UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 4, 2015

|

STAPLES, INC. |

|

(Exact name of registrant as specified in charter) |

|

Delaware |

|

0-17586 |

|

04-2896127 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

Five Hundred Staples Drive, Framingham, MA |

|

01702 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 508-253-5000

|

|

|

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On February 4, 2015, Staples, Inc. (the “Company”) and Office Depot, Inc. (“Office Depot”) issued a joint press release announcing the execution of an Agreement and Plan of Merger, dated as of February 4, 2015, by and among the Company, Staples AMS, Inc. and Office Depot, pursuant to which the Company will acquire Office Depot (the “Merger”), on the terms and conditions contained therein. A copy of the joint press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

On February 4, 2015, the Company will host a conference call to provide supplemental information regarding the Merger to analysts and investors at 8:00 a.m. ET. To access the conference call, dial 617-399-5130. The passcode is 62894773. To access the webcast, visit the Investor Relations section of Staples’ website at http://investor.staples.com. A replay of the conference call is expected to be available online at http://investor.staples.com. A copy of the investor presentation is attached hereto as Exhibit 99.2.

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

The Company plans to file with the SEC a Registration Statement on Form S-4 in connection with the transaction and Office Depot plans to file with the SEC and mail to its stockholders a Proxy Statement/Prospectus in connection with the transaction. The Registration Statement and the Proxy Statement/Prospectus will contain important information about the Company, Office Depot, the transaction and related matters. Investors and security holders are urged to read the Registration Statement and the Proxy Statement/Prospectus carefully when they are available.

Investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus and other documents filed with the SEC by the Company and Office Depot through the web site maintained by the SEC at www.sec.gov.

In addition, investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus from the Company by contacting the Company’s Investor Relations Department at 800-468-7751 or from Office Depot by contacting Office Depot’s Investor Relations Department at 561-438-7878.

The Company and Office Depot, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the Merger Agreement. Information regarding the Company’s directors and executive officers is contained in the Company’s proxy statement dated April 11, 2014, which is filed with the SEC. Information regarding Office Depot’s directors and executive officers is contained in Office Depot’s proxy statement dated March 24, 2014, which is filed with the SEC. To the extent holdings of securities by such directors or executive officers have changed since the amounts printed in the 2014 proxy statements, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement/Prospectus to be filed by Office Depot in connection with the transaction.

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS

Statements in this document regarding the proposed transaction between the Company and Office Depot, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and any other statements about the Company or Office Depot managements’ future expectations, beliefs, goals, plans or prospects constitute forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing “believes,” “anticipates,” “plans,” “expects,” “may,” “will,” “would,” “intends,” “estimates” and similar expressions) should also be considered to be forward looking statements. There are a number of important factors that could cause actual results or events to differ materially

from those indicated by such forward looking statements, including: the ability to consummate the transaction; the risk that Office Depot’s stockholders do not approve the Merger; the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; the risk that the financing required to fund the transaction is not obtained; the risk that the other conditions to the closing of the merger are not satisfied; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Merger; uncertainties as to the timing of the Merger; competitive responses to the proposed Merger; response by activist shareholders to the Merger; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability to successfully integrate the Company’s and Office Depot’s operations and employees; the ability to realize anticipated synergies and cost savings; unexpected costs, charges or expenses resulting from the Merger; litigation relating to the Merger; the outcome of pending or potential litigation or governmental investigations; the inability to retain key personnel; any changes in general economic and/or industry specific conditions; and the other factors described in the Company’s Annual Report on Form 10-K for the year ended February 1, 2014 and Office Depot’s Annual Report on Form 10-K for the year ended December 28, 2013 and their most recent Quarterly Reports on Form 10-Q each filed with the SEC. The Company and Office Depot disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this document.

Item 9.01 Financial Statements and Exhibits

The exhibits listed on the Exhibit Index immediately preceding such exhibits are filed as part of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: February 4, 2015 |

Staples, Inc. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Ronald L. Sargent

Chief Executive Officer |

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Joint Press Release, dated February 4, 2015 |

|

|

|

|

|

99.2 |

|

Investor Presentation, dated February 4, 2015 |

Exhibit 99.1

|

|

Staples Media Contact: |

Kirk Saville |

|

|

|

508-253-8530 |

|

|

|

|

|

|

Staples Investor Contact: |

Chris Powers |

|

|

|

508-253-4632 |

|

|

|

|

|

|

Office Depot Media Contact: |

Karen Denning |

|

|

|

630-864-6050 |

|

|

|

|

|

|

Office Depot Investor Contact: |

Mike Steele |

|

|

|

561-438-3657 |

Staples, Inc. Announces Acquisition of Office Depot, Inc.

