after announcement. Confidential 10

PROJECT PACIFIC Disclosures This information (including, but not

limited to, prices, quotes and statistics) has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without

notice. The information is intended for Institutional Use Only and is not an offer to sell or a solicitation to buy any product to which this information relates. SVB Securities LLC (“Firm”), its officers, directors, employees,

proprietary accounts and affiliates may have a position, long or short, in the securities referred to in this report, and/or other related securities, and from time to time may increase or decrease the position or express a view that is contrary to

that contained in this report. The Firm's research analysts, salespeople, traders and other professionals may provide oral or written market commentary or trading strategies that are contrary to opinions expressed in this report. The Firm's asset

management group and proprietary accounts may make investment decisions that are inconsistent with the opinions expressed in this document. The past performance of securities does not guarantee or predict future performance. Transaction strategies

described herein may not be suitable for all investors. This document may not be reproduced or circulated without SVB Securities’ written authority. Additional information is available upon request by contacting the Editorial Department, SVB

Securities LLC, 53 State Street, 40th Floor, Boston, MA 02109. Like all Firm employees, research analysts receive compensation that is impacted by, among other factors, overall firm profitability, which includes revenues from, among other business

units, Institutional Equities, Research, and Investment Banking. Research analysts, however, are not compensated for a specific investment banking services transaction. To the extent SVB Securities' research reports are referenced in this material,

they are either attached hereto or information about these companies, including prices, rating, market making status, price charts, compensation disclosures, Analyst Certifications, etc. is available on

https://svbsecurities.bluematrix.com/bluematrix/Disclosure2. SVB MEDACorp LLC (MEDACorp), an affiliate of SVB Securities LLC, is a global network of independent healthcare professionals (Key Opinion Leaders and consultants) providing industry and

market insights to SVB Securities and its clients. © 2023 SVB Securities LLC. All Rights Reserved. Member FINRA/SIPC. SVB Securities LLC is a member of SVB Financial Group. Confidential

CERTAIN CONFIDENTIAL PORTIONS OF THIS EXHIBIT HAVE BEEN OMITTED AND

REPLACED WITH [ XYZ ] . SUCH IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT (I) IS NOT MATERIAL AND (II) IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. Exhibit (c)(5)

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

CERTAIN CONFIDENTIAL PORTIONS OF THIS EXHIBIT HAVE BEEN OMITTED AND

REPLACED WITH [ XYZ ] . SUCH IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT (I) IS NOT MATERIAL AND (II) IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. Exhibit (c)(6) PROJECT PACIFIC STRATEGIC PROCESS

UPDATE MAY 24, 2023

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

APPENDIX

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

CERTAIN CONFIDENTIAL PORTIONS OF THIS EXHIBIT HAVE BEEN OMITTED AND

REPLACED WITH [ XYZ ] . SUCH IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT (I) IS NOT MATERIAL AND (II) IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. Exhibit (c)(7) PROJECT PACIFIC SUMMARY OF INITIAL

INDICATIONS OF INTEREST MAY 25, 2023

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a

confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

APPENDIX