Check Point(R) Software Technologies Ltd. (NASDAQ:CHKP), the

worldwide leader in securing the Internet, today announced its

financial results for the fourth quarter and year ended December

31, 2005. "Check Point's fourth quarter business provided a strong

finish to the year 2005," said Gil Shwed, chairman and chief

executive officer of Check Point Software. "Our fourth quarter and

annual 2005 financial results reached record levels across earnings

per share, revenues, deferred revenues, and cash balances."

Financial Highlights for the Fourth Quarter of 2005: -- Revenues:

$156.1 million, an increase of 9% compared to $143.0 million in the

fourth quarter of 2004. -- Net Income: $89.2 million, an increase

of 17% compared to $76.4 million in the fourth quarter of 2004. Net

income excluding acquisition related charges(1) was $90.9 million,

an increase of 15% compared to $78.7 million in the fourth quarter

of 2004. -- Earnings per Diluted Share: $0.36, an increase of 21%

compared to $0.30 in the fourth quarter of 2004. EPS excluding net

acquisition related charges was $0.37, an increase of 20% compared

to $0.31 in the fourth quarter of 2004. -- Deferred Revenues:

$169.0 million, an increase of $24.7 million or 17% over deferred

revenues as of September 30, 2005. -- Share Repurchase Program:

During the fourth quarter of 2005, Check Point purchased 1.25

million shares at a total cost of approximately $27.5 million. In

2005, the company purchased a total of 10.6 million shares for a

total cost of $237 million. Financial Highlights for the Year Ended

December 31, 2005: -- Revenues: $579.4 million, an increase of 12%

compared to $515.4 million for the year ended December 31, 2004. --

Net Income: $319.7 million, an increase of 29% compared to $248.4

million for the year ended December 31, 2004. Net income excluding

acquisition related charges was $326.9 million, an increase of 17%

compared to $278.7 million for the year ended December 31, 2004. --

Earnings per Diluted Share: $1.27, an increase of 33% compared to

$0.95 for the year ended December 31, 2004. EPS excluding net

acquisition related charges was $1.30, an increase of 21% compared

to $1.07 for the year ended December 31, 2004. -- Cash and

Investments Balance: $1.74 billion as of December 31, 2005. During

the year, Check Point introduced many products and technologies, as

well as continued to expand and unify the portfolio of security

solutions. The company also garnered many awards. Key business

highlights, product introductions and accolades include the

following: Business Highlights and Introductions during 2005 --

Expanded Industry's only Unified Security Architecture -- In 2005,

Check Point launched the NGX(TM) platform, a major upgrade to Check

Point's core technology. It is the unified security platform for

perimeter, internal and Web security solutions enabling enterprises

of all sizes to reduce the cost and complexity of security and

ensure that their security systems can be easily extended to adapt

to new and evolving threats. -- Internal Security, Intrusion

Prevention & Web Security -- During the year we have seen

strong growth in our Web-security and SSL VPN product family,

Connectra(TM), with revenue growth of over 250% for the year. We

have also expanded our internal security family, InterSpect(TM),

that combines active intrusion prevention, network zone

segmentation and quarantine capabilities. We look forward to

enhancing our technology with the pending acquisition of

Sourcefire, Inc. A definitive agreement was reached in October

2005. We have received US anti-trust approval and we are waiting

for a determination on our pending application with the Committee

on Foreign Investment in the U.S. (CFIUS). -- New Product Family

for Security Event Management, Eventia(TM) -- In early 2005, Check

Point introduced the new Eventia(TM) family that allows IT

professionals to collect, analyze, correlate and report on security

events, and enables a higher level of intelligence and protection

of the network security. -- Introduced New Unified Threat

Management (UTM) Solutions: Check Point Express CI(TM) and

Safe@Office(R) 500 appliance series -- Check Point has entered the

market for Unified Threat Management Solutions gateways that

include in a single product integrated firewall, VPN, antivirus,

intrusion prevention and many other security technologies. These

two product families enable affordable security for small and

medium businesses ranging from $400 to $15,000 per gateway. --

Expanded Endpoint Security for Consumers and Enterprises --

ZoneAlarm(R) 6.0 provides new multi-layered security for consumers

and debuted with a new OSFirewall(TM) and Anti-Spyware solution to

prevent the most dangerous Internet threats including spyware,

rootkits, viruses, and more from invading PCs. Integrity(TM)