Combined Company Better Positioned to Serve the Changing Needs of Customers and Compete Against a Large and Diverse Set of Competitors

Strategic Combination Expected to Deliver at Least $1 Billion of Annualized Synergies by Third Full Fiscal Year Post-Closing

Cost Savings and Operational Efficiencies to Dramatically Accelerate Staples’ Strategy of Driving Growth in Delivery Businesses and Categories Beyond Office Supplies

Provides Ability to Optimize Retail Footprint

Generates Significant Value for Shareholders; Accretive to EPS in First Year Post-Closing1

FRAMINGHAM, Mass. and BOCA RATON, Fla., February 4, 2015 – Staples, Inc. (Nasdaq: SPLS) and Office Depot, Inc. (Nasdaq: ODP) today announced that the companies have entered into a definitive agreement under which Staples will acquire all of the outstanding shares of Office Depot. Under the terms of the agreement, Office Depot shareholders will receive, for each Office Depot share, $7.25 in cash and 0.2188 of a share in Staples stock at closing. Based on Staples closing share price on February 2, 2015, the last trading day prior to initial media speculation around a possible transaction, the transaction values Office Depot at $11.00 per share. This represents a premium of 44 percent over the closing price of Office Depot shares as of February 2, 2015, and a premium of 65 percent over the 90-day average closing price of Office Depot shares as of February 2, 2015. The transaction values Office Depot at an equity value of $6.3 billion.

1 Excluding one-time integration and restructuring costs and purchase accounting adjustments

Staples began discussions to acquire Office Depot in September 2014. The agreement has been unanimously approved by each company’s Board of Directors. With the acquisition of Office Depot, Staples will have pro forma annual sales of approximately $39 billion.

“This is a transformational acquisition which enables Staples to provide more value to customers, and more effectively compete in a rapidly evolving competitive environment,” said Ron Sargent, Staples’ chairman and chief executive officer. “We expect to recognize at least $1 billion of synergies as we aggressively reduce global expenses and optimize our retail footprint. These savings will dramatically accelerate our strategic reinvention which is focused on driving growth in our delivery businesses and in categories beyond office supplies.”

“This transaction delivers great value for our shareholders and creates a company ideally positioned to serve our customers and grow over the long term,” said Roland Smith, chairman and chief executive officer for Office Depot, Inc. “It is also an endorsement of our many accomplishments and the tremendous success we’ve had integrating Office Depot and OfficeMax over the past year. We look forward to bringing our experience and knowledge to the new organization.”

Staples expects to generate at least $1 billion of annualized cost synergies by the third full fiscal year post-closing. The majority of these synergies would be realized through headcount and general and administrative expense reductions, efficiencies in purchasing, marketing, and supply chain, retail store network optimization, as well as sharing of best practices. Staples estimates one-time costs of approximately $1 billion to achieve its synergy target.

Following the closing of the transaction, Staples’ newly constituted Board of Directors will increase in size from 11 members to 13 members and include two Office Depot directors approved by Staples. Staples’ corporate headquarters will remain in Framingham, Mass. and Sargent will continue to serve as Staples’ Chairman and Chief Executive Officer.

In connection with the acquisition, Staples has obtained financing commitments from Barclays and BofA Merrill Lynch for a $3 billion ABL credit facility, and a $2.75 billion 6-year term loan. The closing of the transaction is not subject to financing conditions. Staples is committed to maintaining its current quarterly dividend of $0.12 per share and has temporarily suspended its share buyback

program to focus on paying down transaction related debt. Staples is committed to a prudent capital structure that maximizes financial flexibility and supports a balanced and diverse cash deployment strategy, including the resumption of share buybacks over the longer term.

The transaction is subject to customary closing conditions, including antitrust regulatory approval and Office Depot shareholder approval, and is expected to close by the end of calendar year 2015. Staples will remain focused on its strategic reinvention plan, and Office Depot will remain focused on its integration of OfficeMax during this period.

Barclays is acting as exclusive financial advisor to Staples. Wilmer Cutler Pickering Hale and Dorr LLP and Weil, Gotshal & Manges LLP are acting as legal advisors to Staples. Peter J. Solomon Company is acting as exclusive financial advisor to Office Depot. Simpson Thacher & Bartlett LLP is acting as legal advisor to Office Depot.

