Clearfield, Inc. Reports Third Quarter FY2010 Performance

July 29 2010 - 11:00AM

| * Revenue: |

$6.8 million, up 43.5% from last quarter;

down 5.3% from |

| |

previous year's third quarter |

| * Gross profit: |

$2.6 million, up 50.2% from last quarter;

down 3.0% from |

| |

previous year's third quarter |

| * Gross margin: |

38.4%, up from 37.5% in previous year's third

quarter |

| * Operating income: |

$611,000, up $68,000 or 12.6% from previous

year's third quarter |

| * Net income: |

$629,000, up $42,000 or 7.2% from previous

year's third quarter |

| * Basic and diluted net income per

share: |

$.05 |

Clearfield, Inc. (Nasdaq:CLFD), the specialist in fiber management

solutions for Fiber to the Premises (FTTp) deployments, today

announced results for the third fiscal quarter of 2010 which ended

June 30, 2010. Net income was $629,000 or $.05 per basic and

diluted income per share, up 7.2% from the previous year's third

quarter. Operating income rose 12.6% to $611,000, up $68,000

from the previous year's third quarter. Gross margin improvements

of nearly 1% as compared to prior year's third quarter off-set a

5.3% reduction in revenue for the quarter as compared to the third

quarter of 2009. Revenue for the quarter ended June 30, 2010 was

$6,778,000 in comparison to $7,160,000 for the quarter ended June

30, 2009. Gross profit dollars for the third quarter of fiscal 2010

were $2,603,000 in comparison to $2,684,000 for the third quarter

of fiscal 2009, a decrease of 3.0%. Gross margins for

the quarter improved one percent to 38.4% from the same quarter of

last fiscal year. The year-over-year improvement is the result of

product mix, material cost improvements and manufacturing

efficiency. Operating expenses were $1,993,000, a decrease of 7%

from $2,142,000 in the same quarter of fiscal 2009. While the

Company continues to invest in sales, marketing and engineering

resources during this period, these increased costs were off-set by

a $300,000 reduction in incentive compensation expense.

Year to Date

Revenue for the first three quarters of fiscal 2010 was

$16,446,000 in comparison to $18,326,000 for the same period of

2009, a decrease of 10%. Gross profit for the nine month period was

$6,038,000 in comparison to $6,517,000 for the comparable period

for fiscal 2009, a decrease of 7%. Gross margins have

continued to improve year-to-date to 37% for the nine months ended

June 30, 2010 compared to 36% from the same period of last fiscal

year. Operating expenses were $5,747,000 for the nine months ended

June 30, 2010 an increase of 2% from $5,637,000 in the same period

of fiscal 2009. The Company's operating income through the first

three quarters of fiscal 2010 was $291,000 compared to $880,000 in

the same period of fiscal 2009 with net income for the same

respective periods of $361,000 and $936,000.

Comments on Operations

"Our market is building momentum as the economy strengthens,"

commented Cheri Beranek, President and Chief Executive Officer of

Clearfield. "Our continual improvement programs focused on

enhancing gross margins are fueling the significant gains in

operating income for the Company this quarter. Strong summer

fiber optic deployments and the funding associated with the

broadband stimulus programs are just now beginning to bear fruit

for Clearfield."

"As our market landscape changes due to consolidation of our

customers and competitors, Clearfield's long-standing commitment to

nimble product development initiatives, aggressive sales strategies

and a customer-first value system is resonating strongly with

customers and our pipeline of active quotes continues to

expand."

About Clearfield, Inc.

Clearfield, Inc. designs and manufactures the FieldSmart Fiber

Management Platform, which includes its latest generation

FieldSmart Fiber Crossover Distribution System (FxDS), FieldSmart

Fiber Scalability Center (FSC) and FieldSmart Fiber Delivery Point

(FDP) series. The FxDS, FSC and FDP product lines are based upon

the patent pending technologies of the Clearview and xPAK cassettes

and support a wide range of panel configurations, densities,

connectors and adapter options, and are offered alongside an

assortment of passive optical components. Clearfield provides a

complete line of fiber and copper assemblies for inside plant,

outside plant and access networks. Clearfield is a public company,

traded on Nasdaq:CLFD. www.ClearfieldConnection.com

Forward-Looking Statements

Forward-looking statements contained herein are made pursuant to

the safe harbor provisions of the Private Litigation Reform Act of

1995. These statements are based upon the Company's current

expectations and judgments about future developments in the

Company's business. Certain important factors could have a material

impact on the Company's performance, including, without limitation

the effect of the significant downturn in the U.S. economy on

Clearfield's customers; the impact of the American Recovery and

Reinvestment Act or any other legislation on customer demand and

purchasing patterns; cyclical selling cycles; need to introduce new

products and effectively compete against competitive products;

dependence on third-party manufacturers; limited experience in

manufacturing, reliance on key customers; rapid changes in

technology; the negative effect of product defects; the need to

protect its intellectual property; the impact on its financial

results or stock price of its ability to use its deferred tax

asset, consisting primarily of net operating loss carryforwards, to

offset future taxable income; the valuation of its goodwill and the

effect of its stock price, among other factors, on the evaluation

of goodwill; and other factors set forth in Clearfield's Annual

Report on Form 10-K for the year ended September 30, 2009 as well

as other filings with the Securities and Exchange Commission. The

Company undertakes no obligation to update such statements to

reflect actual events.