delivers the most complete endpoint security solution, including

intrusion prevention, outbound threat protection, access policy

enforcement, advanced server and policy automation, to proactively

protect PCs and enterprise networks from the newest worms, viruses,

spyware, and hacker attacks. Partial List of Awards & Industry

Recognitions in 2005: Recognition by Industry Analyst Firms: --

Tolly Group Tests Confirm Check Point Solution Completeness and

Lowest TCO -- Tests by the Tolly Group confirmed that Check Point

provides the broadest breadth of security coverage at the lowest

Total Cost of Ownership (TCO) for today's complex security

vulnerabilities in comparison to competing solutions from Cisco and

Juniper. -- Gartner Group Prestigious Magic Quadrant(TM) Report

Leader -- Check Point positioned in the leader quadrant of

Gartner's Magic Quadrant for Network Firewalls. This report

evaluates both network and application firewall vendors on their

ability to execute and completeness of vision. -- META Group

Industry Leader Position in METAspectrum(TM) Report -- Check Point

was ranked as a market leader in META Group's METAspectrum report

on Network Intrusion Control Systems. Of 12 vendors, Check Point

ranked the highest for "performance" -- a category that measures

the company's technology, services pricing and financial standing.

-- Frost & Sullivan Global Market Leadership for Endpoint

Security Solutions -- Check Point, achieved prestigious recognition

from Frost & Sullivan that bestowed Check Point Integrity(TM)

endpoint security solution with their renowned Global Market

Leadership Award for outstanding market share, revenue growth rate,

profitability and market and technology innovation. Awards and

Recognition for Check Point's Partner Program: CMP's VARBusiness

Magazine: -- Top Channel Executive: Kevin Maloney, Vice President,

Worldwide Sales -- Five-Star Rating: Check Point Valued Partner

Program -- 2005 Annual Report Card: Check Point Achieves

Exceptional Partner Satisfaction Computer Reseller News (UK): --

Security Vendor Partner of the Year Awards for Products &

Technology: Check Point VPN-1(R) Pro: the industry's most proven

and secure VPN -- 2005 Global Best Enterprise Security Solution and

Best Firewall -- SC Magazine -- Editor's Choice -- China

Information World -- Best Firewall/VPN -- Computerworld Hong Kong

-- Readers Choice, Best Firewall -- Computerworld Malaysia,

Computerworld Singapore -- Best Firewall -- Relatorio Bancario,

Brazil -- Readers' Choice, Best Server/Standalone Firewall --

Windows IT Pro ZoneAlarm(R) Security Suite: complete internet

protection for consumers -- 2005 Global and European Best SOHO

Security Solution -- SC Magazine, SC Magazine (UK) -- 2005 Readers'

Choice, Best Desktop Firewall -- Windows IT Pro -- Editors' Choice,

Desktop Security -- CNet -- Editors' Choice, Best Security Suite --

PC Magazine -- Editor's Choice, Best Security Suite -- LAPTOP

Magazine Check Point Integrity(TM): complete solution for securing

internal-network endpoint PCs -- 2005 European Best Enterprise

Security Solution -- SC Magazine -- Endpoint Security Evaluation

Winner -- Information Security Magazine Unified Threat Management

(UTM) Solutions for Small and Mid-Size Businesses -- Midmarket

Product of The Year, Check Point Express CI(TM) -- VARBusiness --

Editor's Choice, Safe@Office -- InformationWeek -- Excellent

Security, Safe@Office -- ProtectStar, Germany Mr. Shwed continued,

"We've continued our expansion in 2005 by strengthening our Unified

Security Architecture and delivering a unique set of integrated

network security solutions for our customers. We believe that our

innovative technology, breadth of solutions and customer acceptance

will serve as the foundation for our future success." Conference

Call and Webcast Information Check Point will host a conference

call with the investment community on January 30, 2006 at 8:30 AM

ET/5:30 AM PT. To listen to the live webcast, please visit Check

Point's website at http://www.checkpoint.com/ir. A replay of the

conference call will be available through February 13, 2006 at the

Company's website http://www.checkpoint.com/ir or by telephone at

(973) 341-3080, pass code 6888307. Safe Harbor Statement Certain

statements in this press release are forward-looking statements.

