Crocs, Inc. (NASDAQ: CROX) today reported financial results for

the second quarter ended June 30, 2010.

Revenue for the second quarter of 2010 increased 31% to $228.0

million, over adjusted revenue of $174.1 million reported in the

second quarter of 2009, which excluded $23.7 million in previously

impaired product sales that the Company has stated would be

non-recurring. On a GAAP basis, second quarter revenue increased

15% year-over-year.

Second quarter 2010 net income was $32.3 million with diluted

earnings per share of $0.37, compared to a second quarter 2009 net

loss of $30.3 million, or a loss per diluted share of ($0.36).

Year-over-year second quarter changes in the Company’s channel

revenue streams were as follows:

- Wholesale sales increased 12% to

$140.0 million;

- Retail sales increased 20% to

$66.4 million; and

- Internet sales increased 24% to

$21.6 million.

Changes in the Company’s regional revenue streams during the

same quarterly periods were as follows:

- Americas increased 23% to $104.8

million;

- Asia increased 11% to $88.6

million; and

- Europe increased 7% to $34.6

million.

Gross profit for the second quarter of 2010 increased 30% to

$131.9 million, or 57.8% as a percentage of sales, compared to

$101.1 million, or 51.1% of sales in the year ago period. Selling,

General, & Administrative expenses (including foreign exchange,

restructuring, impairment, and charitable contributions) decreased

25.8% to $93.2 million or 40.9% of sales, versus $125.6 million, or

63.5% of sales in the second quarter of 2009.

Balance Sheet

The Company’s cash and cash equivalents as of June 30, 2010

increased 25% to $96.9 million compared to $77.5 million at June

30, 2009. The Company had no bank debt at June 30, 2010.

Inventory increased 2% to $113.6 million at June 30, 2010 from

$111.6 million at June 30, 2009, resulting in inventory turnover of

3.5 times in the current quarter.

The Company ended the second quarter of 2010 with accounts

receivable of $94.0 million compared to $67.1 million at June 30,

2009.

“We are very pleased with our second quarter results, which show

further strengthening of our global wholesale and consumer direct

businesses” commented John McCarvel, President and Chief Executive

Officer. “We believe sales are being driven by product innovation,

improved service, and brand building initiatives as well as new

distribution from the expansion of our company-operated stores and

key wholesale accounts. Importantly, our updated business model is

generating enhanced profitability and higher cash flow. We are

encouraged with our recent performance and believe we have the

right strategies in place along with the balance sheet strength to

capitalize on the global opportunities still in front of us.”

Guidance

For the third quarter of 2010, the Company expects revenue of

approximately $205 million, a 24% increase over third quarter 2009

adjusted revenue of $165.7 million, which excludes $11.5 million in

impaired product sales that the Company has stated would be

non-recurring. On a GAAP basis, the company expects third quarter

2010 revenue to grow approximately 16% year-over-year.

The Company expects diluted earnings per share for the third

quarter 2010 to increase to approximately $0.22 to $0.24 versus

$0.09 in third quarter 2009, which excludes last year’s one time

tax benefit of $0.16.

Conference Call Information

A conference call to discuss Crocs’ second quarter 2010

financial results is scheduled for today (August 5, 2010) at 5:00

PM Eastern Time. A webcast of the call will take place

simultaneously and can be accessed by clicking the ‘Investor

Relations’ link under the Company section on www.crocs.com or at

www.earnings.com. To listen to the broadcast, your computer must

have Windows Media Player installed. If you do not have Windows

Media Player, go to www.earnings.com prior to the call, where you

can download the software for free.

About Crocs, Inc.

A world leader in innovative casual footwear for men, women and

children, Crocs, Inc. (NASDAQ: CROX), offers several distinct shoe

collections with more than 120 styles to suit every lifestyle. As

lighthearted as they are lightweight, Crocs™ footwear provides

profound comfort and support for any occasion and every season. All

Crocs™ branded shoes feature Croslite™ material, a proprietary,

revolutionary technology that produces soft, non-marking, and

odor-resistant shoes that conform to your feet.

Crocs™ products are sold in 125 countries. Every day, millions

of Crocs™ shoe lovers around the world enjoy the exceptional form,

function, versatility and feel-good qualities of these shoes while

at work, school and play.

Visit www.crocs.com for additional information.

Forward-looking statements

The matters regarding the future discussed in this news release

include “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

involve known and unknown risks, uncertainties and other factors

which may cause our actual results, performance or achievements to

be materially different from any future results, performances, or

achievements expressed or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the following: macroeconomic issues, including, but not

limited to, the current global financial crisis; our ability to

effectively manage our future growth or declines in revenue;

changing fashion trends; our ability to maintain and expand

revenues and gross margin, our management and information systems

infrastructure; our ability to repatriate cash held in foreign

locations in a timely and cost-effective manner; our ability to

develop and sell new products; our ability to obtain and protect

intellectual property rights; the effect of competition in our

industry; and the effect of potential adverse currency exchange

rate fluctuations; and other factors described in our most recent

annual report on Form 10-K under the heading “Risk Factors” and our

subsequent filings with the Securities and Exchange Commission.