Conference Call and Webcast Information

The management teams of Staples and Office Depot will hold a joint conference call and simultaneous webcast today, February 4, 2015 at 8:00 a.m. (ET) to discuss the transaction. Participants will include Ron Sargent, Staples’ Chairman and Chief Executive Officer, Christine Komola, Staples’ EVP and Chief Financial Officer, and Roland Smith, Office Depot’s Chairman and Chief Executive Officer. To access the conference call, dial 617-399-5130. The passcode is 62894773. To access the webcast, visit the Investor Relations section of Staples’ website at http://investor.staples.com. A replay of the webcast will be available online at http://investor.staples.com.

Important Additional Information will be Filed with the SEC

Staples plans to file with the SEC a Registration Statement on Form S-4 in connection with the transaction and Office Depot plans to file with the SEC and mail to its stockholders a Proxy Statement/Prospectus in connection with the transaction. The Registration Statement and the Proxy Statement/Prospectus will contain important information about Staples, Office Depot, the transaction and related matters. Investors and security holders are urged to read the Registration Statement and the Proxy Statement/Prospectus carefully when they are available.

Investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus and other documents filed with the SEC by Staples and Office Depot through the website maintained by the SEC at www.sec.gov.

In addition, investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus from Staples by contacting Staples’ Investor Relations Department at 800-468-7751, or from Office Depot by contacting Office Depot’s Investor Relations Department at 561-438-7878.

Staples and Office Depot, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the Merger Agreement. Information regarding the Staples’ directors and executive officers is contained in Staples’ proxy statement dated April 11, 2014, which is filed with the SEC. Information regarding Office Depot’s directors and executive officers is contained in Office Depot’s proxy statement dated March 24, 2014, which is filed with the SEC. To the extent holdings of securities by such directors or executive officers have changed since the amounts printed in the 2014 proxy statements, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement/Prospectus to be filed by Office Depot in connection with the transaction.

Safe Harbor for Forward-Looking Statements

Statements in this press release regarding the proposed transaction between Staples and Office Depot, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company, and any other statements about Staples’ or Office Depot’s managements’ future expectations, beliefs, goals, plans or prospects constitute forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing “believes,” “anticipates,” “plans,” “expects,” “may,” “will,” “would,” “intends,” “estimates” and similar expressions) should also be considered to be forward looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward looking statements, including: the ability to

consummate the transaction; the risk that Office Depot’s stockholders do not approve the merger; the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; the risk that the financing required to fund the transaction is not obtained; the risk that the other conditions to the closing of the merger are not satisfied; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the merger; uncertainties as to the timing of the merger; competitive responses to the proposed merger; response by activist shareholders to the merger; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; the ability to successfully integrate Staples’ and Office Depot’s operations and employees; the ability to realize anticipated synergies and cost savings; unexpected costs, charges or expenses resulting from the merger; litigation relating to the merger; the outcome of pending or potential litigation or governmental investigations; the inability to retain key personnel; any changes in general economic and/or industry specific conditions; and the other factors described in Staples’ Annual Report on Form 10-K for the year ended February 1, 2014 and Office Depot’s Annual Report on Form 10-K for the year ended December 28, 2013 and their most recent Quarterly Reports on Form 10-Q each filed with the SEC. Staples and Office Depot disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this press release.

About Staples

Staples makes it easy to make more happen with more products and more ways to shop. Through its world-class retail, online and delivery capabilities, Staples lets customers shop however and whenever they want, whether it’s in-store, online or on mobile devices. Staples offers more products than ever, such as technology, facilities and breakroom supplies, furniture, safety supplies, medical supplies, and Copy and Print services. Headquartered outside of Boston, Staples operates throughout North and South America, Europe, Asia, Australia and New Zealand. More information about Staples (SPLS) is available at www.staples.com.

About Office Depot

Formed by the merger of Office Depot and OfficeMax, Office Depot, Inc. is a leading global provider of products, services, and solutions for every workplace – whether your workplace is an office, home, school, or car.

Office Depot, Inc. is a resource and a catalyst to help customers work better. We are a single source for everything customers need to be more productive, including the latest technology, core office supplies, print and document services, business services, facilities products, furniture, and school essentials.

