Notable Items Include:

- Net Income of $2.4 Million, or $0.06 Per Share, for the

Quarter, Which Includes an After-Tax Charge of $1.2 Million, or

$.03 per Share, Related to Costs Associated With the Postponed

Second-Step Offering, and a Tax Benefit of $738,000, or $.02 Per

Share, Related to Recent Tax Law Changes

- Net Income of $10.0 Million, or $0.24 Per Share, for

the Nine Months of 2010, as Compared to $8.1 Million, or $0.19 Per

Share in 2009

- Increase of 6.1% and 11.5% in Net Interest Income for

the Quarter and Nine Months Ended September 30, 2010,

Respectively

- Total Loans Increased 10.1% Year to Date

- Continued Strengthening of Loan Loss Reserves –

Allowance for Loan Losses Increases 35.8%, Year to Date, to $20.9

Million, Representing 2.61% of Total Loans at September 30,

2010

- Nonperforming Loans Total $55.4 Million Compared to

$51.5 Million at June 30, 2010, and $41.8 Million at December 31,

2009

Northfield Bancorp, Inc. (Nasdaq:NFBK), the

holding company for Northfield Bank, reported basic and diluted

earnings per common share of $0.06 and $0.08 for the quarters ended

September 30, 2010 and 2009, respectively, and basic and diluted

earnings per share of $0.24 and $0.19 for the nine months ended

September 30, 2010 and 2009, respectively. Net income for the

quarter and nine months ended September 30, 2010 included an

after-tax charge of $1.2 million, or $0.03 per share, for costs

related to the Company's postponed second-step stock offering. In

addition, net income for the quarter and nine months ended

September 30, 2010 was positively affected by the reversal of

deferred tax liabilities related to state bad debt reserves of

approximately $738,000, or $0.02 per share.

Commenting on the third quarter results, John W. Alexander, the

Company's Chairman and Chief Executive Officer noted, "Although

market conditions in the third quarter were not conducive to us

completing our second-step stock offering, our capital continues to

significantly exceed that required to be considered "well

capitalized" for regulatory purposes, and we remain focused on our

long-term strategic plan of effectively deploying capital and

managing risk to generate solid earnings and returns for our

stockholders."

Mr. Alexander continued, "I am pleased to announce that the

Board of Directors has declared a quarterly cash dividend of $0.05

per common share, payable on November 24, 2010, to stockholders of

record as of November 10, 2010."

Financial Condition

Total assets increased $191.6 million, or 9.6%, to $2.2 billion

at September 30, 2010, from $2.0 billion at December 31, 2009. The

increase was primarily attributable to increases in securities of

$100.9 million and loans held for investment, net, of $73.3

million. In addition, bank owned life insurance increased $30.3

million, primarily resulting from the purchase of $28.8 million of

insurance policies during the nine months ended September 30, 2010,

coupled with $1.5 million of income earned on bank owned life

insurance for the nine months ended September 30, 2010.

Loans held for investment, net, totaled $802.6 million at

September 30, 2010, as compared to $729.3 million at December 31,

2009. The increase was primarily in multi-family real estate

loans, which increased $66.8 million, or 37.4%, to $245.2 million

at September 30, 2010, from $178.4 million at December 31,

2009. Commercial real estate loans increased $13.3 million, or

4.1%, to $341.1 million, insurance premium loans increased $9.1

million, or 22.6%, to $49.5 million, and home equity loans

increased $3.6 million, or 13.8%, to $29.7 at September 30,

2010. These increases were partially offset by decreases in

residential, land and construction, and commercial and industrial

loans.

The Company's securities portfolio totaled $1.2 billion at

September 30, 2010, as compared to $1.1 billion at December 31,

2009, an increase of $100.9 million, or 8.8%. At September 30,

2010, $904.7 million of the portfolio consisted of residential

mortgage-backed securities issued or guaranteed by Fannie Mae,

Freddie Mac, or Ginnie Mae. The Company also held residential

mortgage-backed securities not guaranteed by Fannie Mae, Freddie

Mac, or Ginnie Mae, referred to as "private label

securities." The private label securities had an amortized

cost of $109.4 million and an estimated fair value of $114.2

million at September 30, 2010. These private label securities

were in a net unrealized gain position of $4.8 million at September

30, 2010, consisting of gross unrealized gains of $5.9 million and

gross unrealized losses of $1.1 million.

Of the $114.2 million of private label securities, two

securities with an estimated fair value of $10.5 million (amortized

cost of $11.6 million) were rated less than AAA at September 30,

2010. Of the two securities, one had an estimated fair value

of $4.5 million (amortized cost of $4.8 million) and was rated CC,

and the other had an estimated fair value of $5.9 million

(amortized cost of $6.7 million) and was rated Caa2. The

Company continues to receive principal and interest payments in

accordance with the contractual terms of each of these

securities. Management has evaluated, among other things,

delinquency status, location of collateral, estimated prepayment

speeds, and the estimated default rates and loss severity in

liquidating the underlying collateral for each of these

securities. As a result of management's evaluation of these

securities, the Company recognized other-than-temporary impairment

of $962,000 on the $5.9 million security that was rated Caa2 for

the quarter ended September 30, 2010. Since management does

not have the intent to sell the security, and believes it is more

likely than not that the Company will not be required to sell the

security, before its anticipated recovery, the credit component of

$154,000 was recognized in earnings for the quarter ended September

30, 2010, and the non-credit component of $808,000 was recorded as

a component of accumulated other comprehensive income, net of

tax. All other losses within the Company's investment

portfolio were deemed to be temporary at September 30, 2010, and as

such, were recorded as a component of accumulated other

comprehensive income, net of tax.

