Nano Dimension Ltd. (Nasdaq: NNDM, “Nano

Dimension” or the “Company”), an industry leader

in

Additively

Manufactured

Electronics

(

AME) and

Micro

Additive

Manufacturing

(

Micro-AM), today announced financial results for

the first quarter ended March 31st, 2022.

Nano Dimension reported revenues of $10,430,000

for the first quarter of 2022, an increase of 1,186% over the same

quarter in 2021, and an increase of 38% over the fourth quarter of

2021.

Moreover, the first quarter

of 2022 revenue run-rate indicates the potential for

growth of approximately 300% in full year 2022 over 2021.

If this occurs, the Company will perform ahead

of its own expectations, by growing revenue over 10 times

from 2020 to 2022, assuming no critical changes in world economy

resulting from current international affairs and/or other

factors.

The Company ended the quarter with a cash and

deposits balance of $1.311 Billion (including short and long-term

unrestricted bank deposits), while net loss for the first quarter

was $33.3 million and EBITDA was negative $29.3 million.

Excluding $13.7 million of adjustments for

share-based payments and depreciation and amortization

expenses:

- Adjusted net loss was $19.6 million.

- Gross margin (excluding amortization of intangible assets, also

recognized in business combination) was 37%.

- Adjusted EBITDA was negative $19.2 million.

- Adjusted EBITDA net of $11.7 million of R&D cash expenses

was negative $7.5 million.

Net cash used in operations during the first quarter of 2022 was

$21.4 million.Details regarding EBITDA and Adjusted EBITDA can be

found later in this press release under “Non-IFRS measures”.

CEO MESSAGE TO

SHAREHOLDERS:

Few observations should be noted as our revenue

grows and we endeavor to supplement it, over time, with improved

profitability:

- Gross Margin (“GM”): GM is affected by changing mixture of our

products: over 60% GM for the new and disruptive Additive

Manufacturing (AM) systems, similar and higher GM for materials,

and 35%-50% GM for our other products such as surface mounting and

ink printing machines and subsystems.

- Net Cash Burn: The majority ($11.7 million) of the $21.4

million net cash used in operations in the first quarter of 2022,

was our investment in the research and development (R&D)

efforts.

- R&D Expense: We have spent approximately 23% less in

R&D in comparison to our budget. Our expenses in sales and

marketing are below budget as well. These are indications of the

difficulties we have in recruiting the quality scientists and

engineers that we need, especially in the USA and Israel, and

specifically in the fields of software, data science, algorithm

design and material science as well as high level technical sales

and application engineers. This phenomenon affects our ability to

accelerate our business plans. If it was up to us, the R&D

figure would have been higher, in order to shorten the return on

investment (ROI) timeline.

- Cost of Labor: We are hoping that the current trends in

employment and salaries will reduce the intensity of the point

above, and support our need for increased recruitment pace,

specifically of high-quality research and sales personnel.

- ROI: As we have declared many times over the last few quarters,

as we increase our revenue and invest in R&D, the profitability

that will lead to ROI on the cash investment in R&D is not

going to be demonstrated on an immediate quarterly basis, but it is

rather expected to take at least 8-12 quarters until it will

hopefully be manifested as return on capital invested, in the

EBITDA and profits lines.

The vision of the Company was expanded based on

the conclusion we have reached from analyzing the following data

points:

- Nano Dimension’s successful current growth, through expansion

of revenues in Additive Manufacturing Electronics.

- The emerging results of growth originated by acquisitions and

the organic growth thereof under Nano Dimension’ Go-To-Market and

technology development umbrellas.

- The obvious contraction of multiples in the public and private

market which justify our previous thesis of not burning our cash by

buying at overly inflated values.

- Ample opportunities emerging in Additive Manufacturing, as well

as in adjacent technologies in need of AI, Deep Learning and

digital conversions.

Our vision continues to evolve as we look to

transform AM & AM Electronics & adjacent industrial

non-yet-fully-digitalized sectors into an environmentally

friendly & economically efficient additive manufacturing

Industry 4.0 – enabling a one production-step-conversion

of digital designs into functioning mechanical & electronic

devices, On demand, anytime, anywhere.

The business plan aimed at reaching the above is

heading in a similar direction as before but with a wider field of

view, in order to cover the new opportunities arising from the

dramatic changes in the markets. We hope that if contraction of

multiples and valuation is sustainable, acquisitions will continue

to be at more reasonable prices, which were not available over the

last two years.

