0001762239

false

0001762239

2023-08-17

2023-08-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 17, 2023 (August 12, 2023)

Kaival Brands Innovations Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

000-56016 |

83-3492907 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

4460 Old Dixie Highway

Grant-Valkaria, Florida 32949

(Address of principal executive office, including zip

code)

Telephone: (833) 452-4825

(Registrant’s telephone number, including area

code)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

KAVL |

The Nasdaq Stock Market, LLC |

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On

August 12, 2023, Kaival Brands Innovations Group, Inc. (the “Company”) executed and entered into a Deed of Amendment No. 1

(the “PMI License Amendment”) with Philip Morris Products S.A. (“PMPSA”),

Bidi Vapor LLC (“Bidi Vapor”) and Kaival Brands International, LLC, a wholly-owned subsidiary of the Company (“KBI”).

The PMI License Amendment amends provisions of that certain Deed of Licensing Agreement, dated June 13, 2022, by and between KBI and PMPSA

(the “PMI Licensing Agreement”), Pursuant to the PMI Licensing Agreement, KBI granted PMPSA an exclusive irrevocable sublicense

to use certain intellectual property owned by Bidi Vapor and licensed to KBI (the “Intellectual Property”) to make, distribute,

and sell disposable nicotine e-cigarettes products based on the Intellectual Property (the “Products”) in certain international

markets set forth in the PMI Licensing Agreement (the “PMI Markets”). As of July 31, 2023, PMI has launched commercial

efforts related to the Products in 13 markets in addition to a number of duty free locations.

Pursuant

to the PMI License Amendment (which has an effective date of June 30, 2023), the following material

changes have been made to the PMI License Agreement:

1 Royalty

Rate. The royalty paid by PMPSA to KBI will no longer be based on sales price of the Product being sold, but rather on the volume

of liquid contained within Product being sold. The royalty will be on a sliding scale of between $0.08 to $0.10 per sale based on the

volume of liquid contained in the Product, increasing to between $0.10 to $0.20 per sale upon meeting certain sales milestones. For purposes

of determining aggregate sales threshold, all sales undertaken since commencement of the PMI Licensing Agreement will be counted.

2. Elimination

of Certain Potential Royalty Adjustments. Certain potential adjustments to the royalties receivable by

KBI as provided for in the PMI License Agreement have been eliminated with a view towards streamlining the royalty calculation and payment

process. The Company believes that these modifications to the PMI License Agreement will make royalty payments to KBI more predicable

going forward, assuming sales of the Products are achieved.

3. Guaranteed

Royalty. The guaranteed royalty payment owed to KBI under the PMI License Agreement has been eliminated. Instead, royalties will be

paid on a quarterly basis going-forward based on actual sales. Any unpaid guaranteed royalty has been cancelled.

4. Insurance

Tail Requirements. KBI’s requirement to keep certain tail insurance after the expiration or termination of the PMI Licensing

Agreement was reduced from 6 years to 2 years, thus reducing KBI’s expenses.

5. Markets.

The identification of the PMI Markets that PMI may enter has been expanded to cover certain additional territories.

6. Net

Reconciliation Payment to KBI and Forward-Looking Projected Royalty Payments. As a result of the changes to the PMI License

Agreement described in paragraphs 1 thought 3 above, the value of such changes will be calculated and reconciled as of the date of

commencement of the PMI Licensing Agreement through June 30, 2023, and a reconciliation payment will be paid by August 31, 2023. The

Company expects to receive a reconciliation payment from PMPSA of approximately $135,000 pursuant to this provision. Furthermore,

the Company and KBI project approximately $300,000 in additional royalties to be earned through the end of 2023.

The

above description of the PMI License Amendment does not purport to be complete and are qualified in their entirety by the full text of

such documents, which the Company intends to file as an exhibit to its Quarterly Report on Form 10-Q for the quarter ended July 31, 2022.

On August 17, 2023, the Company

issued a press release announcing Amendment No. 1 to the PMI Licensing Agreement. The full text of the press release is furnished as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

This Current Report and any statements

of the Company’s management and partners related to the subject matter hereof includes statements that constitute “forward-looking

statements” (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended), which are statements other than historical facts. You can identify forward-looking statements by words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “position,” “should,” “strategy,” “target,”