Total liabilities increased to $1.8 billion at September 30,

2010, from $1.6 billion at December 31, 2009. The increase was

primarily attributable to an increase in deposits of $95.5 million,

or 7.3%, an increase in borrowings of $62.7 million, or 22.4%, and

an increase of $20.0 million in amounts due to securities

brokers. The increase in deposits for the nine months ended

September 30, 2010, was due in part to an increase of $52.5 million

in short-term certificates of deposit originated through the CDARS®

Network. The Company utilizes this funding supply as a cost

effective alternative to other short-term funding sources. In

addition, money market deposits, and transaction accounts increased

$78.5 million and $34.8 million, respectively, from December 31,

2009 to September 30, 2010. These increases were partially

offset by a decrease of $6.7 million in savings and a decrease of

$63.6 million in certificates of deposit (issued by the Bank) over

the same time period. The Company continues to focus its

marketing and pricing of its products, which it believes promotes

longer-term customer relationships. The increase in borrowings

was primarily the result of the Company increasing longer-term

borrowings, taking advantage of, and locking in, lower interest

rates, partially offset by maturities during the nine months ended

September 30, 2010. The increase in due to securities brokers

was the result of securities purchases occurring prior to September

30, 2010, and settling after the quarter end.

Total stockholders' equity increased to $402.6 million at

September 30, 2010, from $391.5 million at December 31,

2009. The increase was primarily attributable to net income of

$10.0 million for the nine months ended September 30, 2010, and an

increase in accumulated other comprehensive income of $5.7

million. Generally, as market interest rates decrease, the

estimated fair value of our securities available for sale

increases. The increase in stockholders' equity also was due

to a $2.6 million increase in additional paid-in capital primarily

related to the recognition of compensation expense associated with

equity awards. These increases were partially offset by $5.2

million in stock repurchases, and the payment of approximately $2.4

million in cash dividends for the nine months ended September 30,

2010.

Northfield Bank's (the Company's wholly-owned subsidiary) Tier 1

(core) capital ratio was approximately 13.67%, at September 30,

2010. The Bank's total risk-based capital ratio was

approximately 27.64% at the same date. These ratios continue

to significantly exceed the required regulatory capital ratios

necessary to be considered "well capitalized" under current federal

capital regulations.

Asset Quality

Nonperforming loans totaled $55.4 million (6.9% of total loans)

at September 30, 2010, as compared to $51.5 million (6.7% of total

loans) at June 30, 2010, $50.0 million (6.8% of total loans) at

March 31, 2010, $41.8 million (5.7% of total loans) at December 31,

2009, and $35.7 million (5.4% of total loans) at September 30,

2009. The following table also shows, for the same dates,

troubled debt restructurings on which interest is accruing, and

accruing loans delinquent 30 to 89 days (dollars in thousands).

| |

September 30, |

June 30, |

March 31, |

December 31, |

September 30, |

| |

2010 |

2010 |

2010 |

2009 |

2009 |

| Non-accruing loans |

$37,882 |

34,007 |

31,248 |

30,914 |

19,232 |

| Non-accruing loans subject to restructuring

agreements |

17,261 |

17,417 |

13,090 |

10,717 |

11,003 |

| Total non-accruing loans |

55,143 |

51,424 |

44,338 |

41,631 |

30,235 |

| Loans 90 days or more past due and still

accruing |

248 |

77 |

5,710 |

191 |

5,487 |

| Total non-performing loans |

55,391 |

51,501 |

50,048 |

41,822 |

35,722 |

| Other real estate owned |

171 |

1,362 |

1,533 |

1,938 |

933 |

| Total non-performing assets |

$55,562 |

52,863 |

51,581 |

43,760 |

36,655 |

| |

|

|

|

|

|

| Loans subject to restructuring agreements and

still accruing |

$11,218 |

10,708 |

8,817 |

7,250 |

7,258 |

| |

|

|

|

|

|

| Accruing loans 30 to 89 days delinquent |

$35,190 |

30,619 |

38,371 |

28,283 |

35,466 |

Total non-accruing loans increased $3.7 million, to $55.1

million at September 30, 2010, from $51.4 million at June 30,

2010. This increase was primarily attributable to the

following loan types being placed on non-accrual status during the

quarter ended September 30, 2010: $3.1 million of multifamily

loans, $2.0 million of commercial real estate loans, $456,000 of

commercial and industrial loans, and $199,000 of one-to-four family

residential loans. The above increases in non-accruing loans

during the quarter ended September 30, 2010, are net of charge-offs

of $1.5 million, and have $435,000 in specific reserves allocated

to them at September 30, 2010. These increases were partially

offset by one relationship, consisting of $963,000 of one-to-four

family residential loans, and a $654,000 land loan, being returned

to accrual status, coupled with payoffs of $41,000 on a one-to-four

family residential loan, and principal paydowns of approximately

$373,000. At September 30, 2010, $23.6 million, or 83.0% of

loans subject to restructuring agreements were performing in

accordance with their restructured terms. All of the $11.2

million of accruing troubled debt restructurings, and $12.4 million

of the $17.3 million of non-accruing troubled debt restructurings,

were performing in accordance with their restructured

terms.

