UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

NetApp, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

000-27130 |

|

77-0307520 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS. Employer Identification No.) |

|

|

3060 Olsen Drive San Jose CA 95128 (Address of principal executive offices) |

Elizabeth O’Callahan EVP, Chief Legal Officer & Secretary NetApp, Inc. (408) 822-6000 (Name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

|

|

|

|

|

|

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

|

Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended ___. |

|

|

Section 1 - Conflict Minerals Disclosure

Items 1.01 and 1.02 Conflict Minerals Disclosure and Report; Exhibit

A copy of NetApp, Inc.’s Conflict Minerals Report is provided as Exhibit 1.01 to this Form SD and is available at the following address:

http://investors.netapp.com/corporate-governance

Section 3 - Exhibits

Item 3.01 Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NETAPP, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

Date: May 20, 2024 |

|

|

|

By: |

|

/s/ Elizabeth O’Callahan |

|

|

|

|

|

|

Elizabeth O’Callahan |

|

|

|

|

|

|

EVP, Chief Legal Officer and Secretary |

Exhibit 1.01

Conflict Minerals Report of NetApp, Inc.

For the Calendar Year Ended December 31, 2023

This Conflict Minerals Report contains forward-looking statements. These statements include statements regarding NetApp’s goals for its Conflict Minerals policy and the actions that NetApp intends to take to improve transparency and reporting. All forward-looking statements involve risk and uncertainty. When considering these statements, you should also consider the important factors described in reports and documents NetApp files from time to time with the Securities and Exchange Commission (“SEC”), including the factors described under the sections titled “Risk Factors” in NetApp’s most recently filed Annual and Quarterly Reports on Forms 10-K and 10-Q, respectively. Except as required by law, NetApp disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise.

Unless otherwise stated herein, any documents, third-party materials or references to websites (including NetApp’s) are not incorporated by reference in, or considered to be a part of, this Conflict Minerals Report unless expressly incorporated by reference herein.

This is the Conflict Minerals Report for NetApp, Inc. (“NetApp”) for calendar year 2023 prepared in accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”).

Introduction

NetApp is a leader in data insight, access and control for hybrid cloud environments. NetApp provides global organizations with the ability to manage and share their data across on-premises, private and public clouds.

Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules promulgated thereunder (together “Section 1502”) require NetApp to perform certain due diligence procedures and disclose information about the use and origin of certain minerals if these minerals are deemed to be necessary to the functionality or production of a product manufactured or contracted to be manufactured by NetApp. The NetApp products that contain minerals or metals are its hardware products (storage systems and subsystems) that NetApp contracts to manufacture and sells directly or through resellers. The specific minerals covered by these rules consist of tin, tantalum, tungsten and gold and are referred to as “Conflict Minerals” or alternatively as “3TG”.

Conflict Minerals are necessary to the functionality or production of the hardware storage systems and subsystems that NetApp contracts with third parties to manufacture. Components and subassemblies that are made in part using Conflict Minerals are sourced from a global supply base that includes distributors, value-added resellers, original equipment manufacturers, original design manufacturers and contract manufacturers.

In accordance with Section 1502, NetApp has performed a “reasonable country of origin inquiry” (“RCOI”) on the Conflict Minerals contained in the NetApp products the manufacturing of which was completed during calendar year 2023 to determine whether these minerals were sourced from the Democratic Republic of the Congo or adjoining countries (collectively the “Covered Countries”) and has conducted due diligence measures as described below.

Due Diligence Procedures

In accordance with Rule 13p-1, NetApp undertook due diligence procedures to determine the source and chain of custody of the Conflict Minerals used in its products. NetApp designed its due diligence measures for each of the Conflict Minerals to conform, in all material respects, with the due diligence framework in the Organisation for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition (OECD 2016) (“OECD Framework”) and related supplements. NetApp’s due diligence measures concerning Conflict Minerals included:

1.Establishing strong company management systems regarding conflict minerals;

2.Identifying and assessing risk in the supply chain;

3.Designing and implementing strategies to respond to identified risks;

4.Supporting industry associations that carry out independent third-party audits of smelter and refiner due diligence practices; and

5.Reporting annually on NetApp’s supply chain due diligence activities.