“will,” and similar words. All forward-looking statements speak only as of the date of this Current Report. Although the Company

believes that the plans, intentions, and expectations reflected in or suggested by the forward-looking statements are reasonable, there

is no assurance that these plans, intentions, or expectations will be achieved. Therefore, actual outcomes and results (including, without

limitation, the anticipated benefits to the Company of the PMI License Amendment, including the Company’s anticipations about potential

royalties receivable from PMPSA as described herein) could materially and adversely differ from what is expressed, implied, or forecasted

in such statements. The Company and PMPSA’s businesses may be influenced by many factors that are difficult to predict, involve

uncertainties that may materially affect results, and are often beyond the control of the parties. Factors that could cause or contribute

to such differences include, but are not limited to: (i) future actions by the FDA or its non-U.S. equivalents with respect to the Company’s

or PMPSA’s products, (ii) the outcome of FDA’s scientific review of Bidi Vapor’s pending FDA Premarket Tobacco Product

Applications, (iii) the results of international marketing and sales efforts by PMPSA, (iv) how quickly domestic and international markets

adopt the Company’s products, (v) the scope of future regulatory activity in the ENDS industry, (vi) general economic uncertainty

in key global markets and a worsening of global economic conditions or low levels of economic growth, (vii) circumstances or developments

that may make the Company or PMPSA unable to implement or realize anticipated benefits, or that may increase the costs, of our current

and planned business initiatives, (viii) significant changes in the Company’s relationship with PMPSA or other distributors or sub-distributors

and (ix) other factors detailed by the Company in our public filings with the Securities and Exchange Commission, including the disclosures

under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended October 31, 2022, filed with

the Securities and Exchange Commission on January 27, 2023 and accessible at www.sec.gov. All forward-looking statements included

in this Current Report are expressly qualified in their entirety by such cautionary statements. Except as required under the federal securities

laws and the Securities and Exchange Commission’s rules and regulations, we do not have any intention or obligation to update any

forward-looking statements publicly, whether as a result of new information, future events, or otherwise.

| Item 9.01 |

Financial

Statements and Exhibits. |

| (d) |

Exhibits |

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

Kaival Brands Innovations Group, Inc. |

| |

|

|

| Dated: August 17, 2023 |

By: |

/s/ Eric Mosser |

| |

|

Eric Mosser |

| |

|

Chief Executive Officer and President |

Exhibit 99.1

Kaival Brands Amends Agreement

with Phillip Morris International for Distribution of ENDS Products

GRANT-VALKARIA, Fla., August 17, 2023 /Globenewswire/

-- Kaival Brands Innovations Group, Inc. (NASDAQ: KAVL) ("Kaival Brands," the "Company" or "we,” “our”

or similar terms), the exclusive distributor of all products manufactured by Bidi Vapor, LLC ("Bidi Vapor"), including the BIDI®

Stick electronic nicotine delivery system (ENDS), which are intended for adults 21 and over, today announced that its wholly-owned subsidiary,

Kaival Brands International, LLC (“KBI”), has amended its agreement with Philip Morris Products S.A. (“PMPSA”),

a wholly owned affiliate of Philip Morris International Inc. (“PMI”) (NYSE: PM), for the development and distribution of electronic

nicotine delivery system (“ENDS”) products in markets outside of the U.S.

Eric Mosser, Chief Executive Officer of Kaival Brands,

stated, "With more than a year of operational history for KBI and given the recent changes to regulations in international markets,

it became clear that there were a number of opportunities to improve the terms of the original licensing agreement and reduce the burden

of administering it. We are extremely pleased to reach an agreement that shall enable us to achieve our objectives. The revised licensing

agreement simplifies the payment structure resulting in cost savings of approximately $2.7 million for the Company over the lifetime of

the license agreement. It also enables better predictability and forecasting for KBI and streamlines data reporting. Finally, we anticipate

that the acceleration of royalty payments will be a net positive to our financial performance over the duration of the agreement.”

Under the terms of the amended agreement, the parties

agreed to revise certain terms, which provide for, among other things, a fixed pricing structure with volume-driven increases and a recapture

of non-recurring engineering costs by KBI.

Accordingly, the Company expects a reconciliation

payment of approximately $135,000. Furthermore, the Company projects approximately $300,000 in additional royalties to be earned through

the end of 2023.

Additional information regarding this amendment will

be provided in a Current Report on Form 8-K being filed by Kaival Brands with the Securities and Exchange Commission.

ABOUT KAIVAL BRANDS

Based in Grant-Valkaria, Florida, Kaival Brands is

a company focused on incubating innovative and profitable adult-focused products into mature and dominant brands, with a current focus

on the distribution of electronic nicotine delivery systems (ENDS) also known as “e-cigarettes”. Our business plan is to seek

to diversify into distributing other nicotine and non-nicotine delivery system products (including those related to hemp-derived cannabidiol

(known as CBD) products). Kaival Brands and Philip Morris Products S.A. (via sublicense from Kaival Brands) are the exclusive global distributors

of all products manufactured by Bidi Vapor.