Loans 90 days or more past due and still accruing interest

increased to $248,000 from $77,000 at June 30, 2010. The

increase is primarily due to one construction loan that is

considered well secured and in the process of collection.

Generally, loans are placed on non-accrual status when they

become 90 days or more delinquent, and remain on non-accrual status

until they are brought current, have a minimum of six months of

performance under the loan terms, and factors indicating reasonable

doubt about the timely collection of payments no longer

exist. Therefore, loans may be current in accordance with

their loan terms, or may be less than 90 days delinquent, and still

be on a non-accruing status.

The following tables detail the delinquency status of

non-accruing loans at September 30, 2010 and December 31, 2009

(dollars in thousands).

| |

|

|

|

|

| |

September 30, 2010 |

| |

Days Past Due |

|

| Real estate loans: |

0 to 29 |

30 to 89 |

90 or more |

Total |

| Commercial |

$8,789 |

11,681 |

21,468 |

41,938 |

| One -to- four family

residential |

136 |

576 |

594 |

1,306 |

| Construction and land |

4,036 |

-- |

875 |

4,911 |

| Multifamily |

423 |

511 |

4,488 |

5,422 |

| Home equity and lines of credit |

-- |

-- |

181 |

181 |

| Commercial and industrial loans |

-- |

274 |

1,057 |

1,331 |

| Insurance premium loans |

-- |

-- |

54 |

54 |

| Total non-accruing loans |

$13,384 |

13,042 |

28,717 |

55,143 |

| |

|

|

|

|

| |

|

| |

December 31, 2009 |

| |

Days Past Due |

|

| Real estate loans: |

0 to 29 |

30 to 89 |

90 or more |

Total |

| Commercial |

$2,585 |

10,480 |

15,737 |

28,802 |

| One -to- four family

residential |

-- |

392 |

1,674 |

2,066 |

| Construction and land |

5,864 |

-- |

979 |

6,843 |

| Multifamily |

-- |

530 |

1,589 |

2,119 |

| Home equity and lines of credit |

62 |

-- |

-- |

62 |

| Commercial and industrial loans |

1,470 |

-- |

269 |

1,739 |

| Total non-accruing loans |

$9,981 |

11,402 |

20,248 |

41,631 |

Loans 30 to 89 days delinquent and on accrual status at

September 30, 2010, totaled $35.2 million, an increase of $4.6

million, from the June 30, 2010, balance of $30.6 million. The

following table sets forth delinquencies for accruing loans by type

and by amount at September 30, 2010 (dollars in

thousands).

| |

|

|

|

| |

Delinquent Accruing

Loans |

| |

30 to 89 Days |

90 Days and Over |

Total |

| Real estate loans: |

|

|

|

| Commercial |

$ 13,103 |

$ -- |

$ 13,103 |

| One- to four-family residential |

6,424 |

-- |

6,424 |

| Construction and land |

6,451 |

235 |

6,686 |

| Multifamily |

6,853 |

-- |

6,853 |

| Home equity and lines of credit |

318 |

-- |

318 |

| Commercial and industrial loans |

1,286 |

13 |

1,299 |

| Insurance premium loans |

646 |

-- |

646 |

| Other loans |

109 |

-- |

109 |

| Total |

$ 35,190 |

$ 248 |

$ 35,438 |

Non-accruing loans subject to restructuring agreements totaled

$17.3 million and $10.7 million at September 30, 2010 and December

31, 2009, respectively. During the nine months ended September

30, 2010, we entered into eight troubled debt restructuring

agreements, of which $4.0 million and $8.3 million were classified

as accruing and non-accruing, respectively, at September 30,

2010. The following table sets forth the amounts and

categories of the troubled debt restructurings by loan type as of

September 30, 2010 and December 31, 2009 (dollars in

thousands).

| |

|

|

|

|

| |

At September 30,

2010 |

At December 31, 2009 |

| |

Non-Accruing |

Accruing |

Non-Accruing |

Accruing |

| Troubled debt restructurings: |

|

|

|

|

| Real estate loans: |

|

|

|

|

| Commercial |

$ 12,213 |

$ 7,895 |

$ 3,960 |

$ 5,499 |

| One- to four-family residential |

-- |

1,750 |

-- |

-- |

| Construction and land |

4,036 |

-- |

5,726 |

1,751 |

| Multifamily |

511 |

1,573 |

530 |

-- |

| Commercial and industrial |

501 |

-- |

501 |

-- |

| Total |

$ 17,261 |

$ 11,218 |

$ 10,717 |

$ 7,250 |

Other real estate owned decreased $1.2 million, to $171,000 at

September 30, 2010, from $1.4 million at June 30, 2010. This

decrease was due to the sale of one property during the quarter

ended September 30, 2010.

