Crocs, Inc. (NASDAQ: CROX) today reported strong financial results

for the quarter and fiscal year ended December 31, 2007. Revenues

for the quarter ended December 31, 2007 increased 99.1% to $224.8

million compared to $112.9 million for the quarter ended December

31, 2006. For the quarter ended December 31, 2007 domestic sales

rose approximately 47% to $115.8 million compared to $78.8 million

a year ago and international sales increased 221% to $109 million

from $34 million a year ago. Net income for the quarter ended

December 31, 2007 increased 84.1% to $38.3 million, or $0.45 per

diluted share, compared to $20.8 million, or $0.26 per diluted

share, for the quarter ended December 31, 2006. Net income per

diluted share for the quarters ended December 31 2007 and 2006 are

adjusted to reflect the two-for-one stock split that took effect in

June 2007. Gross profit for the fourth quarter of 2007 was $125.8

million, or 56.0% of revenues, compared to $65.1 million, or 57.7%

of revenues for the fourth quarter of 2006. Selling, general and

administrative expenses for the quarter ended December 31, 2007

were $71.9 million, or 32.0% of revenues, compared to $34.9

million, or 30.9% of revenues in the quarter ended December 31,

2006. Ron Snyder, President and Chief Executive Officer of Crocs,

Inc. commented �For the eighth quarter in a row Crocs delivered

industry leading revenue growth, net income growth and EPS growth.

Our more than 99% revenue gain in the fourth quarter highlights the

ongoing strong demand for Crocs branded footwear. We experienced

better than expected sell through of our fall line across men�s,

women�s, and children�s in each of our markets. To meet the higher

than anticipated orders over the holiday period we delivered a

meaningful amount of Mammoths by air-freight, which impacted our

gross margin. However, we were still able to grow diluted earnings

per share by 73% in the fourth quarter. As we approach the spring

and summer selling seasons, our bookings are strong compared to

December 31, 2006, our inventories are on plan and we believe we

are well positioned to achieve our short and long-term growth

objectives.� Revenues for the year ended December 31, 2007

increased 138.9% to $847.4 million compared to $354.7 million for

the year ended December 31, 2006. For the year ended December 31,

2007, domestic sales rose approximately 82% to $440 million from

$242 million and international sales increased 264% to $408 million

from $112 million a year ago. Net income for the year ended

December 31, 2007 increased 161.2% to $168.2 million, or $2.00 per

diluted share, compared to $64.4 million, or $0.81 per diluted

share for the year ended December 31, 2006. Net income per diluted

share amounts for 2007 and 2006 are adjusted to reflect the

two-for-one stock split that took effect in June 2007. Gross profit

for 2007 was $497.6 million, or 58.7% of revenues, compared to

$200.6 million, or 56.5% of revenues for 2006. Selling, general and

administrative expenses for the year ended December 31, 2007 were

$259.9 million, or 30.7% of revenues, compared to $105.2 million,

or 29.7% of revenues in the year ended December 31, 2006. �We are

very pleased to have completed a landmark year in our Company�s

development with record sales and profits and several important

strategic advances,� continued Mr. Snyder. �2007 was highlighted by

the evolution of our product line, our significant expansion

overseas, key investments in our operating platform, and the

growing popularity of the Crocs brand in various markets throughout

the world. At the same time, we acquired and developed other

businesses and diversified into additional categories which we

believe will provide us with compelling new growth vehicles for the

future. We move forward focused on enhancing our global position

and building a stronger, more financially robust company.� Guidance

For the year ending December 31, 2008, Crocs reiterated its

previously issued growth targets and expects revenues of

approximately $1.16 billion and net income per diluted share of

approximately $2.70. For the six-months ending June 30, 2008, the

Company expects revenues to increase approximately 50% over the

six-month period ended June 30, 2007. Balance Sheet At December 31,

2007, Crocs had inventories of $248.4 million compared to $195.3 as

of September 30, 2007. Accounts receivables were $152.9 million as

of December 31, 2007 compared to $160.6 million as of September 30,

2007. Mr. Snyder concluded, �Since introducing our first shoe just

five years ago, we have rapidly grown our portfolio to

approximately 250 different styles, extended our reach into more

than 90 countries, and achieved almost $850 million in annual

sales. That said, we believe that we are still in the early stages

of our development and see considerable opportunity to grow our

domestic business through product innovation, category expansion,

and increased retail floor space. Internationally, our sales

accelerated over the past 12-months in Europe and Japan thanks to

our many brand building initiatives, which gives us confidence as

we prepare to launch a broader assortment of footwear and continue

with our strategic investments in growing markets. We remain

optimistic about our many long-term growth prospects and dedicated

to creating greater value for our shareholders.� Conference Call

Information A conference call to discuss fourth quarter and fiscal

2007 year-end financial results is scheduled for today (February

19, 2008) at 4:30 PM Eastern Time. A webcast of the call will take

place simultaneously and can be accessed by clicking the �Investor

Relations� link under the Company section on www.crocs.com or at

www.earnings.com. To listen to the broadcast, your computer must

have Windows Media Player installed. If you do not have Windows

Media Player, go to the latter site prior to the call, where you

can download the software for free. About Crocs, Inc: Crocs, Inc.

is a rapidly growing designer, manufacturer and retailer of

footwear for men, women and children under the Crocs� brand. All

Crocs� brand shoes feature Crocs� proprietary closed-cell resin,

Croslite�, which represents a substantial innovation in footwear.

