Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

September 15 2023 - 4:05PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2023

Commission

File Number: 001-40301

Infobird

Co., Ltd

(Registrant’s

Name)

Unit

532A, 5/F, Core Building 2, No. 1 Science Park West Avenue

Hong

Kong Science Park, Tai Po, N.T., Hong Kong

(Address

of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7): ☐

When used in this Form 6-K, unless otherwise indicated,

the terms “the Company,” “Infobird,” “we,” “us” and “our”

refer to Infobird Co., Ltd and its subsidiaries.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Nasdaq Letter

Infobird Co., Ltd received a notice dated September

12, 2023, from the Listings Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”)

notifying the Company that the minimum bid price per share of its ordinary shares was below $1.00 for a period of 30 consecutive business

days and that the Company did not meet the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum

Bid Price Rule”). The Nasdaq notification letter does not result in the immediate delisting of the Company’s ordinary shares,

and the shares will continue to trade uninterrupted under the symbol “IFBD.”

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the

Company has a compliance period of one hundred eighty (180) calendar days, or until March 11, 2024 (the “Compliance Period”),

to regain compliance with Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the closing bid price

per share of the Company’s ordinary shares is at least $1.00 for a minimum of ten (10) consecutive business days, Nasdaq will provide

the Company a written confirmation of compliance and the matter will be closed.

In the event the Company does not regain compliance

by March 11, 2024, the Company may be eligible for an additional 180 calendar day grace period. To qualify, the Company will be required

to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq

Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the

deficiency during the second compliance period, including by effecting a reverse stock split, if necessary. If the Company chooses to

implement a reverse stock split, it must complete the split no later than ten (10) business days prior to March 11, 2024, or the expiration

of the second compliance period if granted.

This information is being provided solely to comply

with NASDAQ Listing Rules requiring public announcement of the Company’s receipt of the letter from NASDAQ.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

INFOBIRD CO., LTD |

| |

|

|

|

| Date: |

September 15, 2023 |

By: |

/s/ Yiting Song |

| |

|

|

Yiting Song, Chief Financial Officer |

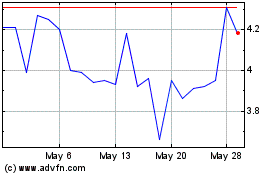

Infobird (NASDAQ:IFBD)

Historical Stock Chart

From Apr 2024 to May 2024

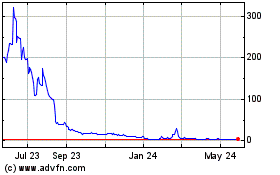

Infobird (NASDAQ:IFBD)

Historical Stock Chart

From May 2023 to May 2024