MYR Group Inc. (“MYR”) (NASDAQ: MYRG), a holding

company of leading specialty contractors serving the electric

utility infrastructure, commercial and industrial construction

markets in the United States and western Canada, today announced

its fourth-quarter and full-year 2018 financial results.

Highlights for Fourth Quarter 2018

- Record fourth quarter revenues of $446.3 million

- Fourth quarter net income attributable to MYR Group Inc. of

$10.7 million, or $0.64 per diluted share attributable to MYR Group

Inc.

- Record backlog of $1.147 billion

Management Comments Rick Swartz, MYR's

President and CEO said, “After completing the year with a strong

fourth quarter, our full year 2018 revenues of $1.53 billion set

another record high for the fourth consecutive year, and we

achieved increases in gross profit, earnings per share, net income

and EBITDA, as compared to our full year of 2017. Along with

execution of our organic and acquisition growth strategies, we

experienced an increase in overall project activity and significant

bidding opportunities in both our Transmission & Distribution

and Commercial & Industrial segments. Total backlog for 2018

increased to $1.147 billion, a 68.8 percent increase over 2017,

demonstrating that our business model continues to be a sound

platform for sustainable growth. We expect active bidding to

continue throughout 2019 and beyond, and believe we are

well-positioned to capitalize on opportunities and deliver

long-term value for all of our stakeholders.”

Fourth-Quarter Results MYR reported

fourth-quarter 2018 revenues of $446.3 million, an increase of

$72.8 million, or 19.5 percent, compared to the fourth quarter of

2017. Specifically, our Transmission and Distribution (“T&D”)

segment reported revenues of $257.2 million, an increase of $29.4

million, or 12.9 percent, from the fourth quarter of 2017,

primarily due to an increase in revenue from large transmission

projects and the number of T&D projects worked. Our Commercial

and Industrial (“C&I”) segment reported fourth-quarter 2018

revenues of $189.1 million, an increase of $43.5 million, or 29.8

percent, from the fourth quarter of 2017, primarily due to the

acquisition of the Huen Companies, increased spending from new and

existing customers and increased volume at certain organic

expansion locations.

Consolidated gross profit increased to $47.4 million in the

fourth quarter of 2018, compared to $36.9 million in the fourth

quarter of 2017. Gross margin increased to 10.6 percent for the

fourth quarter of 2018 from 9.9 percent for the fourth quarter of

2017. The increase in gross margin was primarily due to

improvements in efficiency and organic expansion results, along

with fourth quarter of 2017 results being negatively impacted by

low margins on a large transmission project. The increase in gross

margin was partly due to $1.6 million in estimate changes on

certain contracts associated with the acquisition of the Huen

Companies. These changes in estimates are subject to margin

guarantees and represent potential contingent consideration for

which an offset is recognized in other expense. Changes in

estimates of gross profit on certain projects, excluding estimate

changes on our recent acquisition noted above, resulted in gross

margin decreases of 1.7 percent and 1.9 percent for the fourth

quarters of 2018 and 2017, respectively.

Selling, general and administrative expenses (“SG&A”)

increased to $30.1 million in the fourth quarter of 2018, compared

to $24.0 million in the fourth quarter of 2017. The

period-over-period increase was primarily due to SG&A expenses

related to the acquired Huen Companies, higher employee-related

expenses to support operations and higher bonus costs. As a

percentage of revenues, SG&A increased to 6.7 percent for the

fourth quarter of 2018 from 6.4 percent for the fourth quarter of

2017.

The income tax provision was $3.8 million for the fourth quarter

of 2018, with an effective tax rate of 26.1 percent, compared to an

income tax benefit of $2.9 million in fourth quarter of 2017, which

represented 26.7 percent of pretax income. The difference between

the effective tax rate for the fourth quarter of 2018 and the tax

benefit as a percentage of pretax income for fourth quarter of 2017

was primarily due to the revaluation of our net deferred tax

liabilities in the fourth quarter of 2017 to reflect the impact of

the change from 35% to 21% in the federal corporate tax rate as a

result of the enactment of the United States Tax Cuts and Jobs Act

(“Tax Act”).

For the fourth quarter of 2018, net income attributable to MYR

Group Inc. was $10.7 million, or $0.64 per diluted share

attributable to MYR Group Inc., compared to $13.6 million, or

$0.82, for the same period of 2017. Fourth quarter 2018 EBITDA, a

non-GAAP financial measure, was $26.6 million, or 6.0 percent of

revenues, compared to $20.6 million, or 5.5 percent of revenues, in

the fourth-quarter of 2017.

Full YearMYR reported record revenues of $1.531

billion for the full year of 2018, an increase of $127.9 million,

or 9.1 percent, compared to $1.403 billion for the full year of

2017. Specifically, the T&D segment reported revenues of $893.1

million, an increase of $13.7 million, or 1.6 percent, from the

full year of 2017, primarily due to an increase in distribution

revenues partially offset by lower revenue from large transmission

projects. The C&I segment reported full year of 2018 revenues

of $638.1 million, an increase of $114.2 million, or 21.8 percent,

from the full year of 2017, primarily due the acquisition of the

Huen Companies, increased spending from new and existing customers

and increased volume at certain organic expansion locations.

