false 0001302028 0001302028 2023-11-02 2023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of the earliest event reported) November 2, 2023

MANITEX INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Michigan |

|

001-32401 |

|

42-1628978 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

9725 Industrial Drive, Bridgeview, Illinois 60455

(Address of Principal Executive Offices) (Zip Code)

(708) 430-7500

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value |

|

MNTX |

|

The NASDAQ Stock Market LLC |

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 2, 2023, Manitex International, Inc. (the “Company”) issued a press release announcing its unaudited financial results for the third quarter ended September 30, 2023 (the “Press Release”). The full text of the Press Release is being furnished as Exhibit 99.1 to this Current Report. The Company’s conference call and webcast will take place today November 2, 2023 at 9:00 am eastern time to discuss the third quarter 2023 results. The exhibit can be accessed from the Investor Relations section of the Company’s website at www.ManitexInternational.com.

The information in this Current Report (including Exhibit 99.1) is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The Company references certain non-GAAP financial measures. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached Press Release. Disclosures regarding definitions of these financial measures used by the Company and why the Company’s management believes these financial measures provide useful information to investors is also included in the Press Release.

| Item 9.01 |

Financial Statements and Exhibits. |

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma Financial Information.

Not applicable.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits.

See the Exhibit Index set forth below for a list of exhibits included with this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned thereunder duly authorized.

|

|

|

| MANITEX INTERNATIONAL, INC. |

|

|

| By: |

|

/s/ Joseph Doolan |

| Name: |

|

Joseph Doolan |

| Title: |

|

Chief Financial Officer |

Date: November 2, 2023

Exhibit 99.1

MANITEX INTERNATIONAL REPORTS THIRD QUARTER 2023 RESULTS

Bridgeview, IL, November 2, 2023 – Manitex International, Inc. (Nasdaq: MNTX) (“Manitex” or the

“Company”), a leading international provider of truck cranes, specialized industrial equipment, and construction equipment rental solutions to infrastructure and construction markets, today reported financial results for the three

months ended September 30, 2023.

THIRD QUARTER 2023 RESULTS

(all comparisons versus the prior year period unless otherwise noted)

| |

• |

|

Net revenue of $71.3 million, +9.7% |

| |

• |

|

Gross profit of $16.6 million +34.4%; gross margin of 23.3%, +427 basis points |

| |

• |

|

GAAP Net Income of $1.7 million; Adjusted Net Income of $2.9 million, or $0.14 per diluted share

|

| |

• |

|

Adjusted EBITDA of $8.5 million, +61.7%; Adjusted EBITDA margin of 11.9%, +381 basis points

|

| |

• |

|

TTM Adjusted EBITDA now 10.2% |

| |

• |

|

Backlog of $196.9 million, -4.9% |

| |

• |

|

Net leverage of 2.9X, down from 3.9X at December 31, 2022; total liquidity of $29 million

|

| |

• |

|

Increasing full year guidance |

MANAGEMENT COMMENTARY

“Our strong third quarter

results demonstrate continued progress on our multi-year business transformation strategy,” stated Michael Coffey, CEO of Manitex. “Revenue, margin realization and Adjusted EBITDA increased materially versus the prior year, while net

leverage declined for the fifth consecutive quarter, consistent with our focus on balance sheet optimization.

“Earlier this year we introduced our

new strategy, Elevating Excellence, promising targeted commercial growth, improved production output and higher margins,” continued Coffey. “Driven by the extraordinary efforts of our manufacturing team, third quarter revenue increased 10%

on an organic basis versus the prior year period. Lifting equipment revenue, when adjusting for year-over-year chassis sale reductions, improved 21% in the quarter. I am very proud of the team and their diligence.”

“The early benefits of our initiatives have meaningfully exceeded expectations, resulting in significant margin expansion and improved profitability for

the organization,” continued Coffey. “Third quarter gross margin increased 427 basis points on a year-over-year basis to 23.3%, or more than 200 basis points higher than any quarter we’ve reported in more than five years. We are

pleased with the improved margins and see further opportunities in the future.”

“Adjusted EBITDA margin was 11.9% in the third quarter, up

nearly 400 basis points from the prior year,” continued Coffey. “Adjusted EBITDA grew 60% in the period. Trailing twelve-month EBITDA margins are now 10.2%, achieving short term goal we set for 2023. We are well positioned and on track to

achieve our mid-term goals ahead of schedule.”

“Last quarter we indicated that backlog would begin to decline from historically high levels,”

continued Coffey. “The decline is driven by higher production levels, seasonal customer order timing, and modest order intake declines in Western Europe. Our total backlog at quarter end was $197 million and remains 3-times pre-pandemic levels. Year-to-date book-to-build ratios are also strong as is customer sentiment. Given favorable underlying demand within core infrastructure, energy and mining markets, we remain confident that Manitex will continue to

deliver the above-market growth outlined in our multi-year plan.”