Results of Operations

Net income decreased $792,000, or 24.9%, to $2.4 million for the

quarter ended September 30, 2010, as compared to $3.2 million for

the quarter ended September 30, 2009, due primarily to an increase

of $2.7 million in non-interest expense and an increase of $675,000

in provision for loan losses, partially offset by an increase of

$901,000 in net interest income, an increase of $144,000 in

non-interest income, and a decrease of $1.6 million in income tax

expense.

Net interest income increased $901,000, or 6.1%, due primarily

to average interest earning assets increasing $211.8 million, or

11.6%, partially offset by a decrease in the net interest margin of

15 basis points, or 4.7%, for the quarter ended September 30, 2010,

compared to the quarter ended September 30, 2009. The average

yield earned on interest earning assets decreased 53 basis points,

or 11.2%, to 4.21% for the quarter ended September 30, 2010,

compared to 4.74% for the quarter ended September 30,

2009. This change was offset by a 53 basis point decrease in

the average rate paid on interest-bearing liabilities over the

comparable periods from 1.98% to 1.45%. The general decline in

yields was due to the overall low interest rate environment and was

driven by decreases in yields earned on mortgage-backed securities,

as principal repayments were reinvested into lower yielding

securities. The increase in average interest earning assets

was due primarily to an increase in average loans outstanding of

$134.4 million, other securities of $106.9 million, and $35.7

million in mortgage-backed securities, partially offset by

decreases in interest-earning assets in other financial

institutions. Other securities consist primarily of

investment-grade shorter-term corporate bonds, and

government-sponsored enterprise bonds.

Non-interest income increased $144,000, or 10.6%, to $1.5

million for the quarter ended September 30, 2010, as compared to

$1.4 million for the quarter ended September 30, 2009, primarily as

a result of an increase of $125,000 of income earned on bank owned

life insurance, generated by increased cash surrender values,

primarily from $28.8 million in additional bank owned life

insurance purchased during the nine-months ended September 30,

2010.

Non-interest expense increased $2.7 million, or 32.5%, for the

quarter ended September 30, 2010, as compared to the quarter ended

September 30, 2009, due primarily to the expensing of approximately

$1.8 million in costs incurred for the Company's postponed,

second-step stock offering, which costs management believes provide

no meaningful future benefit. The increase in non-interest

expense is also attributable to compensation and employee benefits

expense increasing $346,000, which resulted primarily from

increases in full time equivalent employees primarily related to

our insurance premium finance division formed in October 2009,

higher health care costs, and to a lesser extent, salary

adjustments effective January 1, 2010. Occupancy expense

increased $214,000, or 19.1%, over the same time period, primarily

due to increases in rent and amortization of leasehold improvements

relating to new branches and the renovation of existing

branches. In addition, other non-interest expense also

increased $385,000, or 37.0%, from the quarter ended September 30,

2009 to the quarter ended September 30, 2010. This increase

was primarily attributable to operating expenses of the insurance

premium finance division.

The provision for loan losses was $3.4 million for the quarter

ended September 30, 2010; an increase of $675,000, or 24.8%, from

the $2.7 million provision recorded in the quarter ended September

30, 2009. The increase in the provision for loan losses in the

current quarter was due primarily to increases in total loans, the

change in the composition of our loan portfolio, and increases in

general loss factors, due primarily to higher levels of charge-offs

experienced in the multifamily loan portfolio. During the

quarter ended September 30, 2010, the Company recorded a $1.2

million charge-off on one non-accruing multifamily loan, based on

the receipt of a current appraisal. Increases in the general

loss factors were also attributable to increases in delinquencies

in the Company's loan portfolio and further deterioration in the

local economy primarily as it relates to commercial real estate

loans. Net charge-offs for the quarter ended September 30,

2010, were $1.6 million, as compared to $600,000 for the quarter

ended September 30, 2009.

The Company recorded income tax expense of $215,000 and $1.8

million for the quarters ended September 30, 2010 and 2009,

respectively. The effective tax rate for the quarter ended

September 30, 2010, was 8.2%, as compared to 36.0% for the quarter

ended September 30, 2009. The decrease in the effective tax

rate was the result of a lower level of pre-tax income being

subject to taxation in 2010 as compared to 2009, and the reversal

of deferred tax liabilities related to state bad debt reserves of

approximately $738,000 resulting from the enactment of State of New

York tax laws during the quarter ended September 30, 2010.

Net income increased $1.9 million, or 23.8%, to $10.0 million

for the nine months ended September 30, 2010, as compared to $8.0

million for the nine months ended September 30, 2009, due primarily

to an increase of $4.8 million in net interest income and an

increase of $1.2 million in non-interest income, partially offset

by an increase of $3.5 million in non-interest expense, and an

increase of $660,000 in provision for loan losses.