Consolidated gross profit was $167.1 million in the full year of

2018, compared to $125.0 million in the full year of 2017. The

increase in gross profit was due to increased margins and higher

revenues. Gross margin increased to 10.9 percent for the full year

of 2018 from 8.9 percent for the full year of 2017. The increase in

gross margin was primarily due to improvements in efficiency, fleet

utilization and organic expansion results. Our prior year gross

margin was significantly impacted by write-downs on three projects.

Gross margin also benefited from $3.9 million in estimate changes

on certain contracts associated with the acquisition of the Huen

Companies. These changes of estimates are subject to margin

guarantees and represent potential contingent consideration for

which an offset is recognized in other expense. These margin

improvements were partially offset by changes in estimates of gross

margin on certain projects. Excluding estimate changes on our

recent acquisition noted above, these changes in estimates of gross

margin on certain projects, including those discussed above,

resulted in gross margin decreases of 0.7 percent and 0.7 percent

for the full years of 2018 and 2017, respectively.

SG&A increased to $118.7 million for the full year of 2018,

from $98.6 million for the full year of 2017. The year-over-year

increase was primarily due to higher bonus and profit sharing

costs, SG&A related to the acquired Huen Companies and higher

employee-related expenses to support operations. As a percentage of

revenues, SG&A increased to 7.8 percent for the full year of

2018 from 7.0 percent for the full year of 2017.

The income tax provision was $11.8 million for the full year of

2018 with an effective tax rate of 27.3 percent, compared to a

provision of $3.5 million for the full year of 2017 with an

effective tax rate of 14.1 percent. The effective tax rate for 2017

was lower than 2018 largely because we revalued our net deferred

tax liability as of December 31, 2017, in conjunction with the

enactment of the Tax Act. Our inability to utilize losses

experienced in certain Canadian operations negatively impacted the

effective tax rate in 2018 and 2017, partially offset by excess tax

benefits pertaining to the vesting of stock awards and the exercise

of stock options.

For the full year of 2018, net income attributable to MYR Group

Inc. was $31.1 million, or $1.87 per diluted share attributable to

MYR Group Inc., compared to $21.2 million, or $1.28, for the same

period of 2017. Full-year 2018 EBITDA, a non-GAAP financial

measure, was $86.6 million, or 5.7 percent of revenues, compared to

$65.8 million, or 4.7 percent of revenues, for the full year of

2017.

Backlog As of December 31, 2018, MYR's backlog

was $1.147 billion, which consisted of $495.0 million in the

T&D segment and $651.7 million in the C&I segment, and was

$49.1 million, or 4.5 percent, higher than September 30, 2018.

T&D backlog increased $21.1 million, or 4.5 percent, from

September 30, 2018, while C&I backlog increased $28.0 million,

or 4.5 percent, over the same period. Total backlog at December 31,

2018 increased $467.5 million, or 68.8 percent, from the same

period last year. Our backlog as of December 31, 2018 included

$33.7 million, our proportionate share, of unconsolidated joint

venture backlog.

Balance Sheet As of December 31, 2018, MYR had

$170.5 million of borrowing availability under its credit

facility.

Non-GAAP Financial Measures To supplement MYR’s

financial statements presented in accordance with generally

accepted accounting principles in the United States (“GAAP”), MYR

uses certain non-GAAP measures. Reconciliation to the nearest GAAP

measures of all non-GAAP measures included in this press release

can be found at the end of this release. MYR’s definitions of these

non-GAAP measures may differ from similarly titled measures used by

others. These non-GAAP measures should be considered supplemental

to, and not a substitute for, financial information prepared in

accordance with GAAP.MYR believes that these non-GAAP measures are

useful because they (i) provide both management and investors

meaningful supplemental information regarding financial performance

by excluding certain expenses and benefits that may not be

indicative of recurring core business operating results, (ii)

permit investors to view MYR’s performance using the same tools

that management uses to evaluate MYR’s past performance, reportable

business segments and prospects for future performance, (iii)

publicly disclose results that are relevant to financial covenants

included in MYR’s credit facility and (iv) otherwise provide

supplemental information that may be useful to investors in

evaluating MYR.

Conference Call MYR will host a conference call

to discuss its fourth-quarter 2018 results on Thursday, March 7,

2019, at 9:00 a.m. Central time. To participate in the conference

call via telephone, please dial (877) 561-2750 (domestic) or (763)

416-8565 (international) at least five minutes prior to the start

of the event. A replay of the conference call will be available

through Thursday, March 14, 2019, at 11:59 p.m. Eastern time, by

dialing (855) 859-2056 or (404) 537-3406, and entering conference

ID 7488347. MYR will also broadcast the conference call live via

the internet. Interested parties may access the webcast through the

Investor Relations section of MYR's website at www.myrgroup.com.