STEP 1: Establish strong company management systems

a)Identified an executive sponsor for NetApp’s supply chain transparency objectives to provide internal leadership and guidance to attain NetApp’s goal of determining the countries of origin of the Conflict Minerals that are necessary for the production or functionality of its products and eliminating sources of Conflict Minerals that benefit armed groups in the Covered Countries.

b)Adopted and posted a Conflict Minerals policy (discussed further below) on its website. NetApp requested all vendors and suppliers of materials that could potentially contain Conflict Minerals (the “in-scope suppliers”) to comply with the requirements of Section 1502, if applicable, and to support NetApp’s compliance program. NetApp continues to educate suppliers on its Conflict Minerals policy and encourage suppliers to have policies of their own.

c)Included a Section 1502 contractual requirement in its Master Supply Agreements that requires suppliers to provide necessary information.

d)Adopted processes, procedures and systems to capture, maintain, retrieve and report on supplier sourcing of Conflict Minerals to further improve transparency and the ability to report on NetApp’s sourcing of Conflict Minerals in accordance with Section 1502 in coming years.

e)Conducted a survey using the Responsible Minerals Initiative or “RMI” Conflict Minerals Reporting Template (the “CMRT”) version 6.31 or higher (the “RCOI Survey”) through a third-party service provider, SupplierSoft, of NetApp’s in-scope suppliers to gather information on the source and chain of custody of the necessary Conflict Minerals included in NetApp products.

f)Instituted a Conflict Minerals risk assessment as part of the NetApp product development process.

g)Identified personnel within NetApp responsible for the NetApp sustainability program, including responsibility for day-to-day consideration and review of compliance requirements related to the Section 1502.

h)Used a third-party service provider, SupplierSoft, to assist with gathering and evaluating supply chain information with respect to Conflict Minerals, training and educating suppliers on Conflict Minerals and providing feedback to the in-scope suppliers on their conflict minerals program.

i)Established a dedicated email address that is published on https://www.netapp.com/company/about-us/conflict-minerals/ and in other communications with suppliers whereby employees and suppliers can (i) communicate with NetApp on questions related to Conflict Minerals, (ii) request Conflict Mineral compliance information, and (iii) report Conflict Minerals grievances.

STEP 2: Identify and assess risks in the supply chain

a)As part of its RCOI, NetApp performed an assessment of all parts represented within its product lines followed by a supplier risk assessment. Suppliers were first assessed by determining whether they supplied hardware, software or services. If the supplier was determined to supply hardware, NetApp assessed whether the materials supplied by the supplier could potentially contain Conflict Minerals to identify the in-scope suppliers. Finally, the in-scope suppliers were surveyed to determine whether they sourced Conflict Minerals from the Covered Countries.

b)Provided letters to the in-scope suppliers explaining NetApp’s country of origin inquiry and due diligence efforts and requesting supplier cooperation. Suppliers were offered training materials on the requirements of Section 1502, NetApp’s plan to achieve compliance with such requirements and NetApp’s goal of achieving responsible sourcing from its suppliers.

c)Partnered with SupplierSoft to conduct an RCOI Survey of NetApp’s in-scope suppliers to gather information on countries of origin and identify smelters or refiners. The RCOI Survey used the CMRT. The in-scope suppliers were asked to identify the smelters and refiners who contributed to the Conflict Minerals materials contained in parts and components that they supplied to NetApp.

d)The in-scope suppliers that responded to NetApp’s RCOI Survey account for 100% of in-scope component spend for calendar year 2023. Maintaining this percentage rate is attributable to NetApp’s and SupplierSoft’s efforts on following up with non-responsive suppliers.

e)Compared smelters and refiners identified against the list of those on RMI’s lists for tantalum, tin, tungsten and gold including those that are conformant with the applicable RMI Responsible Minerals Assurance Process

(“RMAP”) standard or a cross-recognized scheme. Based on the RCOI, NetApp had reason to believe that some of the Conflict Minerals may have originated from the Covered Countries, therefore, in accordance with Section 1502, performed due diligence on the source and chain of custody of the conflict minerals in question.

f)Performed enhanced data analytics to ensure identification of all in-scope suppliers throughout NetApp’s entire supply chain.

g)Analyzed CMRT responses and provided feedback to suppliers on the strength of their conflict minerals program.

