FALSE000178976900017897692024-02-122024-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 12, 2024

Instil Bio, Inc.

(Exact name of registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 001-40215 | 83-2072195 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| | |

3963 Maple Avenue, Suite 350 Dallas, Texas | | 75219 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(972) 499-3350

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.000001 par value | | TIL | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 12, 2024, Instil Bio, Inc. (the “Company”) entered into a 2024 Retention Bonus Agreement with each of Bronson Crouch, the Company’s Chief Executive Officer, and Sandeep Laumas, M.D., the Company’s Chief Financial Officer and Chief Business Officer (together, the “Retention Bonus Agreements”). Pursuant to the Retention Bonus Agreements, the Company agreed to pay a one-year retention bonus to each of Mr. Crouch and Dr. Laumas in the amount of $462,825 and $254,300, respectively (each, a “Retention Bonus”).

Pursuant to the terms of the Retention Bonus Agreements, Mr. Crouch and Dr. Laumas will earn the full amount of his respective Retention Bonus if he remains employed with the Company in good standing through February 12, 2025 (the “Retention Date”). In the event that the Company terminates the employment of Mr. Crouch or Dr. Laumas without Cause (as defined in the Retention Bonus Agreements) or Mr. Crouch or Dr. Laumas resigns his employment for Good Reason (as defined in the Retention Bonus Agreements), and other than as a result of death or disability, at any time prior to the Retention Date, then no portion of the Retention Bonus will be subject to repayment. In the event that Mr. Crouch or Dr. Laumas resigns his employment without Good Reason or his employment is terminated for Cause at any time on or prior to the Retention Date, then a pro-rated amount of such executive’s then unearned Retention Bonus will be subject to repayment to the Company within 30 days of termination.

The above description of the Retention Bonus Agreements is qualified in its entirety by reference to the complete terms and conditions as set forth in the Retention Bonus Agreements, the form of which is filed as Exhibit 10.1 to this Current Report and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1+ | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

+ Indicates a management contractor compensatory plan.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | Instil Bio, Inc. |

| | | | |

| Dated: | February 14, 2024 | | | | By: | | /s/ Sandeep Laumas, M.D. |

| | | | | | | Sandeep Laumas, M.D. |

| | | | | | | Chief Financial Officer and Chief Business Officer

(Principal Financial Officer and Principal Accounting Officer) |

February 12, 2024

[Name and Title]

Re: 2024 Retention Bonus Agreement

Dear _____________:

As we have shared with you, Instil Bio, Inc. (the “Company”) is offering you the retention bonus described in this letter (this “2024 Retention Bonus Agreement” or this “Agreement”) as an incentive for your continued service to the Company over the next year.

If you sign this 2024 Retention Bonus Agreement, you will be eligible to earn a retention bonus in connection with your continued employment with the Company on the terms described below. Specifically, if you remain employed with the Company in good standing through February 12, 2025 (the “Retention Date”), you will earn a retention bonus in the amount of $[ ] (the “Retention Bonus”), less all applicable deductions and tax withholdings.

The Company will advance you a payment equal to the Retention Bonus, less all applicable deductions and tax withholdings, prior to its being earned, on the Company’s next regularly scheduled payroll date at least five (5) days after the date you and the Company sign this 2024 Retention Bonus Agreement.

In the event that the Company terminates your employment without Cause (as defined below), and other than as a result of your disability, provided such termination of employment is a “separation from service” as defined under Treasury Regulation Section 1.409A-1(h), at any time prior to the Retention Date, then you will not be obligated to repay any portion of the Retention Bonus previously received, provided that: (a) you continue to comply with your continuing obligations under all agreements entered into between you and the Company; and (b) you deliver to the Company (and do not later revoke) a general release of claims in favor of the Company (and its officers, directors, employees, and affiliates) in a form satisfactory to the Company and signed within the time period set forth therein .

