Lifeway Beats, Initiates Dividend - Analyst Blog

May 16 2012 - 4:30AM

Zacks

Lifeway Foods

Inc.(LWAY) posted earnings of 7 cents per share in the

first quarter of 2012, edging out the Zacks Consensus Estimate by a

penny, but lagging the year-ago quarter earnings of 12 cents per

share. The better-than-expected results were attributable to

double-digit top-line growth.

Lifeway Foods primarily engages in

manufacturing dairy and non-dairy health food products. The company

reported gross sales of $21.6 million in the quarter, up 13.0% year

over year. The upside in revenue was attributable to higher sales

and increased customer acceptance for its flagship product Kefir as

well as other product lines including Bio Kefir and ProBugs organic

Kefir for kids.

During the quarter, gross profit

slipped 11% year over year to $6.8 million and gross margin

contracted 800 basis points (bps) to 35%, attributed to a 30% surge

in transportation cost arising from higher fuel prices and freight

expense and a 20% hike in the cost of milk, the most crucial

ingredient for the company.

Operating expense jumped 13% year

over year to $4.9 million during the quarter, due to higher

selling, general and administrative expenses particularly related

to increased investment in marketing and advertising for brand

awareness. The upside was partially offset by dip in amortization

expense.

Operating income of the company

fell 43% to $1.9 million due to an upside in operating expenses and

drop in gross margin.

The company recently inked a deal

with Target to triple the distribution of its kefir line in Target

stores as well as add new Lifeway products to Target's dairy

cases.

Financial

Position

As of March 31, 2012, Lifeway Foods

had cash and cash equivalents of $0.8 million versus $1.1 million

at December 31, 2012. During the quarter, net cash provided by

operating activities was up $0.4 million to $1.5 million and

shareholders’ equity increased $1.6 million to $36.3

million.

The Morton Grove, Illinois-based

company also remains focused on boosting shareholder value. Lifeway

has initiated an annual cash dividend of 7 cents per share, payable

on June 29, 2012 to shareholders of record as of May 30, 2012.

Our Take

Morton Grove, Illinois-based

Lifeway reported better-than-expected results and continues to

focus on distribution of its Kefir line, which is Lifeway's

flagship product in both domestic and international markets. The

recent agreement with Target is encouraging as the deal will

bolster sales at the retail chain as well as increase awareness

with Target customers. Management remains optimistic for 2012 and

committed to expanding its business and enhancing shareholder

value. The price of milk is also easing out, but higher freight and

fuel costs will continue to be headwind in 2012. Hence, we expect

estimates to go up in the coming days. The Zacks Consensus

Estimates for 2012 and 2013 are pegged at 26 cents and 30 cents a

share, respectively.

Lifeway, which competes with

Dean Foods Co. (DF), currently retains a Zacks #5

Rank, which translates into a short-term Strong Sell rating. We are

also maintaining our long-term Underperform recommendation on the

stock.

DEAN FOODS CO (DF): Free Stock Analysis Report

LIFEWAY FOODS (LWAY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

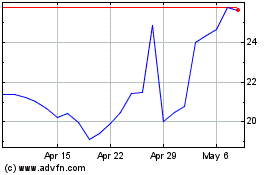

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

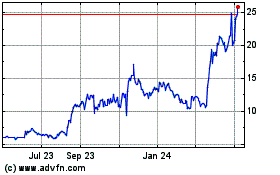

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Jul 2023 to Jul 2024