Current Report Filing (8-k)

April 05 2021 - 9:10AM

Edgar (US Regulatory)

0000887596

false

0000887596

2021-03-30

2021-03-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): March 30, 2021

THE CHEESECAKE FACTORY INCORPORATED

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

0-20574

|

|

51-0340466

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

26901 Malibu Hills Road

Calabasas Hills, California

|

|

91301

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code (818) 871-3000

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Common Stock, par value $.01 per share

|

|

CAKE

|

|

Nasdaq

Stock Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ¨

ITEM 1.01 Entry into a Material Definitive Agreement

On March 30, 2021 (the “Effective Date”),

The Cheesecake Factory Incorporated (the “Company” or “we,” “us” and “our”) entered into

a Second Amendment (the “Second Amendment”) to our existing Third Amended and Restated Loan Agreement, dated July 30,

2019 (as amended by that certain First Amendment, dated as of May 1, 2020 and by the Second Amendment, the “Amended Loan Agreement”),

with JPMorgan Chase Bank, N.A., as administrative agent (“JPMCB”), sole bookrunner and sole lead arranger, Bank of America,

N.A. and Wells Fargo Bank, National Association, as co-syndication agents, Bank of the West, as documentation agent, and the lenders party

thereto.

The Amended Loan Agreement provides for, among

other things, (i) an extension of the Company’s existing covenant relief period, which had been scheduled to end with the delivery

of the Company’s compliance certificate reflecting compliance with its financial covenants as of the quarter ending on or after

June 29, 2021, and will now end when the Company demonstrates compliance with its financial covenants as of the quarter ending on

or after December 28, 2021 (the “Covenant Relief Period”), during which the Company is not required to comply with financial

covenants requiring maintenance of a maximum ratio of net adjusted debt to EBITDAR (the “Net Adjusted Leverage Ratio”) of

4.75 to 1.00 and a minimum ratio of EBITDAR to interest and rent expense of 1.90 to 1.00 (the “EBITDAR to Interest and Rental Expense

Ratio”), (ii) the Company being subject to a monthly liquidity covenant until the calendar month when the Company has demonstrated

compliance with its financial covenants as of the quarter ending December 28, 2021, that requires liquidity of the Company and its

subsidiaries to be at least $100,000,000 at the end of each calendar month (with liquidity being the sum of (a) unrestricted cash

and cash equivalents and (b) the unused portion of the revolving facility), (iii) granting the Administrative Agent a lien on

substantially all of the Company’s and any guarantor’s property, with such collateral to be released upon (a) the termination

of the Covenant Relief Period, (b) the Company’s compliance with the Net Adjusted Leverage Ratio and the EBITDAR to Interest

and Rental Expense Ratio as of the quarter ending on or after March 29, 2022, (c) the Company nor any of the guarantors having

incurred unsecured debt using certain debt baskets under the Amended Loan Agreement unless such debt is convertible debt or subordinated

on customary debt subordination terms reasonably acceptable to JPMCB, and (d) no default or event of default having occurred or be

continuing, and (iv) the payment and declaration of cash dividends with respect to the Company’s Series A Convertible

Preferred Stock, par value $.01 per share (“Series A Preferred Stock”) per each fiscal quarter ending on or prior to

December 28, 2021 in an amount not to exceed $5,250,000.

Borrowings under the Amended Loan Agreement during

the Covenant Relief Period bear interest, at the Company’s option, at a rate equal to either: (i) the adjusted LIBO Rate (as

customarily defined, the “Adjusted LIBO Rate”) plus 2.50%, or (ii) the sum of (a) the highest of (1) the rate

of interest last quoted by The Wall Street Journal as the prime rate in effect in the United States, (2) the greater of the rate

calculated by the Federal Reserve Bank of New York as the effective federal funds rate or the rate that is published by the Federal Reserve

Bank of New York as an overnight bank funding rate, in either case plus 0.5%, and (3) the one-month Adjusted LIBO Rate plus 1.0%,

plus (b) 1.50%. The Company will also pay a fee of 0.40% on the daily amount of unused commitments under the Amended Loan Agreement.

The foregoing description of the Second Amendment

does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amendment, which is filed

herewith as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

ITEM 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The description set forth under Item 1.01 of this

Form 8-K is incorporated by reference herein in its entirety.

