Current Report Filing (8-k)

August 04 2021 - 4:08PM

Edgar (US Regulatory)

0000837852

false

0000837852

2021-07-29

2021-07-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2021 (July 29, 2021)

IDEANOMICS, INC.

(Exact name of registrant as specified

in its charter)

|

Nevada

|

001-35561

|

20-1778374

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of incorporation)

|

|

Identification No.)

|

1441 Broadway, Suite 5116, New York, NY 10018

(Address of principal executive offices)

(Zip Code)

212-206-1216

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed

since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

IDEX

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.02.

|

Termination of a Material Definitive Agreement

|

As

previously disclosed by Ideanomics, Inc. (the “Company”) on February 12, 2021, the Company entered into a convertible debenture

(the “Note”), dated February 8, 2021 with YA II PN, Ltd. with a principal amount of $80,000,000 (the “Principal”).

On August 2, 2021, the Company paid off the $81,551,781 of Principal and interest due pursuant to the Note. The Note had a fixed conversion

price of $4.95 and a maturity date of August 8, 2021.

On July 29, 2021, the Company

entered into an Investment Agreement with Prettl Electronics Automotive GMBH (the “Investment Agreement”), a limited liability

company under the laws of Germany (“Prettl”). Pursuant to the Investment Agreement the Company agreed to invest $9,000,000

in exchange for a 30% ownership in Prettl. Prettl is a business unit within the Prettl Group, a large German industrial company that manufactures

and distributes components and systems for the automotive, energy, and electronics industries. In connection with the Investment Agreement,

the Company entered into a Shareholders’ Agreement with Prettl and Prettl Electronics GmbH (the “Shareholders Agreement”,

together with the Investment Agreement, referred to collectively herein as the “Agreements”). The Company will also receive

exclusive sales and distribution rights for Prettl charging infrastructure products and solutions in North America. Alfred Poor, Chief

Executive Officer of the Company will join Prettl’s Board of Directors. The Agreements contain customary representations, warranties,

covenants, indemnities, information rights, transfer restrictions and anti-dilution rights of the parties.

On August 2, 2021, the Company

issued a press release announcing the Agreements. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form

8-K and is hereby incorporated by reference herein.

The

Company’s subsidiary, Timios Holdings Corp. (“Timios”) experienced a systems outage that was caused by a cybersecurity

incident. Timios has engaged leading forensic information technology firms and legal counsel to assist its investigation into the incident

and is working around the clock to get its system back up as quickly as possible. Although Timios is actively managing this cybersecurity

incident, it has caused and may continue to cause a delay or disruption to parts of Timios’ business, including its ability

to perform its mortgage title, closing and escrow services offerings. The Company is in the early stages of assessing the financial impact

of the incident. Based on the information currently known, the Company is unable to predict at this time whether revenues will be materially

impacted by this attack.

Forward-Looking Information

This Form 8-K

contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements as to future results of operations, express or implied statements relating to

the Company’s expectations regarding its ability to contain and assess the cybersecurity incident and the impact of the

incident on the Company’s business, operations and financial condition. Factors that could cause actual results to differ

materially from those expressed or implied include the ongoing assessment of the cybersecurity incident; legal, reputational and

financial risks resulting from the cybersecurity incident or additional cyberattacks; the effectiveness of business continuity plans

during the cybersecurity incident; and the other factors set forth in Ideanomics’ Annual Report on Form 10-K for the year ended

December 31, 2020, Ideanomics’ Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 and other filings with the

Securities and Exchange Commission. Except as required by the federal securities laws, Ideanomics’undertakes no obligation to

publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

|

Item 9.01

|

Financial Statements and Exhibits

|

d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Ideanomics, Inc.

|

|

|

|

|

|

|

|

|

|

Date: August 4, 2021

|

By:

|

/s/ Alfred Poor

|

|

|

|

Alfred Poor

|

|

|

|

Chief Executive Officer

|

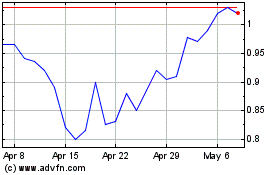

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

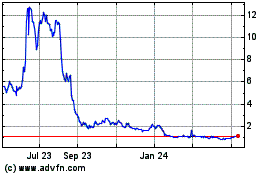

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024