Second Quarter and Recent

Highlights:

- Record quarterly net revenues and Adjusted EBITDA

- The Strat renovations on schedule and on budget; casino

floor renovations and additional room remodels underway

- Implementing operational synergies in Laughlin

- TrueRewards one card loyalty program now live at all ten

casino properties

- Opened two new taverns in Q2 and one in July bringing

current total to 66 Nevada locations

- Refinanced 2nd lien debt and repaid outstanding revolving

credit facility with unsecured notes offering

Golden Entertainment, Inc. (NASDAQ:GDEN) (“Golden

Entertainment”, “Golden” or the “Company”) today reported financial

results for the second quarter ended June 30, 2019.

Blake Sartini, Chairman and Chief Executive Officer of Golden

Entertainment, commented, “Record quarterly revenue and Adjusted

EBITDA in the second quarter reflects solid year-over-year

increases across both our Casinos and Distributed Gaming

operations.

“The improvements we have made at The Strat continue to be well

received by our guests despite the ongoing construction disruption

at the property. We have started renovations to The Strat casino

floor and remodels of additional hotel rooms, which we expect to

complete by the end of the year. We have also integrated the

operations of the Edgewater and Colorado Belle casinos in Laughlin

and we expect these properties to deliver improved results in the

second half of the year as we begin to realize our targeted

synergies. In addition, we have improved our ability to incentivize

guests across our casino platform with the completed rollout of our

new TrueRewards loyalty program at all ten of our casino

properties.

“During the second quarter our Distributed Gaming operations

benefited from six new taverns opened since the prior-year period

and from improved Nevada chain store performance following rent

adjustments to approximately half of our locations. Further, our

Montana business continues to grow organically with the addition of

new locations.

“During the second quarter we completed a $375 million unsecured

notes offering that refinanced our revolver borrowings and

outstanding 2nd lien term loan, reduced secured leverage, extended

maturities and added fixed cost capital to the balance sheet while

maintaining an attractive blended interest rate.

“We expect continued economic growth in southern Nevada will

support the financial performance for the majority of our portfolio

of gaming assets. In addition, we believe our strategic investment

in The Strat as well as our recent property acquisitions in

Laughlin position us favorably to build long-term shareholder

value.”

Consolidated Results

The Company reported record second quarter revenues of $248.1

million, up 14.6% from $216.5 million in the second quarter of

2018. Net loss for the second quarter of 2019 was $14.4 million or

a loss of $0.52 per share, compared to net income of $3.6 million

or $0.12 per diluted share in the second quarter of 2018. Adjusted

EBITDA increased 7.6% to a record $49.8 million for the second

quarter of 2019 compared to $46.3 million for the second quarter of

2018. Results for the second quarter include a full quarter of

operations of the Edgewater and Colorado Belle Casino Resorts

acquired by the Company on January 14, 2019.

Casinos

Casino revenues grew 21.2% to $158.7 million in the second

quarter of 2019 compared to $130.9 million in the second quarter of

2018. Casino Adjusted EBITDA grew 13.7% to $48.0 million compared

to $42.2 million in the same quarter of 2018.

In the second quarter, growth in the casino segment was

primarily driven by the acquisition of two casinos in Laughlin,

Nevada in January 2019, partially offset by the construction

disruption at The Strat and increased regional competition that

impacted Rocky Gap Casino Resort in Maryland.

Distributed Gaming

Distributed Gaming revenues increased 4.4% to $89.2 million from

$85.4 million in the second quarter of 2018. Adjusted EBITDA for

the segment grew 6.5% to $13.7 million from $12.8 million in the

same period of 2018.

The Company generated growth in revenue and Adjusted EBITDA in

both its Nevada and Montana distributed gaming businesses for the

second consecutive quarter. In Nevada, continued growth from the

Company’s wholly-owned tavern portfolio, which added six new

locations since the prior-year period, as well as stabilization of

the Company’s chain store locations contributed to improved

results. In Montana, the Company continued to add new locations and

also benefited from continued investment in new game

technology.

The Strat Renovations

Update

The Strat renovations for 2019 remain on schedule, with

renovations to the casino floor beginning in June and additional

room renovations beginning in July. The Strat’s new tap room,

lounge and sports book were open for the entire second quarter. In

addition, the Company completed renovations to the SkyPod on the

108th floor of the tower, which includes a remodeled gift shop and

food and beverage outlets as well as improvements to the Sky Jump

experience. Prior to the second quarter, Golden completed the

renovation of 317 hotel rooms, other food and beverage outlets

(including Top of the World, Strat Café and Starbucks), exterior

lighting and landscaping of the property.

The remaining projects for 2019 include completing the casino

remodel, renovating an additional 252 hotel rooms and completing

the design of potential group meeting space. Golden expects the

renovations of the casino floor to be ongoing throughout the

remainder of the year.

