Maiden Holdings Selling First US Bond, A $75 Million Issue

June 16 2011 - 4:14PM

Dow Jones News

Maiden Holdings North America Ltd., an affiliate of

Bermuda-based reinsurance company Maiden Holdings Ltd. (MHLD), came

to market Thursday with its inaugural U.S. debt offering.

The $75 million issue, which is targeted at individual or

"retail" investors, is guaranteed by Maiden Holdings, according to

a prospectus.

Neither the issuer nor the parent company has been in the U.S.

investment-grade debt markets before, according to data provider

Dealogic. Maiden Holdings is unrelated to the Maiden Lane vehicles

housing mortgage bonds and other risky securities created by the

Federal Reserve Bank of New York.

Bank of America Merrill Lynch is sole bookrunner on the sale,

which is scheduled to price late Thursday or Friday.

Proceeds from the offering will be used to buy back a batch of

trust preferred securities, or TRUPs, issued by Maiden Capital

Financing Trust in January 2009.

The new unsecured debt, which matures in 30 years and is

expected to be rated BBB-minus by Standard & Poor's, is

callable by Maiden Holdings North America after five years at par.

They can also be redeemed by the issuer after "certain tax events,"

according to the prospectus, which include amendments to tax

laws.

The notes are expected to price to yield around 8.25%, according

to a person familiar with the offering.

Comparable debt includes bonds due 2040 issued by rival

reinsurer Validus Group, now yielding 8.30%, the person familiar

added.

Maiden Holdings, formed in 2007, provides reinsurance solutions

to American and European insurers, focusing on non-catastrophe

inland marine and property coverage.

The company reported global revenues of $1.2 billion in 2010 and

a net income of $19.3 million in the first quarter of 2011.

-By Nicole Hong, Dow Jones Newswires; 212-416-3760;

nicole.hong@dowjones.com

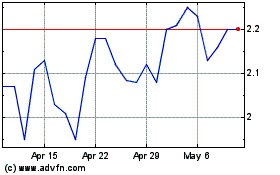

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From May 2024 to Jun 2024

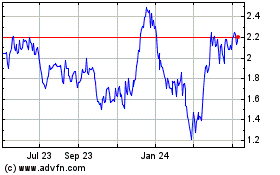

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Jun 2023 to Jun 2024