Hanmi Financial Corporation (NASDAQ: HAFC) (“we,” “our” or

“Hanmi”), the holding company for Hanmi Bank (the “Bank”), reported

a fourth-quarter net loss of $35.9 million, or ($0.70) per share,

primarily driven by $77 million in credit loss provisions, compared

to a net loss of $3.8 million, or ($0.08) per share, in the

comparable period a year ago.

For the year ended December 31, 2009, Hanmi reported a net loss

of $122.3 million, or ($2.57) per share, mainly due to $196.4

million in credit loss provisions, compared to a net loss of $102.1

million, or ($2.23) per share, for the year ended December 31,

2008. In 2008, there was a non-cash impairment loss on goodwill of

$107.4 million, for which there was no comparable loss in 2009.

“Over the past year, we achieved a number of positive changes in

what continues to be a very difficult economic environment,” said

Jay S. Yoo, Hanmi’s President and Chief Executive Officer. “Most

notably, we have made significant progress in strengthening our

loan monitoring and loan review departments, maintaining

appropriate loan loss reserves in anticipation of asset

deterioration, managing our liquidity, and enhancing our net

interest margin.”

“Notwithstanding these improvements, our focus during the first

half of 2010 will be to fully comply with previously announced

regulatory requirements by further strengthening our capital

position, improving asset quality, and enhancing liquidity. Our

highest priority during the next few months will be to raise

sufficient capital, executing our strategic plan to comply with

regulatory requirements.

“To enhance liquidity, we will continue our efforts to reduce

our illiquid assets as well as further increase our core deposits

through product features and upgraded customer service. With the

expectation of substantial progress in achieving these goals along

with a successful capital raise,” concluded Mr. Yoo, “we will

strive to be back in position for organic growth.”

Results of Operations

Net interest income before provision for credit losses increased

by $1.9 million, or 7.3 percent, to $28.4 million in the fourth

quarter of 2009 as compared with $26.5 million in the prior quarter

as the $1.9 million decrease in interest and fees on loans was more

than offset by a $4.5 million decrease in total interest expense.

For the full year 2009, net interest income before provision for

credit losses decreased by $33.2 million, or 24.7 percent, to

$101.2 million, as compared with $134.4 million in the prior

year.

The average yield on the loan portfolio was 5.54 percent in the

fourth quarter of 2009, an increase of four basis points compared

to 5.50 percent in the third quarter. Thanks to our proper

management of high-cost time deposits that were offered through

early 2009 and matured in the fourth quarter, combined with an

overall decline of deposit rates in our community, the cost of

average interest-bearing deposits was 2.26 percent, a decrease of

44 basis points compared to 2.70 percent in the third quarter.

Consistent with this trend, net interest margin was 3.46 percent in

the fourth quarter of 2009, an increase of 46 basis points compared

to 3.00 percent in the third quarter.

The provision for credit losses in the fourth quarter of 2009

increased by $27.5 million to $77.0 million, compared to $49.5

million in the prior quarter, due mainly to the increase in our

historical loss ratios used in the allowance for loan losses

migration analysis which was the result of our increase in

charge-offs in recent quarters. The charge-offs of impaired loans

for the deficiency of collateral in this weakening commercial real

estate (“CRE”) market also contributed to the increase. For the

full year, the provision for credit losses was $196.4 million

compared to $75.7 million in 2008.

Total non-interest income in the fourth quarter of 2009 was $7.8

million as compared with $8.2 million in the third quarter of 2009

and $7.4 million in the fourth quarter of 2008. The decrease in

non-interest income from the third quarter is mainly attributable

to the overall decrease in service charges in the slowed economy.

Consistent with our balance sheet deleveraging strategy, we

continued to sell SBA loans and recognized a $354,000 gain in the

fourth quarter, as compared with $864,000 in the prior quarter. In

the fourth quarter, we also sold investment securities, mainly

municipal bonds, for risk management purposes, and recorded a net

gain of $665,000. For the full year 2009, total non-interest income

was $32.1 million, a decrease of $39,000, or 0.1 percent, from the

prior year.

Total non-interest expense in the fourth quarter of 2009 was

$22.7 million as compared with $23.7 million in the third quarter,

a decrease of $979,000, or 4.1 percent, from the prior quarter. A

major contributor to the sequential decrease in fourth-quarter

non-interest expense was a decrease of $2.5 million in other real

estate owned expenses, partially offset by an increase of $1.0

million in deposit insurance premiums and regulatory assessments.

For the full year 2009, total non-interest expense was $90.4

million compared to $194.3 million in 2008. The 2008 expense

included a $107.4 million impairment loss on goodwill.

With the aforementioned decreases in non-interest expense and

non-interest income and the increase in net interest income before

provision for credit losses, the fourth-quarter 2009 efficiency

ratio (non-interest expense divided by the sum of net interest

income before provision for credit losses and non-interest income)

was 62.6 percent, as compared with 68.2 percent in the third

quarter and 55.5 percent in the comparable period a year ago.