As of June 30, 2019, the Company has invested approximately $54

million on The Strat renovations, including approximately $24

million in 2018. The Company expects approximately $30 million of

additional renovation costs for 2019 which it intends to fund with

cash flow from operations. Golden Entertainment’s total budget for

The Strat renovations remains unchanged at approximately $140

million.

Balance Sheet Highlights

As of June 30, 2019, the Company had cash and cash equivalents

of approximately $117 million and total outstanding debt of $1.15

billion, with no borrowings outstanding under the Company’s $200

million revolving credit facility.

In April, the Company completed a $375 million, 7-year senior

unsecured notes offering which priced at 7.625%. Proceeds from the

notes offering were used to repay $145 million of outstanding

borrowings under the Company’s revolving credit facility, repay the

Company’s $200 million 2nd lien term loan facility, repay $18

million of outstanding borrowings under the Company’s existing 1st

lien term loan facility and pay offering fees and expenses.

Currently, the Company has $772 million outstanding under its first

lien term loan facility with an interest cost of LIBOR plus 3%.

Investor Conference Call and Webcast

The Company will host a webcast and conference call today,

August 6, 2019 at 5:00 p.m. Eastern Time, to discuss the second

quarter 2019 results. The conference call may be accessed live by

dialing (844) 465-3054 or (480) 685-5227 for international callers

and entering the passcode 5152816. A replay will be available

beginning at 8:00 p.m. ET on August 6, 2019 and may be accessed by

dialing (855) 859-2056 or (404) 537-3406 for international callers;

the passcode is 5152816. The replay will be available until August

9, 2019. The call will also be webcast live through the “Investors”

section of the Company’s website, www.goldenent.com. A replay of

the audio webcast will also be archived on the Company’s website,

www.goldenent.com.

Forward-Looking Statements

This press release contains forward-looking statements regarding

future events and our future results that are subject to the safe

harbors created under the Securities Act of 1933 and the Securities

Exchange Act of 1934. Forward-looking statements can generally be

identified by the use of words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “plan,” “project,” “potential,” “seek,” “should,” “think,”

“will,” “would” and similar expressions, or they may use future

dates. Forward-looking statements in this press release include,

without limitation, statements regarding: the integration and

benefits of, and realization of cost synergies from, the Laughlin

acquisition; future financial and operating results; proposed

future capital expenditures, investments and property improvements,

including The Strat renovations, anticipated opening of new tavern

and distributed gaming locations and investment in technology, and

their associated timing, source of funding and cost; and the

Company’s plans, strategic priorities, objectives, expectations,

intentions, including with respect to its growth prospects and

growth opportunities and potential acquisitions. Forward-looking

statements are based on our current expectations and assumptions

regarding the Company’s business, the economy and other future

conditions. These forward-looking statements are subject to

assumptions, risks and uncertainties that may change at any time,

and readers are therefore cautioned that actual results could

differ materially from those expressed in any forward-looking

statements. Factors that could cause actual results to differ

materially include: the Company’s ability to realize the

anticipated cost savings, synergies and other benefits of the

American and Laughlin transactions and its other acquisitions, and

integration risks relating to such transactions; changes in

national, regional and local economic, political and market

conditions; legislative and regulatory matters (including the cost

of compliance or failure to comply with applicable laws and

regulations); increases in gaming taxes and fees in the

jurisdictions in which the Company operates; litigation; increased

competition; the Company’s ability to renew its distributed gaming

contracts; reliance on key personnel (including the Company’s Chief

Executive Officer, Chief Operating Officer and Chief Strategy and

Financial Officer); the level of the Company’s indebtedness and the

Company’s ability to comply with covenants in its debt instruments;

terrorist incidents; natural disasters; severe weather conditions;

the effects of environmental and structural building conditions;

the effects of disruptions to the Company’s information technology

and other systems and infrastructure; factors affecting the gaming,

entertainment and hospitality industries generally; and other risks

and uncertainties discussed in the Company’s filings with the SEC,

including the “Risk Factors” sections of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2018 and most

recent Quarterly Reports on Form 10-Q. The Company undertakes no

obligation to update any forward-looking statements as a result of

new information, future developments or otherwise. All

forward-looking statements in this press release are qualified in

their entirety by this cautionary statement.

Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements

presented in accordance with United States generally accepted

accounting principles (“GAAP”), the Company uses Adjusted EBITDA,

which measure the Company believes is appropriate to provide

meaningful comparison with, and to enhance an overall understanding

of, the Company’s past financial performance and prospects for the

future. The Company believes Adjusted EBITDA provides useful

information to both management and investors by excluding specific

expenses and gains that the Company believes are not indicative of

core operating results. Further, Adjusted EBITDA is a measure of

operating performance used by management, as well as industry

analysts, to evaluate operations and operating performance and is

widely used in the gaming industry. Other companies in the gaming

industry may calculate Adjusted EBITDA differently than the Company

does.