Net interest income increased $4.8 million, or 11.5%, due

primarily to interest earning assets increasing $243.3 million, or

13.9%, partially offset by a decrease in the net interest margin of

seven basis points, or 2.2%, over the prior year comparable

period. The net interest margin decreased for the nine months

ended September 30, 2010, as the average yield earned on interest

earning assets decreased, which was partially offset by a decrease

in the average rate paid on interest-bearing liabilities. The

general decline in yields was due to the overall low interest rate

environment and was driven by decreases in yields earned on

mortgage-backed securities, as principal repayments were reinvested

into lower yielding securities. The decline in yield on

interest-earning assets was also due to declining yields on other

securities and interest-earning deposits in other financial

institutions. These decreases were partially offset by an

increase in yield earned on loans due primarily to the yield earned

on the Company's insurance premium loan portfolio. The

increase in average interest earning assets was due primarily to an

increase in average loans outstanding of $128.3 million, and other

securities of $162.4 million, being partially offset by decreases

in mortgage-backed securities, and interest-earning assets in other

financial institutions. Other securities consist primarily of

investment-grade corporate bonds, and government-sponsored

enterprise bonds.

Non-interest income increased $1.2 million, or 32.2%, primarily

as a result of an increase of $1.1 million in gains on securities

transactions, net for the nine months ended September 30, 2010, as

compared to the nine months ended September 30, 2009. The

Company recognized $1.6 million in gains on securities transactions

during the nine months ended September 30, 2010, as compared to

$477,000 in gains on securities transactions during the nine months

ended September 30, 2009. Securities gains during the nine

months ended September 30, 2010, included gross realized gains of

$1.2 million on the sale of mortgage-backed securities, coupled

with securities gains of $397,000 related to the Company's trading

portfolio. During the nine months ended September 30, 2009,

securities gains included gross realized gains of $7,000 on the

sale of mortgage-backed securities, coupled with securities gains

of $470,000 related to the Company's trading portfolio. The

trading portfolio is utilized to fund the Company's deferred

compensation obligation to certain employees and directors of the

Company. The participants of this plan, at their election,

defer a portion of their compensation. Gains and losses on

trading securities have no effect on net income since participants

benefit from, and bear the full risk of, changes in the trading

securities market values. Therefore, the Company records an

equal and offsetting amount in non-interest expense, reflecting the

change in the Company's obligations under the plan.

Non-interest income also was positively affected by a $191,000,

or 14.6%, increase in income on bank owned life insurance for the

nine months ended September 30, 2010, as compared to the nine

months ended September 30, 2009. The Company also recognized

approximately $197,000 of income on the sale of fixed assets during

the nine months ended September 30, 2010.

Non-interest expense increased $3.5 million, or 13.8%, for the

nine months ended September 30, 2010, as compared to the nine

months ended September 30, 2009, due primarily to the expensing of

approximately $1.8 million in costs incurred on the Company's

postponed, second-step stock offering and an increase of $1.3

million, or 10.0%, in compensation and employee benefits

expense. Compensation and employee benefits expense increased

primarily due to increases in full time equivalent employees

primarily related to our insurance premium finance division formed

in October 2009, higher health care costs, and to a lesser extent,

salary adjustments effective January 1, 2010. Occupancy

expense increased $400,000, or 12.1%, over the same time period,

primarily due to increases in rent and amortization of leasehold

improvements relating to new branches and the renovation of

existing branches. In addition, other non-interest expense

also increased $974,000, or 31.1%, from the nine months ended

September 30, 2009 to the nine months ended September 30,

2010. This increase is primarily attributable to operating

expenses of the insurance premium finance division. These

increases in non-interest expense were partially offset by a

decrease of $548,000 in FDIC insurance expense over the same time

period. FDIC insurance expense for the nine months ended

September 30, 2009 included $770,000 related to the FDIC's special

assessment.

The provision for loan losses was $8.1 million for the nine

months ended September 30, 2010, an increase of $660,000, or 8.8%,

from the $7.5 million provision recorded for the nine months ended

September 30, 2009. The increase in the provision was due

primarily to increases in total loans, the change in the

composition of our loan portfolio, and increases in general loss

factors, due to higher levels of charge-offs primarily in the

multifamily loan portfolio. The increases in the general loss

factors utilized in management's estimate of credit losses inherent

in the loan portfolio were also the result of continued increases

in delinquencies in the Company's loan portfolio and further

deterioration of the local economy. Net charge-offs for the

nine months ended September 30, 2010, were $2.6 million, as

compared to $2.0 million for the nine months ended September 30,

2009.

The Company recorded income tax expense of $4.4 million for the

nine months ended September 30, 2010 and 2009,

respectively. The effective tax rate for the nine months ended

September 30, 2010, was 30.6%, as compared to 35.6% for the nine

months ended September 30, 2009. The decrease in the effective

tax rate was the result of the reversal of deferred tax liabilities

related to state bad debt reserves of approximately $738,000

resulting from the enactment of new State of New York tax laws

during the quarter ended September 30, 2010.

About Northfield Bank

Northfield Bank, founded in 1887, operates 19 full service

banking offices in Staten Island and Brooklyn, New York and

Middlesex and Union counties, New Jersey. For more information

about Northfield Bank, please visit www.eNorthfield.com.