The company has combined pro forma annual sales of approximately $17 billion, employs more than 58,000 associates, and serves consumers and businesses in 57 countries with more than 2,000 retail stores, award-winning e-commerce sites and a dedicated business-to-business sales organization – all delivered through a global network of wholly owned operations, joint ventures, franchisees, licensees and alliance partners. The company operates under several banner brands including Office Depot, OfficeMax, OfficeMax Grand & Toy, Reliable and Viking. The company’s portfolio of exclusive product brands include TUL, Foray, DiVOGA, Ativa, WorkPRO, Realspace and HighMark.

Office Depot, Inc.’s common stock is listed on the NASDAQ Global Select Market under the symbol ODP. Additional press information can be found at: http://news.officedepot.com.

Exhibit

99.2

|

|

February 4,

2015 Staples Announces Acquisition of Office Depot

|

|

|

Important

Additional Information to be Filed with the SEC Staples plans to file with

the SEC a Registration Statement on Form S-4 in connection with the

transaction and Office Depot plans to file with the SEC and mail to its

stockholders a Proxy Statement/Prospectus in connection with the transaction.

The Registration Statement and the Proxy Statement/Prospectus will contain

important information about Staples, Office Depot, the transaction and

related matters. Investors and security holders are urged to read the

Registration Statement and the Proxy Statement/Prospectus carefully when they

are available. Investors and security holders will be able to obtain free

copies of the Registration Statement and the Proxy Statement/Prospectus and

other documents filed with the SEC by Staples and Office Depot through the

web site maintained by the SEC at www.sec.gov. In addition, investors and

security holders will be able to obtain free copies of the Registration

Statement and the Proxy Statement/Prospectus from Staples by contacting

Staples’ Investor Relations Department at 800-468- 7751, or from Office Depot

by contacting Office Depot’s Investor Relations Department at 561-438-7878. Staples

and Office Depot, and their respective directors and executive officers, may

be deemed to be participants in the solicitation of proxies in respect of the

transactions contemplated by the Merger Agreement. Information regarding the

Staples’ directors and executive officers is contained in Staples’ proxy

statement dated April 11, 2014, which is filed with the SEC. Information

regarding Office Depot’s directors and executive officers is contained in

Office Depot’s proxy statement dated March 24, 2014, which is filed with the

SEC. To the extent holdings of securities by such directors or executive

officers have changed since the amounts printed in the 2014 proxy statements,

such changes have been or will be reflected on Statements of Change in

Ownership on Form 4 filed with the SEC. More detailed information regarding

the identity of potential participants, and their direct or indirect

interests, by security holdings or otherwise, will be set forth in the Proxy

Statement/Prospectus to be filed by Office Depot in connection with the

transaction. 2

|

|

|

Forward-Looking

Statements Safe Harbor Statements in this presentation regarding the proposed

transaction between Staples and Office Depot, the expected timetable for

completing the transaction, future financial and operating results, benefits

and synergies of the transaction, future opportunities for the combined

company, and any other statements about Staples’ or Office Depot’s

managements’ future expectations, beliefs, goals, plans or prospects

constitute forward looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statements that are not

statements of historical fact (including statements containing “believes,”

“anticipates,” “plans,” “expects,” “may,” “will,” “would,” “intends,”

“estimates” and similar expressions) should also be considered to be forward

looking statements. There are a number of important factors that could cause

actual results or events to differ materially from those indicated by such

forward looking statements, including: the ability to consummate the

transaction; the risk that Office Depot’s stockholders do not approve the

merger; the risk that regulatory approvals required for the merger are not

obtained or are obtained subject to conditions that are not anticipated; the

risk that the financing required to fund the transaction is not obtained; the

risk that the other conditions to the closing of the merger are not

satisfied; potential adverse reactions or changes to business or employee relationships,

including those resulting from the announcement or completion of the merger;

uncertainties as to the timing of the merger; competitive responses to the

proposed merger; response by activist shareholders to the merger; uncertainty

of the expected financial performance of the combined company following

completion of the proposed transaction; the ability to successfully integrate

Staples’ and Office Depot’s operations and employees; the ability to realize

anticipated synergies and cost savings; unexpected costs, charges or expenses

resulting from the merger; litigation relating to the merger; the outcome of

pending or potential litigation or governmental investigations; the inability

to retain key personnel; any changes in general economic and/or industry

specific conditions; and the other factors described in Staples’ Annual

Report on Form 10-K for the year ended February 1, 2014 and Office Depot’s

Annual Report on Form 10-K for the year ended December 28, 2013 and their

most recent Quarterly Reports on Form 10-Q each filed with the SEC. Staples

and Office Depot disclaim any intention or obligation to update any forward

looking statements as a result of developments occurring after the date of

this presentation. 3

|

|

|

Participants 4

Ron Sargent Staples Chairman & CEO Christine Komola Staples EVP & CFO

Roland Smith Office Depot Chairman & CEO

|

|

|

Onward to

online and boldly to BO$$ Every product your business needs to succeed. #1

Online B2B player #1 Commercial player World’s broadest B2B assortment Turbocharge