The presentation of this additional information is not meant to

be considered in isolation or as a substitute for measures of

financial performance prepared in accordance with GAAP.

Reconciliations of Adjusted EBITDA to net income (loss) are

provided in the financial information tables below.

The Company defines “Adjusted EBITDA” as earnings before

interest and other non-operating income (expense), income taxes,

depreciation and amortization, acquisition expenses, loss on

disposal of property and equipment, share-based compensation

expenses, preopening and related expenses, class action litigation

expenses, executive severance, gain on change in fair value of

derivative, and other gains and losses. Adjusted EBITDA for a

particular segment or operation is Adjusted EBITDA before corporate

overhead, which is not allocated to each segment or operation.

About Golden Entertainment, Inc.

Golden Entertainment owns and operates gaming properties across

two divisions – casino operations and distributed gaming. Golden

operates approximately 17,300 slots, 160 table games, and 7,318

hotel rooms, and provides jobs for approximately 8,200 team

members. Golden owns ten casino resorts – nine in Southern Nevada

and one in Maryland. Through its distributed gaming business in

Nevada and Montana, Golden operates video gaming devices at over

1,000 locations and owns over 60 traditional taverns in Nevada.

Golden is also licensed in Illinois and Pennsylvania to operate

video gaming terminals. For more information, visit

www.goldenent.com.

Golden Entertainment,

Inc.

Consolidated Statements of

Operations

(Unaudited, in thousands, except

per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Revenues

Gaming

$

146,246

$

132,546

$

290,038

$

266,409

Food and beverage

52,104

43,422

101,862

86,025

Rooms

35,514

27,660

66,801

53,787

Other

14,206

12,915

29,261

25,111

Total revenues

248,070

216,543

487,962

431,332

Expenses

Gaming

84,007

78,510

166,355

156,198

Food and beverage

40,216

35,351

78,430

68,943

Rooms

16,008

12,291

30,409

23,856

Other operating

5,160

3,655

11,594

7,651

Selling, general and administrative

56,235

43,615

113,182

87,821

Depreciation and amortization

29,976

22,854

57,241

48,091

Acquisition and severance expenses

1,123

565

2,667

1,864

Preopening expenses

738

389

1,516

837

Loss on disposal of assets

585

218

832

295

Total expenses

234,048

197,448

462,226

395,556

Operating income

14,022

19,095

25,736

35,776

Non-operating income (expense)

Interest expense, net

(19,135

)

(16,066

)

(37,270

)

(30,809

)

Loss on extinguishment and modification of

debt

(9,150

)

—

(9,150

)

—

Change in fair value of derivative

(1,489

)

1,462

(3,737

)

4,673

Total non-operating expense,

net

(29,774

)

(14,604

)

(50,157

)

(26,136

)

Income (loss) before income tax

benefit

(15,752

)

4,491

(24,421

)

9,640

Income tax benefit (provision)

1,344

(897

)

1,995

(2,116

)

Net income (loss)

$

(14,408

)

$

3,594

$

(22,426

)

$

7,524

Weighted-average common shares

outstanding

Basic

27,762

27,406

27,667

27,278

Dilutive impact of stock options and

restricted stock units

—

2,258

—

2,250

Diluted

27,762

29,664

27,667

29,528

Net income (loss) per share

Basic

$

(0.52

)

$

0.13

$

(0.81

)

$

0.28

Diluted

$

(0.52

)

$

0.12

$

(0.81

)

$

0.25

Golden Entertainment,

Inc.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(Unaudited, in thousands)

Three Months Ended June 30,

2019

Casino Segment

Distributed Gaming

Segment

Nevada Casinos

Maryland Casino

Nevada Distributed

Gaming

Montana Distributed

Gaming

Corporate

and Other

Consolidated

Total Revenues

$

140,260

$

18,456

$

71,445

$

17,708

$

201

$

248,070

Net income (loss)

$

18,194

$

4,277

$

6,687

$

660

$

(44,226

)

$

(14,408

)

Depreciation and amortization

23,092

960

3,894

1,675

355

29,976

Preopening and related expenses(1)

685

15

660

-

137

1,497

Acquisition and severance expenses

101

-

9

-

1,013

1,123

Asset disposal and other writedowns

412

99

78

(4

)

-

585

Share-based compensation

-

-

-

-

2,134

2,134

Other, net

81

-

-

-

406

487

Interest expense, net

63

1

21

2

19,048

19,135

Loss on extinguishment and modification of

debt

-

-

-

-

9,150

9,150

Change in fair value of derivative

-

-

-

-

1,489

1,489

Income tax benefit

-

-

-

-

(1,344

)