STEP 3: Design and implement a strategy to respond to identified risks

a)NetApp has established a supplier Conflict Minerals policy, which outlines NetApp’s requirements for its suppliers:

a.Sourcing minerals from socially responsible suppliers;

b.Requesting suppliers downstream to source minerals from socially responsible suppliers;

c.Providing NetApp with prompt, truthful, and accurate information regarding each supply source and the nature of the sourcing materials as it relates to the requirements of Section 1502; and

d.Cooperating with regular business reviews, surveys, and audits undertaken by or for NetApp so that it can comply with the requirements of Section 1502.

b)Through calendar year 2023, NetApp continued to flow down its Conflict Minerals policy to its in-scope supply base. This has aided in defining sourcing requirements for products supplied to NetApp.

c)NetApp’s supplier qualification and assessment program includes audits of supplier representations regarding their status to validate their previous and current reporting.

d)NetApp (or SupplierSoft on NetApp’s behalf) responded to the risks identified in Step 2 by providing feedback and education material to suppliers. This included contacting non-responsive suppliers, following up regarding invalid submissions, providing feedback and recommended next steps for identified smelter risk, and encouraging suppliers to improve their internal compliance practices.

e)In 2023, NetApp attended a Conflict Minerals forum and collaborated with industry peers to define and improve best practices, and encourage responsible sourcing.

f)In calendar year 2023, NetApp plans to:

a.Continue to work with its top materials-spend suppliers to improve transparency and reporting. Concurrently, through its supplier performance management process, NetApp continues to assess risk for those suppliers that are not improving their level of transparency as required by Section 1502. NetApp will work with suppliers with underdeveloped processes, providing information and guidance to increase transparency.

b.Compare RCOI Survey responses to information collected via independent conflict free smelter validation programs, such as RMI’s Responsible Minerals Assurance Process, to identify unknown or unrecognized smelters or refiners.

c.Contact in-scope suppliers with unknown or unrecognized smelters or refiners and request their participation in improving data accuracy and promoting RMI’s efforts.

d.Participate in Conflict Minerals forums and collaborate with industry peers to define best practices and encourage responsible sourcing.

STEP 4: Support industry associations that carry out independent third-partyaudits of smelter and refiner due diligence practices

As a member of the Responsible Business Alliance or “RBA,” NetApp will continue to participate in the RMI to assist in increasing the number of smelters and refiners directly and indirectly in its supply base that are conformant with the applicable RMI RMAP standard or a cross-recognized scheme. NetApp has not voluntarily elected to describe any of its products as “DRC conflict free,” and for this reason, pursuant to SEC guidance issued on April 29, 2014 and the SEC order issued on May 2, 2014, an independent private sector audit of the report presented herein has not been conducted.

STEP 5: Report annually on supply chain due diligence

NetApp’s Conflict Minerals policy, Form SD and this Conflict Minerals Report are available on NetApp’s public website:https://www.netapp.com/company/about-us/conflict-minerals/.

Results of Due Diligence

NetApp, as a purchaser, is many steps removed from the mining of Conflict Minerals and does not purchase raw ore or unrefined Conflict Minerals, nor does it purchase bulk Conflict Minerals in the form of ingots or bullion for use in its products. The origin of NetApp’s Conflict Minerals cannot be determined with any certainty once the raw ores are smelted, refined and converted to ingots, bullion or other derivatives. The smelters and refiners are consolidating points for raw ore and are in the best position in the total supply chain to know the origin of the ores. In addition, the majority of CMRTs received from the in-scope suppliers were made on a company- or division-level basis, rather than on a product-level basis, and therefore NetApp cannot identify with certainty which smelters or refiners actually processed the Conflict Minerals contained in NetApp products.

As a result of NetApp’s RCOI, NetApp’s suppliers identified 349 smelters and refiners from which they source Conflict Minerals that appear on the RMI’s Standard Smelter List, and of those smelters and refiners, 224 smelters and refiners, or approximately 64%, have successfully completed an assessment against the applicable RMI RMAP standard or a cross-recognized scheme. The remainder of the reported smelters and refiners have not, at this time, successfully completed an assessment against the applicable RMAP standard or a cross-recognized scheme. NetApp was not able to determine the country of origin of the Conflict Minerals in its products or whether portions of its products contain recycled or scrap sources.

The information contained in the preceding paragraph is based on supplier responses received through April 18, 2024. Smelter and refiner status is provided as of April 18, 2024.

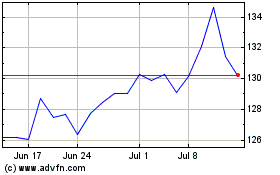

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From May 2024 to Jun 2024

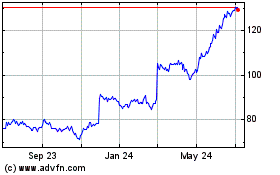

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Jun 2023 to Jun 2024