|

PROSPECTUS SUPPLEMENT NO. 5

|

Filed

Pursuant to Rule 424(b)(3)

|

|

(to prospectus dated July 12, 2021)

|

Registration No. 333-257438

|

NRX Pharmaceuticals,

Inc.

8,757,258 Shares of Common Stock

3,586,250 Shares of Common Stock Issuable Upon Exercise

of Warrants

________________________________

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus, dated July 12, 2021 (the “Prospectus”), related

to the resale, from time to time, of up to 8,757,258 shares of common stock, par value $0.001 per share (the “Common Stock”),

of NRX Pharmaceuticals, Inc. (“NRx”) by the selling securityholders (including their pledgees, donees, transferees

or other successors-in-interest) identified in the Prospectus (the “Selling Securityholders”) and the issuance

by NRx of up to 3,586,250 shares of Common Stock upon the exercise of outstanding warrants, with the information contained in NRx’s

Current Report on Form 8-K, which was filed with the Securities and Exchange Commission (the “SEC”) on October

13, 2021 (the “Current Report”). Accordingly, NRx has attached the Current Report to this prospectus supplement.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and, if

there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information

in this prospectus supplement.

The Common Stock is listed on the Nasdaq Global

Market (“Nasdaq”) under the symbol “NRXP” and NRx’s warrants are listed on Nasdaq under the

symbol “NRXPW”. On October 13, 2021, the closing sale price of the Common Stock as reported on Nasdaq was $9.44, and the

closing sale price of NRx’s warrants as reported on Nasdaq was $4.60.

NRx is an “emerging growth company”

under the federal securities laws and, as such, has elected to comply with certain reduced public company disclosure requirements. See

“Prospectus Summary–Implications of Being an Emerging Growth Company” beginning on page 2 of the Prospectus and

in any applicable prospectus supplement.

NRx’s business and investment in the

Common Stock involve significant risks. These risks are described in the section titled “Risk Factors” beginning on

page 5 of the Prospectus and in any applicable prospectus supplement.

Neither the SEC nor any state securities

commission has approved or disapproved of the securities to be issued or sold under the Prospectus or passed upon the accuracy or adequacy

of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 14,

2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

October 13, 2021

NRX

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38302

|

|

82-2844431

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1201 Orange Street, Suite

600

Wilmington, Delaware

|

|

19801

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(484) 254-6134

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since last

report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.001 per share

|

|

NRXP

|

|

The Nasdaq Stock Market LLC

|

|

Warrants to purchase one share of Common Stock

|

|

NRXPW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

On October 13, 2021, NRX Pharmaceuticals, Inc.

(the “Company”) issued a letter to its shareholders that addresses the lawsuit recently filed by Relief Therapeutics

Holding AG (“Relief”) against the Company in New York State Court. The complaint alleges that the Company failed

to honor its obligations under the Collaboration Agreement between Relief and the Company dated September 18, 2020 (the “Collaboration

Agreement”). The letter advises shareholders of the Company’s position with respect to many of the allegations in

the complaint as well as reiterating the Company’s continued intention to pursue the development and clinical approval of ZYESAMI™.

A copy of the letter to shareholders is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein

by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

Letter to Shareholders, dated October 13, 2021.

|

|

|

|

|

|

104

|

|

Cover page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

|

NRX PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

Date:

|

October 13, 2021

|

By:

|

/s/ Alessandra Daigneault

|

|

|

|

|

Name:

|

Alessandra Daigneault

|

|

|

|

|

Title:

|

General Counsel and Corporate Secretary

|

|

EXHIBIT 99.1

Dear Shareholders of NRx Pharmaceuticals, Inc.

I am writing to you about the

recent lawsuit Relief Therapeutics Holding AG and Relief Therapeutics International SA (together, “Relief”) filed against

NeuroRx, Inc. (“NRx”), in New York State Court, claiming that NRx failed to honor its obligations under the Collaboration

Agreement dated as of September 18, 2020. Relief’s complaint seeks several remedies, including damages for alleged breaches

of the terms of the Collaboration Agreement.

Under the Collaboration Agreement,

Relief was to provide all relevant funding, while NRx was to undertake the research and development, for aviptadil. Relief abandoned the

funding of the project in January 2021. They advised us at the time that in their view the drug had failed and we had “missed

the pandemic.” Relief ended up investing only $10.9 million in our research and development, leaving NRx to fund the remainder of

the costs, which now exceed $25 million and continue to increase as the drug awaits approval. Relief’s lawsuit claims rights to

a drug that NRx continued to fund and develop after Relief ceased funding the project. We advised the public of Relief’s failure

to fund and the potential for a dispute with Relief in prior disclosures made in connection with the recent merger transaction with Big

Rock Partners Acquisition Corp. (Nasdaq:BRPA).

