Crocs, Inc. Revises Second Quarter and Full Year 2008 Sales and Earnings Per Share Guidance

July 24 2008 - 4:01PM

Business Wire

Crocs, Inc. (NASDAQ: CROX) today announced that, based upon

preliminary performance results through June 30, 2008, it expects

its second quarter 2008 revenue to be in the approximate range of

$218 million to $223 million and expects diluted earnings per share

in the range of $0.03 to $0.07, including a portion of the

previously announced pre-tax charge associated with the shutdown of

the Company�s Canadian manufacturing operations equaling

approximately $1.4 million, or $0.01 per diluted share. These

revised estimates compare to its previous guidance of revenues of

approximately $247 million to $258 million and expected diluted

earnings per share between $0.42 and $0.47, which included the

charge associated with the shutdown of the Canadian manufacturing

operations. Despite lower revenue expectations for the second

quarter, the Company still anticipates inventories as of June 30,

2008 to decrease approximately 10% to 15% from $266 million in the

first quarter, and receivable days sales outstanding to improve

approximately 20%-25% as compared to March 31, 2008. Ron Snyder,

President and Chief Executive Officer of Crocs, Inc. commented,

�The domestic marketplace proved to be more challenging during the

second quarter than we had originally anticipated. While we did

experience solid sell-through with many of our major accounts,

retailers across the board were extremely cautious with their level

of reorders, choosing to operate with leaner inventories versus a

year ago. Our international markets continued to perform better

than the U.S., with Asia up roughly 65% and Europe up approximately

13%, however this was below our initial projections. Although we

made important progress reducing costs in our manufacturing and

distribution platform, primarily shutting down our Canadian

facility and lowering our headcount, it was not enough to offset

the lower than projected sales volumes. At the same time, we

continue with our global brand building initiatives and while the

increase in marketing, retail and advertising spend negatively

impacted our near-term profitability we believe this is a key

component to our long-term success.� Crocs also revised its outlook

for the fiscal year ending December 31, 2008. For fiscal 2008,

revenues are now expected be down modestly compared to 2007 levels

with diluted earnings per share of approximately break-even,

including the total pre-tax charge of approximately $20 million, or

$0.16 per diluted share associated with the shutdown of the

Company�s Canadian manufacturing operations. For the third quarter

ending September 30, 2008, the Company expects revenues to be in

the range of $195 million to $205 million and diluted earnings per

share of approximately $0.01 to $0.05. Mr. Snyder concluded, �We

are obviously disappointed with the economic situation in the U.S.

and parts of Europe, however, we remain confident about the

long-term prospects of this business. We are currently in the

process of sizing our business to be profitable on lower projected

sales volumes and these cost actions will continue through the end

of the year. Operationally, we are implementing several strategic

programs aimed at enhancing our supply chain, further reducing

costs and improving working capital. We believe that many of our

markets are underpenetrated and should provide meaningful growth

opportunities for our products well into the future. While in the

U.S. we are focused on expanding consumer awareness, shelf space

and distribution for our new collections of footwear. Our entire

organization is committed to executing our business plan and

returning greater value to our shareholders.� Crocs will host a

conference call to discuss its revised outlook tomorrow, July 25,

2008 at 8:30 am ET. A live broadcast will be available by clicking

the �Investor Relations� link under the Company section at

www.crocs.com and at www.earnings.com. An audio replay of the

webcast will be archived on the Crocs website for two weeks. Please

logon to either website at least fifteen minutes prior to the

webcast in order to download the necessary software. Crocs expects

to report actual fiscal 2008 second quarter results on or about

August 7, 2008. About Crocs, Inc: Crocs, Inc. is a rapidly growing

designer, manufacturer and retailer of footwear for men, women and

children under the Crocs� brand. All Crocs� brand shoes feature

Crocs� proprietary closed-cell resin, Croslite�, which represents a

substantial innovation in footwear. The Croslite� material enables

us to produce soft, comfortable, lightweight, superior-gripping,

non-marking and odor-resistant shoes. These unique elements make

Crocs� footwear ideal for casual wear, as well as for professional

and recreational uses such as boating, hiking, hospitality and

gardening. The versatile use of the material has enabled us to

successfully market our products to a broad range of consumers. In

2006, the company acquired Jibbitz LLC, a unique accessory brand

with colorful snap-on products specifically suited for Crocs shoes.

Today, more than 1,600 Jibbitz designs are available to consumers

for personalizing and customizing their Crocs� footwear. Please

visit www.crocs.com for additional information. Forward Looking

Statements The matters regarding the future discussed in this news

release include forward-looking statements as defined in the

Private Securities Litigation Reform Act of 1995, including

statements related to our preliminary results, future prospects,

inventory and strategic advances and our expectations regarding our

growth, international expansion, bookings, worldwide popularity and

product development. These statements involve known and unknown

risks, uncertainties and other factors which may cause our actual

results, performance or achievements to be materially different

from any future results, performances or achievements expressed or

implied by the forward-looking statements. These risks and

uncertainties include, but are not limited to, the following: our

limited operating history; our significant recent expansion;

changing fashion trends; our reliance on market acceptance of the

small number of products we sell; our ability to develop and sell

new products; our limited manufacturing capacity and distribution

channels; our reliance on third party manufacturing and logistics

providers for the production and distribution of our products; our

reliance on a single-source supply for certain raw materials; our

management and information systems infrastructure; our ability to

obtain and protect intellectual property rights; the effect of

competition in our industry; the effects of seasonality on our

sales; our ability to attract, assimilate and retain management

talent; and other factors described in our annual report on Form

10-K under the heading �Risk Factors,� and our subsequent filings

with the Securities and Exchange Commission. Readers are encouraged

to review that section and all other disclosures appearing in our

filings with the Securities and Exchange Commission. The final

results for the second quarter of 2008 may differ from the

preliminary results discussed above. We do not undertake any

obligation to update publicly any forward looking statement,

including, without limitation, any estimate regarding revenues or

earnings, whether as a result of the receipt of new information,

future events, or otherwise.

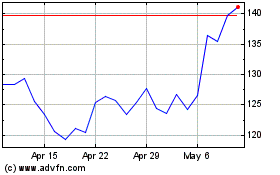

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2024 to Jul 2024

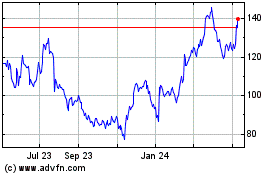

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jul 2023 to Jul 2024