On most weekday mornings, day trader John Woods is trying to

grind out gains in the natural gas pits on the floor of the New

York Mercantile Exchange.

On Monday, before lunch time, the president of JJ Woods

Associates was back on the ferry to New Jersey. His trading day

ended before it began with the bankruptcy of MF Global Holdings

Ltd. (MF).

"We came, and we were told we can't execute our customer

business, we can't trade our own accounts, and we're basically told

to just go home," said Woods, a veteran floor trader who had used

MF Global to clear his trades.

Woods was just one of the many traders across the U.S. that

watched a day of trading wash by after MF Global, one of the

world's biggest commodity and derivatives brokers, was barred from

major commodities and derivatives exchanges.

MF Global traders in Chicago and New York learned after arriving

for work Monday they wouldn't be permitted to trade, with some

having their keycards de-activated as they left the Chicago floor.

Also many traders, like Woods, were prevented from trading because

they use MF Global as a clearing firm to post margins and execute

other operational details.

Rumors had been swirling about MF Global for most of the past

week, but when Woods awoke at 5 a.m. this morning at his home in

Fair Haven, N.J., and turned on his computer, everything seemed

normal. He traveled to lower Manhattan as he has most mornings for

the past twenty-five years.

A little before 9 o'clock he had made it to the Nymex. On the

floor of the exchange, rumors were flying.

"I come in, I say good morning to the boys, and at that point it

was pretty sketchy, nobody new what was going on," he said.

Minutes later a representative from his clearing firm, an

affiliate of MF Global, explained that Woods and anyone else whose

trades were processed by MF Global wouldn't be able to trade. The

six associates at JJ Woods, who had arrived an hour earlier to talk

with clients and plot their trading days, wouldn't be able to

access the market until they found another clearing firm.

The clearing representative told him: "'Here's the deal, you

can't execute customer orders, you can't trade for your own

account'," Woods said. "I have six guys up there. It basically

handcuffed you."

Elsewhere on the trading floor, the mood darted between sullen

and frenetic. Many traders scrambled to find out how to regain

access to the market, while others found themselves with the wrong

name stitched across the back of their jackets.

Three traders wearing MF Global's recognizable light blue

jackets sat off to the side of the still raucous oil-options pit,

one of the last vestiges in New York of open-outcry trading now

that most activity is electronic. The excluded traders were sullen,

avoiding outsiders and talking in quiet tones well below the

floor's normal high-decibel level.

Around midday, Jeffrey Grossman, an oil-options trader at BRG

Brokerage, was pacing outside Nymex near the Hudson River, smoking

a cigar. It was hard for him to believe how quickly MF Global was

cut off.

"On Friday they said everything was fine, and we come in today

and this," he said. His friends at MF Global expect the worst.

"They don't know where they stand. They assume they're going to

be eliminated," Grossman said. "Nobody wants this to happen to

anybody."

In Chicago similar scenes unfolded. Dennis Lawson leaned against

a wall in the main lobby of the historic Chicago Board of Trade

building. A trader for Dowd-Wescott, which uses MF Global to clear

its trades, he came to work at 7 o'clock Monday only to learn he

couldn't access the market.

When he left the trading floor, his keycard stopped working,

barring his return. It wasn't a huge problem since he didn't have

any open trading positions, but he worried for his colleagues.

"There are people who's livelihood is at risk if this is not

resolved," Lawson said.

Kevin Boyle, a veteran trader at Dowd-Wescott in Chicago, was

stopped at the turnstiles. He hasn't been told what happens next,

but with positions in corn and wheat options, Boyle was concerned

about losing money.

By noon, Woods was already on his way back to New Jersey. "A lot

of the guys were pissed," he said later as he sat in the ferry

heading home.

He had closed out his positions before the weekend, so he didn't

have to worry about the market moving against him Monday. But he

was still disappointed as a day to trade slipped away.

"You trade to make money everyday, and these people are

prohibiting you from making a living every day, without a warning.

It's putting a crimp into the market," Woods said.

The affable floor veteran couldn't resist a bit of gallows

humor, though and was thinking about what he'll be telling his kids

back in New Jersey. He's able to watch four of his younger children

march through town in their school Halloween parades. Three are

dressed as sports fanatics; one is dressed up as a hobo.

"My kids are going to ask, 'Did you make any money today,

Daddy?'" he imagined. "No. That candy is for dinner tonight," he

said with a dry laugh.

-By Jerry A. DiColo, Dow Jones Newswires; 212-416-2155;

jerry.dicolo@dowjones.com

--Ian Berry contributed to this article.

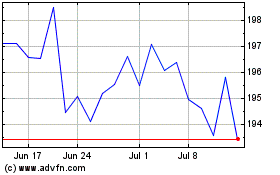

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024