Check Point(R) Software Technologies Ltd. (Nasdaq:CHKP), the

worldwide leader in securing the Internet, today announced its

financial results for the second quarter ended June 30, 2005.

Financial Highlights for the Second Quarter of 2005: -- Revenues:

$144.6 million, an increase of 14% compared to $126.9 million in

the second quarter of 2004. -- Net Income: $78.0 million, an

increase of 23% compared to $63.3 million in the second quarter of

2004. Net income excluding acquisition related charges(1) was $79.8

million, an increase of 21% compared to $65.9 million in the second

quarter of 2004. -- Earnings per Diluted Share: $0.31, an increase

of 30% compared to $0.24 in the second quarter of 2004. EPS

excluding net acquisition related charges was $0.32, an increase of

28% compared to $0.25 in the second quarter of 2004. -- Deferred

Revenues: increased by $4.0 million to a record $154.2 million. --

Share Repurchase Program: During the second quarter of 2005, Check

Point purchased 4.7 million shares at a total cost of close to $103

million. "We are pleased with our second quarter results, which

showed growth in profits and revenues from both existing and newly

announced product lines. We have also seen an increase in the large

deals we won during the quarter, including a few multi-year,

multi-million dollar licensing deals," said Gil Shwed, chairman and

chief executive officer of Check Point Software. "Additionally, Q2

marked a major milestone in Check Point history with the

introduction of the NGX platform; the industry's only unified

security architecture. As IT security remains a global focus, Check

Point NGX is resonating in the marketplace because it unifies

broad, intelligent security and delivers cost savings, reduced

complexity and deployment adaptability to businesses of all sizes."

Business Highlights and Introductions During the Second Quarter

Include: -- Introduced NGX(TM) Platform -- Industry's only Unified

Security Architecture -- the NGX platform is a major upgrade to

Check Point's core technology. It is the unified security platform

for perimeter, internal and Web security solutions enabling

enterprises of all sizes to reduce the cost and complexity of

security and ensure that their security systems can be easily

extended to adapt to new and evolving threats. -- Hosted Successful

Check Point Experience(TM) events for Partners and Customers --

held two major business and networking events to educate over 1,700

partners and customers on Check Point solutions. Participants

benefited from valuable technology and market information via

presentations, technical and business-focused tracks and product

demonstrations provided by Check Point and its partners. --

Introduced Check Point Express CI(TM) Unified Threat Management

(UTM) for Medium Business -- an easy to deploy and manage platform

that comprises multiple vital security features a mid-sized

business needs, including: firewall, VPN, intrusion prevention, and

integrated antivirus protection. -- Introduced Check Point VPN-1(R)