“Our net debt to trailing twelve-month adjusted EBITDA declined to 2.9x at

the end of the third quarter, below our 2023 target of 3.0x,” stated Joseph Doolan, Chief Financial Officer of Manitex. “Throughout 2023, we maintained high levels of working capital, slowing our debt reduction plans. We remain highly

focused on further improving working capital efficiency over the coming quarters. Our total liquidity of nearly $29 million, which includes total cash and availability under our credit facilities, provides us with ample financial flexibility to

support our organic growth initiatives into 2024.”

“At Manitex, we’re building a highly efficient equipment solutions platform equipped to

drive sustained, profitable growth through the cycle,” stated Coffey. “Our third quarter results highlight both the measurable progress we’ve made on our internal initiatives in a relatively short period of time, while signaling the

significant growth potential evident within our business. Based on our strong third quarter results and the continued momentum in our business, we are pleased to be raising our full-year 2023 guidance and remain

on-track to achieve our 2025 financial targets detailed in our Elevating Excellence strategy.”

THIRD QUARTER 2023 PERFORMANCE

Manitex reported net

revenue of $71.3 million in the third quarter 2023, an increase of 9.7% versus the prior-year period, driven by growth in the lifting segment. Revenue growth was negatively impacted by $4.0 million, or approximately 6%, due to lower truck

chassis sales, which are largely pass-through revenue items. The Company continues to expect lower chassis sales to be a headwind to reported sales growth and a benefit to reported gross margin in 2023.

Lifting Equipment Segment revenue was $63.7 million in the third quarter 2023, an increase of 11%, versus the prior-year period, or an increase of 21%

when excluding the impact of truck chassis sales in the quarter. The sales growth is a direct result of improvements in manufacturing throughput, as well as favorable demand trends in both domestic and international markets. In North America, strong

project activity from energy and infrastructure markets continues to drive robust activity levels, while international markets are benefitting from infrastructure projects in Europe and continued strength from mining activity in South America.

Rental Equipment Segment revenue was $7.6 million in the third quarter 2023, supported by strong end-market

demand in key North Texas markets, including contribution from the Lubbock, Texas location that opened in March 2023. The Rabern business benefitted from the deployment of new rental fleet acquired in 2022, pricing gains, and our expansion into the

Lubbock market.

Total gross profit was $16.6 million in the third quarter, an increase from $12.3 million in the prior-year period due to

revenue growth, operational improvement initiatives, improved pricing realization and sales mix. As a result of these factors, gross profit margin increased 427 basis points to 23.3% during the third quarter 2023. The higher US-based steel prices that were a headwind during the second quarter were less of a factor during the third quarter, as the Company has successfully implemented product surcharges in an effort to offset the rising

price of steel.

SG&A expense was $10.5 million for the third quarter, compared to $10.4 million for the

comparable period last year. R&D costs of $0.9 million were up modestly from $0.7 million last year.

Operating income was $5.2 million

for the third quarter 2023, compared to $1.2 million for the same period last year. Third quarter operating margin was 7.3%, an improvement from 1.9% in the prior year period. The year-over-year improvement in operating income was driven by the

strong operating performance and disciplined cost control.

The Company delivered GAAP Net Income of $1.7 million, or $0.08 per diluted share, for

the third quarter 2023, compared to a net loss of ($3.4) million, or ($0.17) per diluted share, for the same period last year.

Adjusted EBITDA was

$8.5 million for the third quarter 2023, or 11.9% of sales, compared to $5.2 million, or 8.0% of sales, for the same period last year. See Non-GAAP reconciliations in the appendix of this release.

As of September 30, 2023, total backlog was $196.9 million, down 4.9% from the end of the third quarter 2022, driven by the increased

production velocity.

BALANCE SHEET AND LIQUIDITY

As

of September 30, 2023, total debt was $91.3 million. Cash and cash equivalents as of September 30, 2023, were $4.9 million, resulting in net debt of $86.4 million, an improvement of $1.4 million for the quarter. Net

leverage was 2.9x at the end of third quarter 2023, down from 3.9x at the end of fourth quarter 2022. As of September 30, 2023, Manitex had total cash and availability of approximately $29 million.

FINANCIAL OUTLOOK

Based on the better than expected third quarter results and continued momentum in the business, the Company increased financial guidance for the full-year

2023. The increased financial targets reflect the underlying strength of the Company’s end markets, market share gains, and margin improvements driven by operational benefits from the Elevating Excellence initiatives. The Company’s updated

financial targets are detailed in the following table.

|

|

|

|

|

|

|

|

|

| ($ in millions) |

|

|

|

|

|

|

| |

|

Full-Year

2022 Actual |

|

|

Full-Year

2023 |

|

| Total Revenue |

|

$ |

273.9 |

|

|

$ |

285 to $290 |

|

| Total Adjusted EBITDA |

|

$ |

21.3 |

|

|

$ |

28 to $30 |

|

| Total Adjusted EBITDA Margin |

|

|

7.8 |

% |

|

|

9.7% to 10.5 |

% |

These targets are current as of the time provided and subject to change, given markets conditions.