On a related matter, as a high-tech growth

company, buyers of our shares at the current price, as it trades

below its cash value, actually imitate an investment in a “value

company.” In practical terms it means that Nano Dimension’s share

price represents a potential valuation upside of a high growth

business but with lower downside, more similar to a value-model

investment profile. Hence, we changed our previous intention with

respect to a Share (ADS) Buy-Back program and initiated a process

to facilitate such plan which is conditioned on receipt of Israeli

court approval (as needed for all programs as such, according to

Israeli Corporate Law). We will provide an update once such

approval is received.

FINANCIAL RESULTS:

First Quarter 2022 Financial

Results

|

● |

Total revenues for the first quarter of 2022 were $10,430,000,

compared to $7,531,000 in the fourth quarter of 2021, and $811,000

in the first quarter of 2021. The increase is attributed to

increased sales of the Company’s product lines. |

| |

|

| ● |

Cost of revenues (excluding amortization of intangibles) for the

first quarter of 2022 were $6,580,000, compared to $4,350,000 in

the fourth quarter of 2021, and $352,000 in the first quarter of

2021. The increase is attributed mostly to the increased sales of

the Company’s product lines. |

| |

|

| ● |

Research and development expenses for the first quarter of 2022

were $17,870,000, compared to $15,099,000 in the fourth quarter of

2021, and $3,732,000 in the first quarter of 2021. The increase is

attributed to an increase in payroll expenses and share-based

payment expenses, as a result of the Company’s increased R&D

efforts. o The

R&D expenses net of depreciation and share-based payments

expenses were $11,723,000. |

| |

|

| ● |

Sales and marketing (S&M) expenses for the first quarter of

2022 were $9,308,000, compared to $7,690,000 in the fourth quarter

of 2021, and $2,713,000 in the first quarter of 2021. The increase

compared to the fourth quarter of 2021 is attributed to an increase

in payroll expenses as a result of our growing sales and marketing

team. The increase compared to the first quarter of 2021 is

attributed to an increase in payroll expenses as well as an

increase in share-based payment expenses.

o The S&M

expenses net of depreciation and share-based payments expenses were

$6,393,000. |

| |

|

| ● |

General and administrative (G&A) expenses for the first quarter

of 2022 were $6,742,000, compared to $6,470,000 in the fourth

quarter of 2021, and $3,425,000 in the first quarter of 2021. The

increase compared to the fourth quarter of 2021 is attributed to an

increase in payroll expenses. The increase compared to the first

quarter of 2021 is attributed to an increase in payroll expenses

and share-based payment expenses, as well as an increase in

professional services expenses.

o The G&A

expenses net of depreciation and share-based payments expenses were

$5,219,000. |

| |

|

| ● |

Net loss for the first quarter of 2022 attributed to the owners was

$33,093,000, or $0.13 per share, compared to $159,624,000, or

$0.62 per share, in the fourth quarter of 2021, and $9,314,000, or

$0.05 per share, in the first quarter of 2021. |

Balance Sheet Highlights

|

● |

Cash and cash equivalents, together with short and long-term bank

deposits totaled $1,311,093,000 as of March 31st, 2022, compared to

$1,355,595,000 as of December 31st, 2021. The decrease compared to

December 31st, 2021, mainly reflects cash used in operating

activities and investing activities. |

| |

|

| ● |

Shareholders’ equity totaled $1,320,520,000 as of March 31st, 2022,

compared to $1,343,356,000 as of December 31st, 2021. |

Conference call information

The Company will host a conference call to

discuss these financial results today, May 31, 2022, at 9:00

a.m. EDT (4:00 p.m. IDT). U.S. Dial-in Number: 1-866-744-5399,

Israel Dial-in Number: 972-3-9180692. Please request the “Nano

Dimension NNDM call” when prompted by the conference call

operator.For those unable to participate in the conference call,

there will be a replay available from a link on Nano Dimension’s

website at

http://investors.nano-di.com/events-and-presentations.