Forward-looking statements include statements regarding factors

driving Check Point's position as a provider of network security

and position for long-term success, and Check Point's beliefs

regarding the potential benefits of the pending acquisition of

Sourcefire, as well as Check Point's expectations regarding the

timing of receipt of any regulatory approvals and completion of the

acquisition. These statements pertain to future events, and

therefore they are subject to various risks and uncertainties, and

actual results could differ materially from Check Point's current

expectations and beliefs. Factors that could cause or contribute to

such differences include, but are not limited to: the impact on

revenues of economic and political uncertainties, the impact of

political changes and weaknesses in various regions of the world,

including the commencement or escalation of hostilities or acts of

terrorism; the inclusion of network security functionality in

third-party hardware or system software; any foreseen and

unforeseen developmental or technological difficulties with regard

to Check Point's products; changes in the competitive landscape,

including new competitors or the impact of competitive pricing and

products; rapid technological advances and changes in customer

requirements to which Check Point is unable to respond

expeditiously, if at all; a shift in demand for products such as

Check Point's; factors affecting third parties with which Check

Point has formed business alliances; timely availability and

customer acceptance of Check Point's new and existing products; the

parties' ability to consummate the Sourcefire transaction,

including the ability of the parties to secure the CFIUS approval

required for the transaction on the terms expected or on the

anticipated schedule, if at all; unanticipated expenses associated

with the Sourcefire acquisition; the possibility that Check Point

may be unable to achieve all of the benefits of the acquisition

within the expected time-frames or at all and to successfully

integrate Sourcefire's operations and technology into those of

Check Point; operating costs, customer loss and business disruption

(including, without limitation, difficulties in maintaining

relationships with employees, customers, clients or suppliers) may

be greater than expected following the Sourcefire acquisition; and

other factors and risks discussed in Check Point's Annual Report on

Form 20-F for the year ended December 31, 2004, which is on file

with the Securities and Exchange Commission. Check Point assumes no

obligation to update information concerning its expectations. About

Check Point Software Technologies Ltd. Check Point Software

Technologies Ltd. (www.checkpoint.com) is a leader in securing the

Internet. It is a market leader in the worldwide enterprise

firewall, personal firewall and VPN markets. Through its NGX

platform, the company delivers a unified security architecture for

a broad range of perimeter, internal, Web, and endpoint security

solutions that protect business communications and resources for

corporate networks and applications, remote employees, branch

offices and partner extranets. The company's ZoneAlarm product line

is the highest rated personal computer security suite, comprised of

award-winning endpoint security solutions that protect millions of

PCs from hackers, spyware and data theft. Extending the power of

the Check Point solution is its Open Platform for Security (OPSEC),

the industry's framework and alliance for integration and

interoperability with "best-of-breed" solutions from over 350

leading companies. Check Point solutions are sold, integrated and

serviced by a network of more than 2,200 Check Point partners in 88

countries and its customers include 100% of Fortune 100 companies

and tens of thousands of businesses and organizations of all sizes.

