In the third bullet under Full Year 2014, non-GAAP income per

share should read $0.33 to $0.35 (instead of $0.29 to $0.31).

The corrected release reads:

CYBERARK ANNOUNCES STRONG THIRD QUARTER 2014

RESULTS

CyberArk, (NASDAQ:CYBR), the company that protects organizations

from cyber attacks that have made their way inside the network

perimeter, today announced financial results for the third quarter

ended September 30, 2014.

Udi Mokady, CyberArk CEO, said, “We are very pleased with our

strong performance in the third quarter, the first quarter we have

completed as a public company. Our solid execution, combined with

our industry-leading solutions and our profitable, scalable

go-to-market model continue to drive our success across the diverse

set of customers in our large and under-penetrated available

market.”

Financial Highlights for the Third Quarter Ended September

30, 2014

Revenue:

- Total revenue was $28.0 million, up 66%

year-over-year compared with the third quarter of 2013. For the

first nine months of 2014, total revenue increased 45% compared

with the first nine months of 2013.

- License revenue was $16.6 million, up

67% compared with the third quarter of 2013.

- Maintenance and Professional Services

revenue was $11.3 million, up 64% year-over-year.

Operating Income:

- GAAP operating income was $7.7 million

for the quarter, compared to $3.0 million in the third quarter of

2013.

- Non-GAAP operating income was $8.4

million for the quarter, compared to $3.1 million in the third

quarter of 2013. Non-GAAP operating income for the third quarter of

2014 excludes $0.7 million of stock-based compensation expense,

compared with $0.1 million in the third quarter of 2013.

Net Income:

- GAAP net income was $3.3 million,

compared to GAAP income of $2.5 million in the third quarter of

2013. GAAP net income for the third quarter of 2014 includes $1.9

million in warrant expense, compared with $0.7 million in the third

quarter of 2013.

- GAAP net income per share was $0.11,

compared to GAAP net income per share of $0.09 in the third quarter

of 2013, based on 29.5 million and 27.0 million diluted shares

outstanding, respectively.

- Non-GAAP net income was $5.9 million,

compared to $3.3 million in the third quarter of 2013.

- Non-GAAP net income per share was

$0.20, compared to income per share of $0.12 in the third quarter

of 2013, based on 29.5 million and 27.0 million diluted shares

outstanding, respectively.

The tables at the end of this press release include a

reconciliation of GAAP to non-GAAP operating income and net income

for the three and nine months ended September 30, 2014 and 2013. An

explanation of these measures is also included below under the

heading “Non-GAAP Financial Measures.”

Balance Sheet and Cash Flow:

- As of September 30, 2014, CyberArk had

$169.0 million in cash and cash equivalents and short-term deposits

inclusive of $90.3 million raised in the Company’s initial public

offering which closed on September 29, 2014.

- During the nine months ended September

30, 2014, the Company generated $13.5 million in cash flow from

operations compared to $13.2 million during the first nine months

of 2013.

Recent Business Highlights

- Completed its initial public offering

of 6,164,000 ordinary shares at a price to the public of $16.00 per

share, which includes 804,000 ordinary shares purchased pursuant to

the full exercise of the underwriters’ option to purchase

additional shares. All of the shares were offered by CyberArk.

- Announced CyberArk Privileged Threat

Analytics 2.0, an expert system for privileged account security

intelligence. The expanded analytics includes new self-learning,

behavior-based algorithms that enable customers to detect attacks

faster by pinpointing malicious privileged account activity

previously hidden in the sheer volume of information collected by

big data analytics solutions.

- Introduced comprehensive Secure Shell

(SSH) key management with the release of version 9 of CyberArk

Privileged Account Security Solution. Customers can now secure and

manage SSH keys as well as other privileged credentials in a

single, integrated platform to protect against advanced external

attackers and malicious insiders.

Business Outlook

Based on information available as of November 12, 2014, CyberArk

is issuing guidance for the fourth quarter and full year 2014 as

indicated below.

Fourth Quarter 2014:

- Total revenue is expected to be in the

range of $26.0 million to $27.0 million which represents 30% to 35%

year-over-year growth.

