First quarter total revenue of $46.9 million

increases 43% year-over-year

CyberArk, (NASDAQ: CYBR), the company that protects

organizations from cyber attacks that have made their way inside

the network perimeter, today announced financial results for the

first quarter ended March 31, 2016.

“Our top and bottom line outperformance in the first quarter was

driven by solid execution and strong demand for privileged account

security,” said Udi Mokady, CyberArk CEO. “The breadth of customers

and partners turning to CyberArk to protect privileged accounts and

credentials demonstrates that every organization regardless of size

or vertical needs this critical new layer of security. We believe

our disciplined investments will enable us to continue to extend

our leadership position, capture share in this greenfield market

and deliver profitable growth.”

Financial Highlights for the First Quarter Ended March 31,

2016

Revenue:

- Total revenue was $46.9 million, up 43%

compared with the first quarter of 2015.

- License revenue was $27.5 million, up

38% compared with the first quarter of 2015.

- Maintenance and Professional Services

revenue was $19.4 million, up 50% compared with the first quarter

of 2015.

Operating Income:

- GAAP operating income was $6.2 million,

compared to $7.5 million in the first quarter of 2015. Non-GAAP

operating income was $10.7 million, an increase from $9.0 million

in the first quarter of 2015.

Net Income:

- GAAP net income was $4.3 million, or

$0.12 per diluted share, compared to GAAP net income of $4.2

million, or $0.12 per diluted share, in the first quarter of 2015.

Non-GAAP net income was $8.3 million, or $0.23 per diluted share,

compared to $5.7 million, or $0.16 per diluted share, in the first

quarter of 2015.

The tables at the end of this press release include a

reconciliation of GAAP to non-GAAP operating income and net income

for the three months ended March 31, 2016 and 2015. An explanation

of these measures is also included below under the heading

“Non-GAAP Financial Measures.”

Balance Sheet and Cash Flow:

- As of March 31, 2016, CyberArk had

$254.3 million in cash, cash equivalents, marketable securities and

short-term deposits, compared to $238.3 million as of December 31,

2015.

- During the first quarter of 2016, the

Company generated $16.5 million in cash flow from operations, an

increase compared to $14.3 million in the first quarter of

2015.

Business Outlook

Based on information available as of May 5, 2016, CyberArk is

issuing guidance for the second quarter and full year 2016 as

indicated below.

Second Quarter 2016:

- Total revenue is expected to be in the

range of $47.5 million to $48.5 million, which represents 31% to

33% year-over-year growth.

- Non-GAAP operating income is expected

to be in the range of $8.6 million to $9.5 million.

- Non-GAAP net income per share is

expected to be in the range of $0.18 to $0.20 per diluted share.

This assumes 35.9 million weighted average diluted shares.

Full Year 2016:

- Total revenue is expected to be in the

range of $209.0 million to $211.0 million, which represents 30% to

31% year-over-year growth.

- Non-GAAP operating income is expected

to be in the range of $41.7 million to $43.3 million.

- Non-GAAP net income per share is

expected to be in the range of $0.87 to $0.91 per diluted share.

This assumes 36.3 million weighted average diluted shares.

Conference Call Information

CyberArk will host a conference call on Thursday, May 5, 2016 at

4:30 p.m. Eastern Time (ET) to discuss the company’s first quarter

financial results and business outlook. To access this call, dial

844-237-3590 (domestic) or +1 484-747-6582 (international). The

conference ID is 85665234. Additionally, a live webcast of the

conference call will be available in the “Investor Relations”

section of the Company’s web site at www.cyberark.com. Following

the conference call, a replay will be available for one week at 855

859-2056 (U.S.) or +1 404-537-3406 (international). The replay pass

code is 85665234. An archived webcast of this conference call will

also be available in the “Investor Relations” section of the

Company’s web site at www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the only security company focused on

eliminating the most advanced cyber threats; those that use insider

privileges to attack the heart of the enterprise. Dedicated to

stopping attacks before they stop business, CyberArk proactively

secures against cyber threats before attacks can escalate and do

irreparable damage. The company is trusted by the world’s leading

companies – including more than 40 percent of the Fortune 100 – to

protect their highest value information assets, infrastructure and

applications. A global company, CyberArk is headquartered in Petach

Tikvah, Israel, with U.S. headquarters located in Newton, MA. The

company also has offices throughout EMEA and Asia-Pacific. To learn

more about CyberArk, visit www.cyberark.com.

Copyright © 2016 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Non-GAAP Financial MeasuresCyberArk believes that the use

of non-GAAP operating income and non-GAAP net income is helpful to

our investors. These financial measures are not measures of the

Company’s financial performance under U.S. GAAP and should not be

considered as alternatives to operating income or net income or any

other performance measures derived in accordance with GAAP.