Balance Sheet and Asset Quality

Reflecting the Bank’s ongoing program to de-leverage the balance

sheet, at December 31, 2009, total assets decreased by $294.8

million, or 8.5 percent, to $3.16 billion as compared with $3.46

billion at September 30, 2009, and decreased by $713.1 million, or

18.4 percent, in comparison to $3.88 billion at December 31,

2008.

Gross loans, net of deferred loan fees, decreased by $158.4

million, or 5.3%, to $2.82 billion as of December 31, 2009,

compared with $2.98 billion at September 30, 2009, and decreased by

$543 million, or 16.2%, as compared with $3.36 billion at December

31, 2008. The bulk of the decrease relative to the prior

quarter-end is attributable to the stringent lending policy

implementing selective loan renewals in addition to sale of loans

and charge-offs.

Total deposits decreased by $242.5 million, or 8.1 percent, to

$2.75 billion at December 31, 2009 compared to $2.99 billion at

September 30, 2009, and decreased by $320.8 million, or 10.4

percent, compared to $3.07 billion at December 31, 2008. The

decrease in total deposits compared to the previous quarter-end

reflects a reduction in brokered deposits of $188.4 million and a

reduction in Freedom CDs of $114.3 million. FHLB advances also

decreased by $6.8 million.

Fourth-quarter charge-offs, net of recoveries, were $57.3

million compared to $29.9 million in the prior quarter and $18.6

million in the fourth quarter of 2008. Fourth-quarter charge-offs

include a partial charge-off in the amount of $4.6 million on a

construction loan to a senior housing project as a result of a

decrease in collateral value; investment property loan charge-offs

totaling $13.5 million; and other commercial term loan charge-offs

totaling $30.3 million, which includes partial charge-offs from

owner-occupied and single-tenant property loans. The remaining

charge-offs of approximately $9 million consist of consumer,

international, and SBA loans as well as commercial lines of credit.

For the full year 2009, charge-offs, net of recoveries, were $122.6

million compared to $46.0 million in 2008.

At December 31, 2009, the allowance for loan losses was $145.0

million, or 5.14 percent of total gross loans (66.19 percent of

total non-performing loans), compared to $71.0 million, or 2.11

percent of total gross loans (58.23 percent of total non-performing

loans), at December 31, 2008. At September 30, 2009, the allowance

for loan losses was $124.8 million, or 4.19 percent of total gross

loans (71.53 percent of total non-performing loans). The increase

in the allowance for loan losses was mainly due to an increase in

quantitative reserves to $90.1 million from $61.1 million at

September 30, 2009. The increase in the quantitative allowance was

partially offset by a decrease in impaired reserves to $23.1

million from $36.7 million at September 30, 2009 as a result of

increased charge-offs. Qualitative allowance slightly increased to

$31.6 million from $26.6 million at the end of the third

quarter.

Delinquent loans were $186.3 million (6.60 percent of total

gross loans) at December 31, 2009, compared to $151.0 million (5.07

percent of total gross loans) at September 30, 2009, and $128.5

million (3.82 percent of total gross loans) at December 31, 2008.

Contributing to the increase in delinquent loans were an increase

in delinquencies of owner-occupied business property loans as well

as an increase in delinquencies of SBA loans. Delinquencies from

these two loan categories increased by approximately $18.0 million

and $13.5 million, respectively, quarter-over-quarter.

Non-performing loans (“NPL”) at December 31, 2009 were $219.1

million (7.77 percent of total gross loans), compared with $174.4

million at September 30, 2009 (5.85 percent of total gross loans),

and $121.9 million (3.62 percent of total gross loans) at December

31, 2008. The majority of the quarter-over-quarter increase in

non-performing loans is attributable to an increase of

approximately $20.7 million in NPLs from income-producing

commercial property loans, and an increase of approximately $17.8

million in NPLs from owner-occupied business property loans.

Non-performing SBA loans also increased by approximately $7.5

million compared to the prior quarter. Non-performing loans at

December 31, 2009 consisted of 5.7 percent construction loans, 46.9

percent commercial and industrial (“C&I”) loans including

owner/user occupied business property loans, 26.9 percent CRE

loans, 16.3 percent SBA loans, 3.0 percent consumer loans, and the

remaining 1.2 percent consisting of commercial lines of credit and

international loans. Of the total NPL of $219.1 million, $74.0

million, or 33.8 percent, is current at December 31, 2009. Of the

total NPL of $174.4 million, $51.9 million, or 29.8%, was current

at September 30, 2009. Of the current NPL of $74.0 million, $35.7

million was moved to non-accrual status from accrual status due to

shortfalls in collateral with negative cash flow; and of the $35.7

million that moved to non-accrual status, $7.9 million was

restructured and identified as troubled debt restructured

loans.

As of December 31, 2009, total non-performing assets of $245.4

million included other real estate owned assets (“OREO”) of $26.3

million compared with total non-performing assets of $201.6 million

with OREO of $27.1 million at September 30, 2009, and total

non-performing assets of $122.7 million with OREO of $823,000 at

December 31, 2008.