Please access the website at least 15 minutes prior to the start of

the call to register, download and install any necessary audio

software. The webcast will be available until Thursday, March 7,

2019, at 11:59 P.M. Eastern time.

About MYRMYR is a holding company of leading

specialty contractors serving the electric utility infrastructure,

commercial and industrial construction markets throughout the

United States and western Canada who have the experience and

expertise to complete electrical installations of any type and

size. Their comprehensive services on electric transmission and

distribution networks and substation facilities include design,

engineering, procurement, construction, upgrade, maintenance and

repair services. Transmission and distribution customers include

investor-owned utilities, cooperatives, private developers,

government-funded utilities, independent power producers,

independent transmission companies, industrial facility owners and

other contractors. Commercial and industrial electrical contracting

services are provided to general contractors, commercial and

industrial facility owners, local governments and developers

throughout the United States and western Canada. For more

information, visit myrgroup.com. Forward-Looking

Statements Various statements in this announcement,

including those that express a belief, expectation, or intention,

as well as those that are not statements of historical fact, are

forward-looking statements. The forward-looking statements may

include projections and estimates concerning the timing and success

of specific projects and our future production, revenue, income,

capital spending, segment improvements and investments.

Forward-looking statements are generally accompanied by words such

as “anticipate,” “believe,” “encouraged,” “estimate,” “expect,”

“intend,” “likely,” “may,” “objective,” “outlook,” “plan,”

“possible,” “potential,” “project,” “remain confident,” “should,”

“unlikely,” or other words that convey the uncertainty of future

events or outcomes. The forward-looking statements in this

announcement speak only as of the date of this announcement; we

disclaim any obligation to update these statements (unless required

by securities laws), and we caution you not to rely on them unduly.

