Kaiser Aluminum Reports Second Quarter 2008 Financial Results

August 06 2008 - 6:45PM

Business Wire

Kaiser Aluminum Corporation (NASDAQ:KALU) today reported net income

of $22.8 million for the second quarter 2008, compared to net

income of $34.7 million for the second quarter 2007. Earnings per

diluted share were $1.12 and $1.71 for the second quarter 2008 and

2007, respectively. For the six months ended June 30, 2008, the

company reported net income of $61.9 million, compared to $51.8

million for the same period in 2007. Earnings per diluted share

were $3.04 for the six months ended June 30, 2008 compared to $2.56

in the prior year period. Net income and earnings per diluted share

for the six months ended June 30, 2008 were favorably impacted by

unrealized gains on derivative transactions. �We continued to

experience robust demand for aerospace and defense products,� said

Jack A. Hockema, Chairman, President and CEO. �However our results

were negatively impacted by escalating energy related costs and

operating inefficiencies in our rod/bar value stream, which our

energy surcharge and our Kalamazoo initiative are intended to

address.� Consolidated net sales for the second quarter ended June

30, 2008 increased 7 percent to $413.5 million, compared to $385.1

million for the second quarter 2007. The increase primarily

reflects an 8 percent increase in shipments from the Fabricated

Products segment and an increase in Primary Aluminum realized

prices, partially offset by a reduction in Primary Aluminum

shipments due to the fire at Anglesey that significantly reduced

production in the latter half of June 2008. For the six months

ended June 30, 2008, consolidated net sales increased 5 percent to

$812.5 million compared to $777.3 million in the six months ended

June 30, 2007. The increase in net sales is primarily the result of

8 percent higher shipments, partially offset by a reduction in

average realized price from our Fabricated Products segment as well

as lower shipments in the Primary Aluminum segment. Operating

income on a consolidated basis for the second quarter decreased to

$38.0 million from $62.7 million in the prior year period

reflecting weaker results from both Fabricated Products and Primary

Aluminum segments. In addition, the second quarter of 2007

benefited from several non-run-rate gains recorded in the Corporate

segment. Operating income on a consolidated basis for the six

months ended June 30, 2008 increased to $106.1 million compared to

$95.0 million for the six months ended June 30, 2007, partly due to

significant unrealized mark-to-market gains on the company�s

derivative hedging contracts. Fabricated Products Operating income

in Fabricated Products was $42.9 million for the second quarter

2008 compared to $48.1 million in the prior-year period. Operating

income for the six months ended June 30, 2008 was $82.9 million

compared to $89.5 million for the same period in 2007. Operating

income for both the quarter and six months ended June 30, 2007

reflected record results in the Fabricated Products segment.

Operating income in 2008 for both the quarter and six month periods

reflect a favorable impact from an 8 percent increase in shipments,

which was more than offset by unfavorable energy related costs,

operating inefficiencies in the rod/bar value stream and higher

depreciation related to the commissioning of new production assets.

The six month period also was impacted by unfavorable currency

exchange rates and higher major maintenance expense. �We expect our

strong overall shipments trend to continue throughout the second

half 2008, driven by sustained strong aerospace and defense demand

for heat treat plate and other products,� said Mr. Hockema. �Our

new automotive programs and selected export opportunities are

anticipated to partially offset the weakness in domestic automotive

demand, and we anticipate the energy surcharge implemented as of

July 1st will begin to soften the negative impact of volatile

energy costs.� Primary Aluminum Operating income in Primary

Aluminum was $8.1 million for the second quarter 2008, compared to

$14.2 million for the second quarter 2007. The impact of higher

realized aluminum prices net of hedging was more than offset by

lower shipments as a result of the production outage at Anglesey in

June 2008, higher power costs, and the impact of unfavorable

currency exchange rates net of hedging. Operating income for the

six months ended June 30, 2008 was $48.7 million compared to $18.4

million in the prior year period, reflecting $34.1 million of

higher unrealized mark-to-market gains for metal and currency

derivatives. Additionally, the favorable impact of higher realized

prices was more than offset by lower volume due to the production

outage at Anglesey, higher power costs, and the net impact of

unfavorable currency exchange rates net of hedging. The first of

two potlines at Anglesey was restored to full production in late

July. Anglesey is anticipated to begin production on the second

potline in late August and be at full production by the end of

November. The company expects that Anglesey�s property damage and

business interruption insurance will cover financial losses of

Anglesey and its owners although the timing of insurance recoveries

is uncertain and could have a potentially significant impact on

quarterly results. Corporate Highlights The third and final phase

of the heat treat plate expansion program began as planned in June,

resulting in a scheduled production interruption on one heat treat

furnace to expand its capacity. The furnace is expected to be fully

operational by the end of 2008. Other projects are proceeding as

planned. The Kalamazoo facility is on track for completion by late

2009 and is expected to significantly improve the cost structure of

the rod/bar value stream. Additional planned outages are scheduled

in the third quarter of 2008 to install equipment upgrades at our

Los Angeles, Chandler and Tulsa operations. Major maintenance

expense related to planned projects is anticipated to result in

higher costs in Fabricated Products during the third quarter. The

company increased inventory during the second quarter (resulting in

higher working capital and lower cash from operations) to continue

to serve customers during the upcoming scheduled outages. The

company continues to maintain sufficient liquidity to support

expansion plans and strategic initiatives for profitable growth.