- For the three months ended March 31,

2016, non-GAAP operating income is calculated as operating income

excluding share-based compensation expense and amortization of

intangible assets related to acquisitions. For the three months

ended March 31, 2015, non-GAAP operating income is calculated as

operating income excluding public offering related expenses and

share-based compensation expense.

- For the three months ended March 31,

2016, non-GAAP net income is calculated as net income excluding

share-based compensation expense, amortization of intangible assets

related to acquisitions and the tax effects related to the non-GAAP

adjustments and for the three months ended March 31, 2015, non-GAAP

net income is calculated as net income excluding public offering

related expenses and share-based compensation expense.

Because of varying available valuation methodologies, subjective

assumptions and the variety of equity instruments that can impact a

company’s non-cash expense, the Company believes that providing

non-GAAP financial measures that exclude share-based compensation,

public offering related expenses and amortization of intangible

assets related to acquisitions allows for more meaningful

comparisons of its period to period operating results. Share-based

compensation expense has been, and will continue to be for the

foreseeable future, a significant recurring expense in the

Company’s business and an important part of the compensation

provided to its employees. The Company believes that expenses

related to its public offerings and amortization of intangible

assets related to acquisitions do not reflect the performance of

its core business and impact period-to-period comparability.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measures to evaluate its business.

Cautionary Language Concerning Forward-Looking

Statements

This release may contain forward-looking statements, which

express the current beliefs and expectations of CyberArk’s (the

“Company”) management. In some cases, forward-looking statements

may be identified by terminology such as “believe,” “may,”

“estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,”

“expect,” “predict,” “potential” or the negative of these terms or

other similar expressions. Such statements involve a number of

known and unknown risks and uncertainties that could cause the

Company’s future results, performance or achievements to differ

significantly from the results, performance or achievements

expressed or implied by such forward-looking statements. Important

factors that could cause or contribute to such differences include

risks relating to: changes in the rapidly evolving cyber threat

landscape; failure to effectively manage growth; near-term declines

in our operating and net profit margins and our revenue growth

rate; real or perceived shortcomings, defects or vulnerabilities in

the Company’s solutions or internal network system, or the failure

of the Company’s customers or channel partners to correctly

implement the Company’s solutions; fluctuations in quarterly

results of operations; the inability to acquire new customers or

sell additional products and services to existing customers;

competition from IT security vendors; the Company’s ability to

successfully integrate recent and or future acquisitions; and other

factors discussed under the heading “Risk Factors” in the Company’s

most recent annual report on Form 20-F filed with the Securities

and Exchange Commission. Forward-looking statements in this release

are made pursuant to the safe harbor provisions contained in the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are made only as of the date hereof, and

the Company undertakes no obligation to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

