Hanmi Financial Corporation (Nasdaq:HAFC), the holding company for

Hanmi Bank, today reported a substantial decline in overall net

loss for the third quarter of 2010 as compared to both the

immediately preceding and year ago quarters. For the third quarter

of 2010, net loss fell to $14.6 million, or $0.12 per share,

compared to a second quarter loss of $29.3 million, or $0.57 per

share, and a loss of $59.7 million, or $1.26 per share, in the

third quarter a year ago. For the first nine months of 2010, net

loss totaled $93.3 million, or $1.24 per share, compared to $86.4

million, or $1.86 per share in the first nine months of 2009.

"The strong support of our shareholders, as well as the

encouraging demand from the capital market, allowed us to raise

gross proceeds of $120 million in new capital at the beginning of

the quarter. As a result, the Bank has met the threshold for being

considered 'well-capitalized' for regulatory purposes at September

30, 2010," said Jay S. Yoo, President and Chief Executive

Officer.

Third Quarter 2010 Highlights

- Hanmi strengthened its capital ratios with the successful sale

of $120 million of common stock at a purchase price of $1.20 per

share, resulting in net proceeds to the Company of $116.3 million.

Hanmi injected $110 million to the Bank which enhanced the Bank's

Total Risk Based Capital Ratio to 11.61% as compared with 7.35% in

the immediate prior quarter and 9.69% a year ago. The Bank's

tangible common equity to tangible assets at quarter end was 8.37%,

up from 7.55% a year earlier.

- Non-performing loans fell to $194.7 million, or 8.13% of gross

loans, from $242.1 million or 9.67% of gross loans in the second

quarter and up from $174.4 million, or 5.85% a year ago. The

coverage ratio of the allowance to non-performing loans increased

to 90.41% at September 30, 2010, compared to 72.96% at the prior

quarter-end and 71.53% at the end of the third quarter a year

ago.

- During the first nine months of 2010, the successful

deleveraging of the balance sheet reduced total assets by 6% or

$194 million to $2.97 billion, with gross loans down 15%.

- The funds raised in the capital offering and sales of loans

provided sufficient liquidity with $608 million in cash and

securities as of September 30, 2010.

- Although slightly reduced from the prior quarter's 3.56%, the

net interest margin (NIM) significantly improved to 3.49% in the

third quarter as compared with 3.00% in the third quarter a year

ago. Year-to-date NIM increased 93 basis points to 3.58% from

2.65% in the first nine months of 2009.

Successful Capital Raise

As previously announced, Hanmi successfully raised gross

proceeds of $120 million of capital with approximately $47 million

in its rights offering and $73 million in the best efforts public

offering. Of the $116.3 million in net proceeds, $110.0

million was down-streamed from the holding company to the

Bank. "With our improved capital position as compared to the

immediately preceding quarter, we believe we are now substantially

in compliance with our regulatory orders, and are working to

finalize our strategic plan and other compliance efforts by the

year end," Mr. Yoo stated.

Asset Quality

At September 30, 2010, the allowance for loan losses was $176.1

million, or 7.35% of gross loans, compared to $176.7 million, or

7.05% of gross loans, at June 30, 2010, and $124.8 million, or

4.19% of gross loans a year ago. Hanmi's loan loss

allowance to non-performing loans ratio significantly increased to

90.41% from 71.53% a year ago. Third quarter charge-offs, net

of recoveries, were down to $21.3 million compared to $38.9 million

in the second quarter and $29.9 million in the third quarter of

2009.

Non-performing loans (NPLs) declined 20% to $194.7 million at

September 30, 2010 from $242.1 million at June 30, 2010, and up 12%

from $174.4 million at September 30, 2009. Of the total $194.7

million NPLs, $33.4 million, or 17.2%, were current on payments and

are supported by underlying collateral or have been made to

borrowers with additional assets to support their loans.

Approximately 94.7% of the total NPLs were impaired with a

$16.1 million impairment reserve for those loans. Sales of

impaired loans also reduced non-performing assets with 12 loan

sales generating $24.7 million in net proceeds in the third

quarter. Year-to-date loan sales have generated $114.6 million

in net proceeds on the sale of 58 loans. Sales of other real

estate owned (OREO) continued during the third quarter, with four

properties sold for the net proceed of $2.5 million, resulting in a

$235,000 net loss. Year-to-date OREO sales have generated $8.8

million in net proceeds on the sale of 13 properties, resulting in

an $81,000 net loss. OREO, real estate acquired through

foreclosure, totaled $20.6 million at September 30, 2010, down from

$24.1 million at June 30, 2010 and also down from $27.1 million a

year ago. "We have been aggressive in selling loans prior to

foreclosure, which partially accounts for the reduction of OREO,"

said Mr. Yoo.

The following table shows non-performing loans by loan

category:

| Total Non-Performing

Loans |

|

|

|

|

|

|

| ('000) |

9/30/2010 |

% of Total NPL |

6/30/2010 |

% of Total NPL |

9/30/2009 |

% of Total NPL |

| Real Estate

Loans: |

|

|

|

|

|

|

| Commercial Property |

31,103 |

16.0% |

42,877 |

17.7% |

39,437 |

22.6% |

| Construction |

9,338 |

4.8% |

9,823 |

4.0% |

10,650 |

6.1% |

| Land Loans |

29,701 |

15.2% |

35,806 |

14.8% |

7,502 |

4.3% |

| Residential Property |

2,264 |

1.2% |

2,836 |

1.2% |

3,450 |

2.0% |

| Commercial & Industrial

Loans: |

|

|

|

|

|

|

| Owner Occupied Property |

90,777 |

46.6% |

113,977 |

47.1% |

72,106 |

41.3% |

| Other C&I |

31,216 |

16.0% |

36,521 |

15.1% |

40,902 |

23.5% |

| Consumer

Loans |

330 |

0.2% |

293 |

0.1% |

380 |

0.2% |

| TOTAL

NPL |

194,729 |

100.0% |

242,133 |

100.0% |

174,427 |

100.0% |

The proactive approach to the problematic credits this year

reduced delinquent loans on accrual status to $23.9 million, or

1.0% of gross loans at September 30, 2010, from $28.5 million, or

1.0% of gross loans at September 30, 2009. Quarter over

quarter, the delinquent loans on accrual status increased from

$21.7 million at June 30, 2010 due to the addition of a single

construction loan in the amount of $8.7 million. However,

delinquency of accrual loans decreased for all other loan

categories. The following table shows delinquent loans on

accrual status by loan category:

| Delinquent loans on

accrual status |

|

|

|

|

|

|

| ('000) |

9/30/2010 |

% of

Total |

6/30/2010 |

% of Total |

9/30/2009 |

% of

Total |

| Real Estate

Loans: |

|

|

|

|

|

|

| Commercial Property |

382 |

1.6% |

3,020 |

13.9% |

8,916 |

31.2% |

| Construction |

8,714 |

36.5% |

-- |

-- |

-- |

-- |

| Land Loans |

-- |

-- |

-- |

-- |

3,550 |

12.5% |

| Residential Property |

801 |

3.4% |

1,858 |

8.6% |

854 |

3.0% |

| Commercial & Industrial

Loans: |

|

|

|

|

|

|

| Owner Occupied Property |

9,261 |

38.7% |

9,964 |

45.9% |

7,825 |

27.5% |

| Other C&I |

4,543 |

19.0% |

6,559 |

30.2% |

6,540 |

23.0% |

| Consumer

Loans |

196 |

0.8% |

300 |

1.4% |

787 |

2.8% |

| TOTAL |

23,897 |

100.0% |

21,701 |

100.0% |

28,472 |

100.0% |

Balance Sheet

"During the past two years, we have employed a strategy to

deleverage our balance sheet to reduce portfolio risk and to

respond to the economic downturn that negatively impacted our

capital levels. With the new capital we have already raised

this year, together with the new capital that we expect from the

Woori transaction, we plan to move from a downsizing mode into

moderately expanding our organization," said Mr. Yoo. Total

assets increased slightly at the end of the third quarter to $2.97

billion, from $2.91 billion at June 30, 2010, and down 14% from

$3.46 billion at September 30, 2009. Gross loans, net of

deferred loan fees, were $2.39 billion at September 30, 2010, down

4% from $2.50 billion at June 30, 2010, and down 20% from $2.98

billion at September 30, 2009.

