Registration No. 333-_________

As filed with the Securities and Exchange Commission on June 18, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ESSA Bancorp, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Pennsylvania

|

20-8023072

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

Incorporation or Organization)

|

|

200 Palmer Street

Stroudsburg, Pennsylvania 18360

(Address of Principal Executive Offices)

ESSA Bancorp, Inc. 2024 Equity Incentive Plan

(Full Title of the Plan)

Copies to:

|

Gary S. Olson

|

Marc P. Levy, Esq.

|

|

President and Chief Executive Officer

|

D. Max Seltzer, Esq.

|

|

ESSA Bancorp, Inc.

|

Luse Gorman, PC

|

|

200 Palmer Street

|

5335 Wisconsin Ave., N.W., Suite 780

|

|

Stroudsburg, Pennsylvania 18360

|

Washington, DC 20015-2035

|

|

(570) 421-0531

|

(202) 274-2000

|

|

(Name, Address and Telephone

|

|

|

Number of Agent for Service)

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ⌧

|

Smaller reporting company⌧

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ☐

PART I. INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Items 1 and 2. Plan Information; and Registrant Information and Employee Plan Annual Information

The documents containing the information specified in Part I of Form S-8 have been or will be sent or given to participants in the ESSA Bancorp, Inc. 2024 Equity Incentive Plan

(the “Plan”) as specified by Rule 428(b)(1) promulgated by the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”).

Such documents are not being filed with the Commission but constitute (along with the documents incorporated by reference into this Registration Statement pursuant to Item 3 of

Part II hereof) a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II. INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents previously filed by ESSA Bancorp, Inc. (the “Company”) with the Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are

incorporated herein by reference (other than any such documents or portions thereof that are furnished under Item 2.02 or Item 7.01 of Form 8-K, unless otherwise indicated therein, including any exhibits included with such Items):

(b)

The Company’s Quarterly Reports on Form 10-Q for the

quarter ended December 31, 2023, filed with the Commission on

February 13, 2024, and for the quarter ended March 31, 2024, filed with the

Commission on

May 13, 2024 (File No. 001-33384);

(d)

The description of the Company’s common stock contained in the

Registration Statement on Form 8-A filed with the Commission on March 27, 2007 (File No. 001-33384), including any subsequent amendments or reports filed for

the purpose of updating such description.

All documents subsequently filed by the Company with the Commission pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, after the date hereof, and prior to the

filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed incorporated by reference into this Registration Statement and to be a

part thereof from the date of the filing of such documents.

Any statement contained in the documents incorporated, or deemed to be incorporated, by reference herein or therein shall be deemed to be modified or superseded for purposes of

this Registration Statement and the prospectus to the extent that a statement contained herein or therein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein or therein modifies or

supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement and the prospectus.

All information appearing in this Registration Statement and the prospectus is qualified in its entirety by the detailed information, including financial statements, appearing in

the documents incorporated herein or therein by reference.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

None.

Item 6. Indemnification of Directors and Officers

Indemnification of Directors and Officers of ESSA Bank & Trust. Article VI of the bylaws of ESSA Bank & Trust, set forth circumstances under which directors, officers, employees and agents of ESSA

Bank & Trust may be insured or indemnified against liability which they incur in their capacities as such:

Section 1. Personal Liability of Directors. A director of the Bank shall not be personally liable for monetary damages for any action taken, or any failure to

take any action, as a director except to the extent that by law (including 42 Pa. C.S. 8332.5 et seq.) a director’s liability for monetary damages may not be limited.

Section 2. Indemnification. The Bank shall indemnify in accordance with its Indemnification Policy any person who was or is a party or is threatened to be made a party to any threatened, pending or

completed action, suit or proceeding, including actions by or in the right of the Bank, whether civil, criminal, administrative or investigative, by reason of the fact that such a person is or was a director or officer of the Bank, or is or was

serving while a director or officer of the Bank and at the request of the Bank, as a director, officer, employee, agent, fiduciary or other representative of another corporation, partnership, joint venture, trust, employee benefit plan or other

enterprise, against expenses (including attorneys’ fees), judgments, fines, excise taxes and amounts paid n settlement actually and reasonable incurred by such person in connection with such action, suit or proceeding to the full extent permissible

under Pennsylvania law.