We have based these forward-looking statements on our current

expectations and assumptions about future events. While our

management considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies

and uncertainties, most of which are difficult to predict and many

of which are beyond our control. No forward-looking statement can

be guaranteed and actual results may differ materially from those

projected. Forward-looking statements in this announcement should

be evaluated together with the many uncertainties that affect MYR's

business, particularly those mentioned in the risk factors and

cautionary statements in Item 1A of MYR's Annual Report on Form

10-K for the fiscal year ended December 31, 2018, and in any risk

factors or cautionary statements contained in MYR's subsequent

Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

MYR Group Inc. Contact:Betty R. Johnson, Chief

Financial Officer, 847-290-1891, investorinfo@myrgroup.com

Investor Contact: Steve Carr, Dresner Corporate

Services, 312-780-7211, scarr@dresnerco.com

Financial tables follow…

MYR GROUP

INC.Consolidated Balance SheetsAs

of December 31, 2018 and 2017

|

|

|

|

|

| |

December

31, |

|

(in thousands, except share and per

share data) |

|

2018 |

|

|

|

2017 |

|

|

ASSETS |

|

|

|

| Current

assets |

|

|

|

| Cash and

cash equivalents |

$ |

7,507 |

|

|

$ |

5,343 |

|

| Accounts

receivable, net of allowances of $1,331 and $605, respectively |

|

288,427 |

|

|

|

240,276 |

|

| Contract

assets |

|

160,281 |

|

|

|

120,992 |

|

| Current

portion of receivable for insurance claims in excess of

deductibles |

|

10,572 |

|

|

|

4,221 |

|

| Refundable

income taxes |

|

— |

|

|

|

391 |

|

| Other

current assets |

|

8,847 |

|

|

|

8,513 |

|

| Total

current assets |

|

475,634 |

|

|

|

379,736 |

|

| Property and

equipment, net of accumulated depreciation of $253,495 and

$231,391, respectively |

|

161,892 |

|

|

|

148,084 |

|

|

Goodwill |

|

56,588 |

|

|

|

46,994 |

|

| Intangible

assets, net of accumulated amortization of $7,031 and $5,183,

respectively |

|

33,266 |

|

|

|

10,852 |

|

| Receivable

for insurance claims in excess of deductibles |

|

17,173 |

|

|

|

14,295 |

|

|

Investment in joint venture |

|

1,324 |

|

|

|

168 |

|

| Other

assets |

|

2,878 |

|

|

|

3,659 |

|

| Total

assets |

$ |

748,755 |

|

|

$ |

603,788 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities |

|

|

|

| Current

portion of long-term debt |

$ |

3,681 |

|

|

$ |

— |

|

| Current

portion of capital lease obligations |

|

1,119 |

|

|

|

1,086 |

|

| Accounts

payable |

|

139,480 |

|

|

|

110,383 |

|

| Contract

liabilities |

|

58,534 |

|

|

|

30,224 |

|

| Current

portion of accrued self-insurance |

|

19,633 |

|

|

|

13,138 |

|

| Other

current liabilities |

|

61,358 |

|

|

|

33,733 |

|

| Total

current liabilities |

|

283,805 |

|

|

|

188,564 |

|

| Deferred

income tax liabilities |

|

17,398 |

|

|

|

13,452 |

|

| Long-term

debt |

|

86,111 |

|

|

|

78,960 |

|

| Accrued

self-insurance |

|

34,406 |

|

|

|

32,225 |

|

| Capital

lease obligations, net of current maturities |

|

1,514 |

|

|

|

2,629 |

|

| Other

liabilities |

|

1,057 |

|

|

|

919 |

|

| Total

liabilities |

|

424,291 |

|

|

|

316,749 |

|

| Commitments

and contingencies |

|

|

|

|

Stockholders’ equity |

|

|

|

| Preferred

stock—$0.01 par value per share; 4,000,000 authorized shares; |

|

|

|

| none

issued and outstanding at December 31, 2018 and December 31,

2017 |

|

— |

|

|