"We continue to build our core deposits and reduce our reliance

on higher-cost certificates of deposits during the third quarter of

2010," stated Brian Cho, EVP & Chief Financial

Officer. "We have reduced our reliance on whole sale funding

by eliminating broker deposits from the deposit mix. Federal

Home Loan Bank advances are also down 4% from a year ago to $153.7

million." Total deposits decreased 16% year-over-year and

declined 2% from the prior quarter. Total deposits were $2.53

billion at September 30, 2010, compared to $2.58 billion at June

30, 2010, and $2.99 billion at September 30, 2009.

Results of Operations

Net interest income, before the provision for credit losses,

totaled $26.3 million for the third quarter of 2010 which was down

slightly from net interest income of $26.5 million in the third

quarter a year ago. Higher cash and cash equivalent balances

as well as increases in investment securities generated lower

yields on assets, but the impact was offset by the decline in cost

of funds associated with replacing high-cost time deposits with

low-cost deposits. For the first nine months of

2010, net interest income before provision for credit losses

totaled $79.9 million compared to $72.8 million in the first nine

months of 2009.

Average gross loans decreased 20.2% to $2.46 billion for the

third quarter of 2010 from $3.08 billion for the same period of

2009 and declined 19.3% to $2.61 billion for the nine months of

2010 from $3.24 billion for the same period of 2009. Average

investment securities increased 7.0% to $223.7 million for the

third quarter of 2010 from $209.0 million for the third quarter of

2009 and decreased 10.9% to $169.6 million for the first nine

months of 2010 from $190.2 million for the same period of 2009.

"The decreases in average gross loans were the direct result of our

balance sheet deleveraging strategy" said Cho. Consistent with this

strategy, average deposits also decreased 17.5% to $2.56 billion

for the third quarter of 2010 from $3.10 billion for the same

period in 2009 and declined 17.7% to $2.61 billion for the nine

months of 2010 from $3.17 billion for the same period of 2009.

The average yield on the loan portfolio decreased slightly by 6

basis points to 5.44% in the third quarter of 2010, compared to the

third quarter a year ago and decreased 11 basis points to 5.37% for

the first nine months of 2010 from 5.48% for the same period of

2009. For the first nine months of 2010, the reversal of

previously recorded interest income due to the additional

non-accrual loans was $2.9 million ($0.3 million in the third

quarter and $2.6 million in the first half of the year), resulting

in a negative impact on NIM by 13 basis points. The cost

of average interest-bearing deposits in the third quarter was

1.65%, down 105 basis points from the third quarter of 2009 and

year-to-date it was 1.75%, down 143 basis points from a year

ago. As a result, Hanmi's net interest margin improved 49

basis points to 3.49% in the third quarter of 2010 compared to

3.00% in the third quarter of 2009 and improved 93 basis points to

3.58% for the first nine months of 2010 from 2.65% for the same

period of 2009.

As a result of the decrease of charge-offs and non-performing

loans, the provision for credit losses in the third quarter of 2010

decreased to $22.0 million, compared to $49.5 million in the third

quarter a year ago. For the first nine months of 2010, the

provision for credit losses totaled $117.5 million down from $119.4

million in the first nine months of 2009.

Total non-interest income in the third quarter of 2010 was $6.5

million compared to $8.2 million in the third quarter of 2009.

The decrease in non-interest income is primarily attributable

to decreases in service charges on deposit accounts and a decrease

in net gain on sales of loans. Service charges on deposit accounts

decreased by $833,000 to $3.4 million for the third quarter of 2010

from $4.3 million for the same period of 2009, primarily due to a

decrease of $751,000 in NSF charges and a decrease in account

analysis fees. Net gain on sale of loans decreased by $635,000 for

the third quarter of 2010, compared to the same period in 2009.

"The gain on sale of loans was substantial during the third quarter

of 2009 when we sold accumulated inventory upon the recovery of the

SBA secondary market," Cho noted. For the first nine months of

2010, non-interest income was $20.1 million, a decrease of $4.1

million, or 17.0%, from $24.3 million for the same period in 2009.

The decrease was due primarily to a $2.3 million decrease in

service charges on deposit accounts associated with the slowed

business activities in the depressed economy and a $1.1 million

decrease in net gain on sales of investment securities.

Total non-interest expense increased $1.2 million to $24.9

million for the third quarter of 2010, up from $23.7 million in the

third quarter a year ago. The overall increase in non-interest

expense was primarily due to an $879,000 impairment charge on

equity securities, acquired prior to 2004 for Community

Reinvestment Act purposes, upon recapitalization of the issuer of

such equity securities, an $860,000 compensation expense for the

preannounced retention plan payable in November 2010, and a

$423,000 increase in directors and officers liability insurance

premium driven by the change in risk categories of the Bank. The

increase was partially offset by decreases in OREO related expenses

and professional fees. Year-to-date non-interest expense increased

by $8.2 million to $75.9 million, up 12% from $67.6 million in the

first nine months of 2009, primarily due to a higher valuation

provision for OREO properties and FDIC insurance premium in

addition to the aforementioned expenses.

Conference Call Information

Management will host a conference today at 1:30 p.m. PDT (4.30

p.m. EDT) to discuss these financial results. This call will

also be broadcast live via the internet. Investment

professionals and all others are invited to access the live call by

dialing (857) 350-1589 at 1:30 p.m. (PDT), using access code

HANMI. To listen to the call online, either live or archived,

visit the Investor Relations page of Hanmi Financial Corporation

website at www.hanmi.com. Shortly after the call concludes,

the replay will also be available at (617) 801-6888, using access

code #46109720 where it will be archived until November 15,

2010.

About Hanmi Financial Corporation

Headquartered in Los Angeles, Hanmi Bank, a wholly-owned

subsidiary of Hanmi Financial Corporation, provides services to the

multi-ethnic communities of California, with 27 full-service

offices in Los Angeles, Orange, San Bernardino, San Francisco,

Santa Clara and San Diego counties, and a loan production office in

Washington State. Hanmi Bank specializes in commercial, SBA and

trade finance lending, and is a recognized community leader. Hanmi

Bank's mission is to provide a full range of quality products and

premier services to its customers and to maximize shareholder

value. Additional information is available at www.hanmi.com.