Section 3. Advancement of Expenses. Reasonable expenses incurred by an officer or director of the Bank in defending a civil or criminal action, suit or proceeding described in Section 2 shall be paid by

the Bank in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such person to repay such amount if it shall ultimately be determined that the person is not entitled to be indemnified

by the Bank.

Section 4. Other Rights. The indemnification and advancement of expenses provided by or pursuant to this Article shall not be deemed exclusive of any other rights to which those seeking indemnification or

advancement of expenses may be entitled, any insurance or other agreement, vote of shareholders or directors or otherwise, both as to actions in their official capacity and as to actions in another capacity

while holding an office, and shall continue as a person who has ceased to be a director or officer and shall inure to the benefit of the heirs, executors and administrators of such person.

Section 5. Insurance. The Bank shall have the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or

agent of the Bank, or is or was serving at the request of the Bank as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, against any liability asserted against

him/her and incurred by him/her in any such capacity, or arising out of his/her status as such, whether or not the Bank should have the power to indemnify him/her against such liability under the provisions of these By-Laws.

Section 6. Security Fund; Indemnity Agreements. By action of the Board of Directors (notwithstanding their interest in the transaction) the Bank may create and

fund a trust or fund of any nature, any may enter into agreements with its officers and directors, for the purpose of securing or insuring in any manner its obligation to indemnify or advance expenses provided for in this Article.

Section 7. Modification. The duties of the Bank to indemnify and to advance expenses to a director or officer provided in this Article shall be in the nature of a contract between the Bank and each such

director or officer, and no amendment or repeal of any provision of the Article, and no amendment or termination of any trust or other fund created pursuant to Section 6 shall alter, the detriment of such director or officer, the right of such person

to the advance of expenses or indemnification related to a claim based on an act or failure to act which took place prior to such amendment, repeal or termination.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. List of Exhibits.

|

Regulation S-K

Exhibit Number

|

|

Document

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

____________________________________

The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are

being made, a post-effective amendment to the Registration Statement:

(i) to include any prospectus required by Section 10(a)(3) of

the Securities Act;

(ii) to reflect in the prospectus any facts or events arising

after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) (section 230.424(b)) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fees” table in the effective registration statement;

(iii) to include any material information with respect to the

plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

provided, however, that paragraphs 1(i) and 1(ii) above do not apply if the information required to be included in a post-effective amendment by these paragraphs is contained in

reports filed with or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by

reference in this Registration Statement;

2. That, for the purpose of determining any liability under the

Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

3. To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering;

4. That, for purposes of determining any liability under the

Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

5. Insofar as indemnification for liabilities arising under the

Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer

or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be

governed by the final adjudication of such issue.

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to

believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement on Form S-8 to be signed on its behalf by the undersigned, thereunto duly authorized, in Stroudsburg, Pennsylvania, on this 18th

day of June, 2024.

| |

|

ESSA BANCORP, INC.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Gary S. Olson

|

| |

|

Gary S. Olson

|

| |

|

President and Chief Executive Officer

|

| |

|

(Duly Authorized Representative)

|

We, the undersigned directors and officers of ESSA Bancorp, Inc. (the “Company”) hereby severally constitute and appoint Gary S. Olson, as our true and lawful attorney and agent,

to do any and all things in our names in the capacities indicated below which said Gary S. Olson may deem necessary or advisable to enable the Company to comply with the Securities Act of 1933, and any rules, regulations and requirements of the

Securities and Exchange Commission, in connection with the registration of shares of common stock to be granted and shares of common stock to be issued upon the exercise of stock options to be granted under the ESSA Bancorp, Inc. 2024 Equity