About Nano DimensionNano

Dimension’s (Nasdaq: NNDM) vision is to transform

the electronics and similar additive manufacturing

sectors through the development and delivery of an

environmentally friendly and economically efficient additive

manufacturing, Industry 4.0 solution, while enabling

a one-production-step-conversion of

digital designs into functioning devices – on demand, anytime,

anywhere.The DragonFly IV® system and

specialized materials serve

cross-industry High-Performance-Electronic-Devices (Hi-PEDs®) fabrication

needs by simultaneously depositing proprietary conductive and

dielectric substances, while integrating in-situ capacitors,

antennas, coils, transformers, and electromechanical components.

The outcomes are Hi-PEDs® which are

critical enablers of autonomous intelligent drones, cars,

satellites, smartphones, and in vivo medical devices. In addition,

these products enable iterative development, IP safety, fast

time-to-market, and device performance gains. Nano

Dimension also develops complementary production equipment

for Hi-PEDs® and printed circuit board

(PCB) assembly (Puma, Fox, Tarantula,

Spider etc.). The core competitive edge for this

technology is in its adaptive, highly flexible surface-mount

technology (SMT) pick-and-place equipment, materials dispenser

suitable for both high-speed dispensing and micro-dispensing, as

well as an intelligent production material storage and logistics

system. Additionally, Nano Dimension is a leading developer

and supplier of high-performance control electronics, software, and

ink delivery system. It invents and delivers state-of-the-art

2D and 3D printing hardware and unique operating

software. It focuses on high-value, precision-oriented

applications such as specialized direct-to-container packaging,

printed electronics functional fluids, and 3D printing, which can

all be controlled by the proprietary software system

- Atlas.Serving similar users

of Hi-PEDs®, Nano

Dimension’s Fabrica 2.0 micro additive

manufacturing system enables the production of microparts based on

a Digital Light Processor (DLP) engine that achieves repeatable

micron levels resolution. The Fabrica 2.0 is engineered with a

patented array of sensors that allows a closed feedback loop, using

proprietary materials to achieve very high accuracy while remaining

a cost-effective mass manufacturing solution. It is used in the

areas of micron-level resolution of medical devices, micro-optics,

semiconductors, micro-electronics, micro-electro-mechanical systems

(MEMS), microfluidics, and life sciences instruments.

For more information, please visit www.nano-di.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995 and other

Federal securities laws. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates” and similar

expressions or variations of such words are intended to identify

forward-looking statements. Because such statements deal with

future events and are based on Nano Dimension’s current

expectations, they are subject to various risks and uncertainties,

and actual results, performance or achievements of Nano Dimension

could differ materially from those described in or implied by the

statements in this press release. For example, Nano Dimension is

using forward-looking statements when it discusses its expected

revenues for 2022, its vision for the future, including regarding

expected growth, profitability, acquisitions, opportunities and

contractions of multiples and expected valuations, potential return

on investment and the repurchase plan. The forward-looking

statements contained or implied in this press release are subject

to other risks and uncertainties, including those discussed under

the heading “Risk Factors” in Nano Dimension’s Annual Report on

Form 20-F filed with the Securities and Exchange Commission (“SEC”)

on March 31, 2022, and in any subsequent filings with the SEC.

Except as otherwise required by law, Nano Dimension undertakes no

obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events. References and links to websites have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release. Nano Dimension

is not responsible for the contents of third-party

websites.

NANO DIMENSION INVESTOR RELATIONS

CONTACT Yael Sandler, CFO

| ir@nano-di.com

Unaudited Consolidated Statements of

Financial Position as at

| |

|

March 31st, |

|

December 31st, |

|

|

|

|

2021 |

|

|

2022 |

|

|

2021(*) |

|

| (In thousands of USD) |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

1,099,057 |

|

|

|

788,141 |

|

|

|

853,626 |

|

|

Bank deposits |

|

|

296,844 |

|

|

|

459,824 |

|

|

|

437,598 |

|

|

Restricted deposits |

|

|

61 |

|

|

|

126 |

|

|

|

148 |

|

|

Trade receivables |

|

|

999 |

|

|

|

6,242 |

|

|

|

3,422 |

|

|

Other receivables |

|

|

972 |

|

|

|

7,307 |

|

|

|

5,902 |

|

|

Inventory |

|

|

3,164 |

|

|

|

15,063 |

|

|

|

11,199 |

|

| Total current

assets |

|

|

1,401,097 |

|

|

|

1,276,703 |

|

|

|

1,311,895 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Restricted deposits |