- Non-GAAP operating income is expected

to in the range of $1.6 million to $2.5 million.

- Non-GAAP income per share is expected

to be in the range of $0.04 to $0.06. This assumes 34.7 million

diluted shares outstanding.

Full Year 2014:

- Total revenue is expected to be in the

range of $92.7 million to $93.7 million which represents 40% to 42%

year-over-year growth.

- Non-GAAP operating income is expected

to in the range of $13.6 million to $14.5 million.

- Non-GAAP income per share is expected

to be in the range of $0.33 to $0.35. This assumes 30.0 million

diluted shares outstanding.

Conference Call Information

CyberArk will host a conference call on Wednesday, November 12,

2014 at 5:00 p.m. Eastern Time (ET) to discuss the company’s third

quarter financial results and business outlook. To access this

call, dial 888-481-2877 (domestic) or 719-325-2215 (international).

The conference ID is 6537013. Additionally, a live webcast of the

conference call will be available in the “Investor Relations”

section of the Company’s web site at www.cyberark.com. Following

the conference call, a replay will be available for one week at

877-870-5176 (U.S.) or 858-384-5517 (international). The replay

pass code is 6537013. An archived webcast of this conference call

will also be available in the “Investor Relations” section of the

Company’s web site at www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the only security company focused on

eliminating the most advanced cyber threats; those that use insider

privileges to attack the heart of the enterprise. Dedicated to

stopping attacks before they stop business, CyberArk proactively

secures against cyber threats before attacks can escalate and do

irreparable damage. The company is trusted by the world’s leading

companies – including more than 35 percent of the Fortune 100 and

17 of the world’s top 20 banks – to protect their highest value

information assets, infrastructure and applications. A global

company, CyberArk is headquartered in Petach Tikvah, Israel, with

U.S. headquarters located in Newton, MA. The company also has

offices throughout EMEA and Asia-Pacific. To learn more about

CyberArk, visit www.cyberark.com.

Copyright © 2014 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP operating income and

non-GAAP net income is helpful to our investors. These financial

measures are not measures of our financial performance under U.S.

GAAP and should not be considered as alternatives to operating

income or net income or any other performance measures derived in

accordance with GAAP.

• For the three and nine months ended September 30, 2014 and

2013, non-GAAP operating income is calculated as operating income

excluding stock-based compensation expense.

• For the three and nine months ended September 30, 2014 and

2013, non-GAAP net income is calculated as net income excluding (i)

stock-based compensation expense and (ii) financial expenses

resulting from the revaluation of warrants to purchase preferred

shares.

Because of varying available valuation methodologies, subjective

assumptions and the variety of equity instruments that can impact a

company’s non-cash expense, the Company believes that providing

non-GAAP financial measures that exclude stock-based compensation

expense allows for more meaningful comparisons of our period to

period operating results. Stock-based compensation expense has

been, and will continue to be for the foreseeable future, a

significant recurring expense in our business and an important part

of the compensation provided to our employees. In addition, the

Company believes that excluding financial expenses with respect to

revaluation of warrants to purchase preferred shares allows for

more meaningful comparison between our net income from period to

period, especially since upon the closing of the IPO, the warrants

were exercised for ordinary shares, and as a result, are no longer

evaluated at each balance sheet date. Each of these financial

measures is an important tool for financial and operational

decision-making and for evaluating our own operating results over

different periods of time.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in our

industry, as other companies in our industry may calculate non-GAAP

financial results differently, particularly related to

non-recurring, unusual items. In addition, there are limitations in

using non-GAAP financial measures as they exclude expenses that may

have a material impact on our reported financial results. The

presentation of non-GAAP financial information is not meant to be

considered in isolation or as a substitute for the directly

comparable financial measures prepared in accordance with U.S GAAP.

CyberArk urges investors to review the reconciliation of our

non-GAAP financial measures to the comparable U.S. GAAP financial

measures included below, and not to rely on any single financial

measures to evaluate our business.

Cautionary Language Concerning Forward-Looking

Statements

This release may contain forward-looking statements, which

express the current beliefs and expectations of our management.