THIRD QUARTER 2023 RESULTS CONFERENCE CALL

Manitex will

host a conference call today at 9:00 AM ET to discuss the Company’s third quarter 2023 results and updated corporate strategy.

A webcast of the

conference call and accompanying presentation materials will be available in the Investor Relations section of the Manitex website at https://www.manitexinternational.com/eventspresentations.aspx, and a replay of the webcast will be available

at the same time shortly after the webcast is complete.

To participate in the live teleconference:

|

|

|

|

|

|

|

| Domestic Live: |

|

|

(855) 327-6837 |

|

|

|

| International Live: |

|

|

(631) 891-4304 |

|

|

|

To listen to a replay of the teleconference, which will be available through August 17, 2023:

|

|

|

|

|

|

|

| Domestic Replay: |

|

|

(844) 512-2921 |

|

|

|

| International Replay: |

|

|

(412) 317-6671 |

|

|

|

| Passcode: |

|

|

10022684 |

|

|

|

NON-GAAP FINANCIAL MEASURES AND OTHER ITEMS

In this press release, we refer to various non-GAAP (U.S. generally accepted accounting principles) financial measures

which management uses to evaluate operating performance, to establish internal budgets and targets, and to compare the Company’s financial performance against such budgets and targets. These non-GAAP

measures, as defined by the Company, may not be comparable to similarly titled measures being disclosed by other companies. While adjusted financial measures are not intended to replace any presentation included in our consolidated financial

statements under generally accepted

accounting principles (GAAP) and should not be considered an alternative to operating performance or an

alternative to cash flow as a measure of liquidity, we believe these measures are useful to investors in assessing our operating results, capital expenditures and working capital requirements and the ongoing performance of its underlying businesses.

A reconciliation of Adjusted GAAP financial measures is included with this press release. All per share amounts are on a fully diluted basis. The quarterly amounts described below are unaudited, are reported in thousands of U.S. dollars, and are as

of the dates indicated.

ABOUT MANITEX INTERNATIONAL

Manitex International is a leading provider of mobile truck cranes, industrial lifting solutions, aerial work platforms, construction equipment and rental

solutions that serve general construction, crane companies, and heavy industry. The company engineers and manufactures its products in North America and Europe, distributing through independent dealers worldwide. Our brands include Manitex, PM,

Oil & Steel, Valla, and Rabern Rentals.

FORWARD-LOOKING STATEMENTS

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This release contains statements that are forward-looking in nature

which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our

business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify

forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,”

“may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other

factors that could cause the Company’s future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional

information are discussed in the Company’s filings with the Securities and Exchange Commission and statements in this release should be evaluated in light of these important factors. Although we believe that these statements are based upon

reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as

a result of new information, future developments or otherwise.

IR CONTACT

Paul Bartolai or Noel Ryan

MNTX@val-adv.com

MANITEX INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands,

except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

4,673 |

|

|

$ |

7,973 |

|

| Cash – restricted |

|

|

203 |

|

|

|

217 |

|

| Trade receivables (net) |

|

|

47,114 |

|

|

|

43,856 |

|

| Other receivables |

|

|

1,059 |

|

|

|

1,750 |

|

| Inventory (net) |

|

|

85,186 |

|

|

|

69,801 |

|

| Prepaid expense and other current assets |

|

|

2,748 |

|

|

|

3,907 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

140,983 |

|

|

|

127,504 |

|

|

|

|

|

|

|

|

|

|

| Total fixed assets, net of accumulated depreciation of $28,382 and $22,441 at September 30,