Forward-Looking Statements

This press release contains forward-looking statements, which

are included in accordance with the "safe harbor" provisions of the

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify forward-looking statements by terminology such as

"may," "will," "should," "could," "expects," "plans," "intends,"

"anticipates," "believes," "estimates," "predicts," "potential," or

"continue," or the negative of such terms and other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

All statements other than statements of historical fact are

"forward –looking statements" for purposes of federal and state

securities laws, including, but not limited to, statements about

anticipated future operating and financial performance, financial

position and liquidity, business strategies, regulatory and

competitive outlook, investment and expenditure plans, capital and

financing needs and availability, plans and objectives of

management for future operations, developments regarding our

securities purchase agreement with Woori Finance Holdings, and

other similar forecasts and statements of expectation and

statements of assumption underlying any of the foregoing. These

statements involve known and unknown risks, uncertainties and other

factors that may cause our actual results, levels of activity,

performance or achievements to differ from those expressed or

implied by the forward-looking statement. These factors include the

following: inability to consummate the proposed transaction with

Woori Finance Holdings on the terms contemplated in the Securities

Purchase Agreement entered into with Woori on May 25, 2010, as

amended (the "transaction"); failure to receive

regulatory approval for the Transaction; inability to continue

as a going concern; inability to raise additional capital on

acceptable terms or at all; failure to maintain adequate levels of

capital and liquidity to support our operations; the effect of

regulatory orders we have entered into and potential future

supervisory action against us or Hanmi Bank; general economic and

business conditions internationally, nationally and in those areas

in which we operate; volatility and deterioration in the credit and

equity markets; changes in consumer spending, borrowing and savings

habits; availability of capital from private and government

sources; demographic changes; competition for loans and deposits

and failure to attract or retain loans and deposits; fluctuations

in interest rates and a decline in the level of our interest rate

spread; risks of natural disasters related to our real estate

portfolio; risks associated with Small Business Administration

loans; failure to attract or retain key employees; changes in

governmental regulation, including, but not limited to, any

increase in FDIC insurance premiums; ability to receive regulatory

approval for Hanmi Bank to declare dividends to the Company;

adequacy of our allowance for loan losses, credit quality and the

effect of credit quality on our provision for credit losses and

allowance for loan losses; changes in the financial performance

and/or condition of our borrowers and the ability of our borrowers

to perform under the terms of their loans and other terms of credit

agreements; our ability to successfully integrate acquisitions we

may make; our ability to control expenses; and changes in

securities markets. In addition, we set forth certain risks in our

reports filed with the U.S. Securities and Exchange Commission

("SEC"), including attached as an Exhibit to a Current Report on

Form 8-K filed with the SEC on June 18, 2010, and our most

recent Quarterly Report on Form 10-Q, as well as current and

periodic reports filed with the U.S. Securities and Exchange

Commission hereafter, which could cause actual results to differ

from those projected. We undertake no obligation to update such

forward-looking statements except as required by law.

Cautionary Statements

The issuance of the securities to Woori described in this news

release have not been and will not be registered under the

Securities Act of 1933, as amended, or any state securities laws,

and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements of the Securities Act and applicable state securities

laws. This press release shall not constitute an offer to sell

or the solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of the securities in

any jurisdiction or state in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction or state.

| HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED

BALANCE SHEETS (UNAUDITED) |

| (Dollars in Thousands) |

| |

|

|

|

|

|

|

|

| |

September

30, |

June 30, |

% |

December

31, |

% |

September

30, |

% |

| |

2010 |

2010 |

Change |

2009 |

Change |

2009 |

Change |

| ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Cash and Due from Banks |

$ 63,455 |

$ 60,034 |

5.7 % |

$ 55,263 |

14.8 % |

$ 57,727 |

9.9 % |

| Interest-Bearing Deposits in Other Banks |

218,843 |

170,711 |

28.2 % |

98,847 |

121.4 % |

155,607 |

40.6 % |

| Federal Funds Sold |

-- |

20,000 |

-- |

-- |

-- |

-- |

-- |

| |

|

|

|

|

|

|

|

| Cash and Cash Equivalents |

282,298 |

250,745 |

12.6 % |

154,110 |

83.2 % |

213,334 |

32.3 % |

| |

|

|

|

|

|

|

|

| Investment Securities |

325,428 |

191,094 |

70.3 % |

133,289 |

144.2 % |

205,901 |

58.1 % |

| |

|

|

|

|

|

|

|

| Loans: |

|

|

|

|

|

|

|

| Gross Loans, Net of Deferred Loan

Fees |

2,394,291 |

2,503,426 |

(4.4)% |

2,819,060 |

(15.1)% |

2,977,504 |

(19.6)% |

| Allowance for Loan Losses |

(176,063) |

(176,667) |

(0.3)% |

(144,996) |

21.4 % |

(124,768) |

41.1 % |

| |

|

|

|

|

|

|

|

| Loans Receivable, Net |

2,218,228 |

2,326,759 |

(4.7)% |

2,674,064 |

(17.0)% |

2,852,736 |

(22.2)% |

| |

|

|

|

|

|

|

|

| Premises and Equipment, Net |

17,639 |

17,917 |

(1.6)% |

18,657 |

(5.5)% |

19,302 |

(8.6)% |

| Accrued Interest Receivable |

8,442 |

7,802 |

8.2 % |

9,492 |

(11.1)% |

11,389 |

(25.9)% |

| Due from Customers on Acceptances |

1,375 |

1,072 |

28.3 % |

994 |

38.3 % |

1,859 |

(26.0)% |

| Other Real Estate Owned, Net |

20,577 |

24,064 |

(14.5)% |

26,306 |

(21.8)% |

27,140 |

(24.2)% |

| Deferred Income Taxes, Net |

-- |

-- |

-- |

3,608 |

-- |

2,464 |

-- |

| Servicing Assets |

3,197 |

3,356 |

(4.7)% |

3,842 |

(16.8)% |

3,957 |

(19.2)% |

| Other Intangible Assets, Net |

2,480 |

2,754 |

(9.9)% |

3,382 |

(26.7)% |

3,736 |

(33.6)% |

| Investment in Federal Home Loan Bank Stock,

at Cost |

28,418 |

29,556 |

(3.9)% |

30,697 |

(7.4)% |

30,697 |

(7.4)% |

| Investment in Federal Reserve Bank Stock, at

Cost |

6,783 |

6,783 |

-- |

7,878 |

(13.9)% |

10,053 |

(32.5)% |

| Bank-Owned Life Insurance |

27,111 |

26,874 |

0.9 % |

26,408 |

2.7 % |

26,171 |

3.6 % |

| Income Taxes Receivable |

9,188 |

9,697 |

(5.2)% |

56,554 |

(83.8)% |

34,908 |

(73.7)% |

| Other Assets |

17,341 |

16,477 |

5.2 % |

13,425 |

29.2 % |

13,843 |

25.3 % |

| |

|

|

|

|

|

|

|

| TOTAL ASSETS |

$ 2,968,505 |

$ 2,914,950 |

1.8 % |

$ 3,162,706 |

(6.1)% |

$ 3,457,490 |

(14.1)% |

| |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

| Noninterest-Bearing |

$ 559,764 |

$ 574,843 |

(2.6)% |

$ 556,306 |

0.6 % |

$ 561,548 |

(0.3)% |

| Interest-Bearing |

1,967,622 |

2,000,271 |

(1.6)% |

2,193,021 |

(10.3)% |

2,430,312 |

(19.0)% |

| |

|

|

|

|

|

|

|

| Total Deposits |

2,527,386 |

2,575,114 |

(1.9)% |

2,749,327 |

(8.1)% |

2,991,860 |

(15.5)% |

| |

|

|

|

|

|

|

|

| Accrued Interest Payable |

13,727 |

14,024 |

(2.1)% |

12,606 |

8.9 % |

19,730 |

(30.4)% |

| Bank Acceptances Outstanding |

1,375 |

1,072 |

28.3 % |

994 |

38.3 % |

1,859 |

(26.0)% |

| Federal Home Loan Bank Advances |

153,734 |

153,816 |

(0.1)% |

153,978 |

(0.2)% |

160,828 |

(4.4)% |

| Other Borrowings |

2,558 |

3,062 |

(16.5)% |

1,747 |

46.4 % |

1,496 |

71.0 % |

| Junior Subordinated Debentures |

82,406 |

82,406 |

-- |

82,406 |

-- |

82,406 |

-- |

| Deferred Tax Liabilities |

807 |

1,203 |

(32.9)% |

-- |

-- |

-- |

-- |

| Accrued Expenses and Other

Liabilities |

13,880 |

11,073 |

25.3 % |

11,904 |

16.6 % |

12,191 |

13.9 % |

| |

|

|

|

|

|

|

|

| Total Liabilities |

2,795,873 |

2,841,770 |

(1.6)% |

3,012,962 |

(7.2)% |

3,270,370 |

(14.5)% |

| |

|

|

|

|

|

|

|

| Stockholders' Equity |

172,632 |

73,180 |

135.9 % |

149,744 |

15.3 % |

187,120 |

(7.7)% |

| |

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY |

$ 2,968,505 |

$ 2,914,950 |

1.8 % |

$ 3,162,706 |

(6.1)% |

$ 3,457,490 |

(14.1)% |

| |

|

|

|

|

|

|

|

|

| HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF OPERATIONS (UNAUDITED) |