In the event that you resign your employment for any reason or your employment is terminated by the Company for Cause at any time on or prior to the Retention Date, then you will be required to repay, and hereby agree to repay, a prorated amount of the unearned Retention Bonus that has been advanced to you under this Agreement calculated as if 1/12th of the Retention Bonus was earned for each full month of service between February 12, 2024 and February 12, 2025, within thirty (30) days of the termination of your employment with Instil Bio.

It is intended that all benefits and other payments under this 2024 Retention Bonus Agreement satisfy, to the greatest extent possible, the exemptions from the application of Internal Revenue Code Section 409A provided under Treasury Regulations 1.409A 1(b)(4) and 1.409A 1(b)(9); this 2024 Retention Bonus Agreement will be construed to the greatest extent possible as consistent with those provisions; and the timing of any such payments or benefits may be modified to satisfy those provisions.

For purposes of this Agreement only, “Cause” means your: (i) failure to substantially perform your duties and responsibilities to the Company or violation of a Company policy; (ii) commission or conviction (including a guilty plea or plea of nolo contendere) of any felony or any other crime involving fraud, dishonesty or moral turpitude; (iii) commission or attempted commission of or participation in a fraud or act of dishonesty or misrepresentation against the Company; (iv) material breach of your duties to the Company; (v) intentional damage to any property of the Company; (vi) misconduct, or other violation of Company policy that causes or is reasonably likely to cause harm; (vii) material violation of any written and

[Executive Name]

February 12, 2024

Page 2 of 2

fully executed contract or agreement between you and the Company, including without limitation, material breach of any agreement between you and the Company regarding protection of confidential information or trade secrets, or of any Company policy, or of any statutory duty you owe to the Company; or (viii) conduct which in the good faith and reasonable determination of the Company demonstrates gross unfitness to serve.

Except as expressly stated herein, nothing in this 2024 Retention Bonus Agreement changes the terms and conditions of your employment with the Company. For example, nothing in this 2024 Retention Bonus Agreement alters the at-will nature of your employment or your right or the Company’s right to terminate your employment at any time, with or without Cause or advance notice.

This 2024 Retention Bonus Agreement constitutes the complete, final and exclusive embodiment of the entire agreement between you and the Company with regard to its subject matter. It is entered into without reliance on any promise or representation, written or oral, other than those expressly contained herein, and it supersedes any other such promises, warranties or representations. This 2024 Retention Bonus Agreement may not be modified or amended except in a writing signed by both you and a duly authorized officer of the Company. This 2024 Retention Bonus Agreement will be deemed to have been entered into and will be construed and enforced in accordance with the laws of the State of Delaware without respect to conflicts of law principles. This 2024 Retention Bonus Agreement may be executed in counterparts and electronic signatures and scanned image copies of signatures will suffice as original signatures.

If this 2024 Retention Bonus Agreement is acceptable to you, please sign below and return the original to me within five (5) days.

Sincerely,

Instil Bio, Inc.

By:

Accepted and Agreed:

______________________________________

______________________________________

Date

v3.24.0.1

Cover

|

Feb. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

Instil Bio, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40215

|

| Entity Tax Identification Number |

83-2072195

|

| Entity Address, Address Line One |

3963 Maple Avenue, Suite 350

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75219

|

| City Area Code |

972

|

| Local Phone Number |

499-3350

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.000001 par value

|

| Trading Symbol |

TIL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001789769

|

| Document Period End Date |

Feb. 12, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

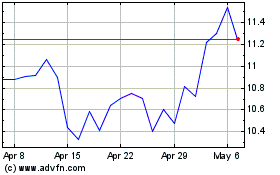

Instill Bio (NASDAQ:TIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

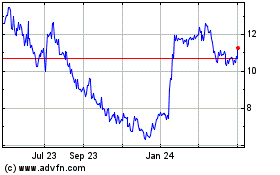

Instill Bio (NASDAQ:TIL)

Historical Stock Chart

From Apr 2023 to Apr 2024