During the quarter the company announced a 33 percent increase in

its quarterly dividend to $0.24 per share and a $75 million share

repurchase program. Conference Call Kaiser Aluminum will host a

conference call on August 7, 2008 at 10:00am (Pacific Time) to

discuss second quarter 2008 results. To participate, call the

conference call line at 1-877-440-5785. A link to the simultaneous

web cast can be accessed on the company website at

http://investors.kaiseraluminum.com/events.cfm. A copy of a

presentation will be available for download prior to the start of

the call. An archive of the call will be available at the same

website location until September 7, 2008. Kaiser Aluminum,

headquartered in Foothill Ranch, Calif., is a leading producer of

fabricated aluminum products, serving customers worldwide with

highly-engineered solutions for aerospace and high-strength,

general engineering, and custom automotive and industrial

applications. The company�s North American facilities annually

produce more than 500 million pounds of value-added sheet, plate,

extrusions, forgings, rod, bar and tube products, adhering to

traditions of quality, innovation and service that have been key

components of our culture since the company was founded in 1946.

The company�s stock is included in the Russell 2000� index. For

more information, please visit www.kaiseraluminum.com. F-1101 This

press release contains statements based on management�s current

expectations, estimates and projections that constitute

�forward-looking statements� within the meaning of the Private

Securities Litigation Reform Act of 1995 involving known and

unknown risks and uncertainties that may cause actual results,

performance or achievements of the company to be materially

different from those expressed or implied. Kaiser Aluminum cautions

that such forward-looking statements are not guarantees of future

performance or events and involve significant risks and

uncertainties and that actual events may vary materially from those

expressed or implied in the forward-looking statements as a result

of various factors. These factors include: (a) changes in economic

or aluminum industry business conditions generally, including

global supply and demand conditions; (b) changes in the markets

served by the company, including aerospace, defense, general

engineering, automotive, distribution and other markets, including

changes impacting the volume, price or mix of products sold by the

company; (c) the company�s ability to complete its expansion and

other organic growth projects as planned and by targeted completion

dates; (d) the company�s ability to effectively address escalating

energy related costs and operating inefficiencies through

surcharges and other initiatives; (e) the company�s ability to meet

contractual commitments and obligations to supply products meeting

required specifications; (f) customer performance; (g) uncertainty

with respect to the future operation of Anglesey, including

Anglesey�s ability to successfully restore capacity and assert

insurance claims for the financial losses of Anglesey and its

owners resulting from the recent outage; (h) changes in competitive

factors in the markets served by the company; (i) developments in

technology used by the company, its competitors or its customers;

(j) changes in accounting that may affect the company�s reported

earnings, operating income or results; and (k) other risk factors

summarized in the company�s reports filed with the Securities and

Exchange Commission, including the company's Form 10-K for the year

ended December 31, 2007. As more fully described in these reports,

�non-run-rate� items are items that, while they may occur from

period to period, are particularly material to results, impact

costs primarily as a result of external market factors and may not

occur in future periods if the same level of underlying performance

were to occur. All information in this release is as of the date of

the release. The company undertakes no duty to update any

forward-looking statement to conform the statement to actual

results or changes in the company�s expectations. KAISER ALUMINUM

CORPORATION AND SUBSIDIARY COMPANIES � STATEMENTS OF CONSOLIDATED

INCOME (1) (2) (Unaudited) (In millions of dollars except share and

per share amounts) � � � Quarter Ended June 30, Six Months Ended

June 30, � 2008 � 2007 2008 � 2007 Net sales $ 413.5 � $ 385.1 � $

812.5 � $ 777.3 � Costs and expenses: Cost of products sold,

excluding depreciation 352.0 314.0 660.5 651.1 Depreciation and

amortization 3.7 2.7 7.2 5.3 Selling, administrative, research and

development, and general 19.7 19.2 38.5 38.2 Other operating

(benefits) charges, net � .1 � � (13.5 ) � .2 � � (12.3 ) Total

costs and expenses � 375.5 � � 322.4 � � 706.4 � � 682.3 �

Operating income 38.0 62.7 106.1 95.0 Other income (expense):

