Crocs, Inc. Announces Cash Tender Offer for Employee Stock Options

April 02 2009 - 8:01AM

Business Wire

Crocs,�Inc. (NASDAQ:CROX) today announced that it is commencing

a cash tender offer for employee stock options. The tender offer

will commence today and will expire, unless otherwise extended by

the Company in its sole discretion, at 11:59 p.m. (Mountain Time)

on April 30, 2009.

The stock options eligible for tender are those with an exercise

price at or above $10.50 per share. As of March 27, 2009, there

were 5,081,823 stock options eligible for tender. If all these

eligible options are tendered and accepted in the offer, the

aggregate cash purchase price for such options would be

approximately $315,000.

As a result of the tender offer, the Company will incur a

one-time non-cash stock-based compensation charge of up to

approximately $32 million upon the closing of the offer if all

unvested eligible options are tendered and accepted by the Company.

This charge represents the compensation expense related to the

acceleration of vesting on the unvested options tendered in the

offer, which would otherwise be expensed over their remaining

vesting period in the future if not tendered. This charge will be

reflected in the financial results for the fiscal quarter in which

the tender offer closes, which the Company expects to be the second

fiscal quarter of 2009.

The tender offer is not contingent on any minimum number of

options being tendered. The tender offer is, however, subject to a

number of other terms and conditions as set forth in the offering

documents. Neither the Company�s management nor its Board of

Directors makes any recommendation in connection with the tender

offer.

This press release is for informational purposes only, and is

not an offer to tender or the solicitation of an offer to tender

any stock options for a cash payment. The full details of the

tender offer, including instructions on how to tender options,

along with the related materials, are expected to be delivered

promptly to each holder of eligible options. Each holder of

eligible options should carefully read the tender offer materials,

as they contain important information, including various terms and

conditions of the tender offer. The tender offer statement has been

filed with the securities and exchange commission (the �SEC�) and

is available along with other filed documents for free on the

website of the SEC at www.sec.gov. Copies of the tender offer

statement may�also be obtained on the Company�s website,

www.crocs.com. Eligible holders of eligible options are urged to

carefully read the tender offer statement prior to making any

decision with respect to the tender offer.

About Crocs,�Inc.

Crocs,�Inc. is a designer, manufacturer and retailer of footwear

for men, women and children under the Crocs� brand.

All Crocs� brand shoes feature Crocs� proprietary closed-cell

resin, Croslite�, which represents a substantial innovation in

footwear. The Croslite� material enables Crocs to produce soft,

comfortable, lightweight, superior-gripping, non-marking and

odor-resistant shoes. These unique elements make Crocs� footwear

ideal for casual wear, as well as for professional and recreational

uses such as boating, hiking, hospitality and gardening. The

versatile use of the material has enabled Crocs to successfully

market its products to a broad range of consumers.

Crocs� shoes are sold in 100 countries and come in a wide array

of colors and styles. Please visit www.crocs.com for additional

information.

Forward-looking statements

The matters regarding the future discussed in this news release

include �forward-looking statements� within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

involve known and unknown risks, uncertainties and other factors

which may cause our actual results, performance or achievements to

be materially different from any future results, performances, or

achievements expressed or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the following: macroeconomic issues, including, but not

limited to, the current global financial crisis, our ability to

obtain adequate financing and other factors described in our annual

report on Form�10-K for the year ended December 31, 2008 under the

heading �Risk Factors� and our subsequent filings with the

Securities and Exchange Commission. Readers are encouraged to

review that section and all other disclosures appearing in our

filings with the Securities and Exchange Commission. We do not

undertake any obligation to update publicly any forward-looking

statements, including, without limitation, any estimate regarding

revenues or earnings, whether as a result of the receipt of new

information, future events, or otherwise.

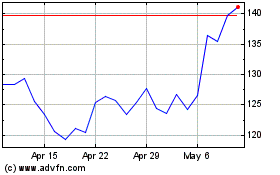

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2024 to Jul 2024

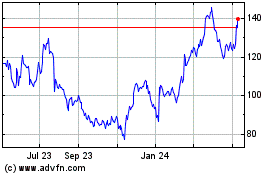

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jul 2023 to Jul 2024