Forward-Looking Statements: This release may

contain certain "forward looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995, and may be

identified by the use of such words as "may," "believe," "expect,"

"anticipate," "should," "plan," "estimate," "predict," "continue,"

and "potential" or the negative of these terms or other comparable

terminology. Examples of forward-looking statements include,

but are not limited to, estimates with respect to the financial

condition, results of operations and business of Northfield

Bancorp, Inc. Any or all of the forward-looking statements in

this release and in any other public statements made by Northfield

Bancorp, Inc. may turn out to be wrong. They can be affected

by inaccurate assumptions Northfield Bancorp, Inc. might make or by

known or unknown risks and uncertainties as described in our SEC

filings, including, but not limited to, those related to general

economic conditions, particularly in the market areas in which the

Company operates, competition among depository and other financial

institutions, changes in laws or government regulations or policies

affecting financial institutions, including changes in regulatory

fees and capital requirements, inflation and changes in the

interest rate environment that reduce our margins or reduce the

fair value of financial instruments, our ability to successfully

integrate acquired entities, if any, and adverse changes in the

securities markets. Consequently, no forward-looking statement

can be guaranteed. Northfield Bancorp, Inc. does not intend to

update any of the forward-looking statements after the date of this

release, or conform these statements to actual events.

| NORTHFIELD BANCORP,

INC. |

| SELECTED CONSOLIDATED FINANCIAL

AND OTHER DATA |

| (Dollars in thousands, except

per share amounts) (unaudited) |

| |

|

|

| |

At |

At |

| |

September 30,

2010 |

December 31,

2009 |

| Selected Financial Condition

Data: |

|

|

| Total assets |

$ 2,193,849 |

$ 2,002,274 |

| Cash and cash equivalents |

36,044 |

42,544 |

| Trading securities |

3,901 |

3,403 |

| Securities available for sale, at estimated

fair value |

1,233,464 |

1,131,803 |

| Securities held to maturity |

5,452 |

6,740 |

| Loans held for investment, net |

802,598 |

729,269 |

| Allowance for loan losses |

(20,929) |

(15,414) |

| Net loans held for investment |

781,669 |

713,855 |

| Non-performing loans(1) |

55,391 |

41,822 |

| Other real estate owned |

171 |

1,938 |

| Bank owned life insurance |

74,034 |

43,751 |

| Federal Home Loan Bank of New York stock, at

cost |

7,084 |

6,421 |

| |

|

|

| Borrowed funds |

342,107 |

279,424 |

| Deposits |

1,412,393 |

1,316,885 |

| Total liabilities |

1,791,252 |

1,610,734 |

| Total stockholders' equity |

$ 402,597 |

$ 391,540 |

| |

|

|

|

|

| |

Quarter

Ended |

Nine Months

Ended |

| |

September

30, |

September

30, |

| |

2010 |

2009 |

2010 |

2009 |

| Selected Operating

Data: |

|

|

|

|

| Interest income |

$ 21,682 |

$ 21,855 |

$ 64,721 |

$ 63,350 |

| Interest expense |

6,004 |

7,078 |

18,577 |

21,975 |

| Net interest income before provision for loan

losses |

15,678 |

14,777 |

46,144 |

41,375 |

| Provision for loan losses |

3,398 |

2,723 |

8,126 |

7,466 |

| Net interest income after provision for loan

losses |

12,280 |

12,054 |

38,018 |

33,909 |

| Non-interest income |

1,501 |

1,357 |

5,090 |

3,850 |

| Non-interest expense |

11,171 |

8,429 |

28,749 |

25,272 |

| Income before income tax expense |

2,610 |

4,982 |

14,359 |

12,487 |

| Income tax expense |

215 |

1,795 |

4,397 |

4,443 |

| Net income |

$ 2,395 |

$ 3,187 |

$ 9,962 |

$ 8,044 |

| |

|

|

|

|

| Basic earnings per share (2) |

$ 0.06 |

$ 0.08 |

$ 0.24 |

$ 0.19 |

| Diluted earnings per share (2) |

$ 0.06 |

$ 0.08 |

$ 0.24 |

$ 0.19 |

| |

|

|

|

|

| NORTHFIELD BANCORP,

INC. |

| SELECTED CONSOLIDATED FINANCIAL

AND OTHER DATA |

| (Dollars in thousands, except

per share amounts) (unaudited) |

| |

|

|

|

|

| |

At or For the

Three |

At or For the

Nine |

| |

Months

Ended |

Months

Ended |

| |

September

30, |

September

30, |

| |

2010 |

2009 |

2010 |

2009 |

| Selected Financial

Ratios: |

|

|

|

|

| Performance Ratios(3): |

|

|

|

|

| Return on assets (ratio of net income to

average total assets)(5) |

0.44 % |

0.66 % |

0.63 % |

0.59 % |

| Return on equity (ratio of net income to

average equity)(5) |

2.36 |

3.23 |

3.35 |

2.76 |

| Average equity to average total

assets |

18.57 |

20.36 |

18.92 |

21.23 |

| Interest rate spread |