(C)2003-2005 Check Point Software Technologies Ltd. All rights

reserved. Check Point, Application Intelligence, Check Point

Express, the Check Point logo, AlertAdvisor, ClusterXL, Cooperative

Enforcement, ConnectControl, Connectra, CoSa, Cooperative Security

Alliance, Eventia, Eventia Analyzer, Eventia Reporter, FireWall-1,

FireWall-1 GX, FireWall-1 SecureServer, FloodGate-1, Hacker ID,

IMsecure, INSPECT, INSPECT XL, Integrity, InterSpect, IQ Engine,

NGX, Open Security Extension, OPSEC, Policy Lifecycle Management,

Provider-1, Safe@Home, Safe@Office, SecureClient, SecureKnowledge,

SecurePlatform, SecuRemote, SecureXL Turbocard, SecureServer,

SecureUpdate, SecureXL, SiteManager-1, SmartCenter, SmartCenter

Pro, Smarter Security, SmartDashboard, SmartDefense, SmartLSM,

SmartMap, SmartUpdate, SmartView, SmartView Monitor, SmartView

Reporter, SmartView Status, SmartViewTracker, SofaWare, SSL Network

Extender, Stateful Clustering, TrueVector, Turbocard, UAM,

User-to-Address Mapping, UserAuthority, VPN-1, VPN-1 Accelerator

Card, VPN-1 Edge, VPN-1 Pro, VPN-1 SecureClient, VPN-1 SecuRemote,

VPN-1 SecureServer, VPN-1 VSX, VPN-1 XL, Web Intelligence,

ZoneAlarm, ZoneAlarm Pro, Zone Labs, and the Zone Labs logo, are

trademarks or registered trademarks of Check Point Software

Technologies Ltd. or its affiliates. All other product names

mentioned herein are trademarks or registered trademarks of their

respective owners. The products described in this document are

protected by U.S. Patent No. 5,606,668, 5,835,726, 6,496,935,

6,873,988 and 6,850,943 and may be protected by other U.S. Patents,

foreign patents, or pending applications. (1) "Acquisition related

charges" refer to the impact of the amortization of intangible

assets and stock-based compensation resulting from the acquisition

of Zone Labs Inc., in March 2004. -0- *T CHECK POINT SOFTWARE

TECHNOLOGIES LTD. CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share amounts) Three Months Ended Year

Ended December 31, December 31, 2005 2004 2005 2004 -----------

----------- ----------- ----------- (unaudited) (unaudited)

(unaudited) (unaudited) Revenues: Products and licenses $ 78,978 $

77,142 $ 281,364 $275,677 Software subscriptions 61,585 53,268

239,319 196,327 ----------- ----------- ----------- -----------

Total product and license revenues 140,563 130,410 520,683 472,004

Services 15,495 12,639 58,667 43,356 ----------- -----------

----------- ----------- Total revenues 156,058 143,049 579,350

515,360 ----------- ----------- ----------- ----------- Operating

expenses: Cost of revenues 6,344 5,988 24,718 23,552 Research and

development 12,193 12,015 49,290 43,186 Selling and marketing

36,271 36,487 140,283 132,796 General and administrative 5,772

6,050 23,984 23,657 Amortization of intangible assets and deferred

stock compensation 2,161 2,783 9,387 8,852 Acquisition related

in-process R&D - - - 23,098 ----------- ----------- -----------

----------- Total operating expenses 62,741 63,323 247,662 255,141

----------- ----------- ----------- ----------- Operating income

93,317 79,726 331,688 260,219 Financial income, net 13,987 11,970

54,177 44,777 ----------- ----------- ----------- -----------

Income before income taxes 107,304 91,696 385,865 304,996 Income

taxes 18,067 15,252 66,181 56,603 ----------- -----------

----------- ----------- Net income $ 89,237 $ 76,444 $ 319,684 $

248,393 =========== =========== =========== =========== Net income

excluding in-process R&D and amortization of intangible assets

and deferred stock compensation $ 90,857 $ 78,684 $ 326,905 $

278,717 =========== =========== =========== =========== Earnings

per share (basic) $ 0.36 $ 0.31 $ 1.30 $ 0.99 ===========

=========== =========== =========== Number of shares used in

computing earnings per share (basic) 244,517 248,585 245,520

251,244 =========== =========== =========== =========== Earnings

per share (fully diluted) $ 0.36 $ 0.30 $ 1.27 $ 0.95 ===========

=========== =========== =========== Earnings per share (fully

diluted) excluding in-process R&D and amortization of

intangible assets and deferred stock compensation $ 0.37 $ 0.31 $

1.30 $ 1.07 =========== =========== =========== =========== Number

of shares used in computing earnings per share (fully diluted)

248,585 257,459 251,747 260,608 =========== =========== ===========

=========== CHECK POINT SOFTWARE TECHNOLOGIES LTD. SELECTED

CONSOLIDATED BALANCE SHEET DATA (In thousands) ASSETS December 31,

December 31, 2005 2004 ------------ ------------ (unaudited)