Interest expense (.3 ) (.6 ) (.5 ) (1.2 ) Other income (expense),

net � .6 � � 1.1 � � 1.2 � � 2.3 � Income before income taxes 38.3

63.2 106.8 96.1 Provision for income taxes � (15.5 ) � (28.5 ) �

(44.9 ) � (44.3 ) Net income $ 22.8 � $ 34.7 � $ 61.9 � $ 51.8 �

Earnings per share � Basic: Net income per share $ 1.14 � $ 1.73 �

$ 3.09 � $ 2.59 � Earnings per share � Diluted : Net income per

share $ 1.12 � $ 1.71 � $ 3.04 � $ 2.56 � Weighted average number

of common shares outstanding (000): Basic � 20,042 � � 20,013 � �

20,034 � � 20,007 � Diluted � 20,409 � � 20,237 � � 20,391 � �

20,209 � � (1)��The consolidated financial statements include the

statements of the Company and its wholly owned subsidiaries and a

49% interest in Anglesey Aluminium Limited (�Anglesey�), which owns

an aluminum smelter in the United Kingdom. � (2)��Please refer to

the Company�s Quarterly Report on Form 10-Q for the quarter ended

June 30, 2008 for additional detail regarding the items in the

table. KAISER ALUMINUM CORPORATION AND SUBSIDIARY COMPANIES �

SELECTED OPERATIONAL AND FINANCIAL INFORMATION (1) (2) (Unaudited)

(In millions of dollars except shipments and average realized

third-party sales price) � � Quarter Ended June 30, Six Months

Ended June 30, 2008 � 2007 2008 � 2007 Shipments (millions of

pounds): Fabricated Products 148.4 137.9 300.2 277.9 Primary

Aluminum � 36.8 � � 39.4 � � 73.8 � � 78.5 � 185.2 177.3 374.0

356.4 Average Realized Third Party Sales Price (per pound):

Fabricated Products $ 2.42 $ 2.40 $ 2.36 $ 2.41 Primary Aluminum $

1.48 $ 1.37 $ 1.41 $ 1.38 Net Sales: Fabricated Products $ 359.2 $

331.1 $ 708.4 $ 669.1 Primary Aluminum � 54.3 � � 54.0 � � 104.1 �

� 108.2 � Total Net Sales $ 413.5 $ 385.1 $ 812.5 $ 777.3 Segment

Operating Income: Fabricated Products $ 42.9 $ 48.1 $ 82.9 $ 89.5

Primary Aluminum 8.1 14.2 48.7 18.4 Corporate and Other (12.9 )

(13.1 ) (25.3 ) (25.2 ) Other Operating Benefits (Charges), Net �

(.1 ) � 13.5 � � (.2 ) � 12.3 � Total Operating Income $ 38.0 $

62.7 $ 106.1 $ 95.0 Net Income $ 22.8 $ 34.7 $ 61.9 $ 51.8 Capital

Expenditures, (net of change in accounts payable) $ 23.3 $ 20.3 $

38.3 $ 27.7 � (1)��The consolidated financial statements include

the statements of the Company and its wholly owned subsidiaries and

a 49% interest in Anglesey Aluminium Limited (�Anglesey�), which

owns an aluminum smelter in the United Kingdom. � (2)��Please refer

to the Company�s Quarterly Report on Form 10-Q for the quarter

ended June 30, 2008 for additional detail regarding the items in

the table. KAISER ALUMINUM CORPORATION AND SUBSIDIARY COMPANIES �

CONDENSED CONSOLIDATED BALANCE SHEETS (1) (2) (Unaudited) (In

millions of dollars) � � June 30, 2008 December 31, 2007 Assets

Current assets (3) 470.9 454.6 Investments in and advances to

unconsolidated affiliate 44.5 41.3 Property, plant, and equipment �

net 253.3 222.7 Net assets in respect of VEBAs 134.8 134.9 Deferred

tax assets � net 232.8 268.6 Other assets � 76.5 � � 43.1 � Total $

1,212.8 � $ 1,165.2 � Liabilities & Stockholders� Equity

Current liabilities 154.3 165.4 Long-term liabilities 57.5 57.0 �

Commitments and contingencies � Stockholders� equity: Common stock

.2 .2 Additional capital 953.2 948.9 Retained earnings 169.3 116.1

Common stock owned by Union VEBA subject to transfer restrictions,

at reorganization value (116.4 ) (116.4 ) Accumulative other

comprehensive income (loss) � (5.3 ) � (6.0 ) Total stockholders�

equity � 1,001.0 � � 942.8 � Total $ 1,212.8 � $ 1,165.2 � �

(1)��The consolidated financial statements include the statements

of the Company and its wholly owned subsidiaries and a 49% interest

in Anglesey Aluminium Limited (�Anglesey�), which owns an aluminum

smelter in the United Kingdom. � (2)��Please refer to the Company�s

Quarterly Report on Form 10-Q for the quarter ended June 30, 2008

for additional detail regarding the items in the table. �

(3)��Includes Cash and cash equivalents of $27.4 and $68.7,

Inventories of $238.2 and $207.6, and net Trade receivables of

$114.4 and $96.5 at June 30, 2008, and December 31, 2007,

respectively.

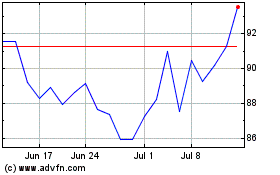

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From May 2024 to Jun 2024

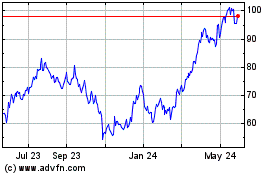

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Jun 2023 to Jun 2024