The aggregate net OREO balance has shown a decreasing trend

since the second quarter of 2009. The net balance decreased from

$34.0 million at June 30, 2009 to $27.1 million at September 30,

2009. The balance further decreased to $26.3 million at December

31, 2009.

Capital Adequacy

The Bank’s capital ratios exceed levels defined as “adequately

capitalized” by our regulators. At December 31, 2009, the Bank’s

Tier 1 Leverage, Tier 1 Risk-Based Capital and Total Risk-Based

Capital Ratio were 6.69 percent, 7.77 percent, and 9.07 percent,

respectively, compared to 7.05 percent, 8.40 percent and 9.69

percent, respectively, at September 30, 2009. The Bank’s ratio of

tangible shareholders’ equity to total tangible assets for the

fourth quarter was 7.13 percent compared to 7.57 percent at

September 30, 2009.

About Hanmi Financial Corporation

Headquartered in Los Angeles, Hanmi Bank, a wholly-owned

subsidiary of Hanmi Financial Corporation, provides services to the

multi-ethnic communities of California, with 27 full-service

offices in Los Angeles, Orange, San Bernardino, San Francisco,

Santa Clara and San Diego counties, and a loan production office in

Washington State. Hanmi Bank specializes in commercial, SBA and

trade finance lending, and is a recognized community leader. Hanmi

Bank’s mission is to provide a full range of quality products and

premier services to its customers and to maximize shareholder

value. Additional information is available at www.hanmi.com.

Forward-Looking Statements

This release contains forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “could,” “expects,” “plans,” “intends,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential,” or

“continue,” or the negative of such terms and other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

These statements involve known and unknown risks, uncertainties and

other factors that may cause our actual results, levels of

activity, performance or achievements to differ from those

expressed or implied by the forward-looking statement. These

factors include the following: failure to maintain adequate levels

of capital and liquidity to support our operations; the effect of

regulatory orders we have entered into and potential future

supervisory action against us or Hanmi Bank; general economic and

business conditions internationally, nationally and in those areas

in which we operate; volatility and deterioration in the credit and

equity markets; changes in consumer spending, borrowing and savings

habits; availability of capital from private and government

sources; demographic changes; competition for loans and deposits

and failure to attract or retain loans and deposits; fluctuations

in interest rates and a decline in the level of our interest rate

spread; risks of natural disasters related to our real estate

portfolio; risks associated with Small Business Administration

(“SBA”) loans; failure to attract or retain key employees; changes

in governmental regulation, including, but not limited to, any

increase in FDIC insurance premiums; ability to receive regulatory

approval for Hanmi Bank to declare dividends to Hanmi Financial;

adequacy of our allowance for loan losses, credit quality and the

effect of credit quality on our provision for credit losses and

allowance for loan losses; changes in the financial performance

and/or condition of our borrowers and the ability of our borrowers

to perform under the terms of their loans and other terms of credit

agreements; our ability to successfully integrate acquisitions we

may make; our ability to control expenses; and changes in

securities markets. In addition, we set forth certain risks in our

reports filed with the Securities and Exchange Commission,

including our Annual Report on Form 10-K for the fiscal year ended

December 31, 2008 and current and periodic reports filed with the

Securities and Exchange Commission thereafter, which could cause

actual results to differ from those projected. You should

understand that it is not possible to predict or identify all such

risks. Consequently, you should not consider such disclosures to be

a complete discussion of all potential risks or uncertainties. We

undertake no obligation to update such forward-looking statements

except as required by law.

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Dollars in Thousands)

December 31,

September 30,

%

December 31, %

2009 2009

Change 2008 Change

ASSETS

Cash and Due from Banks $ 55,263 $ 57,727 (4.3 )% $ 83,933

(34.2 )% Interest-Bearing Deposits in Other Banks 98,847 155,607

(36.5 )% 2,014 4,808.0 % Federal Funds Sold

—

— —

130,000 (100.0 )%

Cash and Cash Equivalents

154,110

213,334 (27.8

)% 215,947

(28.6 )% Investment Securities

133,289 205,901 (35.3 )% 197,117 (32.4 )% Loans: Gross

Loans, Net of Deferred Loan Fees 2,819,060 2,977,504 (5.3 )%

3,362,111 (16.2 )% Allowance for Loan Losses

(144,996 ) (124,768

) 16.2 %

(70,986 ) 104.3

% Loans Receivable, Net

2,674,064 2,852,736

(6.3 )% 3,291,125

(18.7 )% Due from Customers

on Acceptances 994 1,859 (46.5 )% 4,295 (76.9 )% Premises and

Equipment, Net 18,657 19,302 (3.3 )% 20,279 (8.0 )% Accrued

Interest Receivable 9,492 11,389 (16.7 )% 12,347 (23.1 )% Other

Real Estate Owned, Net 26,306 27,140 (3.1 )% 823 3,096.4 % Deferred

Income Taxes, Net — 2,464 (100.0 )% 29,456 (100.0 )% Servicing

Assets 3,842 3,957 (2.9 )% 3,791 1.3 % Other Intangible Assets, Net

3,382 3,736 (9.5 )% 4,950 (31.7 )% Investment in Federal Home Loan

Bank Stock, at Cost 30,697 30,697 — 30,697 — Investment in Federal

Reserve Bank Stock, at Cost 7,878 10,053 (21.6 )% 10,228 (23.0 )%

Bank-Owned Life Insurance 26,408 26,171 0.9 % 25,476 3.7 % Income

Taxes Receivable 60,162 34,908 72.3 % 11,712 413.7 % Other Assets

13,425 13,843

(3.0 )% 17,573

(23.6 )% TOTAL ASSETS

$ 3,162,706

$ 3,457,490

(8.5 )% $

3,875,816 (18.4

)%

LIABILITIES AND STOCKHOLDERS’

