Current Report Filing (8-k)

December 27 2022 - 4:04PM

Edgar (US Regulatory)

0001412100false00014121002022-12-272022-12-270001412100us-gaap:CommonStockMember2022-12-272022-12-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 27, 2022 (December 27, 2022)

MAIDEN HOLDINGS, LTD.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Bermuda | | 001-34042 | | 98-0570192 |

(State or other jurisdiction of incorporation) | |

(Commission File Number) | |

(IRS Employer Identification No.) |

94 Pitts Bay Road, Pembroke HM08, Bermuda

(Address of principal executive offices and zip code)

(441) 298-4900

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

| | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

| | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

| | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading symbol(s) | | Name of Each Exchange on Which Registered |

| Common Shares, par value $0.01 per share | | MHLD | | NASDAQ Capital Market |

| | | | |

| | | | |

| | | | |

On December 27, 2022, the Company issued a press release announcing the completion of the conversion of all of the Company’s outstanding 8.25% Non-Cumulative Preference Shares, Series A, 7.125% Non-Cumulative Preference Shares, Series C and 6.700% Non-Cumulative Preference Shares, Series D for the Company’s common shares, $0.01 par value per share, via its investor relations website at https://www.maiden.bm/investor_relations, which press release is included as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibit

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| | | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | December 27, 2022 | MAIDEN HOLDINGS, LTD. |

| | | | |

| | | By: | /s/ Lawrence F. Metz |

| | | | Lawrence F. Metz |

| | | | President and Co-Chief Executive Officer |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| | | |

| 99.1 | | |

Exhibit 99.1

PRESS RELEASE

Maiden Announces the Successful Completion of the Conversion of its Preferences Shares, Series A, Series C and Series D for Common Shares

PEMBROKE, Bermuda, December 27, 2022 - Maiden Holdings, Ltd., a Bermuda-based holding company (NASDAQ: MHLD) (“Maiden” or the “Company”), announced today that it has completed the previously announced conversion of its outstanding 8.25% Non-Cumulative Preference Shares, Series A (the “Series A Preference Shares”), 7.125% Non-Cumulative Preference Shares, Series C (the “Series C Preference Shares”) and 6.700% Non-Cumulative Preference Shares, Series D (the “Series D Preference Shares” and, together with the Series A Preference Shares and the Series C Preference Shares, the “Preference Shares”) for its common shares, $0.01 par value per share (the “Common Shares”), on December 27, 2022 (the “Exchange Date”). Holders of Preference Shares of each series received, for each Preference Share held, three Common Shares with the value of each Preference Share so exchanged being equal to three times the price that is the lower of: (i) the closing price of the Common Shares (as reflected on Nasdaq.com) immediately preceding the Exchange Date; or (ii) the average closing price of the Common Shares (as reflected on Nasdaq.com) for the five trading days immediately preceding the Exchange Date (the “Exchange”). Such Common Shares are listed for trading on the NASDAQ Capital Market under the symbol “MHLD.”

As a result of the Exchange, the Preference Shares were delisted from the New York Stock Exchange on the Exchange Date. No Preference Shares are issued or outstanding, and the Preference Shares were deregistered under the Securities Exchange Act of 1934, as amended. In addition, all rights of the former holders related to ownership of the Preference Shares terminated.

The Preference Shares were and the Common Shares are held in book-entry through the Depository Trust Company (“DTC”). The Exchange occurred in accordance with the procedures of DTC. Questions relating to the Exchange should be directed to the American Stock Transfer & Trust Company, LLC, the Company’s transfer agent, at 6201 15th Ave., Brooklyn, New York 11219, 1-(800) 937-5449.

THIS PRESS RELEASE IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT AN OFFER OR SOLICITATION TO PURCHASE SECURITIES.

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed in 2007. Maiden creates shareholder value by actively managing and allocating our assets and capital, including through ownership and management of businesses and assets mostly in the insurance and related financial services industries where we can leverage our deep knowledge of those markets. Maiden also provides a full range of legacy services to small insurance companies, particularly those in run-off or with blocks of reserves that are no longer core, working with clients to develop and implement finality solutions including acquiring entire companies that enable our clients to meet their capital and risk management objectives.

Forward-Looking Statements

This press release includes forward-looking statements. These forward-looking statements include general statements both with respect to us and the insurance industry and generally are identified with the words “anticipate,” “believe,” “expect,” “predict,” “estimate,” “intend,” “plan,” “project,” “seek,” “potential,” “possible,” “could,” “might,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. In light of the risks and uncertainties inherent in all forward-looking statements, the inclusion of such statements contained or incorporated by reference herein should not be considered as a representation by us or any other person that our objectives or plans or other matters

described in any forward-looking statement will be achieved. These statements are based on current plans, estimates, assumptions and expectations. Actual results may differ materially from those projected in such forward-looking statements and therefore, you should not place undue reliance on them.

Contact

FGS Global

Maiden@fgsglobal.com

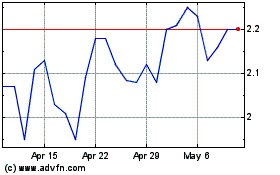

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From May 2024 to Jun 2024

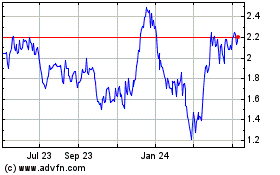

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Jun 2023 to Jun 2024