Incentive Plan, including specifically, but not limited to, power and authority to sign for us in our names in the capacities indicated below the registration statement and any and all amendments (including post-effective amendments) thereto; and we

hereby approve, ratify and confirm all that said Gary S. Olson shall do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement on Form S-8 has been signed by the following persons in the capacities and on the date

indicated.

|

Signatures

|

|

Title

|

|

Date

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Gary S. Olson

|

|

Director, President & Chief Executive

|

|

June 18, 2024

|

|

Gary S. Olson

|

|

Officer (Principal Executive Officer)

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Allan A. Muto

|

|

Executive Vice President & Chief

|

|

June 18, 2024

|

|

Allan A. Muto

|

|

Financial Officer (Principal Financial and Accounting Officer)

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Robert C. Selig Jr.

|

|

Chairman of the Board

|

|

June 18, 2024

|

|

Robert C. Selig Jr.

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Joseph S. Durkin

|

|

Director

|

|

June 18, 2024 |

|

Joseph S. Durkin

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Daniel J. Henning

|

|

Director

|

|

June 18, 2024

|

|

Daniel J. Henning

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Christine D. Gordon J.D.

|

|

Director

|

|

June 18, 2024

|

|

Christine D. Gordon J.D.

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Philip H. Hosbach, IV

|

|

Director

|

|

June 18, 2024

|

|

Philip H. Hosbach, IV

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Tina Q. Richardson

|

|

Director

|

|

June 18, 2024

|

|

Tina Q. Richardson

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Carolyn P. Stennett

|

|

Director

|

|

June 18, 2024

|

|

Carolyn P. Stennett

|

|

|

|

|

/s/ Elizabeth B. Weekes

|

|

Director

|

|

June 18, 2024

|

|

Elizabeth B. Weekes

|

|

|

|

|

5

EXHIBIT 5

LUSE GORMAN, PC

ATTORNEYS AT LAW

5335 WISCONSIN AVENUE, N.W., SUITE 780

WASHINGTON, D.C. 20015

TELEPHONE (202) 274-2000

FACSIMILE (202) 362-2902

www.luselaw.com

June 18, 2024

Board of Directors

ESSA Bancorp, Inc.

200 Palmer Street

Stroudsburg, Pennsylvania 18360

|

Re: |

ESSA Bancorp, Inc. - Registration Statement on Form S-8

|

Ladies and Gentlemen:

You have requested the opinion of this firm as to certain matters in connection with the registration of 200,000 shares of common stock,

$0.01 par value per share (the “Shares”), of ESSA Bancorp, Inc. (the “Company”) to be issued pursuant to the ESSA Bancorp, Inc. 2024 Equity Incentive Plan (the “Equity Plan”).

In rendering the opinion expressed herein, we have reviewed the Articles of Incorporation and Bylaws of the Company, the Equity Plan,

the Company’s Registration Statement on Form S-8 (the “Form S-8”), as well as resolutions of the board of directors of the Company and applicable statutes and regulations governing the Company. We have assumed the authenticity, accuracy and

completeness of all documents in connection with the opinion expressed herein. We have also assumed the legal capacity and genuineness of the signatures of persons signing all documents in connection with which the opinions expressed herein are

rendered. This opinion is limited to matters of Pennsylvania corporate law.

Based on the foregoing, we are of the following opinion:

Following the effectiveness of the Form S-8, the Shares of the Company, when issued in accordance with the terms and conditions of the

Equity Plan, will be legally issued, fully paid and non-assessable.

This opinion has been prepared solely for the use of the Company in connection with the preparation and filing of the Form S-8 and shall

not be used for any other purpose or relied upon by any other person without the prior express written consent of this firm. We hereby consent to the filing of this opinion as an exhibit to the Form S-8. By giving such consent, we do not hereby

admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

| |

Very truly yours,

|

| |

|

| |

|

| |

/s/ Luse Gorman, PC

|

| |

LUSE GORMAN, PC

|

EXHIBIT 10.2

Form Of

ESSA Bancorp, Inc.