| (Dollars in Thousands, Except Per

Share Data) |

| |

|

|

|

|

|

|

|

|

| |

Three

Months Ended |

Nine Months

Ended |

| |

Sept 30, |

June 30, |

% |

Sept 30, |

% |

Sept 30, |

Sept 30, |

% |

| |

2010 |

2010 |

Change |

2009 |

Change |

2010 |

2009 |

Change |

| INTEREST AND DIVIDEND INCOME: |

|

|

|

|

|

|

|

|

| Interest and Fees on Loans |

$ 33,681 |

$ 34,486 |

(2.3)% |

$ 42,705 |

(21.1)% |

$ 104,862 |

$ 132,508 |

(20.9)% |

| Taxable Interest on Investment

Securities |

1,592 |

1,359 |

17.1 % |

1,541 |

3.3 % |

4,035 |

4,261 |

(5.3)% |

| Interest on Interest-Bearing Deposits in

Other Banks |

165 |

99 |

66.7 % |

68 |

-- |

319 |

81 |

-- |

| Dividends on Federal Reserve Bank

Stock |

102 |

103 |

(1.0)% |

150 |

(32.0)% |

323 |

456 |

(29.2)% |

| Tax-Exempt Interest on Investment

Securities |

62 |

77 |

(19.5)% |

607 |

(89.8)% |

216 |

1,871 |

(88.5)% |

| Interest on Term Federal Funds Sold |

32 |

11 |

-- |

293 |

(89.1)% |

29 |

1,688 |

-- |

| Dividends on Federal Home Loan Bank

Stock |

33 |

20 |

65.0 % |

64 |

(48.4)% |

74 |

64 |

15.6 % |

| Interest on Federal Funds Sold and

Securities Purchased Under Resale Agreements |

8 |

16 |

(50.0)% |

67 |

(88.1)% |

41 |

261 |

(84.3)% |

| Total Interest and Dividend Income |

35,675 |

36,171 |

(1.4)% |

45,495 |

(21.6)% |

109,899 |

141,190 |

(22.2)% |

| |

|

|

|

|

|

|

|

|

| INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

| Interest on Deposits |

8,299 |

8,813 |

(5.8)% |

17,365 |

(52.2)% |

26,816 |

62,836 |

(57.3)% |

| Interest on Junior Subordinated

Debentures |

739 |

692 |

6.8 % |

747 |

(1.1)% |

2,100 |

2,581 |

(18.6)% |

| Interest on Federal Home Loan Bank

Advances |

342 |

339 |

0.9 % |

865 |

(60.5)% |

1,027 |

2,987 |

(65.6)% |

| Interest on Other Borrowings |

22 |

31 |

(29.0)% |

-- |

-- |

53 |

2 |

-- |

| Total Interest Expense |

9,402 |

9,875 |

(4.8)% |

18,977 |

(50.5)% |

29,996 |

68,406 |

(56.2)% |

| |

|

|

|

|

|

|

|

|

| NET INTEREST INCOME BEFORE PROVISION FOR

CREDIT LOSSES |

26,273 |

26,296 |

(0.1)% |

26,518 |

(0.9)% |

79,903 |

72,784 |

9.8 % |

| Provision for Credit Losses |

22,000 |

37,500 |

(41.3)% |

49,500 |

(55.6)% |

117,496 |

119,387 |

(1.6)% |

| |

|

|

|

|

|

|

|

|

| NET INTEREST INCOME (LOSS) AFTER PROVISION

FOR CREDIT LOSSES |

4,273 |

(11,204) |

(138.1)% |

(22,982) |

(118.6)% |

(37,593) |

(46,603) |

(19.3)% |

| |

|

|

|

|

|

|

|

|

| NON-INTEREST INCOME: |

|

|

|

|

|

|

|

|

| Service Charges on Deposit Accounts |

3,442 |

3,602 |

(4.4)% |

4,275 |

(19.5)% |

10,770 |

13,032 |

(17.4)% |

| Insurance Commissions |

1,089 |

1,206 |

(9.7)% |

1,063 |

2.4 % |

3,573 |

3,430 |

4.2 % |

| Remittance Fees |

484 |

523 |

(7.5)% |

511 |

(5.3)% |

1,469 |

1,579 |

(7.0)% |

| Other Service Charges and Fees |

409 |

372 |

9.9 % |

489 |

(16.4)% |

1,193 |

1,439 |

(17.1)% |

| Trade Finance Fees |

381 |

412 |

(7.5)% |

512 |

(25.6)% |

1,144 |

1,517 |

(24.6)% |

| Bank-Owned Life Insurance Income |

237 |

235 |

0.9 % |

234 |

1.3 % |

703 |

695 |

1.2 % |

| Net Gain on Sales of Loans |

229 |

220 |

4.1 % |

864 |

(73.5)% |

443 |

866 |

(48.8)% |

| Net Gain on Sales of Investment

Securities |

4 |

8 |

(50.0)% |

-- |

-- |

117 |

1,168 |

(90.0)% |

| Other Operating Income |

186 |

99 |

87.9 % |

265 |

(29.8)% |

731 |

545 |

34.1 % |

| Total Non-Interest Income |

6,461 |

6,677 |

(3.2)% |

8,213 |

(21.3)% |

20,143 |

24,271 |

(17.0)% |

| |

|

|

|

|

|

|

|

|

| NON-INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

| Salaries and Employee Benefits |

9,552 |

9,011 |

6.0 % |

8,648 |

10.5 % |

27,349 |

24,659 |

10.9 % |

| Occupancy and Equipment |

2,702 |

2,674 |

1.0 % |

2,834 |

(4.7)% |

8,101 |

8,506 |

(4.8)% |

| Other Real Estate Owned Expense |

2,580 |

1,718 |

50.2 % |

3,372 |

(23.5)% |

9,998 |

5,017 |

99.3 % |

| Deposit Insurance Premiums and Regulatory

Assessments |

2,253 |

4,075 |

(44.7)% |

2,001 |

12.6 % |

8,552 |

7,420 |

15.3 % |

| Data Processing |

1,446 |

1,487 |

(2.8)% |

1,608 |

(10.1)% |

4,432 |

4,691 |

(5.5)% |

| Professional Fees |

753 |

1,022 |

(26.3)% |

1,239 |

(39.2)% |

2,841 |

2,745 |

3.5 % |

| Directors and Officers Liability

Insurance |

716 |

716 |

-- |

293 |

-- |

2,149 |

881 |

-- |

| Supplies and Communications |

683 |

574 |

19.0 % |

603 |

13.3 % |

1,774 |

1,772 |

0.1 % |

| Advertising and Promotion |

567 |

503 |

12.7 % |

447 |

26.8 % |

1,605 |

1,640 |

(2.1)% |

| Loan-Related Expense |

322 |

310 |

3.9 % |

192 |

67.7 % |

939 |

1,590 |

(40.9)% |

| Amortization of Other Intangible

Assets |

273 |

301 |

(9.3)% |

379 |

(28.0)% |

902 |

1,214 |

(25.7)% |

| Impairment Loss on Investment

Securities |

879 |

-- |

-- |

-- |

-- |

879 |

-- |

-- |

| Other Operating Expenses |

2,143 |

2,375 |

(9.8)% |

2,073 |

3.4 % |

6,339 |

7,509 |

(15.6)% |

| Total Non-Interest Expense |

24,869 |

24,766 |

0.4 % |

23,689 |

5.0 % |

75,860 |

67,644 |

12.1 % |

| |

|

|

|

|

|

|

|

|

| LOSS BEFORE PROVISION (BENEFIT) FOR INCOME

TAXES |

(14,135) |

(29,293) |

(51.7)% |

(38,458) |

(63.2)% |

(93,310) |

(89,976) |

3.7 % |

| Provision (Benefit) for Income Taxes |

442 |

(36) |

-- |

21,207 |

-- |

11 |

(3,580) |

-- |

| |

|

|

|

|

|

|

|

|

| NET LOSS |

$ (14,577) |

$ (29,257) |

(50.2)% |

$ (59,665) |

(75.6)% |

$ (93,321) |

$ (86,396) |

8.0 % |

| |

|

|

|

|

|

|

|

|

| HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES |

| SELECTED FINANCIAL

DATA (UNAUDITED) |

| (Dollars in Thousands) |

| |

|

|

|

|

|

|

|

|

| |

Three

Months Ended |

Nine Months

Ended |

| |

Sept. 30, |

June 30, |

% |

Sept. 30, |

% |

Sept. 30, |

Sept 30, |

% |

| |

2010 |

2010 |

Change |

2009 |

Change |

2010 |

2009 |

Change |

| |

|

|

|

|

|

|

|

|

| AVERAGE BALANCES: |

|

|

|

|

|

|

|

|

| Average Gross Loans, Net of Deferred Loan

Fees |

$ 2,456,883 |

$ 2,611,178 |

(5.9)% |

$ 3,078,104 |

(20.20)% |

$ 2,610,122 |

$ 3,235,455 |

(19.3)% |

| Average Investment Securities |

223,709 |

158,543 |

41.1 % |

209,021 |

7.0 % |

169,558 |

190,243 |

(10.9)% |

| Average Interest-Earning Assets |

2,989,762 |

2,965,975 |

0.8 % |

3,552,698 |

(15.80)% |

2,988,813 |

3,718,837 |

(19.6)% |

| Average Total Assets |

2,983,632 |

2,978,245 |

0.2 % |

3,672,253 |

(18.8)% |

3,015,243 |

3,842,266 |

(21.5)% |

| Average Deposits |

2,559,116 |

2,617,738 |

(2.2)% |

3,100,419 |

(17.5)% |

2,612,891 |

3,174,880 |

(17.7)% |

| Average Borrowings |

239,992 |

240,189 |

(0.1)% |

297,455 |

(19.3)% |

245,708 |

374,139 |

(34.3)% |

| Average Interest-Bearing Liabilities |

2,238,036 |

2,292,121 |

(2.4)% |

2,844,821 |

(21.30)% |

2,296,599 |

3,013,651 |

(23.8)% |

| Average Stockholders' Equity |

155,056 |

91,628 |

69.2 % |

232,136 |

(33.2)% |

128,268 |

249,742 |

(48.6)% |

| Average Tangible Equity |

152,417 |

88,692 |

71.8 % |

228,169 |

(33.2)% |

125,327 |

245,377 |

(48.9)% |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| PERFORMANCE RATIOS

(Annualized): |

|

|

|

|

|

|

|

|

| Return on Average Assets |

(1.94)% |

(3.94)% |

|

(6.45)% |

|

(4.14)% |

(3.01)% |

|

| Return on Average Stockholders'

Equity |

(37.30)% |

(128.07)% |

|

(101.97)% |

|

(97.27)% |

(46.25)% |

|

| Return on Average Tangible Equity |

(37.94)% |

(132.31)% |

|

(103.75)% |

|

(99.55)% |

(47.08)% |

|

| Efficiency Ratio |

75.97% |

75.11% |

|

68.21% |

|

75.82% |

69.70% |

|

| Net Interest Spread (1) |

3.07% |

3.17% |

|

2.47% |

|

3.17% |

2.08% |

|

| Net Interest Margin (1) |

3.49% |

3.56% |

|

3.00% |

|

3.58% |

2.65% |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| ALLOWANCE FOR LOAN

LOSSES: |

|

|

|

|

|

|

|

|

| Balance at Beginning of Period |

$ 176,667 |

$ 177,820 |

(0.6)% |

$ 105,268 |

67.8 % |

$ 144,996 |

$ 70,986 |

104.3 % |

| Provision Charged to Operating

Expense |

20,700 |

37,793 |

(45.2)% |

49,375 |

(58.1)% |

117,710 |

119,067 |

(1.1)% |

| Charge-Offs, Net of Recoveries |

(21,304) |

(38,946) |

(45.3)% |

(29,875) |

(28.7)% |

(86,643) |

(65,285) |

32.7 % |

| Balance at End of Period |

$ 176,063 |

$ 176,667 |

(0.3)% |

$ 124,768 |

41.1 % |

$ 176,063 |

$ 124,768 |

41.1 % |

| |

|

|

|

|

|

|

|

|

| Allowance for Loan Losses to Total Gross

Loans |

7.35% |

7.05% |

|

4.19% |

|

7.35% |

4.19% |

|

| Allowance for Loan Losses to Total

Non-Performing Loans |

90.41% |

72.96% |

|

71.53% |

|

90.41% |

71.53% |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| ALLOWANCE FOR OFF-BALANCE SHEET