EQUITY

Liabilities: Deposits: Noninterest-Bearing $ 556,306 $

561,548 (0.9 )% $ 536,944 3.6 % Interest-Bearing

2,193,021 2,430,312

(9.8 )% 2,533,136

(13.4 )% Total Deposits

2,749,327 2,991,860 (8.1 )% 3,070,080 (10.4 )% Accrued

Interest Payable 12,606 19,730 (36.1 )% 18,539 (32.0 )% Bank

Acceptances Outstanding 994 1,859 (46.5 )% 4,295 (76.9 )% Federal

Home Loan Bank Advances 153,978 160,828 (4.3 )% 422,196 (63.5 )%

Other Borrowings 1,747 1,496 16.8 % 787 122.0 % Junior Subordinated

Debentures 82,406 82,406 — 82,406 — Accrued Expenses and Other

Liabilities

11,904

12,191 (2.4 )%

13,598 (12.5 )%

Total Liabilities 3,012,962 3,270,370 (7.9 )% 3,611,901

(16.6 )% Stockholders’ Equity

149,744

187,120 (20.0

)% 263,915

(43.3 )% TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY $

3,162,706 $

3,457,490 (8.5

)% $ 3,875,816

(18.4 )% HANMI

FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(Dollars in Thousands, Except Per

Share Data)

Three Months Ended

Year Ended Dec. 31, Sept.

30, %

Dec. 31, %

Dec. 31,

Dec. 31, %

2009

2009 Change

2008 Change

2009 2008

Change INTEREST AND DIVIDEND INCOME: Interest and Fees

on Loans $ 40,810 $ 42,705 (4.4 )% $ 51,305 (20.5 )% $ 173,318 $

223,942 (22.6 )% Taxable Interest on Investment Securities

1,414

1,541 (8.2 )% 1,644 (14.0 )% 5,675 9,387 (39.5 )% Tax-Exempt

Interest on Investment Securities 432 607 (28.8 )% 646 (33.1 )%

2,303 2,717 (15.2 )% Interest on Term Federal Funds Sold 30 293

(89.8 )% 43 (30.2 )% 1,718 43 3,895.3 % Dividends on Federal

Reserve Bank Stock 136 150 (9.3 )% 164 (17.1 )% 592 692 (14.5 )%

Interest on Federal Funds Sold and Securities Purchased Under

Resale Agreements 65 67 (3.0 )% 29 124.1 % 326 166 96.4 % Interest

on Interest-Bearing Deposits in Other Banks 70 68 2.9 % 5 1,300.0 %

151 10 1,410.0 % Dividends on Federal Home Loan Bank Stock

— 64

(100.0 )% 273

(100.0 )% 64

1,226 (94.8 )%

Total Interest and Dividend Income

42,957

45,495 (5.6

)% 54,109

(20.6 )% 184,147

238,183 (22.7

)% INTEREST EXPENSE: Interest on Deposits

13,410 17,365 (22.8 )% 19,654 (31.8 )% 76,246 84,353 (9.6 )%

Interest on Federal Home Loan Bank Advances 412 865 (52.4 )% 2,621

(84.3 )% 3,399 14,027 (75.8 )% Interest on Junior Subordinated

Debentures 690 747 (7.6 )% 1,293 (46.6 )% 3,271 5,056 (35.3 )%

Interest on Other Borrowings

—

— — 2

(100.0 )% 2

346 (99.4

)% Total Interest Expense

14,512

18,977 (23.5

)% 23,570

(38.4 )% 82,918

103,782 (20.1

)% NET INTEREST INCOME BEFORE PROVISION FOR

CREDIT LOSSES 28,445 26,518 7.3 % 30,539 (6.9 )% 101,229 134,401

(24.7 )% — — — Provision for Credit Losses

77,000 49,500

55.6 % 25,450

202.6 % 196,387

75,676 159.5

% NET INTEREST INCOME (LOSS) AFTER PROVISION

FOR CREDIT LOSSES

(48,555 )

(22,982 ) 111.3

% 5,089

(1,054.1 )% (95,158

) 58,725

(262.0 )% NON-INTEREST INCOME:

Service Charges on Deposit Accounts 4,022 4,275 (5.9 )% 4,559 (11.8

)% 17,054 18,463 (7.6 )% Insurance Commissions 1,062 1,063 (0.1 )%

1,174 (9.5 )% 4,492 5,067 (11.3 )% Remittance Fees 530 511 3.7 %

651 (18.6 )% 2,109 2,194 (3.9 )% Trade Finance Fees 439 512 (14.3

)% 614 (28.5 )% 1,956 3,088 (36.7 )% Other Service Charges and Fees

371 489 (24.1 )% 513 (27.7 )% 1,810 2,365 (23.5 )% Net Gain on

Sales of Loans 354 864 (59.0 )% — — 1,220 765 59.5 % Bank-Owned

Life Insurance Income 237 234 1.3 % 237 — 932 952 (2.1 )% Gain on

Sales of Investment Securities 1,050 — — — — 2,327 618 276.5 % Loss

on Sales of Investment Securities (385 ) — — (58 ) 563.8 % (494 )

(541 ) (8.7 )% Other-Than-Temporary Impairment Loss on Investment

Securities — — — — — — (2,410 ) (100.0 )% Other Operating Income

(Loss)

159 265

(40.0 )% (286

) (155.6 )%

704 1,588

(55.7 )% Total Non-Interest Income

7,839 8,213

(4.6 )% 7,404

5.9 % 32,110

32,149 (0.1 )%

NON-INTEREST EXPENSE: Salaries and Employee Benefits 8,442

8,648 (2.4 )% 8,846 (4.6 )% 33,101 42,209 (21.6 )% Occupancy and

Equipment 2,733 2,834 (3.6 )% 2,798 (2.3 )% 11,239 11,158 0.7 %

Deposit Insurance Premiums and Regulatory Assessments 2,998 2,001

49.8 % 1,615 85.6 % 10,418 3,713 180.6 % Data Processing 1,606

1,608 (0.1 )% 1,069 50.2 % 6,297 5,799 8.6 % Other Real Estate

Owned Expense 873 3,372 (74.1 )% 249 250.6 % 5,890 390 1,410.3 %

Professional Fees 1,354 1,239 9.3 % 912 48.5 % 4,099 3,539 15.8 %

Advertising and Promotion 762 447 70.5 % 904 (15.7 )% 2,402 3,518

(31.7 )% Supplies and Communications 580 603 (3.8 )% 510 13.7 %

2,352 2,518 (6.6 )% Loan-Related Expense 357 192 85.9 % 221 61.5 %

1,947 790 146.5 % Amortization of Other Intangible Assets 354 379

(6.6 )% 454 (22.0 )% 1,568 1,958 (19.9 )% Other Operating Expenses

2,651 2,366 12.0 % 3,478 (23.8 )% 11,041 11,337 (2.6 )% Impairment

Loss on Goodwill

— —

— —

— —

107,393 (100.0 )%

Total Non-Interest Expense

22,710

23,689 (4.1 )%

21,056 7.9 %

90,354 194,322

(53.5 )% LOSS BEFORE PROVISION

(BENEFIT) FOR INCOME TAXES (63,426 ) (38,458 ) 64.9 % (8,563 )

640.7 % (153,402 ) (103,448 ) 48.3 % Provision (Benefit) for Income

Taxes

(27,545 )

21,207 (229.9 )%

(4,748 ) 480.1

% (31,125 )

(1,355 ) 2,197.0

% NET LOSS $

(35,881 )

$ (59,665

) (39.9 )%

$ (3,815

) 840.5 %

$ (122,277

) $

(102,093 )

19.8 % LOSS PER SHARE:

Basic $ (0.70 ) $ (1.26 ) (44.4 )% $ (0.08 ) 775.0 % $ (2.57 ) $

(2.23 ) 15.2 % Diluted $ (0.70 ) $ (1.26 ) (44.4 )% $ (0.08 ) 775.0

% $ (2.57 ) $ (2.23 ) 15.2 %

WEIGHTED-AVERAGE SHARES

OUTSTANDING: Basic 50,998,103 47,413,141 45,884,462 47,570,361

45,872,541 Diluted 50,998,103 47,413,141 45,884,462 47,570,361

45,872,541

SHARES OUTSTANDING AT PERIOD-END

51,182,390 51,201,390 45,905,549 51,182,390 45,905,549

HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

SELECTED FINANCIAL DATA (UNAUDITED) (Dollars in Thousands)