|

|

391 |

|

|

|

491 |

|

|

|

501 |

|

|

Bank deposits |

|

|

75,113 |

|

|

|

63,128 |

|

|

|

64,371 |

|

|

Deferred tax |

|

|

- |

|

|

|

1,005 |

|

|

|

1,007 |

|

|

Property plant and equipment, net |

|

|

5,422 |

|

|

|

9,844 |

|

|

|

7,690 |

|

|

Right of use asset |

|

|

4,103 |

|

|

|

15,142 |

|

|

|

4,491 |

|

|

Intangible assets |

|

|

4,243 |

|

|

|

21,358 |

|

|

|

- |

|

| Total non-current

assets |

|

|

89,272 |

|

|

|

110,968 |

|

|

|

78,060 |

|

| Total

assets |

|

|

1,490,369 |

|

|

|

1,387,671 |

|

|

|

1,389,955 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Trade payables |

|

|

1,654 |

|

|

|

3,785 |

|

|

|

2,833 |

|

|

Financial derivatives |

|

|

- |

|

|

|

19,977 |

|

|

|

14,910 |

|

|

Other payables |

|

|

5,449 |

|

|

|

19,304 |

|

|

|

13,836 |

|

|

Current portion of other long-term liability |

|

|

- |

|

|

|

416 |

|

|

|

417 |

|

| Total current

liabilities |

|

|

7,103 |

|

|

|

43,482 |

|

|

|

31,996 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Liability in respect of government grants |

|

|

754 |

|

|

|

1,639 |

|

|

|

1,560 |

|

|

Employee benefits |

|

|

- |

|

|

|

4,138 |

|

|

|

4,145 |

|

|

Liability in respect of warrants |

|

|

- |

|

|

|

1,760 |

|

|

|

3,347 |

|

|

Lease liability |

|

|

3,277 |

|

|

|

12,395 |

|

|

|

3,336 |

|

|

Deferred tax liabilities |

|

|

9,570 |

|

|

|

1,101 |

|

|

|

236 |

|

|

Other long-term liabilities |

|

|

- |

|

|

|

1,849 |

|

|

|

1,104 |

|

| Total non-current

liabilities |

|

|

13,601 |

|

|

|

22,882 |

|

|

|

13,728 |

|

| Total

liabilities |

|

|

20,704 |

|

|

|

66,364 |

|

|

|

45,724 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interests |

|

|

- |

|

|

|

787 |

|

|

|

875 |

|

|

Share capital |

|

|

375,594 |

|

|

|

386,723 |

|

|

|

386,665 |

|

|

Share premium and capital reserves |

|

|

1,211,920 |

|

|

|

1,276,443 |

|

|

|

1,266,027 |

|

|

Treasury shares |

|

|

(1,509 |

) |

|

|

(1,509 |

) |

|

|

(1,509 |

) |

|

Presentation currency translation reserve |

|

|

1,431 |

|

|

|

1,190 |

|

|

|

1,407 |

|

|

Accumulated loss |

|

|

(117,771 |

) |

|

|

(342,327 |

) |

|

|

(309,234 |

) |

|

Equity attributable to owners of the company |

|

|

- |

|

|

|

1,320,520 |

|

|

|

1,343,356 |

|

| Total

equity |

|

|

1,469,665 |

|

|

|

1,321,307 |

|

|

|

1,344,231 |

|

| Total liabilities and

equity |

|

|

1,490,369 |

|

|

|

1,387,671 |

|

|

|

1,389,955 |

|

(*) The December 31, 2021, balances were derived from the

Company’s audited annual financial statements.

Unaudited Consolidated Statements of

Profit or Loss and Other Comprehensive Income

(In thousands of USD, except per share

amounts)