|

— |

|

| Common

stock—$0.01 par value per share; 100,000,000 authorized

shares; |

|

|

|

|

16,564,961 and 16,464,757 shares issued and outstanding at December

31, 2018 and December 31, 2017, respectively |

|

165 |

|

|

|

163 |

|

|

Additional paid-in capital |

|

148,276 |

|

|

|

143,934 |

|

|

Accumulated other comprehensive income (loss) |

|

(193 |

) |

|

|

(299 |

) |

| Retained

earnings |

|

174,736 |

|

|

|

143,241 |

|

| Total

stockholders’ equity attributable to MYR Group Inc. |

|

322,984 |

|

|

|

287,039 |

|

|

Noncontrolling interest |

|

1,480 |

|

|

|

— |

|

| Total

stockholders’ equity |

|

324,464 |

|

|

|

287,039 |

|

| |

$ |

748,755 |

|

|

$ |

603,788 |

|

| |

|

|

|

MYR GROUP

INC.Consolidated Statements of

OperationsThree Months and Twelve Months Ended

December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

For the year ended |

| |

December 31, |

|

December 31, |

|

(in thousands, except per share data) |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contract

revenues |

$ |

446,345 |

|

|

$ |

373,501 |

|

|

$ |

1,531,169 |

|

|

$ |

1,403,317 |

|

| Contract

costs |

|

398,954 |

|

|

|

336,607 |

|

|

|

1,364,109 |

|

|

|

1,278,313 |

|

| Gross

profit |

|

47,391 |

|

|

|

36,894 |

|

|

|

167,060 |

|

|

|

125,004 |

|

| Selling,

general and administrative expenses |

|

30,079 |

|

|

|

23,994 |

|

|

|

118,737 |

|

|

|

98,611 |

|

| Amortization

of intangible assets |

|

864 |

|

|

|

(94 |

) |

|

|

1,843 |

|

|

|

499 |

|

| Gain on sale

of property and equipment |

|

(963 |

) |

|

|

(1,062 |

) |

|

|

(3,832 |

) |

|

|

(3,664 |

) |

| Income from

operations |

|

17,411 |

|

|

|

14,056 |

|

|

|

50,312 |

|

|

|

29,558 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

| Interest

income |

|

11 |

|

|

|

— |

|

|

|

24 |

|

|

|

4 |

|

| Interest

expense |

|

(1,134 |

) |

|

|

(810 |

) |

|

|

(3,652 |

) |

|

|

(2,603 |

) |

| Other

income, net |

|

(1,596 |

) |

|

|

(2,531 |

) |

|

|

(3,616 |

) |

|

|

(2,319 |

) |

| Income

before provision for income taxes |

|

14,692 |

|

|

|

10,715 |

|

|

|

43,068 |

|

|

|

24,640 |

|

| Income tax

expense (benefit) |

|

3,834 |

|

|

|

(2,864 |

) |

|

|

11,774 |

|

|

|

3,486 |

|

| Net

income |

|

10,858 |

|

|

|

13,579 |

|

|

|

31,294 |

|

|

|

21,154 |

|

| Less: net

income - noncontrolling interests |

|

207 |

|

|

|

— |

|

|

|

207 |

|

|

|

— |

|

| Net income

attributable to MYR Group Inc. |

$ |

10,651 |

|

|

$ |

13,579 |

|

|

$ |

31,087 |

|

|

$ |

21,154 |

|

| Income per

common share attributable to MYR Group Inc.: |

|

|

|

|

|

|

|

|

—Basic |

$ |

0.65 |

|

|

$ |

0.83 |

|

|

$ |

1.89 |

|

|

$ |

1.30 |

|

|

—Diluted |

$ |

0.64 |

|

|

$ |

0.82 |

|

|

$ |

1.87 |

|

|

$ |

1.28 |

|

| Weighted

average number of common shares and potential common shares

outstanding: |

|

|

|

|

|

|

|

|

—Basic |

|

16,496 |

|

|

|

16,301 |

|

|

|

16,441 |

|

|

|

16,273 |

|

|

—Diluted |

|

16,631 |

|

|

|

16,530 |

|

|

|

16,585 |

|

|

|

16,496 |

|

| |

|

|

|

|

|

|

|

MYR GROUP

INC.Consolidated Statements of Cash

FlowsTwelve Months Ended December 31, 2018 and

2017

|

|

For the year ended December 31, |

| (in thousands

of dollars) |

|

2018 |

|

|

|

2017 |

|

| |

|

|

|

|

Cash flows from operating activities: |

|

|

|

| Net

income |

$ |

31,294 |

|

|

$ |

21,154 |

|

| Adjustments to

reconcile net income to net cash flows provided by (used in)

