Carlyle Secured Lending, Inc. (together with its consolidated

subsidiaries, “we,” “us,” “our,” “CGBD” or the “Company”) (NASDAQ:

CGBD) today announced its financial results for its second quarter

ended June 30, 2024.

Justin Plouffe, CGBD’s Chief Executive Officer said, “Our core

middle-market strategy and active approach to portfolio management

continued to drive strong performance in the second quarter of

2024, as we maintained a dynamic approach to origination in an

increasingly competitive market. With increased volume during the

quarter, we capitalized on attractive origination opportunities,

and we see the potential for increased deal activity through

year-end. Overall, we remain pleased with our results and look

forward to continuing to deliver the consistent income and returns

our investors have come to expect from our portfolio.”

Net investment income for the second quarter of 2024

was $0.51 per common share, and net asset value per

common share decreased by 0.7% for the second quarter to $16.95

from $17.07 as of March 31, 2024. The total fair value of our

investments was $1.7 billion as of June 30, 2024.

On August 2, 2024, the Company entered into an Agreement and

Plan of Merger (the “Merger Agreement”) with Carlyle Secured

Lending III, a Delaware statutory trust (“CSL III”), Blue Fox

Merger Sub, Inc., a Maryland corporation and wholly-owned

subsidiary of the Company (“Merger Sub”), and, solely for the

limited purposes set forth therein, CSL III Advisor, LLC, a

Delaware limited liability company and investment adviser to CSL

III (“CSL III Advisor”), and Carlyle Global Credit Investment

Management, L.L.C. (the “Investment Adviser” and together with CSL

III Advisor, the “Advisors”), pursuant to which, on the terms and

subject to the conditions set forth in the Merger Agreement, (i)

Merger Sub will merge with and into CSL III, with CSL III

continuing as the surviving company and as a wholly-owned

subsidiary of the Company (the “Merger”) and (ii) immediately

thereafter, CSL III will merge with and into the Company, with the

Company continuing as the surviving company (together with the

Merger, the “Mergers”). In support of the Merger Agreement, Carlyle

has agreed to exchange its shares of CGBD convertible preferred

stock (the “Preferred Stock”) for a number of shares of CGBD common

stock equal to the quotient of (i) the aggregate liquidation

preference of the Preferred Stock and (ii) the CGBD net asset value

per share, determined no earlier than 48 hours (excluding Sundays

and holidays) prior to the date of the merger. The transaction is

subject to customary closing conditions and is expected to close

during the first fiscal quarter of 2025.

The Company has issued a separate press release and

presentation, which provide additional detail on the Mergers. The

press release and presentation can also be found on our website.

The Company's Proxy Statement (as defined below) and Registration

Statement (as defined below) that it will file with the SEC in the

coming weeks will also contain important information on the

Mergers.

Dividends

On August 1, 2024, the Board of Directors declared a base

quarterly common dividend of $0.40 per share plus a supplemental

common dividend of $0.07 per share. The dividends are payable on

October 17, 2024 to common stockholders of record on

September 30, 2024.

On June 25, 2024, the Company declared a cash dividend on

the Preferred Stock for the period from April 1, 2024 to

June 30, 2024 in the amount of $0.438 per Preferred Share to

the holder of record on June 28, 2024.

Conference Call

The Company will host a conference call at 10:00 a.m. EST on

Monday, August 5, 2024 to discuss these quarterly financial

results. The conference call will be available via public webcast

via a link on Carlyle Secured Lending’s website and will also be

available on our website soon after the call’s completion.

Carlyle Secured Lending, Inc.

CGBD is an externally managed specialty finance company focused

on lending to middle-market companies. CGBD is managed by Carlyle

Global Credit Investment Management L.L.C., an SEC-registered

investment adviser and a wholly owned subsidiary of The Carlyle

Group Inc. Since it commenced investment operations in May 2013

through June 30, 2024, CGBD has invested approximately

$8.5 billion in aggregate principal amount of debt and equity

investments prior to any subsequent exits or repayments. CGBD’s

investment objective is to generate current income and capital

appreciation primarily through debt investments in U.S. middle

market companies. CGBD has elected to be regulated as a business

development company under the Investment Company Act of 1940, as

amended.

Web: carlylesecuredlending.com

About Carlyle

Carlyle (“Carlyle,” or the “Adviser”) (NASDAQ: CG) is a global

investment firm with deep industry expertise that deploys private

capital across three business segments: Global Private Equity,

Global Credit and Global Investment Solutions. With

$435 billion of assets under management as of June 30,

2024, Carlyle’s purpose is to invest wisely and create value on

behalf of its investors, portfolio companies and the communities in

which we live and invest. Carlyle employs more than 2,200 employees

in 29 offices across four continents. Further information is

available at www.carlyle.com. Follow Carlyle on X @OneCarlyle and

LinkedIn at The Carlyle Group.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking statements that

involve substantial risks and uncertainties. Some of the statements

in this communication constitute forward-looking statements because

they are not historical facts, but instead relate to future events,

future performance or financial condition of CGBD, CSL III or the

Mergers. The forward-looking statements may include statements as

to: future operating results of CGBD and CSL III and distribution

projections; business prospects of CGBD and CSL III and the

prospects of their portfolio companies; and the impact of the

investments that CGBD and CSL III expect to make. You can identify

these statements by the use of forward-looking terminology such as

“anticipates,” “believes,” “expects,” “intends,” “will,” “should,”