ITEM 5.02 DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICER; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

On April 1, 2021, the Compensation Committee (the “Committee”) of the Board of Directors of the Company approved the

grant to each of the Company’s named executive officers of an award of performance-vesting restricted shares of the Company's common

stock (the “2021 Performance Stock Awards”), under the Company’s Stock Incentive Plan. The terms of the 2021 Performance

Stock Awards are substantially similar to the terms set forth in the Form of Notice of Grant and Stock Option Agreement and/or Restricted

Share Agreement for Executive Officers filed as Exhibit 10.15.3 to the Company’s Annual Report on Form 10-K for the fiscal

year ended December 29, 2020, except that the grants were awarded approximately two months later than prior years and the three,

equally weighted, performance goals are now as follows: (i) the Company’s achievement total annual revenue growth goals over

the three-year performance period (2021-2023), (ii) the Company’s achievement of annual sales per square foot goals over the

three-year performance period, and (iii) the Company’s achievement of annual controllable profit goals over the three-year

performance period.

The actual number of restricted shares subject

to the 2021 Performance Stock Awards that will vest (if any) is dependent upon the level of achievement of the performance goals, within

a range between a threshold at 60% of target payout and a maximum at 150% of target payout. The restricted shares subject to the 2021

Performance Stock Award that remain outstanding after the degree of achievement of the performance goals has been determined shall be

subject to time-based vesting, with 60% of the Performance Stock Award vesting on the third annual anniversary of the date of grant (on

April 1, 2024) and 20% of the Performance Stock Award vesting on each of the fourth and fifth annual anniversaries from the date

of grant (on April 1, 2025 and April 1, 2026, respectively) subject to continued service through each vesting date.

On April 1, 2021, the Committee approved

the grant of the following Performance Stock Awards granted to each of our named executive officers are set forth in the table below:

|

Name

|

|

Number of

Restricted Shares

Assuming

Achievement of

Performance Goals

at Target

|

|

|

Number of

Restricted Shares

Assuming

Achievement of

Performance Goals

at Maximum

|

|

|

David Overton, Chairman of the Board and Chief Executive Officer

|

|

|

43,150

|

|

|

|

64,725

|

|

|

David M. Gordon, President, The Cheesecake Factory Incorporated

|

|

|

10,800

|

|

|

|

16,200

|

|

|

Matthew E. Clark, Executive Vice President and Chief Financial Officer

|

|

|

9,800

|

|

|

|

14,700

|

|

|

Scarlett May, Executive Vice President, General Counsel and Secretary

|

|

|

4,850

|

|

|

|

7,275

|

|

|

Keith T. Carango, President, The Cheesecake Factory Bakery Incorporated

|

|

|

3,950

|

|

|

|

5,925

|

|

The foregoing description of the 2021 Performance

Stock Awards is not complete and is subject to and qualified in its entirety by the terms of the form restricted stock unit agreement,

a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 30,

2021.

On March 30, 2021, the Audit Committee of

the Board of Directors of the Company declared a cash dividend of $5,070,265 or $25.35 per share on the Series A Preferred Stock,

which was paid on March 31, 2021 to the holder of record of each share of the Series A Preferred Stock on March 15, 2021,

which is the regular dividend record date set forth in the Certificate of Designations setting forth the terms of the Series A Preferred

Stock (the “Certificate of Designations”). The Certificate of Designations provides that quarterly dividends due on the Series A

Preferred Stock are payable in cash or in-kind at the Company’s election. Subject to certain conditions and restrictions imposed

by the Amended Loan Agreement, the Company may pay quarterly dividends on the Series A Preferred Stock in cash and has elected to

do so for this payment. Future dividends on the Series A Preferred Stock will be paid, either in cash or in-kind, at the Company’s

election, in accordance with the Certificate of Designations and subject to the terms and conditions of the Amended Loan Agreement and

any other restrictions on the Company’s ability to make dividend payments. The Company does not intend to publicly announce elections

to pay dividends in cash or in-kind with respect to future payments of the quarterly dividend on the Series A Preferred Stock.

In addition, in a press release dated March 31,

2021, the Company announced it will release first quarter fiscal 2021 financial results after market close on Wednesday, April 28,

2021. The Company will hold a conference call to discuss its results on the same day beginning at 2:00 p.m. Pacific Time. The conference

call will be webcast and can be accessed on the Company’s website, investors.thecheesecakefactory.com. A replay of the webcast

will be available on the Company’s website through May 28, 2021.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Date: April 5, 2021

|

THE CHEESECAKE FACTORY INCORPORATED

|

|

|

|

|

|

By:

|

/s/ Matthew E. Clark

|

|

|

|

Matthew E. Clark

|

|

|

|

Executive Vice President and Chief Financial Officer

|

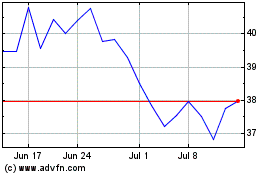

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

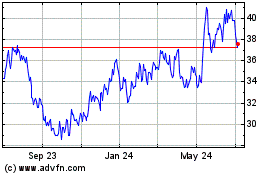

Cheesecake Factory (NASDAQ:CAKE)

Historical Stock Chart

From Apr 2023 to Apr 2024