ITEMS: |

|

|

|

|

|

|

|

|

| Balance at Beginning of Period |

$ 2,362 |

$ 2,655 |

(11.0)% |

$ 4,291 |

(45.0)% |

$ 3,876 |

$ 4,096 |

(5.4)% |

| Provision Charged to Operating

Expense |

1,300 |

(293) |

(543.7)% |

125 |

(535.0)% |

(214) |

320 |

(166.9)% |

| Balance at End of Period |

$ 3,662 |

$ 2,362 |

55.0 % |

$ 4,416 |

(17.1)% |

$ 3,662 |

$ 4,416 |

(17.1)% |

| |

|

|

|

|

|

|

|

|

| (1) Amounts calculated

on a fully taxable equivalent basis using the current statutory

federal tax rate. |

| |

|

|

|

|

|

|

|

|

| HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES |

|

| SELECTED FINANCIAL

DATA (UNAUDITED) (Continued) |

|

| (Dollars in Thousands) |

|

| |

|

|

|

|

|

|

|

|

| |

Sept. 30, |

June 30, |

% |

December

31, |

% |

Sept. 30, |

% |

|

| |

2010 |

2010 |

Change |

2009 |

Change |

2009 |

Change |

|

| NON-PERFORMING ASSETS: |

|

|

|

|

|

|

|

|

| Non-Accrual Loans |

$ 194,729 |

$ 242,133 |

(19.6)% |

$ 219,000 |

(11.1)% |

$ 174,363 |

11.7 % |

|

| Loans 90 Days or More Past Due and Still

Accruing |

-- |

-- |

-- |

67 |

(100.0)% |

64 |

(100.0)% |

|

| Total Non-Performing Loans |

194,729 |

242,133 |

(19.6)% |

219,067 |

(11.1)% |

174,427 |

11.6 % |

|

| Other Real Estate Owned, Net |

20,577 |

24,064 |

(14.5)% |

26,306 |

(21.8)% |

27,140 |

(24.2)% |

|

| Total Non-Performing Assets |

$ 215,306 |

$ 266,197 |

(19.1)% |

$ 245,373 |

(12.3)% |

$ 201,567 |

6.8 % |

|

| |

|

|

|

|

|

|

|

|

| Total Non-Performing Loans/Total Gross

Loans |

8.13% |

9.67% |

|

7.77% |

|

5.85% |

|

|

| Total Non-Performing Assets/Total

Assets |

7.25% |

9.13% |

|

7.76% |

|

5.83% |

|

|

| Total Non-Performing Assets/Allowance for

Loan Losses |

122.3% |

191.6% |

|

138.9% |

|

161.6% |

|

|

| |

|

|

|

|

|

|

|

|

| DELINQUENT LOANS (Accrual

Status) |

$ 23,896 |

$ 21,702 |

10.1 % |

$ 41,151 |

(41.9)% |

$ 28,472 |

(16.1)% |

|

| |

|

|

|

|

|

|

|

|

| Delinquent Loans (Accrual Status)/Total

Gross Loans |

1.00% |

0.87% |

|

1.64% |

|

0.96% |

|

|

| |

|

|

|

|

|

|

|

|

| LOAN PORTFOLIO: |

|

|

|

|

|

|

|

|

| Real Estate Loans |

$ 885,734 |

$ 928,819 |

(4.6)% |

$ 1,043,097 |

(15.1)% |

$ 1,086,735 |

(18.5)% |

|

| Commercial and Industrial Loans (2) |

1,456,163 |

1,519,639 |

(4.2)% |

1,714,212 |

(15.1)% |

1,824,042 |

(20.2)% |

|

| Consumer Loans |

53,237 |

55,790 |

(4.6)% |

63,303 |

(15.9)% |

68,537 |

(22.3)% |

|

| Total Gross Loans |

2,395,134 |

2,504,248 |

(4.4)% |

2,820,612 |

(15.1)% |

2,979,314 |

(19.6)% |

|

| Deferred Loan Fees |

(843) |

(822) |

2.6 % |

(1,552) |

(45.7)% |

(1,810) |

(53.4)% |

|

| Gross Loans, Net of Deferred Loan

Fees |

2,394,291 |

2,503,426 |

(4.4)% |

2,819,060 |

(15.1)% |

2,977,504 |

(19.6)% |

|

| Allowance for Loan Losses |

(176,063) |

(176,667) |

(0.3)% |

(144,996) |

21.4 % |

(124,768) |

41.1 % |

|

| Loans Receivable, Net |

$ 2,218,228 |

$ 2,326,759 |

(4.7)% |

$ 2,674,064 |

(17.0)% |

$ 2,852,736 |

(22.2)% |

|

| |

|

|

|

|

|

|

|

|

| LOAN MIX: |

|

|

|

|

|

|

|

|

| Real Estate Loans |

37.0% |

37.1% |

|

37.0% |

|

36.5% |

|

|

| Commercial and Industrial Loans |

60.8% |

60.7% |

|

60.8% |

|

61.2% |

|

|

| Consumer Loans |

2.2% |

2.2% |

|

2.2% |

|

2.3% |

|

|

| Total Gross Loans |

100.0% |

100.0% |

|

100.0% |

|

100.0% |

|

|

| |

|

|

|

|

|

|

|

|

| DEPOSIT PORTFOLIO: |

|

|

|

|

|

|

|

|

| Demand - Noninterest-Bearing |

$ 559,764 |

$ 574,843 |

(2.6)% |

$ 556,306 |

0.6 % |

$ 561,548 |

(0.3)% |

|

| Savings |

119,824 |

127,848 |

(6.3)% |

111,172 |

7.8 % |

98,019 |

22.2 % |

|

| Money Market Checking and NOW

Accounts |

422,564 |

434,533 |

(2.8)% |

685,858 |

(38.4)% |

723,585 |

(41.6)% |

|

| Time Deposits of $100,000 or More |

1,126,760 |

1,117,025 |

0.9 % |

815,190 |

38.2 % |

845,318 |

33.3 % |

|

| Other Time Deposits |

298,474 |

320,865 |

(7.0)% |

580,801 |

(48.6)% |

763,390 |

(60.9)% |

|

| Total Deposits |

$ 2,527,386 |

$ 2,575,114 |

(1.9)% |

$ 2,749,327 |

(8.1)% |

$ 2,991,860 |

(15.5)% |

|

| |

|

|

|

|

|

|

|

|

| DEPOSIT MIX: |

|

|

|

|

|

|

|

|

| Demand - Noninterest-Bearing |

22.1% |

22.3% |

|

20.2% |

|

18.8% |

|

|

| Savings |

4.7% |

5.0% |

|

4.0% |

|

3.3% |

|

|

| Money Market Checking and NOW

Accounts |

16.7% |

16.9% |

|

24.9% |

