Cooperative Bankshares, Inc. Announces Regulatory Agreement and Order

March 18 2009 - 5:05PM

Business Wire

Cooperative Bankshares, Inc. (the �Company�) (NASDAQ:COOP),

parent company of Cooperative Bank (the �Bank�), the deposits of

which are insured to the highest limits set by the Federal Deposit

Insurance Corporation (the �FDIC�), announced today that the Bank

has entered into an agreement with the FDIC and the North Carolina

Commissioner of Banks (the �Commissioner�) to take affirmative

actions to improve the operations of the Bank.

�Like many financial institutions, we have faced numerous

challenges in light of the current economic environment. Housing

markets have deteriorated nationally as evidenced by the decline in

house prices, reduced levels of sales, increased inventories of

houses on the market and increased foreclosures. The deterioration

in the residential markets has spread into the commercial real

estate markets, resulting in an unprecedented decline in the value

of real estate. This is apparent in our local markets as well. We

are diligently working with the FDIC and the Commissioner to

address the requirements and concerns included in the agreement and

the order. This process is designed to improve stability and the

operation of the Bank and help us in this demanding time,� stated

Todd L. Sammons, Chief Financial Officer and Interim-President and

Chief Executive Officer.

The Bank entered into the Agreement and consented to the

issuance of an Order to Cease and Desist (the �Order�) with the

FDIC and the Commissioner which requires the Bank to take specified

actions to address areas to improve and strengthen the operations

of the Bank. The Order requires, among other things, that the Bank

improve capital levels, develop a management plan, improve funds

management practices, reduce concentrations of credit, improve

lending and collection policies and requires the Board to increase

its participation and supervision of the Bank�s activities. The

Bank entered into the Agreement without admitting or denying any

violations.

The Bank is participating in the FDIC�s Transaction Account

Guarantee Program in which all funds in non-interest bearing

transaction deposit accounts (which include demand deposit checking

accounts that allow for an unlimited number of deposits and

withdrawals at any time) will be protected in full. This insurance

coverage on noninterest-bearing transaction accounts is over and

above the $250,000 coverage already provided to customers. The

coverage will last through December 31, 2009.

The Company filed a Form 8-K with the Securities and Exchange

Commission today that includes the Agreement and the Order as

Exhibits. The descriptions of the Agreement and the Order contained

in this release are qualified in their entirety by reference to

those Exhibits.

Chartered in 1898, Cooperative Bank provides a full range of

financial services through twenty -one offices and one loan

origination office in North Carolina and three offices in South

Carolina. The Bank's subsidiary, Lumina Mortgage, Inc., is a

mortgage-banking firm, originating and selling residential mortgage

loans through four offices in North Carolina.

This document, as well as other written communications made from

time to time by Cooperative Bankshares, Inc. and subsidiaries and

oral communications made from time to time by authorized officers

of the Company, may contain statements relating to the future

results of the Company (including certain projections, such as

earnings projections, necessary tax provisions, and business

trends) that are considered �forward looking statements� as defined

in the Private Securities Litigation Reform Act of 1995 (the

�PSLRA�). Such forward-looking statements may be identified by the

use of such words as �may,� �intend,� �believe,� �expect,�

�should,� �planned,� �estimated,� �potential� and similar

expressions. For these statements, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the PSLRA. The Company�s ability to predict future

results is inherently uncertain and the Company cautions you that a

number of important factors could cause actual results to differ

materially from those currently anticipated in any forward-looking

statement. These factors include, among others, changes in market

interest rates and general and regional economic conditions,

changes in government regulations, changes in accounting

principles, the quality or composition of the loan and investment

portfolios, the Company�s business strategies, exploration of

strategic options, intended results and future performance and

actions of the Company�s and the Bank�s state and federal banking

regulators. Additional factors that may affect our results are

discussed under the headings �Forward-Looking Statements� and �Item

1A. Risk Factors� in the Company�s Annual Report on Form 10-K for

the year ended December 31, 2007 and in the Company�s Quarterly

Reports on Form 10-Q for the periods ended March 31, 2008, June 30,

2008 and September 30, 2008, each filed with the Securities and

Exchange Commission, which are available at the Securities and

Exchange Commission�s Internet website (www.sec.gov) and to which reference is

hereby made. These factors should be considered in evaluating the

forward-looking statements. Stockholders are cautioned not to place

undue reliance on such statements, which speak only as of the date

of those documents. All subsequent written and oral forward-looking

statements attributable to us or any person acting on our behalf

are expressly qualified in their entirety by the cautionary

statements above. Except to the extent required by applicable law

or regulation, the Company does not undertake any obligation to

update any forward-looking statement to reflect circumstances or

events that occur after the date the forward-looking statements are

made.

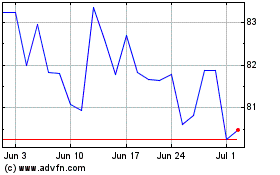

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From May 2024 to Jun 2024

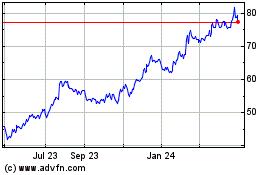

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Jun 2023 to Jun 2024