For Immediate Release

Chicago, IL – December 16, 2011 – Zacks.com announces the list

of stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Lam Research Corp

(LRCX), Novellus Systems Inc (NVLS),

Applied Materials (AMAT), ASML Holding

NV (ASML) and Texas Instruments

(TXN).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Thursday’s Analyst

Blog:

Lam Reaches Out for Novellus

Lam Research Corp (LRCX) will be buying

Novellus Systems Inc (NVLS) for $3.3 billion in

exchange for its shares. Specifically, Novellus shareholders will

get 1.125 shares of Lam stock for each Novellus share, or roughly a

28.0% premium based on Lam’s closing prices yesterday.

The agreement gives Lam shareholders a 59% share of the combined

entity, which will continue to be called Lam Research Corp. The

remaining 41% will go to Novellus shareholders.

Lam will also spend around $1.6 billion for share repurchases

over the next year utilizing the existing domestic cash balances of

both companies. This system is more beneficial for Novellus

shareholders, as it makes the distribution tax-free. It is also

positive for Lam, since it would not have to fork out any cash

right away (as could have been the case if it was a cash-and-stock

purchase).

Why It Makes Sense

The transaction, which is expected to close in the second

quarter of 2012 subject to statutory closing conditions and

shareholder approval of both companies, is a no-brainer, since the

companies complement each other in many respects.

Most importantly, they sell complementary front-end equipment.

Novellus specializes in thin-film deposition and surface

preparation equipment, while Lam is a leading provider of etching

and cleaning equipment.

Semiconductor manufacturing refers to the deposition of several

layers of materials on a silicon wafer in specific patterns using

photomasks, or reticles (held down like a stencil). However,

after the deposition of each layer, the excess material deposited

is etched (or “cleaned”) away and the remaining material is exposed

in a manner that changes the chemical properties of the wafer.

Therefore, after the merger, Lam’s product line would be

considerably broader, taking care of a greater portion of key

semiconductor manufacturing processes.

Combining resources would also be beneficial for the R&D

teams, which could put their heads together to develop solutions

for 450mm wafers and three dimensional chip architectures. A focus

on advanced technologies is a must in the current environment,

where newer generations of computing devices and phones are

increasing chip complexities, while growing demand from emerging

countries is a constant pressure to lower costs.

Naturally, the combination would also enable significant

cross-selling opportunities for both Novellus and Lam sales teams,

helping to drive penetration at existing customer accounts.

In addition to these advantages, the merged company would be

able to eliminate $100 million in costs a year (starting from the

fourth quarter of 2013). The companies have also stated that the

transaction would be accretive to non GAAP earnings within the

first year after the deal closes.

Lam’s competitive position also improves, with the company now

moving to the fourth spot among semi equipment makers, behind

Applied Materials (AMAT), Tokyo Electron and

ASML Holding NV (ASML).

Consolidations Galore

There have been a number of big consolidations in the

semiconductor sector in recent times and we are reminded of Applied

Material’s acquisition of Varian Semiconductor and Texas

Instruments’ (TXN) takeover of National Semiconductor.

We think that the primary concern for semiconductor companies is

the uncertain economic climate and weak consumer spending that has

increased the need for cost control. For example, in the last

reported quarter, Lam and Novellus saw their profits shrinking 63%

and 30%, respectively. The fact that this concern has also kept a

lid on prices is a bonus, because it means that acquiring companies

have to pay relatively less.

For equipment makers, the outlook is decidedly murky, with

Gartner projecting a 23% decline in wafer fabrication equipment in

2012, following an expected 10% increase this year.

To Summarize

Lam and Novellus have entered into a mutually beneficial

agreement in particularly trying times. We believe that the deal

makes sense because synergies look significant right now. Also,

considering the fact that the premium is not too high, Lam

shareholders are likely to approve.

The fact that it is a tax-free distribution is likely to appeal

to Novellus shareholders. Since the combined entity strengthens

competition, legal hurdles are also likely to be limited.

Therefore, the deal should go through smoothly.

Both Lam Research and Novellus have a Zacks Rank of #3,

translating into a Hold rating in the near term (1-3 months).

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

APPLD MATLS INC (AMAT): Free Stock Analysis Report

ASML HOLDING NV (ASML): Free Stock Analysis Report

LAM RESEARCH (LRCX): Free Stock Analysis Report

NOVELLUS SYS (NVLS): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

Zacks Investment Research

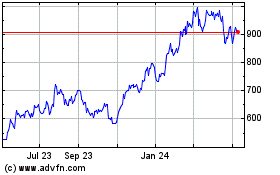

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From May 2024 to Jun 2024

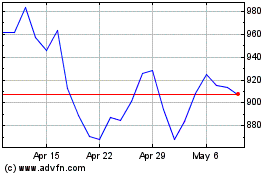

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2023 to Jun 2024