(unaudited) Current Assets: Cash and cash equivalents $ 298,531 $

162,444 Marketable securities 1,052,070 791,799 Trade receivables,

net 127,129 96,006 Other receivables and prepaid expenses 20,646

20,517 ------------ ------------ Total current assets 1,498,376

1,070,766 ------------ ------------ Long-term assets: Long-term

investments 386,753 623,045 Other long-term assets 875 867 Property

and equipment, net 7,665 8,144 Intangible assets 20,215 25,857

Goodwill 174,295 175,536 Deferred income taxes, net 5,650 8,439

------------ ------------ Total long-term assets 595,453 841,888

------------ ------------ Total assets $ 2,093,829 $ 1,912,654

============ ============ LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Deferred revenues $ 168,998 $ 141,114 Trade

payables and other accrued liabilities 136,872 137,932 ------------

------------ Total current liabilities 305,870 279,046 ------------

------------ Accrued severance pay, net 3,271 2,784 ------------

------------ Total liabilities 309,141 281,830 ------------

------------ Shareholders' Equity: Share capital 774 771 Additional

paid-in capital 386,544 369,452 Deferred stock based compensation

(2,831) (10,342) Treasury shares (380,834) (244,586) Retained

earnings 1,781,035 1,515,529 ------------ ------------ Total

shareholders' equity 1,784,688 1,630,824 ------------ ------------

Total liabilities and shareholders' equity $2,093,829 $1,912,654

============ ============ Total cash and cash equivalents and

marketable securities 1,737,354 1,577,288 ============ ============

CHECK POINT SOFTWARE TECHNOLOGIES LTD. SELECTED CONSOLIDATED CASH

FLOW DATA (In thousands) Three Months Ended Year Ended December 31,

December 31, 2005 2004 2005 2004 ----------- -----------

----------- ----------- (unaudited) (unaudited) (unaudited)

(unaudited) Cash flow from operating activities: Net income $

89,237 $ 76,444 $ 319,684 $ 248,393 Adjustments to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 1,371 1,382 5,352 5,519 Increase in trade and

other receivables, net (44,777) (23,233) (31,451) (20,644) Increase

in trade payables and other accrued liabilities 27,467 14,865

28,402 17,868 Other adjustments 6,028 1,285 15,552 1,426

Amortization of intangible assets and deferred stock compensation

2,161 2,783 9,387 8,852 Acquisition related in-process R&D - -

- 23,098 ----------- ----------- ----------- ---------- Net cash

provided by operating activities 81,487 73,526 346,926 284,512

----------- ----------- ----------- ----------- Cash flow from

investing activities: Cash paid in conjunction with the acquisition

of Zone Labs, net - - - (95,343) Investment in property and

equipment (1,392) (1,169) (4,873) (4,500) ----------- -----------

----------- ----------- Net cash used in investing activities

(1,392) (1,169) (4,873) (99,843) ----------- -----------

----------- ----------- Cash flow from financing activities:

Proceeds from issuance of shares upon exercise of options 11,937

10,992 54,942 34,481 Purchase of treasury shares (27,466) (44,349)

(236,929) (244,586) ----------- ----------- ----------- -----------

Net cash used in financing activities (15,529) (33,357) (181,987)

(210,105) ----------- ----------- ----------- ----------- Increase

(decrease) in cash and cash equivalents, deposits and marketable

securities 64,566 39,000 160,066 (25,436) Cash and cash

equivalents, deposits and marketable securities at the beginning of

the period 1,672,788 1,538,288 1,577,288 1,602,724 -----------

----------- ----------- ----------- Cash and cash equivalents and

marketable securities at the end of the period 1,737,354 1,577,288

1,737,354 1,577,288 =========== =========== =========== ===========

*T

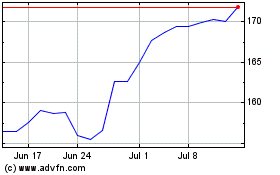

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2024 to Jul 2024

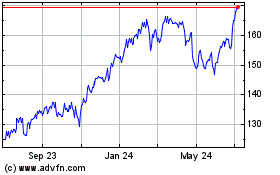

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jul 2023 to Jul 2024