|

24.2% |

|

|

| Time Deposits of $100,000 or More |

44.6% |

43.4% |

|

29.7% |

|

28.3% |

|

|

| Other Time Deposits |

11.9% |

12.4% |

|

21.2% |

|

25.4% |

|

|

| Total Deposits |

100.0% |

100.0% |

|

100.0% |

|

100.0% |

|

|

| |

|

|

|

|

|

|

|

|

| CAPITAL RATIOS (Bank

Only): |

|

|

|

|

|

|

|

|

| Total Risk-Based |

11.61% |

7.35% |

|

9.69% |

|

|

|

|

| Tier 1 Risk-Based |

10.28% |

6.02% |

|

8.40% |

|

|

|

|

| Tier 1 Leverage |

8.26% |

4.99% |

|

7.05% |

|

|

|

|

| |

| (2) Commercial and

industrial loans include owner-occupied property loans of $967.9

million, $995.1 million and $1.16 billion as of September 30,

2010, June 30, 2010, and September 30, 2009,

respectively. |

| |

|

|

|

|

|

|

|

|

|

| HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES |

| AVERAGE BALANCES,

AVERAGE YIELDS EARNED AND AVERAGE RATES PAID

(UNAUDITED) |

| (Dollars in Thousands) |

| |

|

|

|

|

|

|

|

|

|

| |

Three

Months Ended |

| |

September 30,

2010 |

June 30,

2010 |

September 30,

2009 |

| |

Average

Balance |

Interest Income/

Expense |

Average Yield/

Rate |

Average

Balance |

Interest Income/

Expense |

Average Yield/

Rate |

Average

Balance |

Interest Income/

Expense |

Average Yield/

Rate |

| |

|

|

|

|

|

|

|

|

|

| INTEREST-EARNING

ASSETS |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Loans: |

|

|

|

|

|

|

|

|

|

| Real Estate Loans: |

|

|

|

|

|

|

|

|

|

| Commercial Property |

$ 773,589 |

$ 10,638 |

5.46% |

$ 811,063 |

$ 10,351 |

5.12% |

$ 887,028 |

$ 12,051 |

5.39% |

| Construction |

71,545 |

862 |

4.78% |

81,067 |

946 |

4.68% |

138,340 |

1,464 |

4.20% |

| Residential Property |

67,291 |

805 |

4.75% |

69,937 |

932 |

5.35% |

83,387 |

1,050 |

5.00% |

| Total Real Estate Loans |

912,425 |

12,305 |

5.35% |

962,067 |

12,229 |

5.10% |

1,108,755 |

14,565 |

5.21% |

| Commercial and Industrial Loans (1) |

1,490,812 |

20,611 |

5.49% |

1,593,326 |

21,484 |

5.41% |

1,897,321 |

26,863 |

5.62% |

| Consumer Loans |

54,469 |

690 |

5.03% |

56,684 |

738 |

5.22% |

73,670 |

1,084 |

5.84% |

| Total Gross Loans |

2,457,706 |

33,606 |

5.42% |

2,612,077 |

34,451 |

5.29% |

3,079,746 |

42,512 |

5.48% |

| Prepayment Penalty Income |

-- |

75 |

-- |

-- |

35 |

-- |

-- |

193 |

-- |

| Unearned Income on Loans, Net of

Costs |

(823) |

-- |

-- |

(899) |

-- |

-- |

(1,642) |

-- |

-- |

| Gross Loans, Net |

2,456,883 |

33,681 |

5.44% |

2,611,178 |

34,486 |

5.30% |

3,078,104 |

42,705 |

5.50% |

| |

|

|

|

|

|

|

|

|

|

| Investment Securities: |

|

|

|

|

|

|

|

|

|

| Municipal Bonds (2) |

6,301 |

95 |

6.03% |

7,484 |

119 |

6.36% |

58,179 |

933 |

6.41% |

| U.S. Government Agency Securities |

92,690 |

620 |

2.68% |

65,894 |

560 |

3.40% |

37,969 |

431 |

4.54% |

| Mortgage-Backed Securities |

63,439 |

537 |

3.39% |

58,419 |

577 |

3.95% |

82,429 |

807 |

3.92% |

| Collateralized Mortgage Obligations |

45,747 |

300 |

2.62% |

14,287 |

129 |

3.61% |

17,066 |

173 |

4.05% |

| Corporate Bonds |

3,130 |

30 |

3.83% |

-- |

-- |

-- |

401 |

-- |

0.00% |

| Other Securities |

12,402 |

103 |

3.32% |

12,459 |

94 |

3.02% |

12,977 |

130 |

4.01% |

| Total Investment

Securities (2) |

223,709 |

1,685 |

3.01% |

158,543 |

1,479 |

3.73% |

209,021 |

2,474 |

4.73% |

| |

|

|

|

|

|

|

|

|

|

| Other Interest-Earning

Assets: |

|

|

|

|

|

|

|

|

|

| Equity Securities |

36,568 |

135 |

1.48% |

37,979 |

123 |

1.30% |

41,741 |

214 |

2.05% |

| Federal Funds Sold and Securities

Purchased |

|

|

|

|

|

|

|

|

|

| Under Resale Agreements |

6,932 |

8 |

0.46% |

12,198 |

16 |

0.52% |

56,568 |

67 |

0.47% |

| Term Federal Funds Sold |

22,880 |

32 |

0.56% |

7,253 |

11 |

0.61% |

90,239 |

293 |

1.30% |

| Interest-Bearing Deposits in Other

Banks |

242,790 |

165 |

0.27% |

138,824 |

99 |

0.29% |

77,025 |

68 |

0.35% |

| Total Other Interest-Earning

Assets |

309,170 |

340 |

0.44% |

196,254 |

249 |

0.51% |

265,573 |

642 |

0.97% |

| |

|

|

|

|

|

|

|

|

|

| TOTAL INTEREST-EARNING

ASSETS (2) |

$ 2,989,762 |

$ 35,706 |

4.74% |

$ 2,965,975 |

$ 36,214 |

4.90% |

$ 3,552,698 |

$ 45,821 |

5.12% |

| |

|

|

|

|

|

|

|

|

|

| INTEREST-BEARING

LIABILITIES |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Interest-Bearing

