0001471265false00014712652023-09-202023-09-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 20, 2023

Northwest Bancshares, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-34582 | | 27-0950358 |

| (State or other jurisdiction of incorporation) | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| 3 Easton Oval | Suite 500 | Columbus | Ohio | | 43219 | |

| (Address of principal executive office) | | (Zip code) | |

(814) 726-2140

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, 0.01 Par Value | | NWBI | | NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Indicate by a check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On September 20, 2023, Northwest Bancshares, Inc. (the “Company”) and Northwest Bank (the “Bank”) entered into a Retirement Agreement with Senior Executive Vice President, Chief Financial Officer and Chief Operating Officer William W. Harvey, Jr. (the “Retirement Agreement”), pursuant to which Mr. Harvey will transition from his role as Chief Financial Officer on June 30, 2024, or such earlier date in connection with the appointment of a new Chief Financial Officer. Mr. Harvey will then retire as Chief Operating Officer and as a director from the Company and the Bank on December 31, 2024, unless his employment is terminated earlier pursuant to the terms of his existing employment agreement. On September 20, 2023, the Company and the Bank also entered into an Independent Contractor Consulting Agreement with Mr. Harvey (the “Consulting Agreement”), pursuant to which Mr. Harvey will remain with the Company and the Bank as a consultant during 2025. His continued employment and consulting periods are designed to assist with a seamless transition.

Under the Retirement Agreement, all of Mr. Harvey’s unvested equity grants under the Company’s equity incentive plans will vest at the end of the performance period pursuant to the terms of his existing equity award agreements. Under the Consulting Agreement, Mr. Harvey will serve as a consultant to the Company and the Bank for up to 20 hours per month during 2025 at an aggregate consulting fee of $1,081,500. Under the Consulting Agreement, Mr. Harvey will be considered an independent contractor and not a Company or Bank employee.

The foregoing description of the Retirement Agreement does not purport to be complete and it is qualified in its entirety by reference to the Retirement Agreement that is attached hereto as Exhibit 10.1 of this Current Report on Form 8-K, and is incorporated by reference into this Item 5.02.

The foregoing description of the Consulting Agreement does not purport to be complete and it is qualified in its entirety by reference to the Consulting Agreement that is attached hereto as Exhibit 10.2 of this Current Report on Form 8-K, and is incorporated by reference into this Item 5.02.

A press release containing additional information is included herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(a) Financial statements of businesses acquired. Not Applicable.

(b) Pro forma financial information. Not Applicable.

(c) Shell company transactions. Not Applicable.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Retirement Agreement effective September 20, 2023 by and between William W. Harvey, Jr., Northwest Bancshares, Inc. and Northwest Bank |

| | |

| | Independent Contractor Consulting Agreement effective September 20, 2023 by and between William W. Harvey, Jr., Northwest Bancshares, Inc. and Northwest Bank |

| | |

| | Press release dated September 21, 2023 |

| | |

| 104.1 | | Cover Page for this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | NORTHWEST BANCSHARES, INC. |

| | | |

| Date: | September 21, 2023 | | By: | /s/Louis J. Torchio |

| | | | Louis J. Torchio |

| | | | President and CEO |

| | | | |

RETIREMENT AGREEMENT

THIS RETIREMENT AGREEMENT (“Agreement”), effective September 20, 2023, is made by and between William W. Harvey, Jr. (“Executive”), Northwest Bancshares, Inc., a Maryland corporation (the “Company”), and Northwest Bank, a Pennsylvania state-charted stock savings bank (the “Bank”) (the Company and the Bank shall collectively be referred to as the “Employer”).

WHEREAS, Executive is currently employed as the Chief Operating Officer, Chief Financial Officer, Senior Executive Vice President and a Director of the Employer;

WHEREAS, Executive and the Employer are parties to an Employment Agreement effective August 22, 2022 (“Employment Agreement”);

WHEREAS, Executive wishes to retire on December 31, 2024 (“Retirement”), and to provide consulting services to the Bank from January 1, 2025 until December 31, 2025 pursuant to a consulting agreement (“Consulting Agreement”); and

WHEREAS, the parties wish to set forth their agreement with respect to Executive’s Retirement.

NOW THEREFORE, for good and sufficient consideration as set forth below, and intending to be legally bound, the parties agree as follows:

1.Transition in Employment. Commencing no later than June 30, 2024, Executive will transition the duties of Chief Financial Officer to his successor. Executive shall retain the titles and duties of Chief Operating Officer, Senior Executive Vice President and a Director of the Employer until December 31, 2024 (“Retirement Date”), unless Executive’s employment is terminated earlier pursuant to the terms of his Employment Agreement. Executive hereby gives his notice of resignation from the boards of the Company and the Bank effective December 31, 2024.