operating activities — |

|

| Depreciation

and amortization of property and equipment |

|

38,070 |

|

|

|

38,077 |

|

| Amortization

of intangible assets |

|

1,843 |

|

|

|

499 |

|

| Stock-based

compensation expense |

|

3,165 |

|

|

|

4,376 |

|

| Deferred

income taxes |

|

3,649 |

|

|

|

(5,091 |

) |

| Gain on sale

of property and equipment |

|

(3,832 |

) |

|

|

(3,664 |

) |

| Other

non-cash items |

|

237 |

|

|

|

1,194 |

|

| Changes in

operating assets and liabilities, net of acquisitions |

|

|

|

| Accounts

receivable, net |

|

(15,871 |

) |

|

|

(35,944 |

) |

| Contract

assets |

|

(28,141 |

) |

|

|

(17,857 |

) |

| Receivable

for insurance claims in excess of deductibles |

|

(9,229 |

) |

|

|

(39 |

) |

| Other

assets |

|

2,280 |

|

|

|

(2,213 |

) |

| Accounts

payable |

|

19,953 |

|

|

|

8,149 |

|

| Contract

liabilities |

|

22,551 |

|

|

|

(14,317 |

) |

| Accrued

self-insurance |

|

8,701 |

|

|

|

2,765 |

|

| Other

liabilities |

|

10,119 |

|

|

|

(6,287 |

) |

| Net

cash flows provided by (used in) operating activities |

|

84,789 |

|

|

|

(9,198 |

) |

|

Cash flows from investing activities: |

|

|

|

| Proceeds

from sale of property and equipment |

|

4,583 |

|

|

|

4,342 |

|

| Cash paid

for acquisitions, net of cash acquired |

|

(47,082 |

) |

|

|

— |

|

| Purchases of

property and equipment |

|

(50,704 |

) |

|

|

(30,843 |

) |

| Net cash

flows used in investing activities |

|

(93,203 |

) |

|

|

(26,501 |

) |

|

Cash flows from financing activities: |

|

|

|

| Net

borrowings under revolving lines of credit |

|

(20,655 |

) |

|

|

19,890 |

|

| Payment of

principal obligations under capital leases |

|

(1,081 |

) |

|

|

(1,203 |

) |

| Borrowings

under equipment notes |

|

31,486 |

|

|

|

— |

|

| Proceeds

from exercise of stock options |

|

1,897 |

|

|

|

1,232 |

|

| Repurchase

of common shares |

|

(1,043 |

) |

|

|

(3,058 |

) |

| Other

financing activities |

|

38 |

|

|

|

28 |

|

| Net cash

flows provided by financing activities |

|

10,642 |

|

|

|

16,889 |

|

| Effect of

exchange rate changes on cash |

|

(64 |

) |

|

|

307 |

|

| Net

increase in cash and cash equivalents |

|

2,164 |

|

|

|

(18,503 |

) |

|

Cash and cash equivalents: |

|

|

|

|

Beginning of period |

|

5,343 |

|

|

|

23,846 |

|

| End of

period |

$ |

7,507 |

|

|

$ |

5,343 |

|

|

|

|

|

|

MYR GROUP INC.Unaudited

Consolidated Selected Data, Net Income Per Share,

Unaudited Performance Measures and Reconciliation of

Non-GAAP MeasuresThree Months and Twelve Months

Ended December 31, 2018 and 2017

| |

Three months ended |

|

Twelve months ended |

| |

December

31, |

|

December

31, |

|

(in thousands, except per share data and

percentages) |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

|

|

|

|

|

|

|

| Summary

Statement of Operations Data: |

|

|

|

|

|

|

|

| Contract

revenues |

$ |

446,345 |

|

|

$ |

373,501 |

|

|

$ |

1,531,169 |

|

|

$ |

1,403,317 |

|

| Gross

profit |

$ |

47,391 |

|

|

$ |

36,894 |

|

|

$ |

167,060 |

|

|

$ |

125,004 |

|

| Income from

operations |

$ |

17,411 |

|

|

$ |

14,056 |

|

|

$ |

50,312 |

|

|

$ |

29,558 |

|

| Income before provision

for income taxes |

$ |

14,692 |

|

|

$ |

10,715 |

|

|

$ |

43,068 |

|

|

$ |

24,640 |

|

| Income

tax expense (benefit) |

$ |

3,834 |

|

|

$ |

(2,864 |

) |

|

$ |

11,774 |

|

|

$ |

3,486 |

|

| Net income attributable

to MYR Group Inc. |

$ |

10,651 |

|

|

$ |

13,579 |

|

|

$ |

31,087 |

|

|

$ |

21,154 |

|

| Effective tax

rate |

|

26.1 |

% |

|

|

-26.7 |

% |

|

|

27.3 |

% |

|

|

14.1 |

% |

| |

|

|

|

|

|

|

|

| Per Share

Data: |

|

|

|

|

|

|

|

|

Income per common share attributable to MYR Group

Inc.: |

|

|

|

|

|

|

|

|

- Basic |

$ |

0.65 |

|

|

$ |

0.83 |

|

|

$ |

1.89 |

|

|

$ |

1.30 |

|

|

- Diluted |

$ |

0.64 |

|

|

$ |

0.82 |

|

|

$ |

1.87 |

|

|

$ |

1.28 |

|

| Weighted

average number of common

shares |

|

|

|

|

|

|

|

|

and potential common shares

outstanding : |

|

|

|

|

|

|

|

|

- Basic |

|

16,496 |

|

|

|

16,301 |

|

|

|

16,441 |

|

|

|

16,273 |

|

|

- Diluted |

|

16,631 |

|

|

|

16,530 |

|

|

|

16,585 |

|

|

|

16,496 |

|

| |

|

|

|

|

|

|

|

| |

December

31, |

|

December

31, |

|

December

31, |

|

December

31, |

| (in

thousands) |

|

2018 |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

|

|

|

| Summary Balance

Sheet Data: |

|

|

|

|

|

|

|

| Total

assets |

$ |

748,755 |

|

|

$ |

603,788 |

|

|

$ |

573,495 |

|

|

$ |

524,925 |

|

| Total stockholders’

equity attributable to MYR Group Inc. |

$ |

322,984 |

|

|

$ |

287,039 |

|

|

$ |

263,174 |

|

|

$ |

329,880 |

|

| Goodwill and intangible

assets |

$ |

89,854 |

|

|

$ |

57,846 |

|

|

$ |

58,347 |

|

|

$ |

58,486 |

|

| Total

funded debt (1) |

$ |

89,792 |

|

|

$ |

78,960 |

|

|

$ |

59,070 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

Twelve months ended |

| |

|

|

|

|

December

31, |

| |

|

|

|

|

|

2018 |

|

|

|

2017 |

|

|

Financial Performance Measures

(2): |

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP

measures: |

|

|

|

|

|

|

|

| Net income attributable

to MYR Group Inc. |

|

|

|

|

$ |

31,087 |

|

|

$ |

21,154 |

|

| Interest

expense, net |

|

|

|

|

|

3,628 |

|

|

|

2,599 |

|

| Tax impact of

interest |

|

|

|

|

|

(990 |

) |

|

|

(366 |

) |

|

EBIT, net of taxes (3) |

|

|

|

|

$ |

33,725 |

|

|

$ |

23,387 |

|

See notes at the end of this earnings

release.

MYR GROUP INC.Unaudited

Performance Measures and Reconciliation of Non-GAAP

MeasuresThree Months and Twelve Months Ended

December 31, 2018 and 2017

| |

|

|

|

|

|

|

Three months ended |

|

Twelve months ended |

|

| |

|

|

|

|

|

|

December

31, |

|

December

31, |

|

|

(in thousands, except per share

data, ratios and percentages) |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Performance