2023 and December 31, 2022, respectively |

|

|

48,747 |

|

|

|

51,697 |

|

| Operating lease assets |

|

|

7,498 |

|

|

|

5,667 |

|

| Intangible assets (net) |

|

|

12,769 |

|

|

|

14,367 |

|

| Goodwill |

|

|

36,674 |

|

|

|

36,916 |

|

| Deferred tax assets |

|

|

452 |

|

|

|

452 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

247,123 |

|

|

$ |

236,603 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

50,665 |

|

|

$ |

45,682 |

|

| Accrued expenses |

|

|

13,780 |

|

|

|

12,379 |

|

| Related party payables (net) |

|

|

13 |

|

|

|

60 |

|

| Notes payable |

|

|

18,640 |

|

|

|

22,666 |

|

| Current portion of finance lease obligations |

|

|

579 |

|

|

|

509 |

|

| Current portion of operating lease obligations |

|

|

1,998 |

|

|

|

1,758 |

|

| Customer deposits |

|

|

2,220 |

|

|

|

3,407 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

87,895 |

|

|

|

86,461 |

|

|

|

|

|

|

|

|

|

|

| Long-term liabilities |

|

|

|

|

|

|

|

|

| Revolving term credit facilities (net) |

|

|

48,259 |

|

|

|

41,479 |

|

| Notes payable (net) |

|

|

20,857 |

|

|

|

22,261 |

|

| Finance lease obligations (net of current portion) |

|

|

2,940 |

|

|

|

3,382 |

|

| Operating lease obligations (net of current portion) |

|

|

5,500 |

|

|

|

3,909 |

|

| Deferred gain on sale of property |

|

|

367 |

|

|

|

427 |

|

| Deferred tax liability |

|

|

4,574 |

|

|

|

5,151 |

|

| Other long-term liabilities |

|

|

5,057 |

|

|

|

5,572 |

|

|

|

|

|

|

|

|

|

|

| Total long-term liabilities |

|

|

87,554 |

|

|

|

82,181 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

175,449 |

|

|

|

168,642 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Preferred Stock—Authorized 150,000 shares, no shares issued or outstanding at

September 30, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

| Common Stock—no par value 25,000,000 shares authorized, 20,252,114 and 20,107,014 shares

issued and outstanding at September 30, 2023 and December 31, 2022, respectively |

|

|

134,294 |

|

|

|

133,289 |

|

| Paid-in capital |

|

|

5,014 |

|

|

|

4,266 |

|

| Retained deficit |

|

|

(71,182 |

) |

|

|

(73,338 |

) |

| Accumulated other comprehensive loss |

|

|

(6,261 |

) |

|

|

(5,822 |

) |

|

|

|

|

|

|

|

|

|

| Equity attributable to shareholders of Manitex International |

|

|

61,865 |

|

|

|

58,395 |

|

| Equity attributed to noncontrolling interest |

|

|

9,809 |

|

|

|

9,566 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

71,674 |

|

|

|

67,961 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

247,123 |

|

|

$ |

236,603 |

|

|

|

|

|

|

|

|

|

|

MANITEX INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands,

except for share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net revenues |

|

$ |

71,331 |

|

|

$ |

65,037 |

|

|

$ |

212,736 |

|

|

$ |

195,034 |

|

| Cost of sales |

|

|

54,746 |

|

|

|

52,693 |

|

|

|

166,806 |

|

|

|

160,198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

16,585 |

|

|

|

12,344 |

|

|

|

45,930 |

|

|

|

34,836 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development costs |

|

$ |

861 |

|

|

$ |

659 |

|

|

|

2,512 |

|

|

|

2,095 |

|

| Selling, general and administrative expenses |

|

|

10,545 |

|

|

|

10,440 |

|

|

|

32,342 |

|

|

|

30,317 |

|

| Transaction costs |

|

|

— |

|

|

|

37 |

|

|

|

— |

|

|

|

2,236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

11,406 |

|

|

|

11,136 |

|

|

|

34,854 |

|

|

|

34,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

5,179 |

|

|

|

1,208 |

|

|

|

11,076 |

|

|

|

188 |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(1,997 |

) |

|

|

(1,409 |

) |

|

|

(5,658 |

) |

|

|

(2,982 |

) |

| Interest income |

|

|

141 |

|

|

|

— |

|

|

|

141 |

|

|

|

3 |

|

| Foreign currency transaction gain (loss) |

|

|

(883 |

) |

|

|

175 |

|

|

|

(1,656 |

) |

|

|

268 |

|

| Other income (expense) |

|

|

196 |

|

|

|

(2,852 |

) |

|

|

(541 |

) |

|

|

(1,864 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense |

|

|

(2,543 |

) |

|

|

(4,086 |

) |

|

|

(7,714 |

) |

|

|

(4,575 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

2,636 |

|

|

|

(2,878 |

) |

|

|

3,362 |

|

|

|

(4,387 |

) |

| Income tax expense (benefit) |

|

|

742 |

|

|

|

206 |

|

|

|

962 |

|

|

|

570 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

1,894 |

|

|

|

(3,084 |

) |

|

|

2,400 |

|

|

|

(4,957 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to noncontrolling interest |

|

|

194 |

|

|

|

288 |

|

|

|

243 |

|

|

|

442 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to shareholders of Manitex International,

Inc. |

|

$ |

1,700 |

|

|

$ |

(3,372 |

) |

|

$ |

2,157 |

|

|

$ |

(5,399 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.08 |

|

|

$ |

(0.17 |

) |

|

$ |

0.11 |

|

|

$ |

(0.27 |

) |

| Diluted |

|

$ |

0.08 |

|

|

$ |

(0.17 |

) |

|

$ |

0.11 |

|

|

$ |

(0.27 |

) |

| Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

20,252,114 |

|

|

|

20,094,475 |

|

|

|

20,193,696 |

|

|

|

20,039,981 |

|

| Diluted |

|

|

20,254,830 |

|

|

|

20,094,475 |

|

|

|

20,196,255 |

|

|

|

20,039,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Sales and Gross Margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