print Reshape and improve our businesses Optimize our retail footprint Evolve

our supply chain Fund the future Build enablers of our execution Price

perception Technology Evolve brand Talent & culture Big data and

analytics Fix and grow international Accelerating Staples Strategic

Reinvention and Improving Customer Experience 5 . Building scale and

credibility in new categories . Accelerating growth in delivery businesses .

Enhancing multi-channel Copy and Print business . Optimizing retail store

network . Building a stronger connection between retail and online .

Stabilizing sales and earnings in Europe . Reducing expenses to fund

investments in growth priorities Over the past two years, Staples’ Board of

Directors and management team have reinvented Staples to better meet the

changing needs of customers

|

|

|

. Staples’

Board of Directors’ top priority is to create value for shareholders . In the

summer of 2014 as part of long-range plan, Staples’ Board and management team

analyzed the opportunity to accelerate strategic reinvention through the

acquisition of Office Depot . Staples and Office Depot began discussions to

evaluate a potential combination in September of 2014 . Both Staples and

Office Depot have independently analyzed the regulatory considerations

related to this transaction . Agreement unanimously approved by Boards of

Staples and Office Depot Background of the Transaction 6

|

|

|

. Combined

company better positioned to provide more value to customers and compete

against a large and diverse set of competitors . Strategic combination

expected to deliver at least $1 billion of synergies by third full fiscal

year post-closing . Operational efficiencies and cost savings used to

dramatically accelerate Staples’ strategic reinvention . Provides ability to

optimize retail footprint, minimize redundancy, and reduce costs . Accretive

to EPS in first year post-closing after excluding one-time integration and

restructuring costs and purchase accounting adjustments Compelling Strategic

and Financial Rationale 7

|

|

|

Transaction

Overview . $7.25 per share in cash and 0.2188 of a Staples share for each

Office Depot share . Represents $11.00 per Office Depot share based on

Staples closing price as of February 2, 2015, the last trading day prior to

initial media speculation around a possible transaction . Based on Staples

closing price as of February 2, 2015, transaction values Office Depot at an

equity value of $6.3 billion and EV/EBITDA multiple of approximately 8.5x

(1), or approximately 3.5x including minimum estimated run-rate synergies (2)

. Subject to customary closing conditions, antitrust regulatory approval, and

Office Depot shareholder approval . Staples is not required to close

transaction if antitrust authorities require divestiture of assets that

deliver more than $1.25 billion of Office Depot’s 2014 revenues in the United

States or if a requirement of the antitrust authorities has a material

adverse effect on Office Depot’s operations outside of the United States .

Staples to pay a $250 million termination fee to Office Depot if agreement is

terminated due to antitrust requirements . Closing of transaction not subject

to financing conditions . Expected to close by the end of calendar year 2015

8 1. Reflects Office Depot’s fiscal 2014 guidance provided on 11/4/2014 for

adjusted operating income and depreciation and amortization, and

approximately $140 million of synergies achieved but not realized by Office

Depot in fiscal 2014 related to its acquisition of OfficeMax. Excludes

non-recourse debt. 2. Reflects Staples’ guidance of at least $1 billion of

pre-tax run-rate synergies.

|

|

|

. Following

closing of transaction newly constituted Staples Board of directors will

increase from 11 members to 13 members . Board of directors will include two Office

Depot directors approved by Staples . Ron Sargent will continue to serve as

Staples’ Chairman and Chief Executive Officer following the closing of the

transaction . Staples is planning for its corporate headquarters in

Framingham, MA to serve as the combined company’s headquarters following the

closing of the transaction . Staples plans to evaluate maintaining a presence

in Boca Raton, FL Governance and Leadership 9

|

|

|

Creating a $39

Billion Distributor of Products and Services 10 Post-acquisition Store Count

(3) Distribution Facilities (2) LTM Revenue $B (1) 1. LTM Revenue as of

11/1/2014 and 9/27/2014 for Staples and Office Depot, respectively, Office

Depot revenue pro forma for merger with OfficeMax and excludes revenue

generated by the former OfficeMax business in Mexico. 2. As of fiscal year

ended 2/1/2014 and 12/28/2013 for Staples and Office Depot, respectively,

Office Depot data includes cross docks. 3. As of 11/1/2014 and 9/27/2014 for

Staples and Office Depot, respectively. . North America . International .

