Earnings Preview: AutoZone Inc. - Analyst Blog

December 02 2011 - 11:41AM

Zacks

AutoZone Inc. (AZO) expects to release its

first quarter 2012, ended November 19, 2011, on December 06, 2011

before the opening bell. Memphis, Tennessee-based AutoZone earned a

profit of $7.18 in the fourth quarter of fiscal 2011, beating the

Zacks Consensus Estimates of $6.98 per share.

For the upcoming quarter, the Zacks Consensus Estimate for

AutoZone is pegged at $4.45 per share, reflecting an annualized

growth of 18%. There is no upside potential for the estimate.

With respect to earnings surprises, the company outdid the Zacks

Consensus Estimate in the trailing four quarters. This is reflected

in the average earnings surprise of 6.39%, implying that the

company has outperformed the Zacks Consensus Estimate in all the

four quarters.

Fourth Quarter Recap

Net sales grew 8.1% to $2.64 billion, exceeding the Zacks

Consensus Estimate of $2.61 billion. Domestic same-store sales

(sales for stores open at least one year) rose 4.5% during the

quarter.

Gross margin was 51.2% compared with 50.5% in the year-ago

quarter. The increase in gross margin was attributable to lower

shrink expense and higher merchandise margins. The increase in

merchandise margins was driven by retail price increases on

commodity-based products, which were partially offset by higher

commercial sales.

Operating profit rose 11% to $524.0 million from $472.7 million

in the prior year. This translated into an operating margin of

19.8% versus 19.3% in the fourth quarter of fiscal 2010.

Operating expenses, as a percentage of sales, increased to 31.4%

from 31.2% last year due to higher self-insurance costs and higher

fuel costs, partially offset by leverage due to higher sales

volumes.

During the quarter, AutoZone opened 68 new stores, replaced five

stores, and closed one store in the U.S. and opened 18 new stores

in Mexico. As of August 27, 2011, the company had 4,534 stores in

48 states, as well as in the District of Columbia and Puerto Rico

in the U.S. and 279 stores in Mexico.

Estimate Revisions Trend

Earnings estimate for the first quarter of fiscal 2011 is

currently pegged at a profit of $4.45 per share. The improving auto

industry and the strong performance of the company in the last

reported quarter have made the analysts optimistic about its future

financial results.

Agreement of Estimate Revisions

Out of the 18 analysts covering the stock for the first quarter

of fiscal 2011, none revised the estimates in the past 30 days.

Magnitude of Estimate Revisions

Following the fourth quarter earnings release in September,

first quarter 2012 profit per share was projected at $4.35.

However, over the last 60 days, the profit estimate increased to

$4.44 cents per share. Later, the estimate went up to $4.45 per

share in the last 30 days and remained the same since then.

Our Take

AutoZone is focused on expansion of its Hub store, acceleration

of store maintenance and strengthening of its commercial sales

force. Besides, its aggressive share repurchase policy supported by

a strong cash flow is also mention worthy.

However, AutoZone relies heavily on its private label brands,

which could hinder its business should they falter. Vendor

consolidation and appreciation in gas prices coupled with fierce

competition from O’Reilly Automotive Inc. (ORLY)

and Advance Auto Parts Inc. (AAP), both of which

have delivered impressive results during their last reported

quarters, are primary headwinds for the company.

Hence, we have reiterated our long-term Neutral recommendation

on the shares of the company.

ADVANCE AUTO PT (AAP): Free Stock Analysis Report

AUTOZONE INC (AZO): Free Stock Analysis Report

O REILLY AUTO (ORLY): Free Stock Analysis Report

Zacks Investment Research

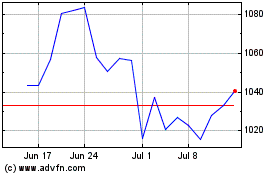

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From May 2024 to Jun 2024

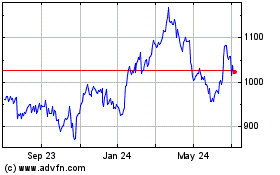

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From Jun 2023 to Jun 2024