2.Employment Agreement. Except as provided in Section 1 above, Executive’s Employment Agreement shall remain in full force and effect until Executive’s Retirement Date, at which time it shall terminate automatically. The parties agree that Executive’s Retirement and the provisions of this Agreement shall not be construed as an Event of Termination as defined in Section 4 of the Employment Agreement and Executive shall not be entitled to any payment under the Employment Agreement as a result of his Retirement. Executive acknowledges that Sections 8(b) and 9 of the Employment Agreement survive termination of the Employment Agreement, and Executive agrees to comply with such Sections. For purposes of clarification, should Executive experience a termination of employment prior to his Retirement Date, the provisions of the Employment Agreement shall control, and this Agreement and the Consulting Agreement shall become null and void ab initio.

3.Consulting Agreement. Executive shall provide consulting services to the Bank under the Consulting Agreement between the Bank and Executive entered into contemporaneously with this Agreement and incorporated herein by reference.

4.Employee Benefits.

a.Executive shall continue to enjoy such employee benefits as are provided under the Employment Agreement, until the termination of such Agreement.

b.Executive shall not be awarded any equity grants for service performed after December 31, 2023.

c.Executive shall continue to participate in the Annual Performance Award Plan (otherwise referred to as the Short-Term Cash Incentive Plan (“STI”) or Management Bonus Plan) for calendar 2024 and shall be entitled to receive a cash bonus payment of not less than $346,500.00. Employer shall pay the cash bonus payment on or before March 15, 2025.

d.Pursuant to Section 5.2 of the Northwest Bancshares, Inc. 2011 Equity Incentive Plan, Northwest Bancshares, Inc. 2018 Equity Incentive Plan, and Northwest Bancshares, Inc. 2022 Equity Incentive Plan (collectively “Equity Incentive Plans”), all of Executive’s Award Agreements under the Equity Incentive Plans are hereby amended effective December 31, 2024, to provide that all unvested equity grants shall not be forfeited upon Executive’s Retirement but shall vest at the end of the performance period upon the terms and conditions of such Award (as defined in the Equity Incentive Plans).

5.Entire Agreement. This Agreement and the Consulting Agreement contains the entire agreement between the Parties and supersedes any and all prior agreements or understandings between the Parties arising out of or relating to Executive’s Retirement and provision of consulting services. This Agreement may not be modified, altered or changed except upon express written consent of the Parties.

6.Applicable Law and Jurisdiction. This Agreement shall be construed and governed by the laws of the Commonwealth of Pennsylvania, without regard to principles of conflicts of laws.

7.Severability. It is agreed that the covenants of this Agreement are severable, and that if any single clause or clauses shall be found unenforceable, the entire Agreement shall not fail but shall be construed and enforced without any severed clauses in accordance with the tenor of this Agreement, except where the general release term is deemed unenforceable.

8.Counterparts and Original Signatures. This Agreement may be executed in counterparts, with a copy having the same effect as an original signature.

{SIGNATURE PAGE TO FOLLOW}

The Parties have executed this Retirement Agreement, intending to be legally bound, as of the date set forth above.

ATTEST: NORTHWEST BANCSHARES, INC.

/s/Kyle P. Kane By: /s/Louis J. Torchio

NORTHWEST BANK

/s/Kyle P. Kane By: /s/Louis J. Torchio

WITNESS: EXECUTIVE

/s/Kyle P. Kane /s/William W. Harvey, Jr.

INDEPENDENT CONTRACTOR CONSULTING AGREEMENT

This Independent Contractor Consulting Agreement (this “Agreement”) is made the September 20, 2023, by and between William W. Harvey, Jr. (“Consultant”), Northwest Bancshares, Inc., a Maryland corporation (the “Company”), and Northwest Bank, a Pennsylvania state-charted stock savings bank (the “Bank”) (the Company and the Bank shall be referred to collectively as “Northwest”).

WHEREAS, Executive has been employed by Northwest since 1996, and is currently serving as its Senior Executive Vice President, Chief Operating Officer and Chief Financial Officer;

WHEREAS, Executive has provided notice of his retirement effective December 31, 2024, and has entered into a Retirement Agreement with Northwest contemporaneously with this Agreement (“Retirement Agreement”);

WHEREAS, Executive has been an integral part of Northwest’s executive management team for many years and would be an invaluable resource for his successors; and

WHEREAS, Executive has agreed to assist with the transition of his positions to his successors as a consultant for a one-year period after his retirement under the terms of this Agreement;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1.Services. Northwest hereby retains Consultant on an as needed basis for the purpose of providing personal knowledge, information and generally being a resource to Northwest to assist in the transitioning of his positions to his successors (“Services”). Consultant agrees to make himself available up to twenty (20) hours per month. The performance of the Services shall be subject to Consultant’s reasonable availability and convenience and may be performed remotely via telephone, email, video conference or other similar technology. Consultant agrees to keep all information provided to him in the performance of the Services confidential.