Restricted Stock Award Agreement (Time Based Vesting)

1. Restricted Stock Award. ESSA Bancorp, Inc. (the “Company”) has granted to the following person (the “Participant”) a Restricted Stock Award (the “Award”),

pursuant to the Company’s 2024 Equity Incentive Plan (the “Plan”), of the number of shares (the “Shares”) of common stock (“Common Stock”) of the Company set forth opposite the

Participant’s name below, subject to the terms and conditions of this Restricted Stock Award Agreement (the “Agreement”) and the Plan. Except

where the context otherwise requires, the term “Company” shall include the parent and all present and future subsidiaries of the Company as defined in Sections 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended or replaced from time

to time (the “Code”). Capitalized terms used herein but not defined shall have the same meaning as in the Plan.

Name of Participant: _____________________________________

Number of Shares of Common Stock Granted: ________________

Date of Grant: ___________________________________________

Grant Price: _____________________________________________

2. Forfeitable Shares and Vested Shares. All Shares shall be deemed to be “Forfeitable Shares” until the Company’s right of Forfeiture, described in Section 4 below, has expired (and the Participant’s right to retain such shares has

accrued) in accordance with the Vesting Schedule set forth in Section 3. Forfeitable Shares shall be subject to Forfeiture as described in Section 4 below. “Vested Shares” are Shares held by the Participant as to which the Company’s right of Forfeiture has expired (and the Participant’s right to retain such Shares

has accrued) based on the Vesting Schedule. All certificates representing Forfeitable Shares shall remain in the possession of the Company until such shares become Vested Shares in accordance with the terms of this Agreement. The Company shall

deliver to the Participant a certificate representing the Participant’s Vested Shares promptly after such Shares become Vested Shares.

3. Vested Shares

(a) Vesting

Schedule. The Company’s right of Forfeiture shall expire and all of the Shares shall become 100% vested on January 1, 20__.

(b) Vesting Upon Death or Disability. In

the event of Participant’s termination of service due to death or Disability of the Participant before the expiration of the Vesting Schedule, then the vesting of the Shares under the Vesting Schedule shall be automatically accelerated in full so

that all of the Shares shall become Vested Shares, effective as of the date of death or Disability.

(c) Vesting Upon a Change in Control. In

the event of the Participant’s Involuntary Termination of Service (as defined in the Plan) following a Change in Control (as defined in the Plan), all Restricted Stock Awards shall become fully earned and vested immediately.

4. Forfeiture of Shares.

(a) Forfeiture. Upon the Participant’s termination of

service for any reason (other than the Participant’s death, Disability or following a Change in Control as provided in Section 3) before the end of the term of the Vesting Schedule, then all Shares which as of the date of such termination

constitute Forfeitable Shares shall be forfeited to the Company (“Forfeiture”) without payment of any consideration by the Company. There shall be no

further accruals under the Vesting Schedule (and no further Forfeitable Shares shall become Vested Shares) from and after the date of any such termination.

(b) Forfeiture of Forfeitable Shares. The

Participant’s rights in all Forfeitable Shares shall terminate automatically on the date of the Participant’s termination of service for reasons other than the Participant’s death or Disability, and the Company may thereupon cancel the certificate

or certificates representing such Forfeitable Shares on its books. In the event that the certificates then being held by the Company under this Agreement represent Vested Shares as well as Forfeitable Shares, the Company shall issue to the

Participant a replacement certificate for such Vested Shares.

5. No Implied Rights. Neither a Participant nor any other person shall by reason of participation in the Plan acquire any right in or title to any assets, funds or property of the Company or any subsidiary whatsoever, including any

specific funds, assets, or other property which the Company or any subsidiary, in its sole discretion, may set aside in anticipation of a liability under the Plan. A Participant shall have only a contractual right to the shares of Common Stock

or amounts, if any, payable or distributable under the Plan, unsecured by any assets of the Company or any subsidiary, and nothing contained in the Plan shall constitute a guarantee that the assets of the Company or any subsidiary shall be

sufficient to pay any benefits to any person. No individual shall have the right to be selected to receive an Award under the Plan, or, having been so selected, to receive a future Award under the Plan.