September 30, 2023 |

|

|

|

|

|

June 30, 2023 |

|

|

|

|

|

September 30, 2022 |

|

|

|

|

| |

|

As

Reported |

|

|

As

Adjusted |

|

|

As Reported |

|

|

As

Adjusted |

|

|

As

Reported |

|

|

As

Adjusted |

|

| Net sales |

|

$ |

71,331 |

|

|

$ |

71,331 |

|

|

$ |

73,534 |

|

|

$ |

73,534 |

|

|

$ |

65,037 |

|

|

$ |

65,037 |

|

| % change Vs Q2 2023 |

|

|

(3.0 |

%) |

|

|

(3.0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| % change Vs Q3 2022 |

|

|

9.7 |

% |

|

|

9.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

16,585 |

|

|

|

16,585 |

|

|

|

14,935 |

|

|

|

14,935 |

|

|

|

12,344 |

|

|

|

12,354 |

|

| Gross margin % of net sales |

|

|

23.3 |

% |

|

|

23.3 |

% |

|

|

20.3 |

% |

|

|

20.3 |

% |

|

|

19.0 |

% |

|

|

19.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Backlog |

|

Sept 30, 2023 |

|

|

June 30, 2023 |

|

|

Mar 31, 2023 |

|

|

Dec 31, 2022 |

|

|

Sept 30, 2022 |

|

| Backlog from continuing operations |

|

|

196,872 |

|

|

|

223,236 |

|

|

|

238,096 |

|

|

|

230,206 |

|

|

|

207,032 |

|

| Change Versus Current Period |

|

|

|

|

|

|

(11.8%) |

|

|

|

(17.3%) |

|

|

|

(14.5%) |

|

|

|

(4.9%) |

|

Backlog is defined as orders for equipment which have not yet shipped as well as orders by foreign subsidiaries for

international deliveries. The disclosure of backlog aids in the analysis the Company’s customers’ demand for product, as well as the ability of the Company to meet that demand.

Backlog is not necessarily indicative of sales to be recognized in a specified future period.

Reconciliation of Net Income (Loss) Attributable to Shareholders of Manitex International, Inc. to Adjusted Net Income

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

|

September 30, 2022 |

|

| Net income (loss) attributable to shareholders of Manitex International, Inc. |

|

$ |

1,700 |

|

|

$ |

404 |

|

|

$ |

(3,372 |

) |

| Adjustments, including net tax impact |

|

|

1,222 |

|

|

|

1,307 |

|

|

|

4,077 |

|

| Adjusted net income (loss) attributable to shareholders of Manitex International, Inc. |

|

$ |

2,922 |

|

|

$ |

1,711 |

|

|

$ |

705 |

|

| Weighted diluted shares outstanding |

|

|

20,254,830 |

|

|

|

20,209,959 |

|

|

|

20,094,475 |

|

| Diluted earnings (loss) per share as reported |

|

$ |

0.08 |

|

|

$ |

0.02 |

|

|

$ |

(0.17 |

) |

| Total EPS effect |

|

$ |

0.06 |

|

|

$ |

0.06 |

|

|

$ |

0.21 |

|

| Adjusted diluted earnings (loss) per share |

|

$ |

0.14 |

|

|

$ |

0.08 |

|

|

$ |

0.04 |

|

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

|

September 30, 2022 |

|

| Net Income (loss) |

|

$ |

1,894 |

|

|

$ |

532 |

|

|

$ |

(3,084 |

) |

| Interest expense |

|

|

1,856 |

|

|

|

1,896 |

|

|

|

1,409 |

|

| Tax expense |

|

|

742 |

|

|

|

207 |

|

|

|

206 |

|

| Depreciation and amortization expense |

|

|

2,739 |

|

|

|

2,869 |

|

|

|

2,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

7,231 |

|

|

$ |

5,504 |

|

|

$ |

1,145 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

| Stock compensation |

|

$ |

457 |

|

|

$ |

588 |

|

|

$ |

749 |

|

| FX |

|

|

883 |

|

|

|

718 |

|

|

|

(175 |

) |

| Pension settlement |

|

|

(118 |

) |

|

|

— |

|

|

|

— |

|

| Litigation / legal settlement |

|

|

— |

|

|

|

— |

|

|

|

3,171 |

|

| Severance / restructuring costs |

|

|

— |

|

|

|

— |

|

|

|

294 |

|

| Rabern transaction costs |

|

|

— |

|

|

|

— |

|

|

|

37 |

|

| Other |

|

|

— |

|

|

|

— |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Adjustments |

|

$ |

1,222 |

|

|

$ |

1,306 |

|

|

$ |

4,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

8,453 |

|

|

$ |

6,810 |

|

|

$ |

5,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA as % of sales |

|

|

11.9 |

% |

|

|

9.3 |

% |

|

|

8.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Debt |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2023 |