Measures (2): |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA

(4) |

|

$ |

26,598 |

|

|

$ |

20,602 |

|

|

$ |

86,609 |

|

|

$ |

65,815 |

|

|

| EBITDA per Diluted Share

(5) |

|

$ |

1.60 |

|

|

$ |

1.25 |

|

|

$ |

5.22 |

|

|

$ |

3.99 |

|

|

| Free Cash Flow

(6) |

|

$ |

15,139 |

|

|

$ |

6,658 |

|

|

$ |

34,085 |

|

|

$ |

(40,041 |

) |

|

| Book Value per Period End Share

(7) |

|

|

|

|

|

$ |

19.33 |

|

|

$ |

17.20 |

|

|

| Tangible Book Value

(8) |

|

|

|

|

|

$ |

233,130 |

|

|

$ |

229,193 |

|

|

| Tangible Book Value per Period

End Share (9) |

|

|

|

|

$ |

13.95 |

|

|

$ |

13.73 |

|

|

| Funded debt to Equity

Ratio

(10) |

|

|

|

|

|

|

0.3 |

|

|

|

0.3 |

|

|

| Asset Turnover

(11) |

|

|

|

|

|

|

2.54 |

|

|

|

2.45 |

|

|

| Return on Assets

(12) |

|

|

|

|

|

|

5.1 |

% |

|

|

3.7 |

% |

|

| Return on

Equity

(13) |

|

|

|

|

|

|

10.8 |

% |

|

|

8.0 |

% |

|

| Return on Invested Capital

(16) |

|

|

|

|

|

|

9.4 |

% |

|

|

7.8 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of

Non-GAAP measures: |

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net income

attributable to MYR Group Inc. to

EBITDA: |

|

|

|

|

|

|

|

| Net

income attributable to MYR Group Inc. |

$ |

10,651 |

|

|

$ |

13,579 |

|

|

$ |

31,087 |

|

|

$ |

21,154 |

|

|

| |

Net

income - noncontrolling interests |

|

|

207 |

|

|

|

— |

|

|

|

207 |

|

|

|

— |

|

|

| Net

income |

|

|

10,858 |

|

|

|

13,579 |

|

|

|

31,294 |

|

|

|

21,154 |

|

|

| |

Interest expense, net |

|

|

1,123 |

|

|

|

810 |

|

|

|

3,628 |

|

|

|

2,599 |

|

|

| |

Income tax expense (benefit) |

|

|

3,834 |

|

|

|

(2,864 |

) |

|

|

11,774 |

|

|

|

3,486 |

|

|

| |

Depreciation and amortization |

|

|

10,783 |

|

|

|

9,077 |

|

|

|

39,913 |

|

|

|

38,576 |

|

|

| EBITDA

(4) |

|

$ |

26,598 |

|

|

$ |

20,602 |

|

|

$ |

86,609 |

|

|

$ |

65,815 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income

attributable to MYR Group Inc. per Diluted

Share |

|

|

|

|

|

| |

|

to EBITDA per Diluted

Share: |

|

|

|

|

|

|

|

|

|

| Net

income attributable to MYR Group Inc. per share |

$ |

0.64 |

|

|

$ |

0.82 |

|

|

$ |

1.87 |

|

|

$ |

1.28 |

|

|

| |

Net

income - noncontrolling interests per share |

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

| Net

income per share |

|

|

0.65 |

|

|

|

0.82 |

|

|

|

1.88 |

|

|

|

1.28 |

|

|

| |

Interest expense, net, per share |

|

|

0.07 |

|

|

|

0.05 |

|

|

|

0.22 |

|

|

|

0.16 |

|

|

| |

Income tax expense (benefit) per share |

|

0.23 |

|

|

|

(0.17 |

) |

|

|

0.71 |

|

|

|

0.21 |

|

|

| |

Depreciation and amortization per share |

|

0.65 |

|

|

|

0.55 |

|

|

|

2.41 |

|

|

|

2.34 |

|

|

| EBITDA per Diluted Share

(5) |

|

$ |

1.60 |

|

|

$ |

1.25 |

|

|

$ |

5.22 |

|

|

$ |

3.99 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of Free Cash

Flow: |

|

|

|

|

|

|

|

|

|

| Net

cash flow from (used in) operating activities |

$ |

26,120 |

|

|

$ |

12,592 |

|

|

$ |

84,789 |

|

|

$ |

(9,198 |

) |

|

| |

Less:

cash used in purchasing property and equipment |

|

(10,981 |

) |

|

|

(5,934 |

) |

|

|

(50,704 |

) |

|

|

(30,843 |

) |

|

| Free Cash Flow

(6) |

|

$ |

15,139 |

|

|

$ |

6,658 |

|

|

$ |

34,085 |

|

|

$ |

(40,041 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Book Value to

Tangible Book Value: |

|

|

|

|

|

|

|

|

| Book value (total stockholders' equity attributable to

MYR Group Inc.) |

|

|

|

$ |

322,984 |

|

|

$ |

287,039 |

|

|

| |

Goodwill and intangible assets |

|

|

|

|

|

|

(89,854 |

) |

|

|

(57,846 |

) |

|

| Tangible Book Value

(9) |

|

|

|

|

|

$ |

233,130 |

|

|

$ |

229,193 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Book Value per

Period End Share |

|

|

|

|

|

|

|

|

| |

|

to Tangible Book Value per

Period End Share: |

|

|

|

|

|

|

|

|

| Book value per period end share |

|

|

|

|

|

$ |

19.33 |

|

|

$ |

17.20 |

|

|

| |

Goodwill and intangible assets per period end

share |

|

|

|

|

|

(5.38 |

) |

|

|

(3.47 |

) |

|

| Tangible Book Value per Period

End Share (8) |

|

|

|

|

$ |

13.95 |

|

|

$ |

13.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Calculation of Period End

Shares: |

|

|

|

|

|

|

|

|

|

|

Shares outstanding |

|

|

|

|

|

|

16,565 |

|

|

|

16,465 |

|

|

| |

Plus: Common equivalents |

|

|

|

|

|

|

144 |

|

|

|

223 |

|

|

| Period End Shares

(14) |

|

|

|

|

|

|

16,709 |

|

|

|

16,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

December

31, |

|

December

31, |

|

| |

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

| Reconciliation of Invested

Capital to Shareholders

Equity: |

|

|

|

|

|

|

|

|

| Book value (total stockholders' equity attributable to

MYR Group Inc.) |

|

|

|

$ |

287,039 |

|

|

$ |

263,174 |

|

|

|

|

|

Plus:

Total funded debt |

|

|

|

|

|

|

78,960 |

|

|

|

59,070 |

|

|

|

|

|

Less: Cash and cash equivalents |

|

|

|

|

|

|

(5,343 |

) |

|

|

(23,846 |

) |

|

| Invested Capital

(15) |

|

|

|

|

|

$ |

360,656 |

|

|

$ |

298,398 |

|

|

See notes at the end of this earnings

release.

