MORNING UPDATE: brokersXpress, LLC Issues Alerts for EBAY, BK, NXTL, LRCX, and NITE

July 21 2005 - 11:54AM

PR Newswire (US)

MORNING UPDATE: brokersXpress, LLC Issues Alerts for EBAY, BK,

NXTL, LRCX, and NITE CHICAGO, July 21 /PRNewswire/ --

brokersXpress, LLC issues the following Morning Update at 8:30 AM

EDT with new PriceWatch Alerts for key stocks. Before the open...

PriceWatch Alerts for EBAY, BK, NXTL, LRCX, and NITE, Market

Overview, Today's Economic Calendar, and the Quote Of The Day.

QUOTE OF THE DAY "The significant rise in purchases of homes for

investment since 2001 seems to have charged some regional markets

with speculative fever." -- Alan Greenspan, Chairman, Federal

Reserve New PriceWatch Alerts for EBAY, BK, NXTL, LRCX, and NITE...

PRICEWATCH ALERTS - HIGH RETURN COVERED CALL OPTIONS ----------- --

eBay Inc. (NASDAQ:EBAY) Last Price 34.87 - AUG 35.00 CALL OPTION@

$1.60 -> 5.2 % Return assigned* -- Bank of New York Co. Inc.

(NYSE:BK) Last Price 31.25 - JAN 30.00 CALL OPTION@ $2.45 -> 4.2

% Return assigned* -- NEXTEL Communications, Inc. (NASDAQ:NXTL)

Last Price 33.03 - NOV 32.50 CALL OPTION@ $1.95 -> 4.6 % Return

assigned* -- Lam Research Corp. (NASDAQ:LRCX) Last Price 32.55 -

DEC 30.00 CALL OPTION@ $4.30 -> 6.2 % Return assigned* -- Knight

Trading Group, Inc. (NASDAQ:NITE) Last Price 7.84 - OCT 7.50 CALL

OPTION@ $0.65 -> 4.3 % Return assigned* * To learn more about

how to use these alerts and for our FREE report, "The 18 Warning

Signs That Tell You When To Dump A Stock", go to:

http://www.investorsobserver.com/mu18 (Note: You may need to copy

the link above into your browser then press the [ENTER] key) **

FREE Access to the Market Intelligence Center where you will find

the news, insight and intelligence that can make a difference in

the way you invest, go to: http://www.investorsobserver.com/FreeMIC

NOTE: All stocks and options shown are examples only. These are not

recommendations to buy or sell any security. NEWS LEADERS AND

LAGGARDS So far today, Whirlpool, Office Depot Inc., and

Caterpillar lead the list of companies with the most news stories

while Hershey Foods and D R Horton are showing a spike in news.

eBay, Coca-Cola Co., and Allstate have the highest srtIndex scores

to top the list of companies with positive news while Unocal and

Delta Air Lines lead the list of companies with negative news

reports. Qualcomm has popped up with a high positive news sraIndex

score. For the FREE article titled, "Earnings Season Decoded - An

Essential 15 Point Checklist For Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Overseas markets are bullish this morning as 13 of the 15 markets

that we track are in the green. The Nikkei slipped by a fraction of

a percent but the other Asian markets closed with gains. In Europe,

Finland is currently the only laggard while the DAX is ahead nearly

one percent. The August contract on sweet crude oil dropped 74

cents yesterday, finishing its last day as the lead contract on a

sour note. The September contract, which now takes the lead, didn't

fare much better, giving back 67 cents to close at $58.02.

Prompting the decline on the day was a smaller- than-expected drop

in crude oil inventories. For the record, The Department of Energy

(DOE) reported that crude inventories fell by 900,000 barrels to

320.1 million in the latest week, while analysts were predicting a

drop of up to 3.0 million barrels. In early trading, crude for

September delivery rose back above $59 per barrel as Hurricane

Emily is set to make landfall today. Be prepared for the investing

week ahead with Bernie Schaeffer's FREE Monday Morning Outlook. For

more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES Wednesday marked what could be Federal Reserve

chairman Alan Greenspan's last ever semi-annual address to Congress

before the 79-year old retires at the end of January 2006. But

judging from the broad smile Greenspan wore as he left, it appears

he's happy with the direction America is taking as he enters the

final months of his tenure. Part of his pleasure comes from his

assertion that US economic growth is solid and firmly on track for

more upside - 3.5% GDP growth, according to the Fed's latest

forecast. Consequently, the bankers will proceed with their

interest rate hiking policy for the foreseeable future. However,

Greenspan does cite "significant uncertainties" stemming from high

energy costs and the stubborn refusal of long-term interest rates

to rise in line with interest rate increases. Greenspan says the

decline in long-term Treasury bond rates is "without precedent" and

poses a threat to long-term growth, while also warning that the

country's housing market could come under some pressure. A

substantial part of the reason for that lies with Greenspan himself

and his rest of his Fed team. By lowering interest rates to 1%, it

sparked an enormous spate of borrowing and refinancing. It's much

different these days, though, with the Fed reversing its strategy.