| CLEARFIELD, INC.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

UNAUDITED |

| |

|

|

|

|

| |

Three Months Ended June

30, |

Nine Months Ended June

30, |

| |

2010 |

2009 |

2010 |

2009 |

| |

|

|

|

|

| Revenues |

$6,778,193 |

$7,160,039 |

$16,445,626 |

$18,325,930 |

| |

|

|

|

|

| Cost of sales |

4,174,998 |

4,475,573 |

10,407,347 |

11,809,104 |

| |

|

|

|

|

| Gross profit |

2,603,195 |

2,684,466 |

6,038,279 |

6,516,826 |

| |

|

|

|

|

| Operating expenses |

|

|

|

|

| Selling, general and administrative |

1,992,576 |

2,142,074 |

5,746,913 |

5,637,002 |

| |

|

|

|

|

| Income from operations |

610,619 |

542,392 |

291,366 |

879,824 |

| |

|

|

|

|

| Other income (expense) |

|

|

|

|

| Interest income |

36,491 |

34,764 |

112,125 |

83,758 |

| Interest expense |

-- |

(1,260) |

(820) |

(4,751) |

| Other income |

11,498 |

48,243 |

35,850 |

75,818 |

| |

47,989 |

81,747 |

147,155 |

154,825 |

| Income before income taxes |

658,608 |

624,139 |

438,521 |

1,034,649 |

| |

|

|

|

|

| Income tax expense |

29,595 |

37,119 |

77,559 |

99,093 |

| |

|

|

|

|

| Net income |

$629,013 |

$587,020 |

$360,962 |

$935,556 |

| |

|

|

|

|

| Net income per share: |

|

|

|

|

| Basic |

$.05 |

$.05 |

$.03 |

$.08 |

| Diluted |

$.05 |

$.05 |

$.03 |

$.08 |

| |

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

| Basic |

11,995,331 |

11,938,131 |

11,987,793 |

11,938,131 |

| Diluted |

12,437,853 |

11,945,419 |

12,460,069 |

12,945,419 |

| |

| CLEARFIELD, INC.

BALANCE SHEETS UNAUDITED |

| |

June 30, 2010 |

September 30, 2009 |

| Assets |

|

|

| Current Assets |

|

|

| Cash and cash equivalents |

$4,886,316 |

$4,731,735 |

| Short-term investments |

1,345,566 |

2,108,566 |

| Accounts receivable, net |

2,473,885 |

2,723,414 |

| Inventories |

1,431,792 |

1,153,862 |

| Other current assets |

213,553 |

180,635 |

| Total Current Assets |

10,351,112 |

10,898,212 |

| |

|

|

| Property, plant and equipment, net |

1,385,062 |

1,319,492 |

| |

|

|

| Other Assets |

|

|

| Long-term investments |

3,760,163 |

2,840,000 |

| Goodwill |

2,570,511 |

2,570,511 |

| Intangibles |

27,649 |

-- |

| Deferred taxes –long term |

2,168,674 |

2,231,990 |

| Other |

176,368 |

568,554 |

| Total other assets |

8,703,365 |

8,211,055 |

| Total Assets |

$20,439,539 |

$20,428,759 |

| |

|

|

| Liabilities and Shareholders' Equity |

|

|

| Total current liabilities |

$2,006,903 |

$2,493,006 |

| Deferred rent |

82,320 |

87,942 |

| Total Liabilities |

2,089,223 |

2,580,948 |

| |

|

|

| Shareholders' Equity |

|

|

| Common stock |

119,953 |

119,746 |

| Additional paid-in capital |

52,513,475 |

52,372,139 |

| Accumulated deficit |

(34,283,112) |

(34,644,074) |

| Total Shareholders' Equity |

18,350,316 |

17,847,811 |

| Total Liabilities and

Shareholders' Equity |

$20,439,539 |

$20,428,759 |

CONTACT: Clearfield, Inc.

Cheryl P. Beranek, Chief Executive Officer and President

763-476-6866

Investor-relations@clfd.net

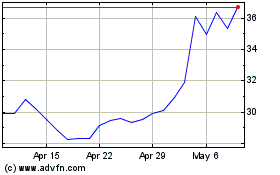

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From May 2024 to Jun 2024

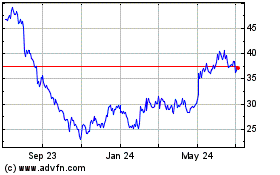

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Jun 2023 to Jun 2024