CYBERARK SOFTWARE LTD. Consolidated

Statements of Operations U.S. dollars in thousands (except

per share data) (Unaudited) Three Months

Ended March 31, 2015

2016 Revenues: License $ 19,978 $ 27,514

Maintenance and professional services 12,937 19,397

Total revenues 32,915 46,911 Cost of revenues: License 550

1,274 Maintenance and professional services 3,707 5,160

Total cost of revenues 4,257 6,434 Gross

profit 28,658 40,477 Operating expenses: Research and

development 4,117 7,933 Sales and marketing 13,460 21,663 General

and administrative 3,578 4,670 Total operating

expenses 21,155 34,266 Operating income 7,503 6,211

Financial income (expenses), net (1,631 ) 67

Income before taxes on income 5,872 6,278

Taxes on income (1,706 ) (1,954 ) Net income $

4,166 $ 4,324 Basic net income per

ordinary share $ 0.14 $ 0.13 Diluted net income per

ordinary share $ 0.12 $ 0.12 Shares used in

computing net income per ordinary shares, basic 30,563,888

33,366,332 Shares used in computing net income

per ordinary shares, diluted 34,786,581

35,707,977

Share-based

Compensation Expense: Three Months Ended March

31, 2015 2016 Cost of revenues $ 63

$ 241 Research and development 82 940 Sales and marketing 139 1,225

General and administrative 181 967

Total share-based compensation expense $ 465 $ 3,373

CYBERARK SOFTWARE

LTD. Consolidated Balance Sheets U.S. dollars in

thousands (Unaudited) December 31,

March 31, 2015 2016

ASSETS CURRENT ASSETS: Cash and cash equivalents $

234,539 $ 238,202 Short-term bank deposits 3,713 8,680 Marketable

securities - 597 Trade receivables 20,410 15,819 Prepaid expenses

and other current assets 3,293 4,770

Total current assets 261,955 268,068

LONG-TERM ASSETS: Property and equipment, net 3,584 4,023

Intangible assets, net 18,558 17,424 Goodwill 35,145 35,145

Marketable securities - 6,857 Severance pay fund 3,230 3,361

Prepaid expenses and other long-term assets 1,954 2,050 Deferred

tax asset 9,998 10,431 Total long-term

assets 72,469 79,291

TOTAL

ASSETS $ 334,424 $ 347,359

LIABILITIES AND

SHAREHOLDERS' EQUITY CURRENT LIABILITIES: Trade payables

$ 2,530 $ 2,222 Employees and payroll accruals 15,860 12,350

Deferred revenues 37,104 43,746 Accrued expenses and other current

liabilities 9,366 7,888 Total current

liabilities 64,860 66,206 LONG-TERM

LIABILITIES: Deferred revenues 17,285 19,862 Other long-term

liabilities 188 236 Accrued severance pay 4,667 5,043 Deferred tax

liabilities 754 652 Total long-term

liabilities 22,894 25,793

TOTAL

LIABILITIES 87,754 91,999

SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par value 86 86

Additional paid-in capital 200,107 203,969 Accumulated other

comprehensive income (loss) (93 ) 411 Retained earnings

46,570 50,894 Total shareholders' equity

246,670 255,360

TOTAL LIABILITIES

AND SHAREHOLDERS’ EQUITY $ 334,424 $ 347,359

CYBERARK SOFTWARE LTD.

Consolidated Statements of Cash Flows U.S. dollars in

thousands (Unaudited) Three Months Ended

March 31, 2015 2016 Cash flows from

operating activities: Net income $ 4,166 $ 4,324 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and Amortization 222 1,518 Share-based compensation

expenses 465 3,373 Tax benefit related to share-based compensation

(529 ) (217 ) Deferred income taxes, net (245 ) (598 ) Decrease in

trade receivables 4,351 4,591 Increase in prepaid expenses and

other current and long-term assets (932 ) (1,008 ) Increase

(decrease) in trade payables 871 (200 ) Increase in short term and

long term deferred revenues 9,171 9,219 Decrease in employees and

payroll accruals (3,183 ) (3,510 ) Decrease in accrued expenses and

other current and long-term liabilities (242 ) (1,200 ) Increase in

accrued severance pay, net 225 245

Net cash provided by operating activities 14,340

16,537

Cash flows from investing

activities: Proceeds from short and long term deposits 24,279 -

Investment in short and long term deposits - (4,998 ) Investment in

marketable securities - (7,435 ) Purchase of property and equipment

(620 ) (930 ) Net cash provided by (used in)

investing activities 23,659 (13,363 )

Cash flows from financing activities: Tax benefit related to

share-based compensation 529 217 Proceeds from exercise of options

234 272 Net cash provided by

financing activities 763 489

Increase in cash and cash equivalents 38,762 3,663 Cash and

cash equivalents at the beginning of the period 124,184

234,539 Cash and cash equivalents at

the end of the period $ 162,946 $ 238,202

CYBERARK SOFTWARE LTD. Reconciliation of GAAP Measures to

Non-GAAP Measures U.S. dollars in thousands (except per

share data) (Unaudited)

Reconciliation of Operating Income to Non-GAAP Operating

Income: Three Months Ended March 31,

2015 2016 Operating income $ 7,503 $

6,211 Public offering related expenses 1,081 - Share-based

compensation 465 3,373 Amortization of intangible assets - Cost of

revenues - 355 Amortization of intangible assets - Research and

development - 478 Amortization of intangible assets - Sales and

marketing - 301 Non-GAAP operating

income $ 9,049 $ 10,718

Reconciliation of

Net Income to Non-GAAP Net Income: Three Months

Ended March 31, 2015 2016

Net income $ 4,166 $ 4,324 Public offering related expenses 1,081 -

Share-based compensation 465 3,373 Amortization of intangible

assets - Cost of revenues - 355 Amortization of intangible assets -

Research and development - 478 Amortization of intangible assets -

Sales and marketing - 301 Taxes on income related to non-GAAP

adjustments - (513 ) Non-GAAP net income $

5,712 $ 8,318 Non-GAAP net income per share Basic $

0.19 $ 0.25 Diluted $ 0.16 $ 0.23 Weighted

average number of shares Basic 30,563,888 33,366,332

Diluted 34,786,581 35,707,977

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160505006397/en/

CyberArkInvestor Contact:Erica Smith,

617-558-2132ir@cyberark.comorMedia Contact:Christy Lynch,

617-796-3210press@cyberark.com

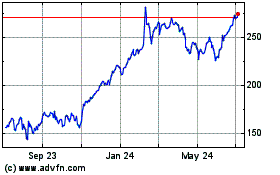

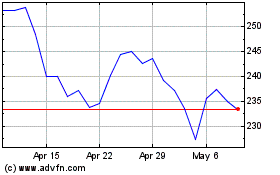

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Jul 2023 to Jul 2024