|

|

|

For the Three-Month Period Ended March 31st, |

|

For the Year Ended December 31st, |

|

|

|

2021 |

|

|

2022 |

|

|

2021(*) |

|

|

|

|

|

|

|

|

|

Revenues |

|

|

811 |

|

|

|

10,430 |

|

|

|

10,493 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

352 |

|

|

|

6,580 |

|

|

|

5,730 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues -

amortization of assets recognized in business combination and

technology |

|

|

197 |

|

|

|

2,849 |

|

|

|

3,641 |

|

| |

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

549 |

|

|

|

9,429 |

|

|

|

9,371 |

|

| |

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

262 |

|

|

|

1,001 |

|

|

|

1,122 |

|

| |

|

|

|

|

|

|

|

|

|

| Research and development

expenses, net |

|

|

3,732 |

|

|

|

17,870 |

|

|

|

41,686 |

|

| |

|

|

|

|

|

|

|

|

|

| Sales and marketing

expenses |

|

|

2,713 |

|

|

|

9,308 |

|

|

|

22,713 |

|

| |

|

|

|

|

|

|

|

|

|

| General and administrative

expenses |

|

|

3,425 |

|

|

|

6,742 |

|

|

|

19,644 |

|

| |

|

|

|

|

|

|

|

|

|

| Impairment losses |

|

|

- |

|

|

|

- |

|

|

|

140,290 |

|

| |

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(9,608 |

) |

|

|

(32,919 |

) |

|

|

(223,211 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Finance income |

|

|

818 |

|

|

|

2,861 |

|

|

|

17,909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance expense |

|

|

(524 |

) |

|

|

(3,685 |

) |

|

|

(428 |

) |

| |

|

|

|

|

|

|

|

|

|

| Total comprehensive loss |

|

|

(9,314 |

) |

|

|

(33,743 |

) |

|

|

(205,730 |

) |

| |

|

|

|

|

|

|

|

|

|

| Tax income |

|

|

- |

|

|

|

455 |

|

|

|

4,906 |

|

| |

|

|

|

|

|

|

|

|

|

| Total comprehensive loss after

tax |

|

|

(9,314 |

) |

|

|

(33,288 |

) |

|

|

(200,824 |

) |

| |

|

|

|

|

|

|

|

|

|

| Total comprehensive loss

attributable to: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Non-controlling interests |

|

|

- |

|

|

|

(195 |

) |

|

|

(47 |

) |

| |

|

|

|

|

|

|

|

|

|

| Owners of the Company |

|

|

(9,314 |

) |

|

|

(33,093 |

) |

|

|

(200,777 |

) |

| |

|

|

|

|

|

|

|

|

|

| Basic loss per share |

|

|

(0.05 |

) |

|

|

0.13 |

) |

|

|

(0.81 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other comprehensive

income items that after initial recognition

in comprehensive income were or will be transferred to

profit or loss |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Foreign currency translation

differences for foreign operations |

|

|

- |

|

|

|

232 |

|

|

|

(46 |

) |

| |

|

|

|

|

|

|

|

|

|

| Total comprehensive

loss |

|

|

(9,314 |

) |

|

|

(33,520 |

) |

|

|

(200,870 |

) |

| Comprehensive loss

attributable to non-controlling interests |

|

|

- |

|

|

|

(210 |

) |

|

|

(69 |

) |

| Comprehensive loss

attributable to owners of the Company |

|

|

(9,314 |

) |

|

|

(33,310 |

) |

|

|

(200,801 |

) |

(*) The December 31st, 2021, balances were derived from the

Company’s audited annual financial statements.

Consolidated Statements of Changes in

Equity (Unaudited)(In thousands of USD)

|

|

|

Share capital |

|

Share premium and capital reserves |

|

|

Treasury shares |

|

|

Foreign currency translation reserve |

|

|

Accumulated loss |

|

|

Total |

|

|

Non-controlling interests |

|

|

Total equity |

|

For the three months ended March 31st,

2022: |

|

Thousands USD |

|

Thousands USD |

|

|

Thousands USD |

|

|

Thousands USD |

|

|

Thousands USD |

|

|

Thousands USD |

|

|

Thousands USD |

|

|

Thousands USD |

|

Balance as of January 1, 2022 |

|

386,665 |

|

1,266,027 |

|

|

(1,509 |

) |

|

1,407 |

|

|

(309,234 |

) |

|

1,343,356 |

|

|

875 |

|

|

1,344,231 |

|

| Investment of

non-controlling party in subsidiary |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