Such statements involve a number of known and unknown risks and

uncertainties that could cause our future results, performance or

achievements to differ significantly from the results, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include risks relating to: changes in the new and

rapidly evolving cyber threat landscape; our failure to effectively

manage our growth; fluctuations in our quarterly results of

operations; real or perceived shortcomings, defects or

vulnerabilities in our solution or the failure of our solution to

meet customers’ needs; our inability to acquire new customers or

sell additional products and services to existing customers;

competition from IT security vendors and other factors discussed

under the heading “Risk Factors” in the final prospectus for our

initial public offering filed with the Securities and Exchange

Commission on September 24, 2014. Forward-looking statements in

this release are made pursuant to the safe harbor provisions

contained in the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are made only as of the date

hereof, and we undertake no obligation to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise.

CYBERARK SOFTWARE LTD.

Consolidated Statements of Operations

3 Months Ended 9 Months Ended Sep 30, Sep

30, 2013 2014

2013 2014 (unaudited)

(unaudited) Revenues: License $ 9,970 $ 16,620 $ 26,389 $ 36,869

Maintenance and professional services 6,920 11,341 19,716 29,825

Total revenues 16,890 27,961 46,105

66,694 Cost of revenues: License 223 462 735 1,823

Maintenance and professional services 1,920 3,072 5,786 8,372

Total cost of revenues 2,143 3,534

6,521 10,195 Gross profit 14,747 24,427

39,584 56,499 Operating expenses:

Research and development 2,717 3,658 7,554 10,237 Sales and

marketing 7,876 11,040 22,433 30,155 General and administrative

1,156 2,041 3,176 5,159 Total operating

expenses 11,749 16,739 33,163 45,551

Operating income 2,998 7,688 6,421 10,948 Financial

expenses, net (341 ) (2,952 ) (623 ) (5,433 ) Taxes on

income (144 ) (1,424 ) (559 ) (2,221 )

Net income $ 2,513 $ 3,312 $ 5,239 $

3,294 Basic net income (loss) per ordinary

share $ 0.18 $ 0.24 $ 0.24 $ (0.07 ) Diluted

net income (loss) per ordinary share $ 0.09 $ 0.11 $

0.17 $ (0.07 ) Shares used in computing net income

per ordinary shares, basic 6,928,430 8,658,491

6,881,006 7,624,462 Shares used

in computing net income per ordinary shares, diluted

27,003,882 29,488,511 9,446,687

7,624,462

Share-based

Compensation Expense: 3 Months Ended 9 Months

Ended Sep 30, Sep 30, 2013

2014 2013

2014 (unaudited) (unaudited) Cost of revenues

$ 8 $ 23 $ 25 $ 68 Research and development 17 33 47 99 Sales and

marketing 47 52 141 150 General and administrative 38

578 73 709 Total

share-based compensation expense $ 110 $ 686 $ 286

$ 1,026

CYBERARK SOFTWARE LTD.

Consolidated Balance Sheets

Dec 31,

Sep 30,

2013

2014

(unaudited)

ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 62,379 $ 167,846 Short-term bank deposits 3,182 1,163

Trade receivables 12,728 11,033 Prepaid expenses and other current

assets 2,119 1,760 Short-term deferred tax asset 2,676

3,023 Total current assets 83,084

184,825 LONG-TERM ASSETS: Property and

equipment, net 1,272 1,916 Severance pay fund 3,071 3,158 Prepaid

expenses and other long-term assets 819 767 Long-term deferred tax

asset 1,478 2,364 Total long-term

assets 6,640 8,205 Total assets $

89,724 $ 193,030

LIABILITIES AND SHAREHOLDERS'

EQUITY CURRENT LIABILITIES: Trade payables $ 1,766 $

1,944 Employees and payroll accruals 6,821 6,170 Deferred revenues

18,175 19,130 Accrued expenses and other current liabilities

4,582 5,596 Total current liabilities

31,344 32,840 LONG-TERM LIABILITIES: Deferred

revenues 6,303 8,612 Long-term deferred tax Liabilities 27 27

Accrued severance pay 4,070 4,183 Warrants to purchase preferred

shares 2,134 - Total long-term

liabilities 12,534 12,822 SHAREHOLDERS'