|

|

June 30, 2023 |

|

|

September 30, 2022 |

|

| Total cash & cash equivalents |

|

$ |

4,876 |

|

|

$ |

7,302 |

|

|

$ |

11,865 |

|

| Notes payable - short term |

|

$ |

18,640 |

|

|

$ |

23,857 |

|

|

$ |

16,486 |

|

| Current portion of finance leases |

|

|

579 |

|

|

|

555 |

|

|

|

487 |

|

| Notes payable - long term |

|

|

20,857 |

|

|

|

21,585 |

|

|

|

23,829 |

|

| Finance lease obligations - LT |

|

|

2,940 |

|

|

|

3,093 |

|

|

|

3,518 |

|

| Revolver, net |

|

|

48,259 |

|

|

|

45,982 |

|

|

|

53,152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total debt |

|

$ |

91,275 |

|

|

$ |

95,072 |

|

|

$ |

97,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net debt |

|

$ |

86,399 |

|

|

$ |

87,770 |

|

|

$ |

85,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net debt is calculated using the Consolidated Balance Sheet amounts for current and long-term portion of long-term debt,

capital lease obligations, notes payable, and revolving credit facilities minus cash and cash equivalents.

Exhibit 99.2 Third Quarter 2023 Results Conference Call November 2, 2023

Safe Harbor Statement Safe Harbor Statement under the U.S. Private

Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of

operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and

objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,”

“project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar

expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ

significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and

statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of

the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. 2 2

Key Messages Third Quarter 2023 Highlights ❖ Elevated Backlog

Levels ❖ Solid Revenue Growth Performance Revenue increased 10% during 3Q23 Backlog decreased versus last year owing to increased throughput and driven by organic growth in lifting highlighted by organic equipment order timing, but backlog

remains at elevated levels relative to historical growth, continued ❖ Rental Momentum trends operating execution, Continued favorable demand drivers in core markets, pricing benefits and and meaningful margin ❖ Elevating Excellence

ramp-up of new branch in Lubbock, Continued progress on strategic initiatives expansion TX including growing momentum in new product introductions, ramp of new Rental ❖ Operating Execution branch in Lubbock, and strong execution 3Q23 Gross

Margin increased 427 bps • 10% revenue growth driven on manufacturing throughput to 23.3%, driven by pricing benefits, by strong organic growth in improved productivity, and increased lifting equipment fixed cost absorption ❖ Raising

2023 Targets Based on favorable end market trends, • Strong execution drove 427 combined with continued operational bps of y/y 3Q23 gross margin ❖ EBITDA Margin Expansion execution, raising 2023 financial targets; expansion Adjusted

EBITDA margin of 11.9% EBITDA forecast assumes nearly 40% improved significantly y/y growth at the mid-point of the new • Record EBITDA margin of guidance range 11.9% resulted in 62% EBITDA growth 3

Value Creation Roadmap We introduced Elevating Excellence Initiative in

First Quarter 2023 Manitex introduced its Elevating Excellence initiative in the first Manitex has identified quarter 2023 representing a new long-term value creation strategy historical challenges to profitable growth • Too many go-to-market

Disciplined Targeted Sustained Operational brands - diluted brand Capital identity Commercial Excellence Allocation • Unrealized synergies of Expansion scale • Lack of production velocity High-return organic growth Organic share

expansion Optimize operating structure; product • Ineffective structure investments; invest from in favorable markets mix optimization; increased facility cash flow; opportunistic, • Lack of data-centric (North America / Western

utilization; supply chain optimization; accretive bolt-on Europe); Share expansion improved fixed cost absorption reporting (KPI, balanced acquisitions in of PM | Oil & Steel and scorecard) complementary adjacent Valla in the USA markets Our

Past Our Path Forward 4

Targeted Commercial Expansion Drive above-market organic growth,

leveraging incumbent position Retain leadership position within Straight Mast market, while investing Manitex will leverage in higher-growth, underpenetrated adjacent markets its incumbent, Delivering “One Driving balanced growth across

Relative growth leadership position in new and existing markets Manitex” to the market contribution by product Straight Mast Cranes Market Share Expansion to expand across Market Share | Growth Leverage strong market share in Valla PM straight

mast cranes to grow Articulated, Industrial articulated cranes, Industrial Cranes Straight Mast Manitex Lifting, and AWP share in N.A. Lift / AWP and Rental Simplify Brand Identity Markets Simplify our go-to-market branding, supporting our dealers

with segmented brands serving • Manitex has 35% market share specific applications within the domestic Straight Enhanced Product Distribution Mast market O&S Consolidate distribution across AWP Articulated Rental targeted geographies

• Brand consolidation, Industrial Lift & market positioning will help to Product Innovation AWPs drive organic share gains in Rentals Invest in new, adjacent markets customer-led innovation and Growth product development 5 Share