6. No Rights as a Stockholder. Except as

otherwise provided in the Plan, no Award under the Plan shall confer upon the holder thereof any rights as a stockholder of the Company prior to the date on which the individual fulfills all conditions for receipt of such rights.

7. Dividends. Any dividends or

distributions (other than a stock dividend consisting of shares of Common Stock) declared and paid with respect to shares of Common Stock subject to the Award, without regard to vesting status, shall be immediately distributed to the Participant.

8. Voting Rights. The Participant shall have the right to vote the shares of Common Stock subject to this Award, without regard to vesting status, unless shares are forfeited.

9. Availability of Tax Election. The Participant acknowledges that the Company has

advised the Participant of the possibility of making an election under Section 83(b) of the Code with respect to the Award of the Shares and has recommended that the Participant consult a qualified tax advisor regarding the desirability of making

such an election in light of the Participant’s individual circumstances.

10. Acceptance and Acknowledgment. The

Recipient hereby accepts this Award, subject to all the terms and provisions herein and to the provisions of the Plan (as it may be amended from time to time). The Recipient hereby agrees to accept as binding, conclusive, and final, all

decisions and interpretations of the Committee upon any questions arising under the Plan. As a condition to the issuance of shares of common stock of the Company under this Award, the Recipient authorizes the Company to deduct from the settlement

of an Award any taxes required to be withheld by the Company under federal, state, or local law as a result of his receipt of this Award. This Agreement shall not be deemed to constitute a contract of employment between the parties hereto, nor

shall any provision hereof

restrict the right of the Company or ESSA Bank & Trust to discharge the Participant or restrict the right of the

Participant to terminate his or her service.

11. Miscellaneous.

(a) This Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

(b) All notices under this Agreement shall be mailed or delivered by hand to the parties at their respective addresses set forth beneath their names below or at such other address

as may be designated in writing by either of the parties to one another.

(c) This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania, without regard to its principles of conflicts of laws.

(d) This Agreement is executed in two (2) counterpart originals, one (1) to be retained by the Participant and one (1) to be retained by the Company.

ESSA Bancorp, Inc.

By:_______________________________

President and Chief Executive Officer

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the grant of the Award described in this Agreement and agrees to the terms and

conditions thereof. The undersigned hereby acknowledges receipt of a copy of the Company’s 2024 Equity Incentive Plan.

PARTICIPANT

_____________________________________

4

EXHIBIT 10.3

Form Of

ESSA Bancorp, Inc.

Restricted Stock Award Agreement (Time Based Vesting)

1. Restricted

Stock Award. ESSA Bancorp, Inc. (the “Company”) has granted to the following person (the “Participant”) a Restricted Stock Award (the “Award”), pursuant to the Company’s 2024 Equity

Incentive Plan (the “Plan”), of the number of shares (the “Shares”)

of common stock (“Common Stock”) of the Company set forth opposite the Participant’s name below, subject to the terms and conditions of this Restricted

Stock Award Agreement (the “Agreement”) and the Plan. Except where the context otherwise requires, the term “Company” shall include the parent and all

present and future subsidiaries of the Company as defined in Sections 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended or replaced from time to time (the “Code”). Capitalized terms used herein but not defined shall have the same meaning as in the Plan.

Name of Participant:______________________________________

Number of Shares of Common Stock Granted:_________________

Date of Grant:_____________________________________________

Grant Price:______________________________________________

2. Forfeitable Shares and Vested Shares. All Shares shall be deemed to be “Forfeitable Shares” until the Company’s right of Forfeiture, described in Section 4 below, has expired (and the Participant’s right to retain such shares has

accrued) in accordance with the Vesting Schedule set forth in Section 3. Forfeitable Shares shall be subject to Forfeiture as described in Section 4 below. “Vested Shares” are Shares held by the Participant as to which the Company’s right of Forfeiture has expired (and the Participant’s right to retain such Shares

has accrued) based on the Vesting Schedule. All certificates representing Forfeitable Shares shall remain in the possession of the Company until such shares become Vested Shares in accordance with the terms of this Agreement. The Company shall

deliver to the Participant a certificate representing the Participant’s Vested Shares promptly after such Shares become Vested Shares.