Three Months Ended Year

Ended

December 31,

September 30,

%

December 31,

%

December 31, December 31, %

2009 2009

Change 2008 Change

2009 2008

Change AVERAGE BALANCES: Average Gross

Loans, Net of Deferred Loan Fees $ 2,924,722 $ 3,078,104 (5.0 )% $

3,366,601 (13.1 )% $ 3,157,133 $ 3,332,133 (5.3 )% Average

Investment Securities 182,635 209,021 (12.6 )% 205,305 (11.0 )%

188,325 271,802 (30.7 )% Average Interest-Earning Assets 3,291,042

3,552,698 (7.4 )% 3,637,232 (9.5 )% 3,611,009 3,653,720 (1.2 )%

Average Total Assets 3,356,383 3,672,253 (8.6 )% 3,789,435 (11.4 )%

3,717,179 3,866,856 (3.9 )% Average Deposits 2,914,794 3,100,419

(6.0 )% 2,879,674 1.2 % 3,109,322 2,913,171 6.7 % Average

Borrowings 244,704 297,455 (17.7 )% 602,838 (59.4 )% 341,514

591,930 (42.3 )% Average Interest-Bearing Liabilities 2,598,520

2,844,821 (8.7 )% 2,913,723 (10.8 )% 2,909,014 2,874,470 1.2 %

Average Stockholders’ Equity 164,767 232,136 (29.0 )% 271,544 (39.3

)% 225,708 323,462 (30.2 )% Average Tangible Equity 161,169 228,169

(29.4 )% 266,333 (39.5 )% 221,537 264,490 (16.2 )%

PERFORMANCE RATIOS (Annualized): Return on Average Assets

(4.24 )% (6.45 )% (0.40 )% (3.29 )% (2.64 )% Return on Average

Stockholders’ Equity (86.40 )% (101.97 )% (5.59 )% (54.17 )% (31.56

)% Return on Average Tangible Equity (88.33 )% (103.75 )% (5.70 )%

(55.19 )% (38.60 )% Efficiency Ratio 62.59 % 68.21 % 55.49 % 67.76

% 116.67 %

Net Interest Spread(1)

2.99 % 2.47 % 2.74 % 2.28 % 2.95 %

Net Interest Margin(1)

3.46 % 3.00 % 3.38 % 2.84 % 3.72 %

ALLOWANCE FOR

LOAN LOSSES: Balance at Beginning of Period $ 124,768 $ 105,268

18.5 % $ 63,948 95.1 % $ 70,986 $ 43,611 62.8 % Provision Charged

to Operating Expense 77,540 49,375 57.0 % 25,660 202.2 % 196,607

73,345 168.1 % Charge-Offs, Net of Recoveries

(57,312 ) (29,875

) 91.8 %

(18,622 ) 207.8

% (122,597 )

(45,970 ) 166.7

% Balance at End of Period

$

144,996 $ 124,768

16.2 % $

70,986 104.3 %

$ 144,996 $

70,986 104.3 %

Allowance for Loan Losses to Total Gross Loans 5.14 % 4.19 % 2.11 %

5.14 % 2.11 % Allowance for Loan Losses to Total Non-Performing

Loans 66.19 % 71.53 % 58.23 % 66.19 % 58.23 %

ALLOWANCE FOR OFF-BALANCE SHEET ITEMS: Balance at Beginning

of Period $ 4,416 $ 4,291 2.9 % $ 4,306 2.6 % $ 4,096 $ 1,765 132.1

% Provision Charged to Operating Expense

(540

) 125 (532.0

)% (210 )

153.3 % (220

) 2,331 (109.4

)% Balance at End of Period

$

3,876 $ 4,416

(12.2 )% $

4,096 (5.4 )%

$ 3,876 $

4,096 (5.4 )%

(1) Amounts calculated on a fully

taxable equivalent basis using the current statutory federal tax

rate.

December 31,

September 30,

%

December 31,

%

2009

2009

Change

2008

Change

NON-PERFORMING ASSETS: Non-Accrual Loans $ 219,000 $

174,363 25.6 % $ 120,823 81.3 % Loans 90 Days or More Past Due and

Still Accruing

67 64

4.7 % 1,075

(93.8 )% Total Non-Performing

Loans 219,067 174,427 25.6 % 121,898 79.7 % Other Real Estate

Owned, Net

26,306

27,140 (3.1 )%

823 3,096.4 % Total

Non-Performing Assets

$ 245,373

$ 201,567 21.7

% $ 122,721

99.9 % Total Non-Performing

Loans/Total Gross Loans 7.77 % 5.85 % 3.62 % Total Non-Performing

Assets/Total Assets 7.76 % 5.83 % 3.17 % Total Non-Performing

Assets/Allowance for Loan Losses 169.2 % 161.6 % 172.9 %

DELINQUENT LOANS $ 186,257

$ 151,047 23.3

% $ 128,469

45.0 % Delinquent Loans/Total

Gross Loans 6.60 % 5.07 % 3.82 %

LOAN PORTFOLIO: Real

Estate Loans $ 1,043,097 $ 1,086,735 (4.0 )% $ 1,180,114 (11.6 )%

Commercial and Industrial Loans 1,714,212 1,824,042 (6.0 )%

2,099,732 (18.4 )% Consumer Loans

63,303

68,537 (7.6 )%

83,525 (24.2

)% Total Gross Loans 2,820,612 2,979,314 (5.3 )%

3,363,371 (16.1 )% Deferred Loan Fees

(1,552

) (1,810 )

(14.3 )% (1,260

) 23.2 % Gross Loans, Net of

Deferred Loan Fees 2,819,060 2,977,504 (5.3 )% 3,362,111 (16.2 )%

Allowance for Loan Losses

(144,996

) (124,768 )