Edge(TM) W Wireless Security Appliance for Branch Offices -- a

series of enterprise-level VPN/firewall wireless security

appliances for remote site business locations, branch offices and

partner sites. Provides flexible high-speed wireless access,

unmatched security protection, simple and scalable management and

business continuity. -- Achieved Industry Leader Position in

METAspectrum(SM) Report -- Check Point was ranked as a market

leader in META Group's METAspectrum report on Network Intrusion

Control Systems. Of 12 vendors, Check Point ranked the highest for

"performance" -- a category that takes into account the company's

technology, services pricing and financial standing. List of Awards

in the Second Quarter: -- SC Magazine Global Awards 2005 (UK) --

The 2005 SC Magazine Global Awards Program reviewed over 1,000

security product and service nominations across 35 security-related

categories and the publication's panel of judges voted on the best

for 2005. Among others, Check Point products won Best Enterprise

Security Solution for Integrity and Best SOHO Security Solution for

ZoneAlarm Security Suite. -- VARBusiness Magazine's Midmarket

"Products of the Year" 2005 for Check Point Express CI(TM) --

Editors evaluated more than 400 nominated products to determine

which products and services were best for midmarket customers with

100 to 999 employees. -- eWEEK Excellence Awards for Integrity 5.0

-- recognized in the area of Vulnerability Assessment and

Remediation. The eWEEK Excellence Awards recognize vendors that

meet today's rigorous enterprise IT demands. -- PC World 2005 World

Class Awards for ZoneAlarm(R) Antivirus -- honored in the Antivirus

and Firewall Software category. -- Computerworld Hong Kong Best

Firewall Award for VPN-1(R)/FireWall-1(R) -- award based solely on

votes it receives from readers. Shwed continued, "We have embarked

on a major initiative with NGX, and in Q3, we will remain focused

on one thing: execution. We anticipate the delivery of new

NGX-based versions of our security products in the perimeter,

internal, Web and endpoint product categories as we continue

architecting a secure future for our customers." Conference Call

and Webcast Information Check Point will host a conference call

with the investment community on July 19, 2005 at 8:30 AM ET/5:30

AM PT. A replay of the conference call will be available through

August 2, 2005 at the Company's website

http://www.checkpoint.com/ir or by telephone at (973) 341-3080,

pass code 6235460. Safe Harbor Statement Certain statements in this

press release are forward-looking statements. Forward-looking

statements include statements regarding Check Point's anticipated

delivery of new NGX-based security products. Because such

statements deal with future events, they are subject to various

risks and uncertainties and actual results could differ materially

from Check Point's current expectations. Factors that could cause

or contribute to such differences include, but are not limited to:

timely availability and customer acceptance of Check Point's new

NGX-based products and other products; the impact on revenues of

economic and political uncertainties and weaknesses in various

regions of the world, including the commencement or escalation of

hostilities or acts of terrorism; the inclusion of network security

functionality in third-party hardware or system software; any

unforeseen developmental or technological difficulties with regard

to Check Point's products; changes in the competitive landscape,

including new competitors or the impact of competitive pricing and

products; a shift in demand for products such as Check Point's;