2.76 |

2.76 |

2.78 |

2.65 |

| Net interest margin |

3.05 |

3.20 |

3.10 |

3.17 |

| Efficiency ratio(4)(6) |

65.03 |

52.24 |

56.11 |

55.88 |

| Non-interest expense to average total

assets(6) |

2.04 |

1.74 |

1.83 |

1.84 |

| Average interest-earning assets to

average interest-bearing liabilities |

124.70 |

128.87 |

125.63 |

130.73 |

| Asset Quality Ratios: |

|

|

|

|

| Non-performing assets to total

assets |

2.53 |

1.84 |

2.53 |

1.84 |

| Non-performing loans to total loans held

for investment, net |

6.90 |

5.36 |

6.90 |

5.36 |

| Allowance for loan losses to

non-performing loans |

37.78 |

39.74 |

37.78 |

39.74 |

| Allowance for loan losses to total

loans |

2.61 |

2.13 |

2.61 |

2.13 |

| Annualized net charge-offs to total

average loans |

0.80 |

0.36 |

0.46 |

0.43 |

| Provision for loan losses as a multiple

of net charge-offs |

2.14 x |

4.54 x |

3.11 x |

3.65 x |

| |

|

|

|

|

| (1) Non-performing loans consist

of non-accruing loans and loans 90 days or more past due and still

accruing, and are included in loans held-for-investment, net. |

| (2) Basic net income per

common share is calculated based on 41,341,567 and 42,212,440

average shares outstanding for the three months ended September 30,

2010, and September 30, 2009, respectively. Basic net income

per common share is calculated based on 41,422,228 and 42,639,492

average shares outstanding for the nine months ended September 30,

2010, and September 30, 2009, respectively. Diluted earnings

per share is calculated based on 41,498,622 and 42,375,268

average shares outstanding for the three months ended September 30,

2010 and September 30, 2009, respectively. Diluted earnings

per share is calculated based on 41,701,476 and 42,729,918 average

shares outstanding for the nine months ended September 30, 2010 and

September 30, 2009, respectively. |

| (3) Annualized when

appropriate. |

| (4) The efficiency ratio

represents non-interest expense divided by the sum of net interest

income and non-interest income. |

| (5) September 30, 2010,

amounts include a $1.8 million charge ($1.2 million after-tax)

related to costs associated with the Company's postponed

second-step offering, and a $738,000 benefit related the

elimination of deferred tax liabilities associated with a change in

New York state tax law. September 30, 2009, amounts include a

$770,000 expense ($462,000 after-tax) related to a special FDIC

deposit insurance assessment. |

| (6) September 30, 2010, amounts

include a $1.8 million charge ($1.2 million after-tax) related to

costs associated with the Company's postponed second-step

offering. September 30, 2009, amounts include a $770,000

expense ($462,000 after-tax) related to a special FDIC deposit

insurance assessment. |

| |

|

|

|

|

|

|

| NORTHFIELD BANCORP,

INC. |

| ANALYSIS OF NET INTEREST

INCOME |

| (Dollars in thousands) |

| |

|

|

|

|

|

|

| |

For the Quarter

Ended September 30, |

| |

2010 |

2009 |

| |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

| |

|

|

|

|

|

|

| Interest-earning

assets: |

|

|

|

|

|

|

| Loans |

$793,600 |

$11,908 |

5.95% |

$659,247 |

$10,251 |

6.17% |

| Mortgage-backed securities |

958,409 |

8,224 |

3.40 |

922,723 |

10,382 |

4.46 |

| Other securities |

256,146 |

1,457 |

2.26 |

149,291 |

1,024 |

2.72 |

| Federal Home Loan Bank of New York

stock |

7,426 |

75 |

4.01 |

7,056 |

113 |

6.35 |

| Interest-earning deposits in financial

institutions |

26,541 |

18 |

0.27 |

91,970 |

85 |

0.37 |

| Total interest-earning

assets |

2,042,122 |

21,682 |

4.21 |

1,830,287 |

21,855 |

4.74 |

| Non-interest-earning assets |

125,438 |

|

|

95,418 |

|

|

| Total assets |

2,167,560 |

|

|

1,925,705 |

|

|

| |

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

| Savings, NOW, and money market

accounts |

673,243 |

1,223 |

0.72 |

576,055 |

1,484 |

1.02 |

| Certificates of deposit |

626,309 |

1,974 |

1.25 |

537,865 |

2,861 |

2.11 |

| Total interest-bearing

deposits |

1,299,552 |

3,197 |

0.98 |

1,113,920 |

4,345 |

1.55 |

| Borrowed funds |

338,094 |

2,807 |

3.29 |

306,335 |

2,733 |

3.54 |

| Total

interest-bearing liabilities |

1,637,646 |

6,004 |

1.45 |

1,420,255 |

7,078 |

1.98 |

| Non-interest bearing deposit accounts |

115,614 |

|

|

100,299 |

|

|

| Accrued expenses and other

liabilities |

11,704 |

|

|

13,144 |

|

|

| Total liabilities |

1,764,964 |

|

|

1,533,698 |

|

|

| Stockholders' equity |

402,596 |

|

|

392,007 |

|

|

| Total liabilities and stockholders'