2.Term. Provided that Consultant’s employment with Northwest has not been terminated prior to his retirement on December 31, 2024, the term of this Agreement shall begin on January 1, 2025, and shall end on December 31, 2025 (the “Term”). Should Consultant’s employment with Northwest terminate prior to his retirement on December 31, 2024, for any reason, this Agreement shall be null and void ab initio.

3.Consideration. As full and complete payment for all Services to be rendered pursuant to this Agreement, the Bank shall pay Consultant one million, eighty-one thousand five hundred dollars ($1,081,500) payable in 12 equal monthly installments. Upon Consultant’s death during the Term, Consultant’s beneficiary, or if none, Consultant’s estate, shall receive, within thirty (30) days of Consultant’s death, a cash lump sum payment equal to the consideration that would have been paid to Consultant during the Term had Consultant continuously provided Services to the Bank for the remaining Term.

4.Independent Contractor Status. Consultant is an independent contractor and not a Company or Bank employee. Nothing in this Agreement creates or is intended to create any employment relationship between Consultant and the Bank or the Company. Consultant shall not be eligible to participate in or receive any benefit from any benefit plan or program available to Northwest employees. Specifically, Consultant shall not be eligible to receive any awards of equity under the Company’s Equity Incentive Plan and shall not be eligible to participate in the Bank’s 401(k), Pension Plan, Nonqualified Supplemental Retirement Plan, and welfare plans, except as required by COBRA. Northwest shall not provide workers’ compensation coverage for Consultant. Consultant shall comply with all applicable laws and regulations and shall have sole responsibility for the payment of all applicable taxes and withholdings with respect to Compensation paid to Consultant. Consultant retains sole and absolute discretion in the manner and means of carrying out the Services.

5.Other Employment. During the Term, Consultant is free to work full-time or part-time for any other employer or consulting client to the extent such work does not violate the restrictive covenant to which Consultant is bound. Nothing contained in this Agreement shall be deemed to in any way limit or restrict Consultant’s other employment or consulting opportunities nor is there any implied minimum number of hours that Consultant must dedicate to the Company over the Term of this Agreement.

6.No Assignment. This Agreement shall not be assignable by any party, except by Northwest to a successor in interest. Northwest shall require any successor to assume and agree to perform Northwest’s obligations under this Agreement in the same manner and to the same extent as Northwest would be required to perform if no succession had taken place. However, if a merger or change in control of either Company or Bank occurs during the Term, Northwest will pay the remaining payments owed pursuant to Section 3 of this Agreement within 15 days of the merger or change of control.

7.Notices. Whenever notice is to be served under this Agreement, service shall be made personally, by electronic mail, by overnight courier, or by registered or certified mail.

8.Governing Law. This Agreement shall be governed by Commonwealth of Pennsylvania, without reference to rules regarding conflicts of law.

9.Counterparts. This Agreement may be executed in multiple counterparts, each of which shall constitute an original and all of which together shall constitute one instrument.

10.Severability. If any term or provision of this Agreement, or the application thereof to any person or circumstance, shall to any extent be found to be invalid, void, or unenforceable, the remaining provisions of this Agreement and any application thereof shall, nevertheless, continue in full force and effect without being impaired or invalidated in any way.

11.Waiver. No waiver of any term, provision, or condition of this Agreement, whether by conduct or otherwise, in any one or more instances, shall be deemed to be or be construed as a further or continuing waiver of any such term, provision, or condition or as a waiver of any other term, provision, or condition of this Agreement.

12.Entire Agreement. This Agreement and the Retirement Agreement contains the entire agreement and understanding of the parties with respect to Consultant’s provision of Services, and merges and supersedes all prior agreements, discussions, and writings with respect to that subject matter. No modification or alteration of this Agreement shall be effective unless made in writing and signed by both Consultant and Northwest.

[SIGNATURE PAGE TO FOLLOW]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the first day above written.

ATTEST: NORTHWEST BANCSHARES, INC.

/s/Kyle P. Kane By: /s/Louis J. Torchio

NORTHWEST BANK

/s/Kyle P. Kane By: /s/Louis J. Torchio

WITNESS: CONSULTANT

/s/Kyle P. Kane /s/William W. Harvey, Jr.