Sustained Operational Excellence Building a durable, more efficient

business to drive profitable growth Key drivers of multi-year margin improvement, Manitex intends weighted by potential anticipated margin uplift to drive productivity and efficiency improvements in Product support of profitable Mix Process growth

through Parts Sales the cycle Supply Chain • Implement a lean, more efficient organizational structure, increase production velocity, expand 2023 Priorities 2024 Priorities 2025 Priorities sourcing and procurement capabilities, improve •

Systems utilization (Process • Drive growth of PM | Oil & Steel | • Product rationalization inventory management, Improvements) Valla in NA • Strategic, bolt-on acquisitions leverage data and analytics • Rationalize &

Centralize supply chain• Rental growth and margin in support of cultural expansion • Improve capacity utilization accountability • Position new dealers and NA channel support 6

Disciplined Capital Allocation Prioritize reduction in net leverage,

targeted organic growth investments Manitex intends to reduce net leverage, while continuing to optimize liquidity with which to support organic growth across the business 2023-2024 Acquisition Criteria Capital allocation priorities 1. Reduce net

leverage towards target of 3.0x or less 2. Selectively invest in new organic growth opportunities Revenue and Product line | Technical accretive 3. Opportunistic, shareholder-friendly return of capital Aftermarket end-market capabilities margin

appeal expansion expansion synergies 2025+ Capital allocation priorities 1. Strategic, bolt-on acquisitions 2. Selectively invest in new organic growth opportunities 3. Opportunistic, shareholder-friendly return of capital Building a more efficient,

lean organization before we begin to pursue strategic acquisitions 7

2025 Financial Targets Positioned to drive significant organic growth

and margin expansion 2022A-2025E Between YE 2022 and Revenue Bridge ($MM) EBITDA Bridge ($MM) EBITDA Margin (%) YE 2025, Manitex ~25% ~65-110% +300-500 bps intends to deliver revenue growth at EBITDA growth of margin expansion incremental growth

mid-point of range 11% to 13% in revenue, EBITDA and EBITDA margin $325 to $360 $35 to $45 8% $274 realization through a $21 combination of commercial 2022 2025E 2022 2025E 2022 2025E expansion, sustained operational Revenue Drivers Margin Drivers

(2024 and 2025 Focus on Growth) (2023 is a foundational year with focus on margins / process and systems) excellence and disciplined • End-market growth• Improved fixed-cost absorption through improved operating leverage • Improved

capacity utilization• Reweight product mix toward higher-margin offering capital allocation • Product innovation / NPD• Centralization of procurement and supply chain • Market share gains 8

Third Quarter 2023 Results

3Q23 Financial Performance Strong operational and commercial execution,

Elevating Excellence initiatives underway 3Q23 results highlighted by strong organic growth in Lifting Equipment, meaningful EBITDA margin expansion, and progress on Elevating Excellence initiatives Third Quarter 2023 Elevating Excellence Key

Highlights Key Highlights Strong customer response for new product Revenue increased 10% driven by strong organic introductions growth in Lifting Equipment Targeting significant new product introductions in Backlog decreased 5% to $197 million due

to 2023 increased manufacturing throughput and order timing; at nine months of sales, backlog remains Ramp of new Rental location in Lubbock, TX at healthy levels Ongoing resource optimization initiatives driving Gross margin of 23.3% up 427 bps due

to higher improvement in manufacturing throughput pricing, better manufacturing throughput, and New sourcing initiatives provide opportunity for efficiency gains incremental cost savings Adjusted EBITDA increased 62% y/y Net leverage of 2.9x, down

from 3.9x at year-end 2022, achieved goal of 3.0x ahead of plan EBITDA margin of 11.9%, up 381 basis points 10 10

3Q23 Performance Summary Strong backlog growth, meaningful margin

improvement 10% y/y Revenue Growth 5% y/y Backlog Decline Favorable end ($MM) ($MM) market trends and $78.8 $238.1 $230.2 strong execution $223.2 $73.5 $71.3 $207.0 $67.9 $196.9 $65.0 • Revenue growth due to favorable market trends benefitting

Lifting Equipment 3Q22 4Q22 1Q23 2Q23 3Q23 3Q22 4Q22 1Q23 2Q23 3Q23 • 5% backlog decrease at 9/30/23 owing to increased throughput 427 bps y/y Gross Margin Expansion 62% y/y Adjusted EBITDA Growth • Gross margin improved 427 bps (%)

($MM) y/y due to operational 23.3% 21.2% improvement and more favorable $8.5 20.3% $8.1 19.3% 19.0% pricing $6.8 $6.3 $5.2 • Trailing twelve-month EBITDA of $29.7 million, up from $13.4 million in the prior twelve-month period. 3Q22 4Q22 1Q23

