Crocs, Inc. (NASDAQ: CROX) today reported financial results for

the fourth quarter and fiscal year ended December 31, 2010.

Revenue for the fourth quarter of 2010 increased 32% to $179.2

million, over revenue of $136.0 million reported in the fourth

quarter of 2009. Net income for the fourth quarter 2010 improved to

$4.7 million, or $0.05 per diluted share compared to a net loss of

$11.4 million, or ($0.13) per diluted share in the fourth quarter

2009.

Year-over year fourth quarter changes in the Company’s channel

and regional revenue streams were as follows:

- Wholesale sales increased 27% to $97.7

million;

- Retail sales increased 36% to $59.6

million;

- Internet sales increased 44% to $21.9

million;

- Americas increased 36% to $94.1

million;

- Asia increased 24% to $62.4

million;

- Europe increased 37% to $22.7

million.

Gross profit for the fourth quarter of 2010 increased 43% to

$86.3 million, or 48.2% as a percentage of sales, from $60.3

million, or 44.3% of sales in same period last year. Selling,

General, & Administrative expenses (including foreign exchange,

restructuring, impairment, and charitable contributions) increased

9% to $80.9 million versus $74.1 million a year ago. As a

percentage of sales, SG&A decreased to 45.1% from 54.5% in the

fourth quarter of 2009.

Revenue for 2010 increased 22% to $789.7 million, over revenue

of $645.8 million reported in 2009. Net income for 2010 improved to

$67.7 million, or $0.76 per diluted share compared to a net loss of

$42.1 million, or ($0.49) per diluted share in 2009.

Year-over year annual changes in the Company’s channel and

regional revenue streams were as follows:

- Wholesale sales increased 19% to $481.8

million;

- Retail sales increased 29% to $232.9

million;

- Internet sales increased 24% to $75.0

million;

- Americas increased 25% to $377.1

million;

- Asia increased 20% to $284.8

million;

- Europe increased 21% to $127.7

million.

Gross profit for 2010 increased 41% to $423.8 million or 53.7%

as a percentage of sales, from $301.0 million, or 46.6% of sales in

2009. Selling, General, & Administrative expenses (including

foreign exchange, restructuring, impairment, and charitable

contributions) decreased 3% to $342.7 million versus $352.1 million

a year ago. As a percentage of sales, SG&A decreased to 43.4%

from 54.5% in 2009.

Balance Sheet

Cash and cash equivalents at December 31, 2010 increased 88% to

$145.6 million compared to $77.3 million at December 31, 2009. The

Company had an immaterial amount of bank debt as of December 31,

2010.

In-line with the 32% increase in year-over-year fourth quarter

sales and in support of the 57% increase over prior year end

backlog to $258.4 million, inventory grew 30% to $121.2 million at

December 31, 2010 from $93.3 million at December 31, 2009. On a

sequential basis, inventories declined 15% from $142.5 million at

September 30, 2010. The Company ended the fourth quarter of 2010

with accounts receivable of $64.3 million compared to $50.5 million

at December 31, 2009.

“We had a good fourth quarter that concluded a year in which we

achieved profitability in all four quarters for the first time

since 2007,” said John McCarvel, President and Chief Executive

Officer. “We reengaged the consumer during 2010 through great

product and more effective marketing and merchandising programs.

Our recent performance demonstrates we are succeeding at generating

new demand and evolving into a year round brand as we continue to

diversify our product line. At the same time, we’ve made important

investments in our operating platform to support our multi channel

growth strategy and drive efficiency. Looking ahead, our backlog is

up 57%, with all regions posting strong increases. We're very

pleased with the brand strength reflected in these future orders

and we see continued potential for profitable expansion of our

business."

Guidance

For the first quarter of 2011, the Company expects revenue of

approximately $215 million, a 29% increase over first quarter 2010.

The Company expects diluted earnings per share for the first

quarter 2011 to be approximately $0.19. This guidance assumes an

effective tax rate of 27% and outstanding diluted shares of

approximately 91 million.

Conference Call Information

A conference call to discuss Crocs’ fourth quarter and full year

2010 financial results is scheduled for today (February 24, 2011)

at 5:00 PM Eastern Time. A webcast of the call will take place

simultaneously and can be accessed by clicking the ‘Investor

Relations’ link under the Company section on www.crocs.com or at

www.earnings.com. To listen to the broadcast, your computer must

have Windows Media Player installed. If you do not have Windows

Media Player, go to www.earnings.com prior to the call, where you

can download the software for free.

About Crocs, Inc.

A world leader in innovative casual footwear for men, women and

children, Crocs, Inc. (NASDAQ: CROX), offers several distinct shoe

collections with more than 120 styles to suit every lifestyle. As

lighthearted as they are lightweight, Crocs™ footwear provides

profound comfort and support for any occasion and every season. All

Crocs™ branded shoes feature Croslite™ material, a proprietary,

revolutionary technology that produces soft, non-marking, and

odor-resistant shoes that conform to your feet.

Crocs™ products are sold in 129 countries. Every day, millions

of Crocs™ shoe lovers around the world enjoy the exceptional form,

function, versatility and feel-good qualities of these shoes while

at work, school and play.

Visit www.crocs.com for additional information.