The Croslite� material enables us to produce soft, comfortable,

lightweight, superior-gripping, non-marking and odor-resistant

shoes. These unique elements make Crocs� footwear ideal for casual

wear, as well as for professional and recreational uses such as

boating, hiking, hospitality and gardening. The versatile use of

the material has enabled us to successfully market our products to

a broad range of consumers. In 2006, the company acquired Jibbitz

LLC, a unique accessory brand with colorful snap-on products

specifically suited for Crocs shoes. Today, more than 1,600 Jibbitz

designs are available to consumers for personalizing and

customizing their Crocs� footwear. Please visit www.crocs.com for

additional information. Forward Looking Statements The matters

regarding the future discussed in this news release include

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995, including statements related to our

future prospects, inventory and strategic advances and our

expectations regarding our growth, international expansion,

bookings, worldwide popularity and product development. These

statements involve known and unknown risks, uncertainties and other

factors which may cause our actual results, performance or

achievements to be materially different from any future results,

performances or achievements expressed or implied by the

forward-looking statements. These risks and uncertainties include,

but are not limited to, the following: our limited operating

history; our significant recent expansion; changing fashion trends;

our reliance on market acceptance of the small number of products

we sell; our ability to develop and sell new products; our limited

manufacturing capacity and distribution channels; our reliance on

third party manufacturing and logistics providers for the

production and distribution of our products; our reliance on a

single-source supply for certain raw materials; our management and

information systems infrastructure; our ability to obtain and

protect intellectual property rights; the effect of competition in

our industry; the effects of seasonality on our sales; our ability

to attract, assimilate and retain management talent; and other

factors described in our annual report on Form 10-K under the

heading �Risk Factors,� and our subsequent filings with the

Securities and Exchange Commission. Readers are encouraged to

review that section and all other disclosures appearing in our

filings with the Securities and Exchange Commission. We do not

undertake any obligation to update publicly any forward looking

statement, including, without limitation, any estimate regarding

revenues or earnings, whether as a result of the receipt of new

information, future events, or otherwise. Crocs, Inc. Consolidated

Statements of Operations (In thousands, except share and per share

data) (unaudited) � � THREE MONTHS ENDED � TWELVE MONTHS ENDED

December 31, December 31, 2007 � 2006 2007 � 2006 � Revenues $

224,800 $ 112,904 $ 847,350 $ 354,728 Cost of sales 98,973 47,809

349,701 154,158 Gross profit 125,827 65,095 497,649 200,570 � �

Selling, general and administrative expenses 71,926 34,879 259,882

105,224 Income from operations 53,901 30,216 237,767 95,346 �

Interest expense 132 35 438 567 Other income, net (923) (537)

(2,997) (1,847) Income before income taxes 54,692 30,718 240,326

96,626 � Income tax expense 16,408 9,933 72,098 32,209 � Net income

38,284 20,785 168,228 64,417 � Dividends on redeemable convertible

preferred shares - - - 33 Net income attributable to common

stockholders 38,284 20,785 168,228 64,384 � Net income per share:

Basic $ 0.47 $ 0.27 $ 2.08 $ 0.87 Diluted $ 0.45 $ 0.26 $ 2.00 $

0.81 � Weighted average common shares: Basic 81,937,028 78,301,000

80,759,077 74,598,400 Diluted 85,240,020 82,240,722 84,194,883

80,170,512 Crocs, Inc. Consolidated Balance Sheets (In thousands,

except share and per share data) (unaudited) � � December 31, �

December 31, 2007 2006 ASSETS Current assets: Cash and cash

equivalents $ 36,335 $ 42,656 Restricted cash 300 2,890 Short-term

investments - 22,325 Accounts receivable, net 152,919 65,588

Inventories, net 248,391 86,210 Deferred tax assets 13,507 3,690

Prepaid income tax - 4,715 Prepaid expenses and other current

assets 17,865 9,617 � Total current assets 470,331 237,691 �

Property and equipment, net 88,184 34,849 Restricted Cash 1,014 -

Goodwill 23,759 11,552 Other intangibles, net 31,634 12,210

Deferred tax assets, net 67 1,280 Other assets 12,168 1,875 Total

assets $ 626,143 $ 299,457 � LIABILITIES AND STOCKHOLDERS' EQUITY �

Current liabilities: Accounts payable $ 82,979 $ 43,794 Accrued

expenses and other liabilities 57,246 31,109 Deferred tax

liabilities 24 - Income taxes payable 16,596 12,465 Notes payable

and current installments of long-term debt 7,107 541 � Total

current liabilities 163,952 87,909 � Long-term debt 9 116 Deferred

tax liabilities 2,414 1,688 Other liabilities 8,789 1,486 � Total

liabilities 175,164 91,199 � � Stockholders' equity: Common shares,

par value $0.001 per share; 250,000,000 authorized, 82,198,426 and

78,681,418 shares issued and outstanding in 2007 and 2006 83 77

Treasury Stock, at cost, 524,000 shares as of December 31, 2007

(25,022) Additional paid-in-capital 218,802 131,796 Deferred

compensation (2,402) (5,702) Retained earnings 249,309 81,081

Accumulated other comprehensive income 10,209 1,006 Total

stockholders' equity 450,979 208,258 � Total liabilities and

stockholders' equity $ 626,143 $ 299,457

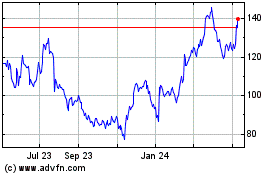

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2024 to Jul 2024

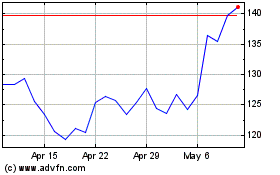

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jul 2023 to Jul 2024