Current Report Filing (8-k)

August 30 2019 - 7:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): August 30, 2019

DMC Global Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-8328

|

|

84-0608431

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

11800 Ridge Parkway, Suite 300

Broomfield, Colorado 80021

(Address of Principal Executive Offices, Including Zip Code)

(303) 665-5700

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

|

|

|

|

Item 2.05

|

Costs Associated with Exit or Disposal Activities.

|

On August 28, 2019, the Board of Directors (the “Board”) of DMC Global Inc. (the “Company”), approved management's plan to shut down and liquidate DYNAenergetics Siberia Limited, a wholly-owned subsidiary of the Company located in Tyumen, Russia. DYNAenergetics Siberia will immediately cease all business operations except for the purpose of closing down its business and affairs.

In connection with the shut down, the Company is evaluating assets for impairment. Currently the Company expects to record total non-cash charges of approximately $15 to $20 million, including a non-cash impairment charge of approximately $6.0 to $7.0 million related to property, plant and equipment and other non-cash charges for the impairment of inventory and other current assets. In addition, DynaEnergetics Siberia has a cumulative currency translation loss, and once substantial liquidation has been completed, the balance at that time will be recorded as a non-cash expense.

The Company currently estimates cash wind-down and severance costs to be $2.0 to $2.5 million primarily related to termination of 47 employees as well as outside legal and liquidator fees.

The Company expects to cease production immediately and the liquidation to be completed during fiscal 2020.

|

|

|

|

Item 2.06

|

Material Impairments.

|

The information set forth in Item 2.05 is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report on Form 8-K that are not purely historical, including those statements regarding the timing of the shut down and liquidation, the Company’s estimates of cash and non-cash charges related to the shut down and the timing of such charges, constitute forward-looking statements for purposes of the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based upon the Company’s plans, estimates and expectations as of the date of this Current Report on Form 8-K. The inclusion of this forward-looking information should not be regarded as a representation by the Company or any other person that the future results, plans, estimates, intentions or expectations expressed or implied by the Company will be achieved. You are cautioned that matters subject to forward-looking statements involve known and unknown risks and uncertainties, including economic, legislative, regulatory, competitive and other factors, which may cause the shut down and liquidation, or the timing of the events related thereto, to be materially different than those expressed or implied by forward-looking statements. Important factors that could cause or contribute to such differences include: a decision not to proceed with the shut down and liquidation for any reason, including, without limitation, the inability to obtain the required legal and regulatory approvals, the timing of any such approvals; additional costs and uncertainties associated with the shutdown and liquidation; governmental and regulatory actions and uncertainties; and the other factors detailed from time to time in our SEC reports, including the annual report on Form 10-K for the year ended December 31, 2018. The Company specifically disclaims any obligation to update any forward-looking statements as a result of developments occurring after the date of this Current Report on Form 8-K, even if the Company’s estimates change, and you should not rely on those statements as representing the Company’s views as of any date subsequent to the date of this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

DMC Global Inc.

|

|

|

|

|

|

|

|

|

|

Dated:

|

August 30, 2019

|

By:

|

/s/ Michael Kuta

|

|

|

|

|

Michael Kuta

|

|

|

|

|

Chief Financial Officer

|

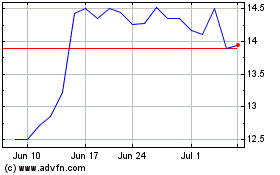

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

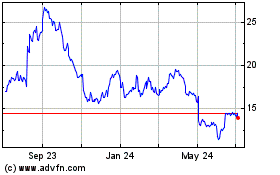

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Apr 2023 to Apr 2024