Forward-looking statements

The matters regarding the future discussed in this news release

include “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

include, but not limited to, statements regarding future revenue,

margin and earnings; backlog and future orders; expansion of our

business; and product diversification. These statements involve

known and unknown risks, uncertainties and other factors which may

cause our actual results, performance or achievements to be

materially different from any future results, performances, or

achievements expressed or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the following: macroeconomic issues, including, but not

limited to, the current global financial conditions; the effect of

competition in our industry; our ability to effectively manage our

future growth or declines in revenue; changing fashion trends; our

ability to maintain and expand revenues and gross margin; our

ability to accurately forecast consumer demand for our products;

our ability to develop and sell new products; our ability to obtain

and protect intellectual property rights; the effect of potential

adverse currency exchange rate fluctuations and other international

operating risks; our ability to open and operate additional retail

locations; and other factors described in our most recent annual

report on Form 10-K under the heading “Risk Factors” and our

subsequent filings with the Securities and Exchange Commission.

Readers are encouraged to review that section and all other

disclosures appearing in our filings with the Securities and

Exchange Commission. We do not undertake any obligation to update

publicly any forward-looking statements, including, without

limitation, any estimate regarding revenues or earnings, whether as

a result of the receipt of new information, future events, or

otherwise.

CROCS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except share and per share

data) (Unaudited) Three

Months Ended

December 31,

Twelve Months Ended

December 31,

2010 2009 2010 2009 Revenues $

179,192 $ 136,011 $ 789,695 $ 645,767 Cost of sales 92,859

75,743 365,931 344,806

Gross profit 86,333 60,268 423,764 300,961 Selling, general

and administrative expenses 81,104 70,835 342,121 311,592

Foreign currency transaction losses

(gains), net

(583 ) 582 (2,912 ) (665 ) Restructuring charges - 1,653 2,539

7,623 Asset impairment charges - 638 141 26,085 Charitable

contributions expense 344 214

840 7,510 Income (loss) from operations 5,468

(13,072 ) 81,035 (51,184 ) Interest expense 212 83 657 1,495 Gain

on charitable contributions (88 ) (330 ) (223 ) (3,163 ) Other

(income) expense (278 ) 625 (191 )

(895 ) Income (loss) before income taxes 5,622 (13,450 )

80,792 (48,621 ) Income tax (benefit) expense 893

(2,002 ) 13,066 (6,543 ) Net income

(loss) $ 4,729 $ (11,448 ) $ 67,726 $ (42,078 ) Net

income (loss) per common share: Basic $ 0.05 ($0.13 )

$ 0.78 ($0.49 ) Diluted $ 0.05 ($0.13 )

$ 0.76 ($0.49 ) Weighted average common shares

outstanding: Basic 86,449,792 85,670,340

85,482,055 85,112,461 Diluted

88,632,967 85,670,340 87,595,618

85,112,461

CROCS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (In thousands, except share

data)

December 31,2010

December 31,2009

ASSETS Current assets: Cash and cash equivalents $ 145,583 $

77,343

Accounts receivable, net of allowance for

doubtful accounts of $10,249 and $9,839, respectively

64,260 50,458 Inventories 121,155 93,329 Deferred tax assets, net

15,888 7,358 Income tax receivable 9,062 8,611 Other Receivables

11,637 16,140 Prepaid expenses and other current assets

13,429 14,015 Total current assets 381,014

267,254 Property and equipment, net 70,014 71,084 Intangible

assets, net 45,461 35,984 Deferred tax assets, net 34,711 18,479

Other assets 18,281 16,937 Total assets

$ 549,481 $ 409,738

LIABILITIES AND

STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $

35,669 $ 23,434 Accrued expenses and other current liabilities

59,049 53,580 Accrued restructuring charges 439 2,616 Deferred tax

liabilities, net 17,620 9 Income taxes payable 23,084 6,377 Note

payable, current portion of long-term debt and capital lease

obligations 1,901 640 Total current

liabilities 137,762 86,656 Deferred tax liabilities, net 847

2,192 Long-term income tax payable 29,861 27,890 Other liabilities

4,905 5,380 Total liabilities

173,375 122,118 Commitments and

contingencies Stockholders’ equity: Preferred shares, par

value $0.001 per share, 5,000,000 shares authorized, none

outstanding. - - Common shares, par value $0.001 per share,

250,000,000 shares authorized, 88,600,860 and 88,065,859 shares

issued and outstanding, respectively, at December 31, 2010 and

86,224,760 and 85,659,581 shares issued and outstanding,

respectively, at December 31, 2009. 88 85 Treasury stock, at cost,

535,001 and 565,179 shares, respectively. (22,008 ) (25,260 )

Additional paid-in capital 277,293 266,472 Retained earnings 89,881

22,155 Accumulated other comprehensive income 30,852

24,168 Total stockholders’ equity 376,106

287,620 Total liabilities and stockholders’

equity $ 549,481 $ 409,738

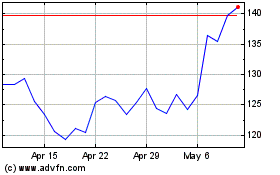

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

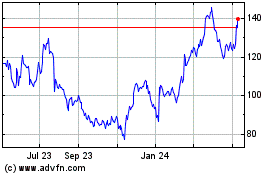

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024