(1) Funded debt includes borrowings under our revolving credit

facility and the outstanding balances of our outstanding equipment

notes.(2) These financial performance measures are provided as

supplemental information to the financial statements. These

measures are used by management to evaluate our past performance,

our prospects for future performance and our ability to comply with

certain material covenants as defined within our credit agreement,

and to compare our results with those of our peers. In addition, we

believe that certain of the measures, such as book value, tangible

book value, free cash flow, asset turnover, return on equity and

debt leverage are measures that are monitored by sureties, lenders,

lessors, suppliers and certain investors. Our calculation of each

measure is described in the following notes; our calculation may

not be the same as the calculations made by other companies. (3)

EBIT, net of taxes is defined as net income attributable to MYR

Group Inc. plus net interest, less the tax impact of net interest.

The tax impact of net interest is computed by multiplying net

interest by the effective tax rate. Management uses EBIT, net of

taxes, to measure our results exclusive of the impact of financing

costs.(4) EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. EBITDA is not recognized under

GAAP and does not purport to be an alternative to net income as a

measure of operating performance or to net cash flows provided by

operating activities as a measure of liquidity. EBITDA is a

component of the debt to EBITDA covenant, as defined in our credit

agreement, which we must comply with to avoid potential immediate

repayment of amounts borrowed or additional fees to seek relief

from our lenders. In addition, management considers EBITDA a useful

measure because it eliminates differences which are caused by

different capital structures as well as different tax rates and

depreciation schedules when comparing our measures to our peers’

measures. (5) EBITDA per diluted share is calculated by dividing

EBITDA by the weighted average number of diluted shares

attributable to MYR Group Inc. outstanding for the period. EBITDA

per diluted share is not recognized under GAAP and does not purport

to be an alternative to income per diluted share. (6) Free cash

flow, which is defined as cash flow provided by operating

activities minus cash flow used in purchasing property and

equipment, is not recognized under GAAP and does not purport to be

an alternative to net income attributable to MYR Group Inc., cash

flow from operations or the change in cash on the balance sheet.

Management views free cash flow as a measure of operational

performance, liquidity and financial health. (7) Book value

per period end share is calculated by dividing total stockholders’

equity attributable to MYR Group Inc. at the end of the period by

the period end shares outstanding. (8) Tangible book value is

calculated by subtracting goodwill and intangible assets at the end

of the period from stockholders’ equity attributable to MYR Group

Inc. at the end of the period. Tangible book value is not

recognized under GAAP and does not purport to be an alternative to

book value or stockholders’ equity attributable to MYR Group Inc.

(9) Tangible book value per period end share is calculated by

dividing tangible book value at the end of the period by the period

end number of shares outstanding. Tangible book value per period

end share is not recognized under GAAP and does not purport to be

an alternative to income per diluted share. (10) The funded debt to

equity ratio is calculated by dividing total funded debt at the end

of the period by total stockholders’ equity attributable to MYR

Group Inc. at the end of the period. (11) Asset turnover is

calculated by dividing the current period revenue by total assets

at the beginning of the period. (12) Return on assets is calculated

by dividing net income attributable to MYR Group Inc. for the

period by total assets at the beginning of the period. (13) Return

on equity is calculated by dividing net income attributable to MYR

Group Inc. for the period by total stockholders’ equity

attributable to MYR Group Inc. at the beginning of the period.(14)

Period end shares is calculated by adding average common stock

equivalents for the quarter to the period end balance of common

shares outstanding. Period end shares is not recognized under GAAP

and does not purport to be an alternative to diluted shares.

Management views period end shares as a better measure of shares

outstanding as of the end of the period.(15) Invested capital is

calculated by adding net funded debt (total funded debt less cash

and marketable securities) to total stockholders’ equity

attributable to MYR Group Inc.(16) Return on invested capital is

calculated by dividing EBIT, net of taxes, less any dividends, by

invested capital at the beginning of the period. Return on invested

capital is not recognized under GAAP, and is a key metric used by

management to determine our executive compensation.

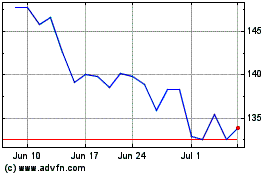

MYR (NASDAQ:MYRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

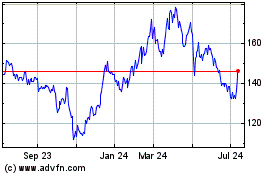

MYR (NASDAQ:MYRG)

Historical Stock Chart

From Apr 2023 to Apr 2024