According to a Merrill Lynch survey of 300 global fund managers,

the consensus forecast for interest rates is 4% before the Fed

calls a halt to its monetary tightening. This is the so-called

"neutral level" viewed by many as one that keeps the economy

humming, while also containing inflationary pressures. Read more

analysis from the 247Profits Group every trading day with the FREE

247Profits e-Dispatch, featuring insightful economic commentary,

profitable investment recommendations, and full access to a leading

team of financial experts. Register for free here:

http://www.247profits.com/enter.html TODAY'S ECONOMIC CALENDAR 8:30

a.m. Jobless Claims 10:00 a.m. June Conference Board Leading

Economic Indicators 10:00 a.m. Fed Chairman Greenspan presents the

semiannual report on monetary policy to the U.S. Senate Banking

Committee in Washington 10:00 a.m. DJ-BTM Business Barometer 10:00

a.m. June Chicago Fed National Activity Index 12:00 a.m. July

Philadelphia Fed Business Index 1:30 p.m. Fed Gov Kohn speaks on

monetary policy at the Fed's risk management conference 2:00 p.m.

FOMC minutes 4:30 p.m. Money Supply The Mankus-Lavelle Group is an

independent brokerage branch of brokersXpress, LLC, a wholly owned

subsidiary of optionsXpress Holdings, Inc. The Mankus-Lavelle Group

has some of the most experienced, respected options professionals

in the industry. Both novice option investors and experienced

traders are attracted to MLG. Less experienced investors appreciate

Mankus- Lavelle Group's friendly expert guidance while more

seasoned investors value Mankus-Lavelle Group's highly trained

staff of option experts. To improve your understanding of options

get a free option kit at: http://www.mlgos.com/. If you are

familiar with stock investing but not sure what options can do for

you, call 1-800-230-5570 for a FREE 3-point portfolio check up.

Securities offered through brokersXpress, LLC Member NASD/SPIC.

Corporate Office: 39 South LaSalle Street o Suite 220 o Chicago,

Illinois 60603-1608 brokersXpress(SM) is the online broker-dealer

for independent reps and advisors. Powered by the award-winning

technology of optionsXpress(R), its parent company, brokersXpress

provides a leading-edge trading platform particularly powerful for

reps and advisors who employ option strategies. For more

information on how partnering with brokersXpress can empower your

business to new levels, contact us confidentially by e-mail at .

Member NASD/SPIC. CRD# 127081 This Morning Update was prepared with

data and information provided by: InvestorsObserver.com - Better

Strategies for Making Money -> For Investors With a Sense of

Humor. Only $1 for your first month plus seven free bonuses worth

over $420, see: http://www.investorsobserver.com/must Quote.com

QCharts- Real time quotes and streaming technical charts to keep

you up with the market. Analyze, predict, and stay ahead. For a

Free 30 day trial go to: http://www.investorsobserver.com/MUQuote2

247profits.com: You'll get exclusive financial commentary, access

to a global network of experts and undiscovered stock alerts.

Register NOW for the FREE 247profits e-Dispatch. Go to:

http://www.investorsobserver.com/TPA Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Michael at 800-230-5570 or

at http://www.cboe.com/Resources/Intro.asp. Privacy policy

available upon request. DATASOURCE: brokersXpress, LLC CONTACT:

Mike Lavelle of Mankus-Lavelle Group, +1-800-230-5570

Copyright

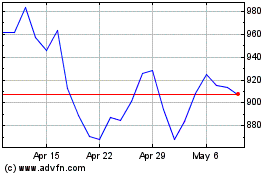

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

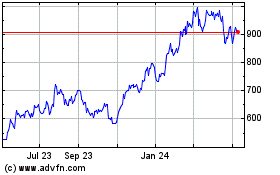

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2023 to Jul 2024