unknown factors affecting third parties with which Check Point has

formed business alliances; timely availability and customer

acceptance of Check Point's new and existing products, and other

factors and risks discussed in Check Point's Annual Report on Form

20-F for the year ended December 31, 2004, which is on file with

the Securities and Exchange Commission. Check Point assumes no

obligation to update information concerning its expectations. About

Check Point Software Technologies Ltd. Check Point Software

Technologies Ltd. (www.checkpoint.com) is the worldwide leader in

securing the Internet. It is the market leader in the worldwide

enterprise firewall, personal firewall and VPN markets. Through its

NGX platform, the company delivers a unified security architecture

for a broad range of perimeter, internal and Web security solutions

that protect business communications and resources for corporate

networks and applications, remote employees, branch offices and

partner extranets. The company's ZoneAlarm product line is one of

the most trusted brands in Internet security, creating

award-winning endpoint security solutions that protect millions of

PCs from hackers, spyware and data theft. Extending the power of

the Check Point solution is its Open Platform for Security (OPSEC),

the industry's framework and alliance for integration and

interoperability with "best-of-breed" solutions from over 350

leading companies. Check Point solutions are sold, integrated and

serviced by a network of more than 2,200 Check Point partners in 88

countries. (C)2003-2005 Check Point Software Technologies Ltd. All

rights reserved. Check Point, Application Intelligence, Check Point

Express, the Check Point logo, AlertAdvisor, ClusterXL, Cooperative

Enforcement, ConnectControl, Connectra, CoSa, Cooperative Security

Alliance, Eventia, Eventia Analyzer, Eventia Reporter, FireWall-1,

FireWall-1 GX, FireWall-1 SecureServer, FloodGate-1, Hacker ID,

IMsecure, INSPECT, INSPECT XL, Integrity, InterSpect, IQ Engine,

NGX, Open Security Extension, OPSEC, Policy Lifecycle Management,

Provider-1, Safe@Home, Safe@Office, SecureClient, SecureKnowledge,

SecurePlatform, SecuRemote, SecureXL Turbocard, SecureServer,

SecureUpdate, SecureXL, SiteManager-1, SmartCenter, SmartCenter

Pro, Smarter Security, SmartDashboard, SmartDefense, SmartLSM,

SmartMap, SmartUpdate, SmartView, SmartView Monitor, SmartView

Reporter, SmartView Status, SmartViewTracker, SofaWare, SSL Network

Extender, Stateful Clustering, TrueVector, Turbocard, UAM,

User-to-Address Mapping, UserAuthority, VPN-1, VPN-1 Accelerator

Card, VPN-1 Edge, VPN-1 Pro, VPN-1 SecureClient, VPN-1 SecuRemote,

VPN-1 SecureServer, VPN-1 VSX, VPN-1 XL, Web Intelligence,

ZoneAlarm, ZoneAlarm Pro, Zone Labs, and the Zone Labs logo, are

trademarks or registered trademarks of Check Point Software

Technologies Ltd. or its affiliates. All other product names

mentioned herein are trademarks or registered trademarks of their

respective owners. The products described in this document are

protected by U.S. Patent No. 5,606,668, 5,835,726, 6,496,935,

6,873,988 and 6,850,943 and may be protected by other U.S. Patents,

foreign patents, or pending applications. (1) "Acquisition related

charges" refer to the impact of the amortization of intangible

assets and stock-based compensation resulting from the acquisition

of Zone Labs Inc., in March 2004. -0- *T CHECK POINT SOFTWARE

TECHNOLOGIES LTD. CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share amounts) Three Months Ended Six

Months Ended June 30, June 30, 2005 2004 2005 2004 -----------

----------- ----------- ----------- (unaudited) (unaudited)