3. Vested Shares

(a) Vesting Schedule. The Company’s right

of Forfeiture shall expire and the Shares shall become Vested Shares in accordance with the following:

(b) Vesting Upon Death or Disability. In

the event of Participant’s termination of employment due to death or Disability of the Participant before the expiration of the Vesting Schedule,

then the vesting of the Shares under the Vesting Schedule shall be automatically accelerated in full so that all of the Shares shall become Vested

Shares, effective as of the date of death or Disability.

(c) Vesting Upon a Change in Control. In the event of the Participant’s Involuntary

Termination of Employment (as defined in the Plan) following a Change in Control (as defined in the Plan), all Restricted Stock Awards shall become fully earned and vested immediately.

4. Forfeiture of Shares.

(a) Forfeiture. Upon the Participant’s

termination of employment for any reason (other than the Participant’s death, Disability or following a Change in Control as provided in Section 3) before the end of the term of the Vesting Schedule, then all Shares which as of the date of such

termination constitute Forfeitable Shares shall be forfeited to the Company (“Forfeiture”) without payment of any consideration by the Company. There

shall be no further accruals under the Vesting Schedule (and no further Forfeitable Shares shall become Vested Shares) from and after the date of any such termination.

(b) Forfeiture of Forfeitable Shares. The

Participant’s rights in all Forfeitable Shares shall terminate automatically on the date of the Participant’s termination of employment for reasons other than the Participant’s death or Disability, and the Company may thereupon cancel the

certificate or certificates representing such Forfeitable Shares on its books. In the event that the certificates then being held by the Company under this Agreement represent Vested Shares as well as Forfeitable Shares, the Company shall issue to

the Participant a replacement certificate for such Vested Shares.

5. No Implied Rights. Neither a Participant nor any other person shall by reason of participation in the Plan acquire any right in or title to any assets, funds or property of the Company or any subsidiary whatsoever, including any

specific funds, assets, or other property which the Company or any subsidiary, in its sole discretion, may set aside in anticipation of a liability under the Plan. A Participant shall have only a contractual right to the shares of Common Stock

or amounts, if any, payable or distributable under the Plan, unsecured by any assets of the Company or any subsidiary, and nothing contained in the Plan shall constitute a guarantee that the assets of the Company or any subsidiary shall be

sufficient to pay any benefits to any person. No individual shall have the right to be selected to receive an Award under the Plan, or, having been so selected, to receive a future Award under the Plan.

6. No Rights as a Stockholder. Except as

otherwise provided in the Plan, no Award under the Plan shall confer upon the holder thereof any rights as a stockholder of the Company prior to the date on which the individual fulfills all conditions for receipt of such rights.

7. Dividends. Any dividends or

distributions (other than a stock dividend consisting of shares of Common Stock) declared and paid with respect to shares of Common Stock subject to the Award, without regard to vesting status, shall be immediately distributed to the Participant.

8. Voting Rights. The Participant shall have the right to vote the shares of Common Stock subject to this Award, without regard to vesting status, unless shares are forfeited.

9. Availability of Tax Election. The Participant acknowledges that the Company has

advised the Participant of the possibility of making an election under Section 83(b) of the Code with respect to the Award of the Shares and has recommended that the Participant consult a qualified tax

advisor regarding the desirability of making such an election in light of the Participant’s individual circumstances.

