Kaiser Aluminum Posts Reduced Energy Surcharge for October

September 29 2008 - 8:00AM

Business Wire

Kaiser Aluminum (NASDAQ:KALU) today announced that the applicable

energy surcharge for October shipments of fabricated products will

be: 6xxx alloys: � $0.019 per pound All other alloys: $0.029 per

pound This is a reduction from the September surcharge of $0.040

per pound for 6xxx alloys and $0.056 for all other alloys. The

reduction in the surcharge was driven by lower natural gas and

diesel prices. The surcharges are based on a calculation tied to

indices provided by the U.S. Department of Energy and are updated

on a monthly basis. Customers can view the formulas for calculating

surcharges on the Kaiser Aluminum Web site at

www.kaiseraluminum.com. Up-to-date information on how these

surcharges impact specific products are also included on the site.

Kaiser Aluminum, headquartered in Foothill Ranch, Calif., is a

leading producer of fabricated aluminum products, serving customers

worldwide with highly-engineered solutions for aerospace and

high-strength, general engineering, and custom automotive and

industrial applications. The company�s North American facilities

annually produce more than 500 million pounds of value-added sheet,

plate, extrusions, forgings, rod, bar and tube products, adhering

to traditions of quality, innovation and service that have been key

components of our culture since the company was founded in 1946.

The company�s stock is included in the Russell 2000� index. For

more information, please visit www.kaiseraluminum.com. F-1103

Certain statements in this release relate to future events and

expectations and, as a result, constitute forward-looking

statements involving known and unknown risks and uncertainties that

may cause actual results, performance or achievements of the

company to be different from those expressed or implied in the

forward-looking statements. Important factors that could cause

actual results to differ materially from those in the

forward-looking statements include: (a) the effectiveness of

management's strategies and decisions; (b) the ability of the

company to effectively recover higher costs; (c) the company�s

ability to reduce costs to mitigate inflationary pressure; (d)

adverse changes in economic or aluminum industry conditions

generally; (e) adverse changes in the markets served by the

company, including the aerospace, defense, general engineering,

automotive, distribution and other markets; (f) the company's

ability to leverage its technologies and the Kaiser Production

System methodology; and (g) the other risk factors summarized in

the company's Form 10-K for the year ended December 31, 2007 and

other reports filed with the Securities and Exchange Commission.

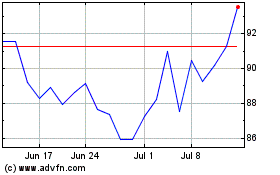

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From May 2024 to Jun 2024

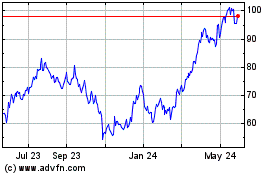

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Jun 2023 to Jun 2024