Learn more about Kaival Brands at https://ir.kaivalbrands.com/overview/default.aspx.

ABOUT KAIVAL LABS

Based in Grant-Valkaria, Florida, Kaival Labs is a

100% wholly-owned subsidiary of Kaival Brands focused on developing new branded and white-label products and services in the vaporizer

and inhalation technology sectors. Kaival Labs’ current patent portfolio consists of 12 existing and 46 pending with novel technologies

across extrusion dose control, product preservation, tracking and tracing usage, multiple modalities and child safety. The patents and

patent applications cover territories including the United States, Australia, Canada, China, the European Patent Organisation, Israel,

Japan, Mexico, New Zealand and South Korea. The portfolio also includes a fully-functional proprietary mobile device software application

that is used in conjunction with certain patents in the portfolio.

Learn more about Kaival Labs at https://kaivallabs.com.

ABOUT BIDI VAPOR

Based in Melbourne, Florida, Bidi Vapor maintains

a commitment to responsible, adult-focused marketing, supporting age-verification standards and sustainability through its BIDI®

Cares recycling program. Bidi Vapor's premier device, the BIDI® Stick, is a premium product made with high-quality components,

a UL-certified battery and technology designed to deliver a consistent vaping experience for adult smokers 21 and over. Bidi Vapor is

also adamant about strict compliance with all federal, state and local guidelines and regulations. At Bidi Vapor, innovation is key to

its mission, with the BIDI® Stick promoting environmental sustainability, while providing a unique vaping experience to

adult smokers.

Nirajkumar Patel, the Company’s Chief Science

and Regulatory Officer and director, owns and controls Bidi Vapor. As a result, Bidi Vapor is considered a related party of the Company.

For more information, visit www.bidivapor.com.

Cautionary Note Regarding Forward-Looking Statements

This press release and any statements of the Company’s

management and partners related to the subject matter hereof includes statements that constitute “forward-looking statements”

(as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended),

which are statements other than historical facts. You can identify forward-looking statements by words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “position,” “should,” “strategy,” “target,”

“will,” and similar words. All forward-looking statements speak only as of the date of this press release. Although the Company

believes that the plans, intentions, and expectations reflected in or suggested by the forward-looking statements are reasonable, there

is no assurance that these plans, intentions, or expectations will be achieved. Therefore, actual outcomes and results (including, without

limitation, the anticipated benefits to the Company of the PMI License Amendment, including the Company’s anticipations about potential

royalties receivable from PMPSA as described herein) could materially and adversely differ from what is expressed, implied, or forecasted

in such statements. The Company and PMPSA’s businesses may be influenced by many factors that are difficult to predict, involve

uncertainties that may materially affect results, and are often beyond the control of the parties. Factors that could cause or contribute

to such differences include, but are not limited to: (i) future actions by the FDA or its non-U.S. equivalents with respect to the Company’s

or PMPSA’s products, (ii) the outcome of FDA’s scientific review of Bidi Vapor’s pending FDA Premarket Tobacco Product

Applications, (iii) the results of international marketing and sales efforts by PMPSA, (iv) how quickly domestic and international markets

adopt the Company’s products, (v) the scope of future regulatory activity in the ENDS industry, (vi) general economic uncertainty

in key global markets and a worsening of global economic conditions or low levels of economic growth, (vii) circumstances or developments

that may make the Company or PMPSA unable to implement or realize anticipated benefits, or that may increase the costs, of our current

and planned business initiatives, (viii) significant changes in the Company’s relationship with PMPSA or other distributors or sub-distributors

and (ix) other factors detailed by the Company in our public filings with the Securities and Exchange Commission, including the disclosures

under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended October 31, 2022, filed with

the Securities and Exchange Commission on January 27, 2023 and accessible at www.sec.gov. All forward-looking statements included in this

press release are expressly qualified in their entirety by such cautionary statements. Except as required under the federal securities

laws and the Securities and Exchange Commission’s rules and regulations, we do not have any intention or obligation to update any

forward-looking statements publicly, whether as a result of new information, future events, or otherwise.

Kaival Brands Investor Relations:

Brett Maas, Managing Partner

Hayden IR

(646) 536-7331

brett@haydenir.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

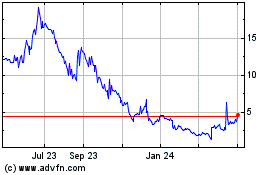

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

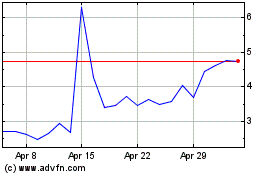

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024