122 |

|

|

122 |

|

| Loss for the

period |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

(33, 093 |

) |

|

(33,093 |

) |

|

(195 |

) |

|

(33,288 |

) |

| Other comprehensive

loss for the period |

|

- |

|

- |

|

|

- |

|

|

(217 |

) |

|

- |

|

|

(217 |

) |

|

(15 |

) |

|

(232 |

) |

| Exercise of warrants

and options and conversion of convertible notes |

|

58 |

|

(58 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Share-based

payments |

|

- |

|

10,474 |

|

|

- |

|

|

- |

|

|

- |

|

|

10,474 |

|

|

- |

|

|

10,474 |

|

| Balance as of

March 31st, 2022 |

|

386,723 |

|

1,276,443 |

|

|

(1,509 |

) |

|

1,190 |

|

|

(342,327 |

) |

|

1,320,520 |

|

|

787 |

|

|

1,321,307 |

|

Consolidated Statements of Cash Flows

(Unaudited)(In thousands of USD)

|

|

|

For the Three-Month Period Ended March 31st, |

|

For the Year ended December 31st, |

|

|

|

|

2021 |

|

|

2022 |

|

|

2021 (*) |

|

| Cash flow from

operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(9,314 |

) |

|

|

(33,288 |

) |

|

|

(200,824 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

787 |

|

|

|

1,141 |

|

|

|

7,383 |

|

| Impairment losses |

|

|

- |

|

|

|

- |

|

|

|

140,290 |

|

| Financing expenses (income),

net |

|

|

(708 |

) |

|

|

2,194 |

|

|

|

(6,873 |

) |

| Revaluation of financial

liabilities accounted at fair value |

|

|

414 |

|

|

|

(1,370 |

) |

|

|

(10,608 |

) |

| Loss from disposal of property

plant and equipment and right-of-use assets |

|

|

2 |

|

|

|

(3 |

) |

|

|

567 |

|

| Increase in deferred tax |

|

|

- |

|

|

|

(461 |

) |

|

|

(5,013 |

) |

| Share-based payments |

|

|

3,435 |

|

|

|

10,123 |

|

|

|

29,782 |

|

| Salary expenses paid by

NCI |

|

|

- |

|

|

|

122 |

|

|

|

- |

|

| |

|

|

3,930 |

|

|

|

11,746 |

|

|

|

155,528 |

|

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Decrease (increase) in

inventory |

|

|

150 |

|

|

|

(468 |

) |

|

|

2,382 |

|

| Decrease (increase) in other

receivables |

|

|

154 |

|

|

|

(851 |

) |

|

|

(429 |

) |

| Decrease (increase) in trade

receivables |

|

|

(286 |

) |

|

|

(2,175 |

) |

|

|

(449 |

) |

| Increase (decrease) in other

payables |

|

|

(649 |

) |

|

|

1,724 |

|

|

|

1,139 |

|

| Increase in employee

benefits |

|

|

- |

|

|

|

1,148 |

|

|

|

- |

|

| Increase in trade

payables |

|

|

837 |

|

|

|

729 |

|

|

|

74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

206 |

|

|

|

107 |

|

|

|

2,717 |

|

| Net cash used in

operating activities |

|

|

(5,178 |

) |

|

|

(21,435 |

) |

|

|

(42,579 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cash flow from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Investment in bank deposits,

net |

|

|

(286,065 |

) |

|

|

(21,907 |

) |

|

|

(416,019 |

) |

| Interest received |

|

|

432 |

|

|

|

762 |

|

|

|

3,706 |

|

| Change in restricted bank

deposits |

|

|

16 |

|

|

|

20 |

|

|

|

(32 |

) |

| Acquisition of property plant

and equipment |

|

|

(599 |

) |

|

|

(1,975 |

) |

|

|

(9,761 |

) |

| Acquisition of subsidiary, net

of cash acquired |

|

|

- |

|

|

|

(18,124 |

) |

|

|

(74,574 |

) |

| Net cash used in

investing activities |

|

|

(286,216 |

) |

|

|

(41,224 |

) |

|

|

(496,680 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Cash flow from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of