Readers are encouraged to review that section and all other

disclosures appearing in our filings with the Securities and

Exchange Commission. We do not undertake any obligation to update

publicly any forward-looking statements, including, without

limitation, any estimate regarding revenues or earnings, whether as

a result of the receipt of new information, future events, or

otherwise.

CROCS, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (In thousands, except share and per

share data) (Unaudited)

Three Months EndedJune

30,

Six Months EndedJune

30,

2010 2009 2010 2009 Revenues $

228,046 $ 197,722 $ 394,898 $ 332,614 Cost of sales 96,127

96,610 176,275 181,771

Gross profit 131,919 101,112 218,623 150,843 Selling,

general and administrative expenses 94,047 94,606 168,825 163,395

Foreign currency transaction

losses (gains), net

(1,129 ) (3,623 ) (1,421 ) (214 ) Restructuring charges - 5,915

2,539 5,953 Impairment charges - 23,655 141 23,724 Charitable

contributions expense 275 5,078

418 5,119 Income (loss) from operations 38,726

(24,519 ) 48,121 (47,134 ) Interest expense 163 562 292 1,257 Gain

on charitable contributions (32 ) (2,024 ) (116 ) (2,024 ) Other

(income) expense (291 ) (343 ) (50 )

(1,446 ) Income (loss) before income taxes 38,886 (22,714 ) 47,995

(44,921 ) Income tax (benefit) expense 6,602

7,567 9,994 7,777 Net income

(loss) $ 32,284 $ (30,281 ) $ 38,001 $ (52,698 ) Net

income (loss) per common share: Basic $ 0.38 ($0.36 )

$ 0.44 ($0.62 ) Diluted $ 0.37 ($0.36 )

$ 0.43 ($0.62 )

CROCS, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data) (Unaudited)

June 30, 2010 December 31, 2009

June 30, 2009 ASSETS Current assets: Cash and cash

equivalents $ 96,867 $ 77,343 $ 77,477 Restricted cash 590 1,144

813 Accounts receivable, net 93,974 50,458 67,050 Inventories

113,553 93,329 111,615 Deferred tax assets, net 7,569 7,358 11,386

Income tax receivable 11,297 8,611 1,138 Other Receivables 11,715

16,140 7,126 Prepaid expenses and other current assets

14,277 12,871 13,884 Total

current assets 349,842 267,254 290,489 Property and

equipment, net 66,731 71,084 74,475 Restricted cash 1,466 1,506

1,795 Intangible assets, net 41,335 35,984 34,026 Deferred tax

assets, net 17,403 18,479 21,669 Marketable Securities 5,444 866 -

Other assets 14,832 14,565

15,113 Total assets $ 497,053 $ 409,738 $

437,567

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities: Accounts payable $ 51,841 $ 23,434 $ 42,296

Accrued expenses and other current liabilities 58,544 53,589 48,711

Accrued restructuring charges 3,977 2,616 6,445 Income taxes

payable 20,120 6,377 22,311 Note payable, current portion of

long-term debt and capital lease obligations 1,556

640 17,732 Total current liabilities

136,038 86,656 137,495 Long-term debt and capital lease

obligations 1,434 912 - Deferred tax liabilities, net 1,867 2,192

5,087 Long-term restructuring 103 520 663 Other liabilities

31,803 31,838 32,374 Total

liabilities 171,245 122,118

175,619 Commitments and contingencies

Stockholders’ equity: Common shares, par value $0.001 per share;

250,000,000 shares authorized, 87,079,451 and 86,482,574 shares

issued and outstanding, respectively, at June 30, 2010 and

86,224,760 and 85,659,581 shares issued and outstanding,

respectively, at December 31, 2009 and 86,144,566 and 85,620,566

shares issued and outstanding, respectively, at June 30, 2009. 87

85 84 Treasury Stock, at cost, 596,877 and 565,179 and

524,000 shares, respectively (24,963 ) (25,260 ) (25,022 )

Additional paid-in capital 272,146 266,472 256,981 Deferred

compensation - - (13 ) Retained earnings 60,156 22,155 11,535

Accumulated other comprehensive income 18,382

24,168 18,383 Total stockholders’ equity

325,808 287,620 261,948

Total liabilities and stockholders’ equity $ 497,053 $

409,738 $ 437,567

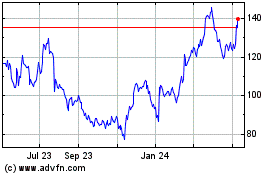

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2024 to Jul 2024

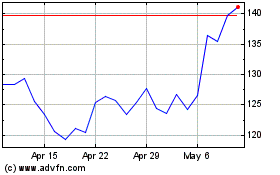

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jul 2023 to Jul 2024