16.2 % (70,986

) 104.3 % Loans Receivable,

Net

$ 2,674,064 $

2,852,736 (6.3 )%

$ 3,291,125 (18.7

)% LOAN MIX: Real Estate Loans 37.0 %

36.5 % 35.1 % Commercial and Industrial Loans 60.8 % 61.2 % 62.4 %

Consumer Loans

2.2 %

2.3 % 2.5

% Total Gross Loans

100.0

% 100.0 %

100.0 % DEPOSIT PORTFOLIO:

Demand - Noninterest-Bearing $ 556,306 $ 561,548 (0.9 )% $ 536,944

3.6 % Savings 111,172 98,019 13.4 % 81,869 35.8 % Money Market

Checking and NOW Accounts 685,858 723,585 (5.2 )% 370,401 85.2 %

Time Deposits of $100,000 or More 815,190 845,318 (3.6 )% 849,800

(4.1 )% Other Time Deposits

580,801

763,390 (23.9

)% 1,231,066

(52.8 )% Total Deposits

$

2,749,327 $ 2,991,860

(8.1 )% $

3,070,080 (10.4 )%

DEPOSIT MIX: Demand - Noninterest-Bearing 20.2 % 18.8

% 17.5 % Savings 4.0 % 3.3 % 2.7 % Money Market Checking and NOW

Accounts 24.9 % 24.2 % 12.1 % Time Deposits of $100,000 or More

29.7 % 28.3 % 27.7 % Other Time Deposits

21.2

% 25.4 %

40.0 % Total Deposits

100.0 % 100.0

% 100.0 %

CAPITAL RATIOS (Bank Only): Total Risk-Based 9.07 % 9.69 %

10.71 % Tier 1 Risk-Based 7.77 % 8.40 % 9.44 % Tier 1 Leverage 6.69

% 7.05 % 8.85 %

HANMI FINANCIAL CORPORATION AND

SUBSIDIARIES AVERAGE BALANCES, AVERAGE YIELDS EARNED AND

AVERAGE RATES PAID (UNAUDITED) (Dollars in Thousands)

Three Months Ended Year

Ended December 31, 2009

September 30, 2009

December 31,

2008

December 31, 2009 December 31,

2008

AverageBalance

Interest

Income/Expense

Average

Yield/Rate

AverageBalance

Interest

Income/Expense

Average

Yield/Rate

AverageBalance

Interest

Income/Expense

Average

Yield/Rate

AverageBalance

Interest

Income/Expense

Average

Yield/Rate

AverageBalance

Interest

Income/Expense

Average

Yield/Rate

INTEREST-EARNING ASSETS Loans: Real Estate

Loans: Commercial Property $ 861,831 $ 11,872 5.47 % $ 887,028 $

12,051 5.39 % $ 902,367 $ 14,074 6.20 % $ 894,408 $ 49,901 5.58 % $

841,526 $ 56,968 6.77 % Construction 130,400 1,342 4.08 % 138,340

1,464 4.20 % 186,080 1,881 4.02 % 156,619 5,947 3.80 % 202,879

9,962 4.91 % Residential Property

80,257

997 4.93 %

83,387 1,050

5.00 % 91,366

1,174 5.11 %

85,228 4,329

5.08 % 90,395

4,758 5.26 % Total

Real Estate Loans 1,072,488 14,211 5.26 % 1,108,755 14,565 5.21 %

1,179,813 17,129 5.78 % 1,136,255 60,177 5.30 % 1,134,800 71,688

6.32 % Commercial and Industrial Loans 1,787,795 25,472 5.65 %

1,897,321 26,863 5.62 % 2,104,820 32,691 6.18 % 1,947,669 108,346

5.56 % 2,112,421 145,107 6.87 % Consumer Loans

66,074 965

5.79 % 73,670

1,084 5.84 %

83,411 1,353

6.45 % 74,700

4,310 5.77 %

86,787 6,142

7.08 % Total Gross Loans 2,926,357 40,648

5.51 % 3,079,746 42,512 5.48 % 3,368,044 51,173 6.04 % 3,158,624

172,833 5.47 % 3,334,008 222,937 6.69 % Prepayment Penalty Income —

162 — —

193

—

— 132 — — 485 — — 1,005 — Unearned Income on Loans, Net of Costs

(1,635 ) —

—

(1,642 ) —

— (1,443 )

— —

(1,491 ) —

— (1,875 )

— — Gross Loans, Net

2,924,722

40,810 5.54

% 3,078,104

42,705 5.50

% 3,366,601

51,305 6.06

% 3,157,133

173,318 5.49

% 3,332,133

223,942 6.72

% Investment Securities:

Municipal Bonds(1)

