2nd UPDATE: Cisco To Acquire Video-Software Maker NDS Group

March 15 2012 - 12:27PM

Dow Jones News

Cisco Systems Inc. (CSCO) agreed to acquire video-software maker

NDS Group Ltd. for $4 billion, the company's biggest deal in more

than two years and a reflection of Cisco's focus on video.

The U.K.-based NDS--partially owned by News Corp. (NWS,

NWSA)--provides equipment and services to television providers like

cable and satellite companies. Cisco said it was attracted by NDS's

technology, its services-based business model that derives more

than half of its revenue from recurring sources, and how NDS could

help grow the Videoscape product Cisco sells to online media

providers.

Under the deal, expected to close in the second half of the

year, Cisco also will assume nearly $1 billion of debt, in addition

to paying the $4 billion. Cisco, which had been in less formal

talks with NDS since last year, entered exclusive talks to buy the

company about three weeks ago, a person familiar with the deal

said.

Cisco, which sees the acquisition adding to its adjusted

earnings in the first full year after completion, doesn't expect to

encounter big antitrust hurdles, another person familiar with the

matter said.

Cisco shares slid 1.7% to $19.86.

The buyout comes as NDS was on course to go public this year.

The company is 51% owned by private-equity firm Permira Advisers

LLP, with News Corp. holding the remaining stake. News Corp. also

owns Dow Jones & Co., publisher of this newswire and The Wall

Street Journal.

News Corp.'s Class A shares rose nearly 1% to $20.21. The deal

will help simplify News Corp.'s structure that some investors say

contains too many minority stakes in varied companies.

NDS, with more than 5,000 employees, makes software used by

cable-television and satellite companies to encrypt signals to

deliver TV programming and other video though various devices,

including TVs and set-top boxes. Its customers include DirecTV and

China Central Television. The company was taken private in 2009 in

a deal that valued it at $3.6 billion.

NDS had revenue of $957 million in the fiscal year ended June

30, according to a regulatory filing. It reported income of $252

million.

The tie-up allows Cisco to tap into some of its overseas cash,

which Chief Executive John Chambers called an additional benefit.

The company had more than $46 billion in cash at the end of

January, but only a small amount is in the U.S.

Chambers has been among the most vocal advocates of a tax

holiday that would allow U.S. businesses to repatriate cash without

having to pay much tax. Absent that, he has said Cisco is likely to

spend it overseas.

Historically one of Silicon Valley's most active buyers, Cisco

has focused more recently on acquiring start-ups and small

companies. Last month, though, Cisco executives said on the

company's earnings conference call that they were seeking bigger

acquisitions.

Of late, the San Jose, Calif., company has been backtracking

from an effort to expand into 30 new businesses, instead narrowing

its focus to a few core areas, including video. The deal is a

natural extension of Cisco's Scientific-Atlanta set-top business,

although Chambers said NDS and Scientific Atlanta products have

almost no overlap.

The addition of NDS would accelerate Videoscape's shift in

revenue streams from set-top boxes into more profitable

service-based models by at least one to two years, Chambers said.

Videoscape--which includes a set-top box, software interface and

other gear--allows users to watch and search across live, on-demand

and recorded TV programming as well as online video.

Evercore Partners analyst Alkesh Shah said NDS's financial

profile should benefit Cisco, as both its earnings and revenue

growth and gross-margin levels trump the tech giant's. Chambers

noted that NDS was in the hot area of technology that allows

service providers to bring content to any device and be able to

monetize it.

Shah also said NDS is a very interesting play in the emerging

markets of Brazil, India and China because of its strong encryption

capabilities, which give video providers security and access

control for set-top boxes. Encryption is important in those

countries, and NDS's growth is concentrated in those areas, Shah

said.

Cisco executives, meanwhile, said NDS's strong relationships

with satellite providers complement Cisco's own base of

telecommunications companies.

Joanna Makris, analyst at Mizuho Securities USA, noted that

"right now there's a convergence going on between the television

and PC, and what Cisco is trying to do is capitalize on that

convergence."

-By Joan E. Solsman and Ben Worthen, Dow Jones Newswires;

212-416-2291; joan.solsman@dowjones.com

--Dana Cimilluca and Anupreeta Das contributed to this

report.

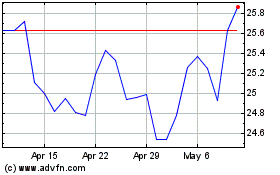

News (NASDAQ:NWS)

Historical Stock Chart

From Jun 2024 to Jul 2024

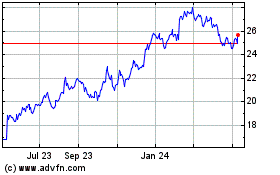

News (NASDAQ:NWS)

Historical Stock Chart

From Jul 2023 to Jul 2024