Total . North America . International . Total . North America . International

. Total 69 47 116 91 36 127 160 83 243 . North America . International .

Total . North America . International . Total . North America . International

. Total $18.8 $3.9 $22.7 $12.7 $3.5 $16.2 $31.5 $7.4 $38.9 . North America .

International . Total . North America . International . Total . North America

. International . Total 1,721 303 2,024 1,851 145 1,996 3,572 448 4,020

|

|

|

Providing

Significant Value to Office Depot Shareholders 11 . Endorsement of success

integrating Office Depot and OfficeMax over the past year . Tremendous

opportunities for growth while creating increased value and convenience for

customers . Office Depot shareholders have the opportunity to participate in

combined company . Transaction value represents a premium of 44 percent over

closing price of Office Depot shares as of February 2, 2015 . Transaction

value represents a premium of 65 percent over 90-day average closing price of

Office Depot shares as of February 2, 2015 . Office Depot shareholders to own

approximately 16 percent of combined company

|

|

|

Annualized

Synergies Building to at Least $1 Billion Over Three Year Integration Period

12 Year 1 Year 2 Year 3 Expanded product and service offering drives revenue

synergies Cumulative Annualized Synergies Cumulative Costs to Achieve

Synergies Key Synergy Opportunities . Headcount and G&A Expense

Reductions . Procurement . Advertising and Marketing . Retail Network

Optimization . Headcount and G&A Expense Reductions . Procurement .

Advertising and Marketing . Retail Network Optimization . Supply Chain .

Headcount and G&A Expense Reductions . Supply Chain . Retail Network

Optimization One-time costs of approximately $1 billion to achieve synergies

Building to at least $1 billion by 3rd fiscal year post-closing The

acquisition presents a unique and exciting opportunity to reduce costs and

improve service in a way that neither company could achieve on its own

|

|

|

Transaction

Funding Sources & Uses 13 Sources of Funds ($B) Uses of Funds ($B) Excess

Cash $0.5 Rolled Debt & Capital Leases $0.5 New Debt $4.3 Staples Equity

Issued to Office Depot $2.1 Total Sources $7.3 Purchase Office Depot Equity

$6.3 Rolled Debt & Capital Leases $0.5 Refinance Office Depot Debt $0.3

Transaction Fees, Expenses and Breakage Costs $0.4 Total $7.3 . Obtained $3

billion ABL credit facility, plan for $1.5 billion drawn at closing .

Obtained $2.75 billion 6-year Term Loan . Utilized $2.1 billion of Staples’

equity . Utilized $0.5 billion of cash from balance sheet . Rolled over $0.5

billion of Office Depot debt and capital leases Note: Figures may not sum to

total due to rounding.

|

|

|

. Committed to

maintaining current quarterly dividend of $0.12 per share . Temporarily

suspending share repurchase program to focus on paying down transaction

related debt . Committed to prudent capital structure that maximizes

financial flexibility and supports a balanced and diverse cash deployment

strategy, including the resumption of share buybacks over the longer term

Commitment to Return Excess Cash to Shareholders 14

|

|

|

Key Takeaways

15 . Creates significant value for Staples and Office Depot shareholders .

Enables Staples to provide more value to customers and compete against a

large and diverse set of competitors . Accelerates Staples’ strategy of

driving growth in delivery businesses and categories beyond office supplies .

Provides ability to optimize retail footprint and reduce costs . Delivers at

least $1 billion of expected synergies over three year integration period .

Generates EPS accretion in first year post-closing excluding one-time

integration and restructuring costs and purchase accounting adjustments

|

|

|

16 Q&A

|

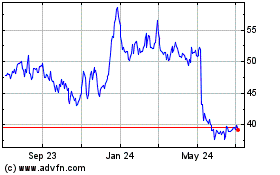

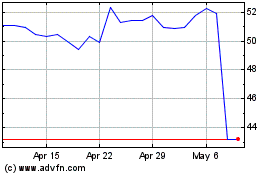

ODP (NASDAQ:ODP)

Historical Stock Chart

From Jun 2024 to Jul 2024

ODP (NASDAQ:ODP)

Historical Stock Chart

From Jul 2023 to Jul 2024