2Q23 3Q23 3Q22 4Q22 1Q23 2Q23 3Q23 11

Disciplined Balance Sheet Management Focus on debt reduction and

investment in organic growth initiatives Net Leverage Ratio Cash and Availability Capital allocation ($MM) (Net debt to Adjusted EBITDA) focused on debt $37.6 $36.6 $35.9 $31.2 reduction and organic $28.7 3.9x growth initiatives 3.5x 3.3x 3.0x

• Stable liquidity profile, modest 2.9x decline due to normal seasonal 2021 2022 1Q23 2Q23 3Q23 working capital requirements • Debt levels increased following Net Debt the acquisition of Rabern ($MM) completed in Apr-22 $87.8 $86.0 $86.4

$82.1 • Net leverage of 2.9x, down from 3.9x at YE22 driven by strong EBITDA growth. Achieved long- $23.8 term target of 3.0x or less ahead of plan 2021 2022 1Q23 2Q23 3Q23 2021 2022 1Q23 2Q23 3Q23 12

Full-Year 2023 Financial Guidance Raising Outlook, reflects nearly 40%

Adjusted EBITDA growth and continued margin expansion Raised Guidance reflects favorable end market trends and progress on Elevating Excellence initiatives $ in millions Fiscal Full-Year 2022 Fiscal Full-Year 2023 Revenue $273.9 $285 to $290 •

Continued end market momentum and contribution Adjusted EBITDA $21.3 $28 to $30 from new products driving solid Adjusted EBITDA Margin 7.8% 9.7% to 10.5% revenue growth • Improved production velocity and operating efficiencies resulting in

margin expansion and strong Adjusted EBITDA growth • Expect continued balance sheet de-leveraging 13

Appendix

Statement on Non-GAAP Financial Measures NON-GAAP FINANCIAL MEASURES

AND OTHER ITEMS In this presentation, we refer to various non-GAAP (U.S. generally accepted accounting principles) financial measures which management uses to evaluate operating performance, to establish internal budgets and targets, and to compare

the Company's financial performance against such budgets and targets. These non-GAAP measures, as defined by the Company, may not be comparable to similarly titled measures being disclosed by other companies. While adjusted financial measures are

not intended to replace any presentation included in our consolidated financial statements under generally accepted accounting principles (GAAP) and should not be considered an alternative to operating performance or an alternative to cash flow as a

measure of liquidity, we believe these measures are useful to investors in assessing our operating results, capital expenditure and working capital requirements and the ongoing performance of its underlying businesses. A reconciliation of Adjusted

GAAP financial measures is included with this presentation. All per share amounts are on a fully diluted basis. The quarterly amounts described below are unaudited, are reported in thousands of U.S. dollars, and are as of the dates indicated.

15

Appendix - Reconciliations Reconciliation of GAAP Net Income (Loss) to

Adjusted Net Income (Loss) Reconciliation of Net Income (Loss) Attributable to Shareholders of Manitex International, Inc. to Adjusted Net Income Three Months Ended September 30, 2023 June 30, 2023 September 30, 2022 Net income (loss) attributable

to shareholders of Manitex $ 1,700 $ 404 $ (3,372) International, Inc. Adjustments, including net tax impact 1,222 1,307 4,077 Adjusted net income (loss) attributable to shareholders of $ 2 ,922 $ 1,711 $ 705 Manitex International, Inc. Weighted

diluted shares outstanding 20,254,830 20,209,959 20,094,475 Diluted earnings (loss) per share as reported $ 0 .08 $ 0 .02 $ (0.17) Total EPS effect $ 0.06 $ 0 .06 $ 0 .21 Adjusted diluted earnings (loss) per share $ 0.14 $ 0.08 $ 0 .04 16

Appendix - Reconciliations Reconciliation of GAAP Net Income (Loss) to

Adjusted EBITDA Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA Three Months Ended September 30, 2023 June 30, 2023 September 30, 2022 Net Income (loss) $ 1,894 $ 532 $ (3,084) Interest expense 1,856 1,896 1,409 Tax expense 742 207 206

Depreciation and amortization expense 2,739 2,869 2,614 EBITDA $ 7,231 $ 5,504 $ 1,145 Adjustments: Stock compensation $ 457 $ 588 $ 749 FX 883 718 (175) Pension settlement (118) - - Litigation / legal settlement - - 3,171 Severance / restructuring

costs - - 294 Rabern transaction costs - - 37 Other - - 5 Total Adjustments $ 1,222 $ 1,306 $ 4,081 Adjusted EBITDA $ 8,453 $ 6,810 $ 5,226 Adjusted EBITDA as % of sales 11.9% 9.3% 8.0% 17

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

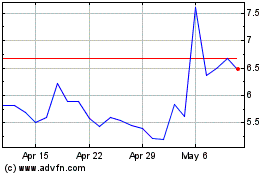

Manitex (NASDAQ:MNTX)

Historical Stock Chart

From Apr 2024 to May 2024

Manitex (NASDAQ:MNTX)

Historical Stock Chart

From May 2023 to May 2024