Deposits: |

|

|

|

|

|

|

|

|

|

| Savings |

$ 122,122 |

$ 889 |

2.89% |

$ 125,016 |

$ 922 |

2.96% |

$ 93,404 |

$ 585 |

2.48% |

| Money Market Checking and NOW

Accounts |

429,601 |

1,094 |

1.01% |

458,137 |

1,217 |

1.07% |

629,124 |

2,998 |

1.89% |

| Time Deposits of $100,000 or

More |

1,133,970 |

5,059 |

1.77% |

1,090,412 |

5,057 |

1.86% |

983,341 |

7,447 |

3.00% |

| Other Time Deposits |

312,351 |

1,257 |

1.60% |

378,367 |

1,617 |

1.71% |

841,497 |

6,335 |

2.99% |

| Total Interest-Bearing

Deposits |

1,998,044 |

8,299 |

1.65% |

2,051,932 |

8,813 |

1.72% |

2,547,366 |

17,365 |

2.70% |

| |

|

|

|

|

|

|

|

|

|

| Borrowings: |

|

|

|

|

|

|

|

|

|

| FHLB Advances |

153,777 |

342 |

0.88% |

153,859 |

339 |

0.88% |

213,583 |

865 |

1.61% |

| Other Borrowings |

3,809 |

22 |

2.29% |

3,924 |

31 |

3.17% |

1,466 |

-- |

0.00% |

| Junior Subordinated Debentures |

82,406 |

739 |

3.56% |

82,406 |

692 |

3.37% |

82,406 |

747 |

3.60% |

| Total Borrowings |

239,992 |

1,103 |

1.82% |

240,189 |

1,062 |

1.77% |

297,455 |

1,612 |

2.15% |

| |

|

|

|

|

|

|

|

|

|

| TOTAL INTEREST-BEARING

LIABILITIES |

$ 2,238,036 |

$ 9,402 |

1.67% |

$ 2,292,121 |

$ 9,875 |

1.73% |

$ 2,844,821 |

$ 18,977 |

2.65% |

| |

|

|

|

|

|

|

|

|

|

| NET INTEREST

INCOME (2) |

|

$ 26,304 |

|

|

$ 26,339 |

|

|

$ 26,844 |

|

| |

|

|

|

|

|

|

|

|

|

| NET INTEREST

SPREAD (2) |

|

|

3.07% |

|

|

3.17% |

|

|

2.47% |

| |

|

|

|

|

|

|

|

|

|

| NET INTEREST

MARGIN (2) |

|

|

3.49% |

|

|

3.56% |

|

|

3.00% |

| |

|

|

|

|

|

|

| HANMI FINANCIAL

CORPORATION AND SUBSIDIARIES |

| AVERAGE BALANCES, AVERAGE

YIELDS EARNED AND AVERAGE RATES PAID (UNAUDITED) |

| (Dollars in Thousands) |

| |

|

|

|

|

|

|

| |

Nine Months

Ended |

| |

September 30,

2010 |

September 30,

2009 |

| |

Average

Balance |

Interest Income/

Expense |

Average Yield/

Rate |

Average

Balance |

Interest Income/

Expense |

Average Yield/

Rate |

| |

|

|

|

|

|

|

| INTEREST-EARNING

ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Loans: |

|

|

|

|

|

|

| Real Estate Loans: |

|

|

|

|

|

|

| Commercial Property |

$ 806,704 |

$ 32,363 |

5.36% |

$ 905,386 |

$ 38,029 |

5.62% |

| Construction |

88,424 |

3,202 |

4.84% |

165,455 |

4,605 |

3.72% |

| Residential Property |

70,410 |

2,520 |

4.79% |

86,904 |

3,332 |

5.13% |

| Total Real Estate Loans |

965,538 |

38,085 |

5.27% |

1,157,745 |

45,966 |

5.31% |

| Commercial and Industrial Loans (1) |

1,588,153 |

64,330 |

5.42% |

2,001,546 |

82,874 |

5.54% |

| Consumer Loans |

57,425 |

2,277 |

5.30% |

77,606 |

3,345 |

5.76% |

| Total Gross Loans |

2,611,116 |

104,692 |

5.36% |

3,236,897 |

132,185 |

5.46% |

| Prepayment Penalty Income |

-- |

170 |

-- |

-- |

323 |

-- |

| Unearned Income on Loans, Net of

Costs |

(994) |

-- |

-- |

(1,442) |

-- |

-- |

| Gross Loans, Net |

2,610,122 |

104,862 |

5.37% |

3,235,455 |

132,508 |

5.48% |

| |

|

|

|

|

|

|

| Investment Securities: |

|

|

|

|

|

|

| Municipal Bonds (2) |

7,107 |

332 |

6.23% |

58,760 |

2,878 |

6.53% |

| U.S. Government Agency Securities |

63,790 |

1,563 |

3.27% |

20,345 |

671 |

4.40% |

| Mortgage-Backed Securities |

61,265 |

1,604 |

3.49% |

77,720 |

2,582 |

4.43% |

| Collateralized Mortgage Obligations |

23,931 |

542 |

3.02% |

23,742 |

736 |

4.13% |

| Corporate Bonds |

1,055 |

30 |

3.79% |

265 |

-- |

0.00% |

| Other Securities |

12,410 |

295 |

3.17% |

9,411 |

272 |

3.85% |

| Total Investment

Securities (2) |

169,558 |

4,366 |

3.43% |

190,243 |

7,139 |

5.00% |

| |

|

|

|

|

|

|

| Other Interest-Earning

Assets: |

|

|

|

|

|

|

| Equity Securities |

37,961 |

397 |

1.39% |

41,667 |

520 |

1.66% |

| Federal Funds Sold and Securities

Purchased |

|

|

|

|

|

|

| Under Resale Agreements |

11,056 |

41 |

0.49% |

95,365 |

261 |

0.36% |

| Term Federal Funds Sold |

10,128 |

29 |

0.38% |

125,249 |

1,688 |

1.80% |

| Interest-Bearing Deposits in Other

Banks |

149,988 |

319 |

0.28% |

30,858 |

81 |

0.35% |

| Total Other Interest-Earning

Assets |

209,133 |

786 |

0.50% |

293,139 |

2,550 |

1.16% |

| |

|

|

|

|

|

|

| TOTAL INTEREST-EARNING

ASSETS (2) |

$ 2,988,813 |

$ 110,014 |

4.92% |

$ 3,718,837 |

$ 142,197 |

5.11% |

| |

|

|

|

|

|

|

| INTEREST-BEARING

LIABILITIES |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Interest-Bearing

Deposits: |

|

|

|

|

|

|

| Savings |

$ 120,945 |

$ 2,635 |

2.91% |

$ 86,715 |

$ 1,617 |

2.49% |

| Money Market Checking and NOW

Accounts |

481,744 |

3,933 |

1.09% |

431,646 |

6,278 |

1.94% |

| Time Deposits of $100,000 or

More |

1,050,248 |

14,793 |

1.88% |

1,124,876 |

29,877 |

3.55% |

| Other Time Deposits |

397,954 |

5,455 |

1.83% |

996,275 |

25,064 |

3.36% |

| Total Interest-Bearing

Deposits |

2,050,891 |

26,816 |

1.75% |

2,639,512 |

62,836 |

3.18% |

| |

|

|

|

|

|

|

| Borrowings: |

|

|

|

|

|

|

| FHLB Advances |

160,162 |

1,027 |

0.86% |

290,142 |

2,987 |

1.38% |

| Other Borrowings |

3,140 |

53 |

2.26% |

1,591 |

2 |

0.17% |

| Junior Subordinated Debentures |

82,406 |

2,100 |

3.41% |

82,406 |

2,581 |

4.19% |

| Total Borrowings |

245,708 |

3,180 |

1.73% |

374,139 |

5,570 |

1.99% |

| |

|

|

|

|

|

|

| TOTAL INTEREST-BEARING

LIABILITIES |

$ 2,296,599 |

$ 29,996 |

1.75% |

$ 3,013,651 |

$ 68,406 |

3.03% |

| |

|

|

|

|

|

|

| NET INTEREST

INCOME (2) |

|

$ 80,018 |

|

|

$ 73,791 |

|

| |

|

|

|

|

|

|

| NET INTEREST

SPREAD (2) |

|

|

3.17% |

|

|

2.08% |

| |

|

|

|

|

|

|

| NET INTEREST

MARGIN (2) |

|

|

3.58% |

|

|

2.65% |

| |

|

|

|

|

|

|

| (1) Commercial and

industrial loans include owner-occupied commercial real etate

loans |

|

|

|

|

| (2) Amounts calculated

on a fully taxable equivalent basis using the current statutory

federal tax rate. |

|

|

|

|

CONTACT: Hanmi Financial Corporation

BRIAN E. CHO

Chief Financial Officer

(213) 368-3200

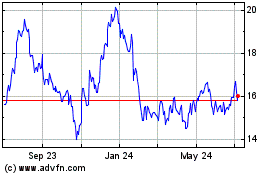

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jul 2023 to Jul 2024