Ordinary Shares, warrants and convertible notes, net |

|

|

805,497 |

|

|

|

- |

|

|

|

805,497 |

|

| Exercise of warrants and

options |

|

|

100 |

|

|

|

- |

|

|

|

212 |

|

| Lease payments |

|

|

(304 |

) |

|

|

(796 |

) |

|

|

(1,494 |

) |

| Proceeds from non-controlling

interests |

|

|

- |

|

|

|

- |

|

|

|

944 |

|

| Long-term bank debt |

|

|

- |

|

|

|

(80 |

) |

|

|

(814 |

) |

| Amounts recognized in respect

of government grants liability, net |

|

|

(72 |

) |

|

|

(45 |

) |

|

|

(96 |

) |

| Interest and other fees

paid |

|

|

(9 |

) |

|

|

(28 |

) |

|

|

(70 |

) |

| Net cash provided by

financing activities |

|

|

805,212 |

|

|

|

(949 |

) |

|

|

804,179 |

|

| Increase in

cash |

|

|

513,818 |

|

|

|

(63,608 |

) |

|

|

264,920 |

|

| Cash at beginning of

the period |

|

|

585,338 |

|

|

|

853,626 |

|

|

|

585,338 |

|

| Effect of exchange

rate fluctuations on cash |

|

|

(99 |

) |

|

|

(1,877 |

) |

|

|

3,368 |

|

| Cash at end of the

period |

|

|

1,099,057 |

|

|

|

788,141 |

|

|

|

853,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-cash

transactions: |

|

|

|

|

|

|

|

|

|

|

|

| Property plant and equipment

acquired on credit |

|

|

41 |

|

|

|

211 |

|

|

|

249 |

|

| Conversion of convertible

notes and warrants to equity |

|

|

2,830 |

|

|

|

- |

|

|

|

2,830 |

|

| Acquisition of a right-of-use

asset |

|

|

1,217 |

|

|

|

11,237 |

|

|

|

1,919 |

|

(*) The December 31st, 2021, balances were derived from the

Company’s audited annual financial statements.

Non-IFRS measures

The following is a reconciliation of EBITDA and

adjusted EBITDA to net loss, as calculated in accordance with

International Financial Reporting Standards (“IFRS”):

|

|

|

|

|

|

| |

|

|

For the Three-Month PeriodEndedMarch 31st, |

|

| |

|

|

2022 |

|

| |

|

|

(In thousands of USD) |

|

| Operating loss |

|

|

(32,919 |

) |

| Depreciation and amortization

(*) |

|

|

3,605 |

|

| EBITDA |

|

|

(29,314 |

) |

| Share-based payments |

|

|

10,123 |

|

| Adjusted EBITDA |

|

|

(19,191 |

) |

(*) Including amortization of assets recognized in business

combination and technology

EBITDA is a non-IFRS measure and is defined as

operating loss excluding depreciation and amortization expenses and

amortization of assets recognized in business combination. We

believe that EBITDA, as described above, should be considered in

evaluating the Company’s operations. EBITDA facilitates operating

performance comparisons from period to period and company to

company by backing out potential differences caused by variations

in capital structures, and the age and depreciation charges and

amortization of fixed and intangible assets, respectively

(affecting relative depreciation and amortization expense,

respectively) and EBITDA is useful to an investor in evaluating our

operating performance because it is widely used by investors,

securities analysts and other interested parties to measure a

company’s operating performance without regard to the items

mentioned above.

Adjusted EBITDA is a non-IFRS measure and is

defined as operating loss excluding depreciation and amortization

expenses and amortization of assets recognized in business

combination and share based payments. We believe that Adjusted

EBITDA, as described above, should also be considered in evaluating

the Company’s operations. Like EBITDA, Adjusted EBITDA facilitates

operating performance comparisons from period to period and company

to company by backing out potential differences caused by

variations in capital structures, and the age and depreciation

charges and amortization of fixed and intangible assets,

respectively (affecting relative depreciation and amortization

expense, respectively), as well as from share-based payment

expenses. Adjusted EBITDA is useful to an investor in evaluating

our operating performance because it is widely used by investors,

securities analysts and other interested parties to measure a

company’s operating performance without regard to non-cash items,

such as expenses related to share-based payments.

EBITDA and Adjusted EBITDA do not represent cash

generated by operating activities in accordance with IFRS and

should not be considered alternatives to net income (loss) as

indicators of our operating performance or as measures of our

liquidity. These measures should be considered in conjunction with

net income (loss) as presented in our consolidated statements of

profit or loss and other comprehensive income. Other companies may

calculate EBITDA and Adjusted EBITDA differently than we do.

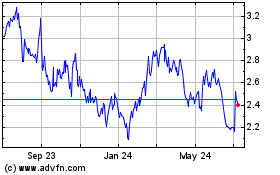

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Aug 2024 to Sep 2024

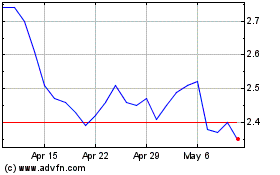

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Sep 2023 to Sep 2024