Now Relief has filed a lawsuit

in order to claim rights to a drug that the shareholders of NRx believed in and funded when Relief stopped funding. The purpose of this

letter is to reassure you that notwithstanding Relief’s failure to fund our research and development and filing a lawsuit, NRx is

determined to see this drug through to completion. NRx has and will continue to undertake the necessary research and development, conclude

the clinical trials, and manage the regulatory submissions needed to achieve our goal of delivering a lifesaving drug to patients.

Over the past 18 months, the NRx

team has taken an old drug from the research files of Prof. Sami Said and brought it to life. We have created the first GMP, shelf stable

formulation of Zyesami™ (aviptadil), figured out how to manufacture it at scale without damaging a delicate peptide, and performed

two clinical trials that have shown statistically significant benefits in survival among patients with COVID-19 respiratory failure. On

a regular basis, we hear from patients and families who have benefited from Zyesami and returned home against all odds. According to a

presentation given recently by Dr. Francis Collins, Director of the National Institutes of Health, Zyesami is one of 23 COVID-19

drugs still prioritized for testing by NIH from among the 750 candidates originally screened. To our knowledge, Zyesami is the only COVID

therapeutic to be selected for both the NIH ACTIV-3 trial and the BARDA I-SPY trial. NRx was selected as an industry partner for both

ACTIV-3 and I-SPY and supplies the investigational drug to NIH and I-SPY for both trials.

We believe that Relief decided

to stop funding because it thought aviptadil would fail (as it had in the hands of their predecessor company). However, now that Relief

realizes the drug may well succeed, Relief has filed a lawsuit seeking all the benefits under the contract that it abandoned through

its failure to fund.

Relief seeks to justify its halt

in funding with the allegation that it did not receive necessary information from NRx as to how the funds would be spent. The simple truth

is that there is no mystery about the use of funds. The majority of R&D costs are associated with third party invoices from reputable

contractors reflecting our payments for drug formulation and manufacture, payments to study sites for treating patients, payments for

clinical laboratory services, payments for statistical and regulatory support, etc. Until the moment when Relief advised us it would

no longer fund, Relief received all invoices with all underlying contracts and backup detail. Our public auditors inspect those invoices

on an annual basis and you can read their report documenting that the financial statements of our company fairly reflect the financial

position of the company.

To get regulatory approval for

a drug, however, a pharmaceutical company actually has to demonstrate its ability to manufacture a drug. To the best of our knowledge,

we believe that Relief still has no commercial formulation of Zyesami and no manufactured drug for a regulator to inspect. Last week,

we sent the full GMP manufacturing files to the FDA for their review. Yesterday, we also announced that Zyesami just passed a European

Qualified Person (QP) audit of its first manufactured batch of Zyesami destined for the EU.

Relief has accused NRx of withholding

data that is needed to enable patients in the EU and UK to receive Zyesami. In fact, NRx gave Relief the full Clinical Study Report given

to the FDA on the same day it was provided to the FDA and offered to provide all electronic data to any regulator despite Relief’s

failure to pay the full costs of the clinical trial.

We are attempting to help patients

worldwide and we believe that Relief’s accusations that we are preventing them from formulating and manufacturing aviptadil are

misleading. If Relief truly wanted to save the lives of COVID patients in Europe, we believe they would already have manufactured drug

according to the patented formulation they have described in their public filings.

Relief’s demand that NRx

cease development of a new Coronavirus vaccine in partnership with the government of Israel is especially shocking. The logic they seemed

to articulate in their complaint is that a successful vaccine against COVID-19 might reduce the number of patients with respiratory failure

and therefore reduce the need for Zyesami.

We believe we have taken all reasonable

steps to attempt to resolve this dispute in an equitable fashion without resorting to litigation. We have repeatedly attempted to invoke

the mediation clause in the Collaboration Agreement, only to be repeatedly rebuffed. Instead, Relief has brought litigation that contains

allegations we view as baseless and that we will dispute in court. From our perspective, Relief’s initiation of litigation is neither

in the interest of patients or shareholders and that sentiment is echoed in mail we receive daily from investors in both companies.

Rest assured that in the absence

of a mediated solution, NRx intends to defend this case vigorously and will, at the appropriate time, assert significant counterclaims

against Relief. In the meantime, we will continue to work tirelessly to deliver a lifesaving drug to patients who have no therapeutic

alternative.

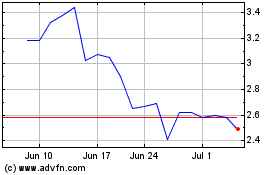

NRX Pharmaceuticals (NASDAQ:NRXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

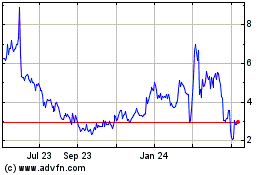

NRX Pharmaceuticals (NASDAQ:NRXP)

Historical Stock Chart

From Apr 2023 to Apr 2024