(1,344

)

Adjusted EBITDA

$

42,628

$

5,352

$

11,349

$

2,333

$

(11,838

)

$

49,824

Three Months Ended June 30,

2018

Casino Segment

Distributed Gaming

Segment

Nevada Casinos

Maryland Casino

Nevada Distributed

Gaming

Montana Distributed

Gaming

Corporate

and Other

Consolidated

Total Revenues

$

112,917

$

18,009

$

69,507

$

15,890

$

220

$

216,543

Net income (loss)

$

19,632

$

4,604

$

6,583

$

969

$

(28,194

)

$

3,594

Depreciation and amortization

16,364

1,048

3,745

1,234

463

22,854

Preopening expenses(1)

-

-

88

-

301

389

Acquisition and severance expenses

168

-

2

-

395

565

Asset disposal and other writedowns

214

4

-

-

-

218

Share-based compensation

-

-

-

-

2,758

2,758

Other, net

123

-

195

-

99

417

Interest expense, net

23

2

25

1

16,015

16,066

Change in fair value of derivative

-

-

-

-

(1,462

)

(1,462

)

Income tax provision

-

-

-

-

897

897

Adjusted EBITDA

$

36,524

$

5,658

$

10,638

$

2,204

$

(8,728

)

$

46,296

Six Months Ended June 30,

2019

Casino Segment

Distributed Gaming

Segment

Nevada Casinos

Maryland Casino

Nevada Distributed

Gaming

Montana Distributed

Gaming

Corporate

and Other

Consolidated

Total Revenues

$

275,889

$

34,201

$

142,850

$

34,660

$

362

$

487,962

Net income (loss)

$

38,056

$

7,104

$

13,719

$

1,234

$

(82,539

)

$

(22,426

)

Depreciation and amortization

43,781

1,914

7,617

3,281

648

57,241

Preopening and related expenses(1)

2,339

15

1,226

-

149

3,729

Acquisition and severance expenses

387

-

22

13

2,245

2,667

Asset disposal and other writedowns

668

99

78

(13

)

390

1,222

Share-based compensation

11

-

5

-

6,302

6,318

Other, net

92

-

-

-

1,259

1,351

Interest expense, net

113

3

36

3

37,115

37,270

Loss on extinguishment and modification of

debt

-

-

-

-

9,150

9,150

Change in fair value of derivative

-

-

-

-

3,737

3,737

Income tax benefit

-

-

-

-

(1,995

)

(1,995

)

Adjusted EBITDA

$

85,447

$

9,135

$

22,703

$

4,518

$

(23,539

)

$

98,264

Six Months Ended June 30,

2018

Casino Segment

Distributed Gaming

Segment

Nevada Casinos

Maryland Casino

Nevada Distributed

Gaming

Montana Distributed

Gaming

Corporate

and Other

Consolidated

Total Revenues

$

228,584

$

32,829

$

138,241

$

31,317

$

361

$

431,332

Net income (loss)

$

40,772

$

7,305

$

13,406

$

1,594

$

(55,553

)

$

7,524

Depreciation and amortization

34,973

2,074

7,525

2,602

917

48,091

Preopening expenses(1)

-

-

236

-

601

837

Acquisition and severance expenses

219

-

37

-

1,608

1,864

Asset disposal and other writedowns

276

4

5

10

-

295

Share-based compensation

-

-

-

-

4,602

4,602

Other, net

160

-

362

-

203

725

Interest expense, net

45

4

69

3

30,688

30,809

Change in fair value of derivative

-

-

-

-

(4,673

)

(4,673

)

Income tax provision

-

-

-

-

2,116

2,116

Adjusted EBITDA

$

76,445

$

9,387

$

21,640

$

4,209

$

(19,491

)

$

92,190

(1) Preopening and related expenses include rent, organizational

costs, non-capital costs associated with the opening of tavern and

casino locations, and expenses related to The Strat rebranding and

the launch of the TrueRewards loyalty program.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190806005906/en/

Golden Entertainment, Inc. Charles H. Protell Chief Financial

Officer 702/893-7777

Investor Relations Joseph Jaffoni, Richard Land, James Leahy

JCIR 212/835-8500 or gden@jcir.com

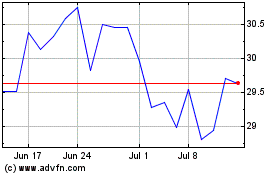

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

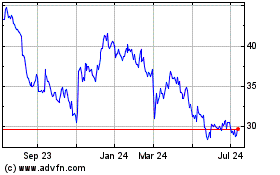

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Jul 2023 to Jul 2024