10. Acceptance and Acknowledgment. The Recipient hereby accepts this Award, subject to

all the terms and provisions herein and to the provisions of the Plan (as it may be amended from time to time). The Recipient hereby agrees to accept as binding, conclusive, and final, all decisions and interpretations of the Committee upon any

questions arising under the Plan. As a condition to the issuance of shares of common stock of the Company under this Award, the Recipient authorizes the Company to deduct from the settlement of an Award any taxes required to be withheld by the

Company under federal, state, or local law as a result of his receipt of this Award. This Agreement shall not be deemed to constitute a contract of employment between the parties hereto, nor shall any provision hereof restrict the right of the

Company or ESSA Bank & Trust to discharge the Participant or restrict the right of the Participant to terminate his or her employment.

11. Miscellaneous.

(a) This Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

(b) All notices under this Agreement shall be mailed or delivered by hand to the parties at their respective addresses set forth beneath their names below or at such other address

as may be designated in writing by either of the parties to one another.

(c) This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania, without regard to its principles of conflicts of laws.

(d) This Agreement is executed in two (2) counterpart originals, one (1) to be retained by the Participant and one (1) to be retained by the Company.

ESSA Bancorp, Inc.

By:_________________________________

Elizabeth B. Weekes, Esq.

Chair of the Compensation Committee of the Board

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the grant of the Award described in this Agreement and agrees to the terms and

conditions thereof. The undersigned hereby acknowledges receipt of a copy of the Company’s 2024 Equity Incentive Plan.

PARTICIPANT

____________________________________

ACKNOWLEDGMENT OF RECEIPT OF EARNED SHARES

I hereby acknowledge the delivery to me by ESSA Bancorp, Inc. (the “Company”) on _____________________, of stock certificates for

____________shares of common stock of the Company earned by me pursuant to the terms and conditions of the ESSA Bancorp, Inc. Restricted Stock Award Agreement, and the ESSA Bancorp, Inc. 2024 Equity Incentive Plan, which shares were transferred to me

on the Company’s stock record books on _______________________.

Dated:_______________________

________________________________________

Participant’s name

________________________________________

Participant’s signature

5

EXHIBIT 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated December 14, 2023, relating to our audit of the consolidated financial statements, which appears in the Annual Report to Shareholders, which

is incorporated in this Annual Report on Form 10-K of ESSA Bancorp, Inc. and subsidiary for the year ended September 30, 2023.

/s/ S.R. Snodgrass P.C.

King of Prussia, Pennsylvania

June 18, 2024

Calculation of Filing Fee Tables

Form S-8

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount to be Registered(1)

|

Proposed Maximum Aggregate Offering Price Per Share(2)

|

Maximum Aggregate Offering Price(2)

|

Fee Rate

|

Amount of Registration Fee(2)

|

|

Equity

|

Common stock, $0.01 par value per share

|

457(c) and 457(h)

|

200,000

|

$16.55

|

$3,310,000

|

0.00014760

|

$488.56

|

|

Total Offering Amounts

|

|

$3,310,000

|

|

$488.56

|

|

Total Fee Offsets

|

|

$0.00

|

|

$0.00

|

|

Net Fee Due

|

|

$3,310,000

|

|

$488.56

|

___________________________________________

|

(1)

|

Together with an indeterminate number of additional shares that may be necessary to adjust the number of shares reserved for issuance pursuant to

the ESSA Bancorp, Inc. 2024 Equity Incentive Plan (the “Equity Plan”) as a result of a stock split, stock dividend or similar adjustment of the outstanding common stock of ESSA Bancorp, Inc. (the “Company”) pursuant to 17 C.F.R. Section

230.416(a).

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee

in accordance with Rules 457(c) and (h) under the Securities Act, based on the average of the high and low prices of the Company’s common stock as reported on the Nasdaq Global Select Market on June 14, 2024.

|

Table 2: Fee Offset Claims and Sources

N/A

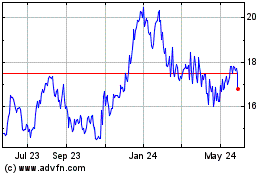

ESSA Bancorp (NASDAQ:ESSA)

Historical Stock Chart

From Jun 2024 to Jul 2024

ESSA Bancorp (NASDAQ:ESSA)

Historical Stock Chart

From Jul 2023 to Jul 2024