EQUITY: Ordinary shares of NIS 0.01 par value 17 74 Preferred

shares of NIS 0.01 par value 41 - Additional paid-in capital 34,811

133,359 Accumulated other comprehensive income (Loss) 155 (181 )

Retained earnings 10,822 14,116 Total

shareholders' equity 45,846 147,368

Total liabilities and shareholders' equity $ 89,724 $ 193,030

CYBERARK SOFTWARE LTD.

Consolidated Statements of Cash

Flows

9 Months Ended

Sep 30,

2013

2014

(unaudited) Cash flows from operating activities: Net income

$ 5,239 $ 3,294 Adjustments to reconcile net income to net cash

provided in operating activities: Depreciation 341 570 Share based

compensation expenses 286 1,026 Tax benefit related to exercise of

share options - 139 Deferred income taxes, net (525 ) 392 Decrease

(increase) in trade receivables (1,792 ) 1,695 Decrease (increase)

in prepaid expenses and other current and long-term assets (568 )

221 Increase (decrease) in trade payables 335 (627 ) Changes in

fair value of warrants to purchase preferred shares 799 4,309

Increase in short term and long term deferred revenues 7,654 3,264

Increase in employees and payroll accruals (174 ) (651 ) Increase

(decrease) in accrued expenses and other current liabilities 1,276

(144 ) Increase in accrued severance pay, net 337

26 Net cash provided by operating activities

13,208 13,514 Cash flows from

investing activities: Proceeds from short term deposit 4,913 3,333

Investment in short term deposit (7,145 ) (1,314 ) Purchase of

property and equipment (601 ) (1,256 ) Net

cash provided by (used in) investing activities (2,833 )

763 Cash flows from financing activities:

Issuance of shares, net - 90,325 Proceeds from exercise of options

and warrants 118 865 Net cash

provided by financing activities 118 91,190

Increase in cash and cash equivalents 10,493 105,467

Cash and cash equivalents at the beginning of the period

42,887 62,379

Cash and cash equivalents at the end of

the period

$

53,380

$

167,846

Reconciliation of Operating

Income to Non-GAAP Operating Income:

3 Months Ended

9 Months Ended

Sep 30,

Sep 30,

2013

2014

2013

2014

(unaudited) (unaudited) Operating income $ 2,998 $ 7,688 $

6,421 $ 10,948 Share-based compensation 110 686

286 1,026 Non-GAAP operating income $ 3,108 $

8,374 $ 6,707 $ 11,974

Reconciliation of Net

Income to Non-GAAP Net Income: 3 Months Ended

9 Months Ended Sep 30, Sep 30, 2013

2014 2013 2014 (unaudited) (unaudited)

Net income $ 2,513 $ 3,312 $ 5,239 $ 3,294 Share-based compensation

110 686 286 1,026 Warrant adjustment 647 1,879

799 4,309 Non-GAAP net income $ 3,270 $ 5,877 $ 6,324

$ 8,629 Non-GAAP net income per share Basic $ 0.29 $ 0.53 $

0.39 $ 0.63 Diluted $ 0.12 $ 0.20 $ 0.24 $ 0.34 Weighted

average number of shares Basic 6,928,430 8,658,491

6,881,006 7,624,462 Diluted 27,003,882

29,488,511 26,015,767 25,613,856

Investor Contact:ICRStaci Mortenson,

617-558-2132ir@cyberark.comorMedia Contact:CyberArkEric

Seymour, 617-796-3240press@cyberark.com

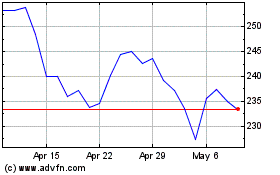

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

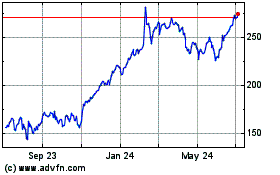

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Jul 2023 to Jul 2024