(unaudited) (unaudited) Revenues: Products and licenses $71,248

$67,899 $136,770 $130,908 Software subscriptions 58,892 48,681

117,339 92,694 ----------- ----------- ----------- -----------

Total product and license revenues 130,140 116,580 254,109 223,602

Services 14,423 10,339 28,115 19,379 ----------- -----------

----------- ----------- Total revenues 144,563 126,919 282,224

242,981 ----------- ----------- ----------- ----------- Operating

expenses: Cost of revenues 6,505 6,443 12,057 11,377 Research and

development 11,880 10,844 24,656 19,506 Selling and marketing

36,905 34,417 70,966 63,015 General and administrative 6,013 6,474

12,261 11,324 Amortization of intangible assets and deferred stock

compensation 2,353 3,144 4,978 3,144 Acquired in-process R&D -

- - 23,098 ----------- ----------- ----------- ----------- Total

operating expenses 63,656 61,322 124,918 131,464 -----------

----------- ----------- ----------- Operating income 80,907 65,597

157,306 111,517 Financial income, net 13,468 10,579 25,869 21,348

----------- ----------- ----------- ----------- Income before

income taxes 94,375 76,176 183,175 132,865 Income taxes 16,378

12,913 31,472 27,674 ----------- ----------- -----------

----------- Net income $77,997 $63,263 $151,703 $105,191

=========== =========== =========== =========== Net income

excluding in-process R&D and amortization of intangible assets

and deferred stock compensation $79,808 $65,865 $155,598 $130,891

=========== =========== =========== =========== Earnings per share

(basic) $0.32 $0.25 $0.61 $0.42 =========== =========== ===========

=========== Number of shares used in computing earnings per share

(basic) 245,398 254,778 246,674 252,484 =========== ===========

=========== =========== Earnings per share (fully diluted) $0.31

$0.24 $0.60 $0.40 =========== =========== =========== ===========

Earnings per share (fully diluted) excluding in-process R&D and

amortization of intangible assets and deferred stock compensation

$0.32 $0.25 $0.61 $0.50 =========== =========== ===========

=========== Number of shares used in computing earnings per share

(fully diluted) 252,179 266,800 254,165 263,315 ===========

=========== =========== =========== CHECK POINT SOFTWARE

TECHNOLOGIES LTD. SELECTED CONSOLIDATED BALANCE SHEET DATA (In

thousands) ASSETS June 30, December 31, 2005 2004 ---------------

--------------- (unaudited) (unaudited) Current Assets: Cash and

cash equivalents $127,532 $157,655 Marketable securities and

deposits 898,420 796,588 Trade receivables, net 89,289 96,006 Other

receivables and prepaid expenses 23,571 20,517 ---------------

--------------- Total current assets 1,138,812 1,070,766

--------------- --------------- Long-term assets: Long-term

investments 599,811 623,912 Property and equipment, net 7,699 8,144

Intangible assets 23,036 25,857 Goodwill 175,536 175,536 Deferred

income taxes, net 7,108 8,439 --------------- --------------- Total

long-term assets 813,190 841,888 --------------- ---------------

Total assets $1,952,002 $1,912,654 =============== ===============

LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Deferred

revenues $154,204 $141,114 Trade payables and other accrued

liabilities 137,640 137,932 ----------- ----------- Total current

liabilities 291,844 279,046 ----------- ----------- Accrued

severance pay, net 3,242 2,784 ----------- ----------- Total

liabilities 295,086 281,830 ----------- ----------- Shareholders'

Equity: Share capital 774 771 Additional paid-in capital 379,336

369,452 Deferred stock based compensation (4,944) (10,342) Treasury

shares (368,298) (244,586) Retained earnings 1,650,048 1,515,529

----------- ----------- Total shareholders' equity 1,656,916

1,630,824 ----------- ----------- Total liabilities and

shareholders' equity $1,952,002 $1,912,654 =========== ===========

Total cash and cash equivalents, deposits and marketable securities

1,624,899 1,577,291 =========== =========== CHECK POINT SOFTWARE

TECHNOLOGIES LTD. SELECTED CONSOLIDATED CASH FLOW DATA (In

thousands) Three Months Ended Six Months Ended June 30, June 30,

2005 2004 2005 2004 ----------- ----------- ----------- -----------

(unaudited) (unaudited) (unaudited) (unaudited) Cash flow from

operating activities: Net income 77,997 63,263 151,703 105,191

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 1,320 1,424

2,625 2,681 Decrease (increase) in trade and other receivables, net

(9,803) 8,986 3,686 963 Increase in trade payables and other

accrued liabilities 8,662 4,785 13,256 9,044 Other adjustments

4,373 289 5,714 2,444 Amortization of intangible assets and

deferred stock compensation 2,353 3,144 4,978 3,144 Acquisition of

in- process R&D - - - 23,098 ----------- -----------

----------- ----------- Net cash provided by operating activities

84,902 81,891 181,962 146,565 ----------- ----------- -----------

----------- Cash flow from investing activities: Cash paid in

conjunction with the acquisition of Zone Labs, net - - - (95,343)

Investment in property and equipment (1,038) (966) (2,180) (2,327)

----------- ----------- ----------- ----------- Net cash used in

investing activities (1,038) (966) (2,180) (97,670) -----------

----------- ----------- ----------- Cash flow from financing

activities: Proceeds from issuance of shares upon exercise of

options 13,355 8,545 20,097 19,797 Purchase of treasury shares

(102,565) (78,649) (152,271) (78,649) ----------- -----------

----------- ----------- Net cash used in financing activities

(89,210) (70,104) (132,174) (58,852) ----------- -----------

----------- ----------- Increase (decrease) in cash and cash

equivalents, deposits and marketable securities (5,346) 10,821

47,608 (9,957) Cash and cash equivalents, deposits and marketable

securities at the beginning of the period 1,630,245 1,581,946

1,577,291 1,602,724 ----------- ----------- ----------- -----------

Cash and cash equivalents, deposits and marketable securities at

the end of the period 1,624,899 1,592,767 1,624,899 1,592,767

=========== =========== =========== =========== *T

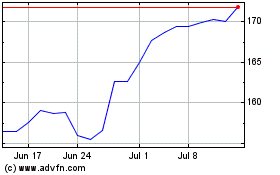

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2024 to Jun 2024

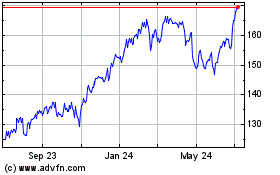

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Jun 2023 to Jun 2024