Current Report Filing (8-k)

January 16 2020 - 4:10PM

Edgar (US Regulatory)

0000879169

false

0000879169

2020-01-11

2020-01-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 12, 2020

INCYTE CORPORATION

(Exact name of registrant as specified in

its charter)

Delaware

(State or Other Jurisdiction of

Incorporation)

|

|

001-12400

(Commission File Number)

|

|

94-3136539

(I.R.S. Employer

Identification No.)

|

|

1801 Augustine Cut-Off

|

|

|

|

Wilmington, DE

|

|

19803

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(302) 498-6700

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $.001 par value per share

|

|

INCY

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ¨

Item 1.01 Entry Into a Material Definitive

Agreement.

On January 12, 2020, Incyte

Corporation (the “Company”) entered into a Collaboration and License Agreement (the “Collaboration Agreement”)

with MorphoSys AG and MorphoSys US Inc., a wholly-owned subsidiary of MorphoSys AG (together with MorphoSys AG, “MorphoSys”),

covering the worldwide development and commercialization of MOR208 (tafasitamab). Tafasitimab is an investigational monoclonal

antibody directed against the target molecule CD19 that is currently in clinical development by MorphoSys. MorphoSys has exclusive

worldwide development and commercialization rights to tafasitamab under a June 2010 collaboration and license agreement with Xencor,

Inc. In December 2019, MorphoSys submitted a Biologics License Application to the U.S. Food and Drug Administration for tafasitamab

for the treatment of relapsed or refractory diffuse large B cell lymphoma.

Under the terms of the

Collaboration Agreement, the Company will receive exclusive commercialization rights outside of the United States, and MorphoSys

and the Company will have co-commercialization rights in the United States, with respect to tafasitamab. MorphoSys will be responsible

for leading commercialization strategy and booking all revenue from sales of tafasitamab in the United States, and the Company

and MorphoSys will both be responsible for commercialization efforts in the United States and will share equally the profits and

losses from the co-commercialization efforts. The Company will lead the commercialization strategy outside of the United States,

and will be responsible for commercialization efforts and book all revenue from sales of tafasitamab outside of the United States,

subject to the Company’s royalty payment obligations set forth below. The Company and MorphoSys have agreed to co-develop

tafasitamab and to share development costs associated with global and U.S.-specific clinical trials, with the Company responsible

for 55% of such costs and MorphoSys responsible for 45% of such costs. Each company will be responsible for funding any independent

development activities, and the Company will be responsible for funding development activities specific to its territory. All development

costs related to the collaboration will be subject to a joint development plan.

The Company has agreed

to pay MorphoSys an upfront non-refundable payment of $750 million. MorphoSys will be eligible to receive up to $740 million in

future contingent development and regulatory milestones and up to $315 million in commercialization milestones as well as tiered

royalties ranging from the mid-teens to mid-twenties of net sales outside of the United States. MorphoSys’ right to receive

royalties in any particular country will expire upon the last to occur of (a) the expiration of patent rights in that particular

country, (b) a specified period of time after the first post-marketing authorization sale of a licensed product comprising tafasitamab

in that country, and (c) the expiration of any regulatory exclusivity for that licensed product in that country.

The Collaboration Agreement

includes various representations, warranties, covenants, indemnities and other provisions customary for transactions of this nature.

The Collaboration Agreement will continue until the termination of the Collaboration Agreement in accordance with its terms. The

Collaboration Agreement may be terminated, following a specified time period of multiple years, by the Company for convenience,

subject to a specified notice period. The Collaboration Agreement may also be terminated by either party under certain other circumstances,

including material breach, as set forth in the Agreement.

The effectiveness of the

Collaboration Agreement is conditioned on the early termination or expiration of the waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976 as well as clearance by the German and Austrian antitrust authorities; however, certain confidentiality

and antitrust filing provisions became effective upon execution of the Collaboration Agreement.

In addition, under the

Collaboration Agreement and pursuant to a related purchase agreement (the “Purchase Agreement”), the Company has agreed

to purchase American Depositary Shares (“ADSs”), each representing 0.25 of an ordinary share of MorphoSys AG, for an

aggregate purchase price of $150 million (such ADSs to be purchased, the “New ADSs”). The actual number of New ADSs

to be purchased will be determined by reference to the market price of the ADSs around the time of issuance and the price per New

ADS will represent a premium to the market price of the ADSs on the execution date of the Collaboration Agreement. Under the Purchase

Agreement, the Company has agreed, subject to limited exceptions, not to sell or otherwise transfer any of the New ADSs for an

18-month period. Closing of the purchase of the New ADSs is subject to customary conditions, as well as the effectiveness of the

Collaboration Agreement.

The foregoing descriptions

of the Collaboration Agreement and Purchase Agreement do not purport to be complete and are qualified in their entirety by reference

to such agreements, copies of which the Company expects to file as exhibits to the Company’s Quarterly Report on Form 10-Q

for the quarter ending March 31, 2020.

Item 7.01 Regulation FD Disclosure.

On January 13, 2020, the Company and MorphoSys

issued a press release relating to the Collaboration Agreement. A copy of the press release is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

|

|

104

|

Cover Page Interactive

Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: January 16, 2020

|

|

|

|

|

|

|

INCYTE CORPORATION

|

|

|

|

|

|

By:

|

/s/ Maria E. Pasquale

|

|

|

|

Maria E. Pasquale

|

|

|

|

Executive Vice President and

|

|

|

|

General Counsel

|

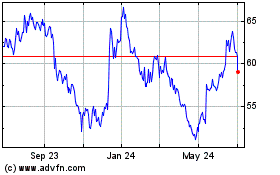

Incyte (NASDAQ:INCY)

Historical Stock Chart

From Jul 2024 to Aug 2024

Incyte (NASDAQ:INCY)

Historical Stock Chart

From Aug 2023 to Aug 2024