41,653 665 6.39 % 58,179 933 6.41 % 59,718 994 6.66 % 54,448 3,543

6.51 % 63,918 4,180 6.54 % U.S. Government Agency Securities 36,500

437 4.79 % 37,969 431 4.54 % 21,720 201 3.70 % 24,417 1,108 4.54 %

65,440 2,813 4.35 % Mortgage-Backed Securities 77,354 738 3.82 %

82,429 807 3.92 % 79,821 971 4.87 % 77,627 3,320 4.28 % 87,930

4,217 4.77 % Collateralized Mortgage Obligations 14,312 143 4.00 %

17,066 173 4.05 % 37,853 403 4.26 % 21,365 879 4.11 % 43,842 1,865

4.25 % Corporate Bonds 286 — 0.00 % 401 — 0.00 % 1,688 46 10.90 %

271 — 0.00 % 6,671 333 4.59 % Other Securities

12,530 97 3.10

% 12,977

130 4.01 %

4,505 23 2.04

% 10,197

369 3.62 %

4,001 159 4.73

%

Total Investment

Securities(1)

182,635

2,080 4.56

% 209,021

2,474 4.73

% 205,305

2,638 5.14

% 188,325

9,219 4.90

% 271,802

13,567 4.99

% Other Interest-Earning Assets:

Equity Securities 40,605 136 1.34 % 41,741 214 2.05 % 42,551 437

4.11 % 41,399 656 1.58 % 38,516 1,918 4.98 % Federal Funds Sold and

Securities Purchased Under Resale Agreements 51,713 65 0.50 %

56,568 67 0.47 % 14,410 29 0.80 % 84,363 326 0.39 % 8,934 166 1.86

% Term Federal Funds Sold 8,500 30 1.41 % 90,239 293 1.30 % 7,609

43 2.26 % 95,822 1,718 1.79 % 1,913 43 2.25 % Interest-Bearing

Deposits in Other Banks

82,867

70 0.34 %

77,025 68 0.35

% 756 5

2.65 % 43,967

151 0.34 %

422 10 2.37

% Total Other Interest-Earning Assets

183,685 301

0.66 %

265,573 642

0.97 %

65,326 514

3.15 %

265,551 2,851

1.07 %

49,785 2,137

4.29 %

TOTAL INTEREST-EARNING

ASSETS(1)

$ 3,291,042

$ 43,191

5.21 %

$ 3,552,698

$ 45,821

5.12 %

$ 3,637,232

$ 54,457

5.96 %

$ 3,611,009

$ 185,388

5.13 %

$ 3,653,720

$ 239,646

6.56 %

INTEREST-BEARING LIABILITIES Interest-Bearing

Deposits: Savings $ 104,068 $ 711 2.71 % $ 93,404 $ 585 2.48 %

$ 83,777 $ 506 2.40 % $ 91,089 $ 2,328 2.56 % $ 89,866 $ 2,093 2.33

% Money Market Checking and NOW Accounts 733,063 3,508 1.90 %

629,124 2,998 1.89 % 506,062 3,963 3.12 % 507,619 9,786 1.93 %

618,779 19,909 3.22 % Time Deposits of $100,000 or More 835,726

4,930 2.34 % 983,341 7,447 3.00 % 754,081 8,162 4.31 % 1,051,994

34,807 3.31 % 1,045,968 43,598 4.17 % Other Time Deposits

680,959 4,261

2.48 % 841,497

6,335 2.99 %

966,965 7,023

2.89 % 916,798

29,325 3.20 %

527,927 18,753

3.55 % Total Interest-Bearing

Deposits 2,353,816

13,410 2.26

% 2,547,366

17,365 2.70

% 2,310,885

19,654 3.38

% 2,567,500

76,246 2.97

% 2,282,540

84,353 3.70

% Borrowings: FHLB Advances

160,754 412 1.02 % 213,583 865 1.61 % 518,058 2,620 2.01 % 257,529

3,399 1.32 % 498,875 14,026 2.81 % Other Borrowings 1,544 — 0.00 %

1,466 — 0.00 % 2,374 3 0.50 % 1,579 2 0.13 % 10,649 347 3.26 %

Junior Subordinated Debentures

82,406

690 3.32 %

82,406 747

3.60 % 82,406

1,293 6.24 %

82,406 3,271

3.97 % 82,406

5,056 6.14 % Total

Borrowings 244,704

1,102 1.79

% 297,455

1,612 2.15

% 602,838

3,916 2.58

% 341,514

6,672 1.95

% 591,930

19,429 3.28

% TOTAL INTEREST-BEARING

LIABILITIES $ 2,598,520

$ 14,512

2.22 %

$ 2,844,821

$ 18,977

2.65 %

$ 2,913,723

$ 23,570

3.22 %

$ 2,909,014

$ 82,918

2.85 %

$ 2,874,470

$ 103,782

3.61 %

NET INTEREST INCOME(1)

$ 28,679

$ 26,844

$ 30,887

$ 102,470

$ 135,864

NET INTEREST SPREAD(1)

2.99 %

2.47 %

2.74 %

2.28 %

2.95 %

NET INTEREST MARGIN(1)

3.46 %

3.00 %

3.38 %

2.84 %

3.72 %

(1) Amounts calculated on a fully

taxable equivalent basis using the current statutory federal tax

rate.

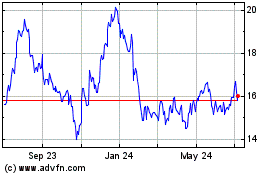

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jul 2023 to Jul 2024