NEWS RELEASE

FOR IMMEDIATE RELEASE

Contact: Shawn O. Walker, EVP – Communications

(814) 728-7674

shawn.walker@northwest.com

www.northwest.bank

Northwest Bancshares, Inc. and Northwest Bank Announce CFO Retirement Date

Columbus, Ohio (September 21, 2023) — Northwest Bancshares, Inc. (Nasdaq: NWBI) (the “Company”) and Northwest Bank announced today that they have entered into a retirement agreement and a consulting agreement pursuant to which Senior Executive Vice President, Chief Financial Officer and Chief Operating Officer William W. Harvey, Jr. will transition from his current roles in 2024. Mr. Harvey will retire from the Company and Northwest Bank and their associated boards on December 31, 2024 but remain with the organization as a consultant through December 31, 2025. His continued employment and consulting periods are designed to assist with a seamless transition of duties.

The Company and Northwest Bank have initiated a search to hire an individual who will serve as Mr. Harvey’s replacement as Chief Financial Officer. The search will consider both internal and external candidates. The Company estimates that the search will take four to six months to complete.

In connection with this announcement, President and Chief Executive Officer of the Company and Northwest Bank, Louis J. Torchio said “I would like to thank Bill for his decades-long contributions to Northwest Bank. His noteworthy experience with finance, mergers and acquisitions, operations and strategy have been invaluable in supporting Northwest’s growth. In addition, he provided quality stewardship of the bank while serving as interim President and Chief Executive Officer following Ron Seiffert’s passing in 2022. We look forward to Bill’s continued leadership and involvement as we work together to recruit and onboard our next Chief Financial Officer. We respect Bill’s personal decision to retire and thank him for his ample and thoughtful notice. We wish he and Amy all the best in their well-deserved retirement.”

Mr. Harvey said “It has been a privilege and a true pleasure working with the Board of Directors, leadership team and employees of Northwest Bank for the past 27 years. I am proud of the work we accomplished in growing the Northwest organization while navigating evolving market and economic landscapes. I am confident that Northwest is well-positioned to capitalize on future opportunities.”

About Northwest

Headquartered in Columbus, Ohio, Northwest Bancshares, Inc. is the bank holding company of Northwest Bank. Founded in 1896 and headquartered in Warren, Pennsylvania, Northwest Bank is a full-service financial institution offering a complete line of business and personal banking products, as well as employee benefits and wealth management services. As of June 30, 2023, Northwest operated 134 full-service community banking offices and eight free standing drive-through facilities in Pennsylvania, New York, Ohio and Indiana. Northwest Bancshares, Inc.’s common stock is listed on the NASDAQ Global Select Market (“NWBI”). Additional information regarding Northwest Bancshares, Inc. and Northwest Bank can be accessed on-line at www.northwest.com.

Forward-Looking Statements

This Press Release contains forward-looking statements regarding the future operations of the Company and Northwest Bank. For these statements, the Company and Northwest Bank claim the protections of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this communication should be considered in conjunction with the other information available about the Company and Northwest Bank, including the information in the filings the Company makes with the U.S. Securities and Exchange Commission. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Forward-looking statements are typically identified by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “would,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Undue reliance should not be placed on the forward-looking statements, which speak only as of the date hereof. The Company and Northwest Bank do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law.

###

v3.23.3

Cover Page Document

|

Sep. 20, 2023 |

| Cover page. [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 20, 2023

|

| Entity Registrant Name |

Northwest Bancshares, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34582

|

| Entity Tax Identification Number |

27-0950358

|

| Entity Address, Address Line One |

3 Easton Oval

|

| Entity Address, City or Town |

Columbus

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43219

|

| City Area Code |

814

|

| Local Phone Number |

726-2140

|

| Title of 12(b) Security |

Common Stock, 0.01 Par Value

|

| Trading Symbol |

NWBI

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001471265

|

| Amendment Flag |

false

|

| Entity Address, Address Line Two |

Suite 500

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

nwbi_Coverpage.Abstract |

| Namespace Prefix: |

nwbi_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

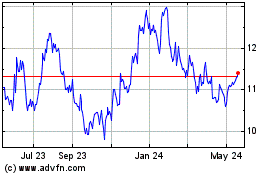

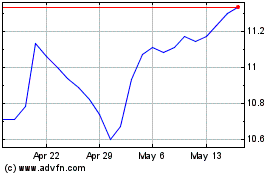

Northwest Bancshares (NASDAQ:NWBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Bancshares (NASDAQ:NWBI)

Historical Stock Chart

From Apr 2023 to Apr 2024