equity |

2,167,560 |

|

|

1,925,705 |

|

|

| |

|

|

|

|

|

|

| Net interest income |

|

$15,678 |

|

|

$14,777 |

|

| Net interest rate spread (2) |

|

|

2.76 |

|

|

2.76 |

| Net interest-earning assets (3) |

$404,476 |

|

|

$410,032 |

|

|

| Net interest margin (4) |

|

|

3.05% |

|

|

3.20% |

| Average interest-earning

assets to interest-bearing liabilities |

|

124.70 |

|

|

128.87 |

| |

|

|

|

|

|

|

| (1) Average yields and

rates for the three months ended September 30, 2010, and 2009 are

annualized. |

| (2) Net interest rate

spread represents the difference between the weighted average yield

on interest-earning assets and the weighted average cost of

interest-bearing liabilities. |

| (3) Net

interest-earning assets represent total interest-earning assets

less total interest-bearing liabilities. |

| (4) Net interest margin

represents net interest income divided by average total

interest-earning assets. |

| |

|

|

|

|

|

|

| NORTHFIELD BANCORP,

INC. |

| ANALYSIS OF NET INTEREST

INCOME |

| (Dollars in thousands) |

| |

|

|

|

|

|

|

| |

For the Nine

Months Ended September 30, |

| |

2010 |

2009 |

| |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

| |

|

|

|

|

|

|

| Interest-earning

assets: |

|

|

|

|

|

|

| Loans |

$761,969 |

$34,299 |

6.02% |

$633,660 |

$28,075 |

5.92% |

| Mortgage-backed securities |

920,864 |

25,837 |

3.75 |

926,679 |

32,420 |

4.68 |

| Other securities |

245,731 |

4,220 |

2.30 |

83,284 |

1,828 |

2.93 |

| Federal Home Loan Bank of New York

stock |

6,661 |

233 |

4.68 |

7,670 |

300 |

5.23 |

| Interest-earning deposits in financial

institutions |

53,250 |

132 |

0.33 |

93,857 |

727 |

1.04 |

| Total interest-earning

assets |

1,988,475 |

64,721 |

4.35 |

1,745,150 |

63,350 |

4.85 |

| Non-interest-earning assets |

114,515 |

|

|

92,182 |

|

|

| Total assets |

2,102,990 |

|

|

1,837,332 |

|

|

| |

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

| Savings, NOW, and money market

accounts |

668,854 |

3,907 |

0.78 |

551,009 |

4,589 |

1.11 |

| Certificates of deposit |

590,303 |

6,624 |

1.50 |

482,796 |

9,299 |

2.58 |

| Total interest-bearing

deposits |

1,259,157 |

10,531 |

1.12 |

1,033,805 |

13,888 |

1.80 |

| Borrowed funds |

323,654 |

8,046 |

3.32 |

301,110 |

8,087 |

3.59 |

| Total

interest-bearing liabilities |

1,582,811 |

18,577 |

1.57 |

1,334,915 |

21,975 |

2.20 |

| Non-interest bearing deposit accounts |

112,777 |

|

|

97,980 |

|

|

| Accrued expenses and other

liabilities |

9,431 |

|

|

14,425 |

|

|

| Total liabilities |

1,705,019 |

|

|

1,447,320 |

|

|

| Stockholders' equity |

397,971 |

|

|

390,012 |

|

|

| Total liabilities and stockholders'

equity |

2,102,990 |

|

|

1,837,332 |

|

|

| |

|

|

|

|

|

|

| Net interest income |

|

$46,144 |

|

|

$41,375 |

|

| Net interest rate spread (2) |

|

|

2.78 |

|

|

2.65 |

| Net interest-earning assets (3) |

$405,664 |

|

|

$410,235 |

|

|

| Net interest margin (4) |

|

|

3.10% |

|

|

3.17% |

| Average interest-earning assets to

interest-bearing liabilities |

|

|

125.63 |

|

|

130.73 |

| |

|

|

|

|

|

|

| (1) Average yields and

rates for the nine months ended September 30, 2010 and 2009, are

annualized. |

| (2) Net interest rate

spread represents the difference between the weighted average yield

on interest-earning assets and the weighted average cost of

interest-bearing liabilities. |

| (3) Net

interest-earning assets represent total interest-earning assets

less total interest-bearing liabilities. |

| (4) Net interest margin

represents net interest income divided by average total

interest-earning assets. |

CONTACT: Northfield Bancorp, Inc.

Steven M. Klein, Chief Financial Officer

(732) 499-7200 ext. 2510

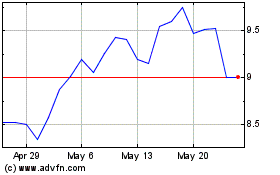

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From May 2024 to Jun 2024

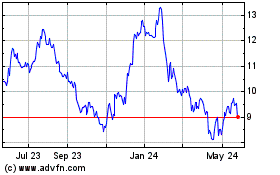

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From Jun 2023 to Jun 2024