“may,” “plans,” “continue,” “believes,” “seeks,” “estimates,”

“would,” “could,” “targets,” “projects,” “outlook,” “potential,”

“predicts” and variations of these words and similar expressions to

identify forward-looking statements, although not all

forward-looking statements include these words. The forward-looking

statements contained in this press release involve risks and

uncertainties. Certain factors could cause actual results and

conditions to differ materially from those projected, including the

uncertainties associated with (i) the timing or likelihood of the

Mergers closing; (ii) the expected synergies and savings associated

with the Mergers; (iii) the ability to realize the anticipated

benefits of the Mergers, including the expected elimination of

certain expenses and costs due to the Mergers; (iv) the percentage

of CGBD stockholders voting in favor of the proposals submitted for

their approval; (v) the possibility that competing offers or

acquisition proposals will be made; (vi) the possibility that any

or all of the various conditions to the consummation of the Mergers

may not be satisfied or waived; (vii) risks related to diverting

management’s attention from ongoing business operations; (viii) the

risk that stockholder litigation in connection with the Mergers may

result in significant costs of defense and liability; (ix) changes

in the economy, financial markets and political environment,

including the impacts of inflation and rising interest rates; (x)

risks associated with possible disruption in the operations of CGBD

and CSL III or the economy generally due to terrorism, war or other

geopolitical conflict (including the uncertainty surrounding

Russia’s military invasion of Ukraine and the impact of

geopolitical tensions in other regions such as the Middle East, and

developing tensions between China and the United States); (xi)

future changes in laws or regulations (including the interpretation

of these laws and regulations by regulatory authorities); (xii)

conditions in CGBD’s and CSL III’s operating areas, particularly

with respect to business development companies or regulated

investment companies; and (xiii) other considerations that may be

disclosed from time to time in CGBD’s and CSL III’s publicly

disseminated documents and filings. CGBD and CSL III have based the

forward-looking statements included in this press release on

information available to them on the date hereof, and they assume

no obligation to update any such forward-looking statements. You

should read statements that contain these words carefully because

they discuss our plans, strategies, prospects and expectations

concerning our business, operating results, financial condition and

other similar matters. We believe that it is important to

communicate our future expectations to our investors. There may be

events in the future, however, that we are not able to predict

accurately or control. You should not place undue reliance on these

forward-looking statements, which speak only as of the date on

which we make it. Factors or events that could cause our actual

results to differ, possibly materially from our expectations,

include, but are not limited to, the risks, uncertainties and other

factors we identify in the sections entitled “Risk Factors” and

“Cautionary Statement Regarding Forward-Looking Statements” in

filings we make with the Securities and Exchange Commission, and it

is not possible for us to predict or identify all of them. Although

CGBD and CSL III undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, you are advised to consult any

additional disclosures that they may make directly to you or

through reports that CGBD and CSL III have filed or in the future

may file with the Securities and Exchange Commission (“SEC”),

including the Proxy Statement and the Registration Statement (each

as defined below), annual reports on Form 10-K, quarterly reports

on Form 10-Q and current reports on Form 8-K.

Additional Information and Where to

Find It

In connection with the Mergers, CGBD plans to file with the SEC

and mail to its stockholders a proxy statement on Schedule 14A (the

“Proxy Statement”), CSL III plans to file with the SEC and mail to

its shareholders an information statement (the “Information

Statement”), and CGBD plans to file with the SEC a registration

statement on Form N-14 (the “Registration Statement”) that will

include the Proxy Statement, the Information Statement and a

prospectus of CGBD. The Proxy Statement, Information Statement and

the Registration Statement will each contain important information

about CGBD, CSL III, the Mergers and related matters. This press

release does not constitute an offer to sell or the solicitation of

an offer to buy any securities or a solicitation of any vote or

approval. No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act. STOCKHOLDERS OF CGBD AND CSL III ARE URGED TO READ THE PROXY

STATEMENT, THE INFORMATION STATEMENT AND REGISTRATION STATEMENT,

AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CSL III, CGBD, THE

MERGERS AND RELATED MATTERS. Investors and security holders will be

able to obtain the documents filed with the SEC free of charge at

the SEC’s website at http://www.sec.gov or, for documents filed by

CGBD, from CGBD’s website at carlylesecuredlending.com.

Participants in the Solicitation

CGBD, its directors, certain of its executive officers and

certain employees and officers of CGCIM and its affiliates may be

deemed to be participants in the solicitation of CGBD proxies in

connection with the Mergers. Information about the directors and

executive officers of CGBD is set forth in its proxy statement for

its 2024 Annual Meeting of Stockholders, which was filed with the

SEC on April 26, 2024. CSL III, its trustees, certain of its

executive officers and certain employees and officers of CSL III

Advisor and its affiliates may be deemed to be participants in the

solicitation of CGBD proxies in connection with the Mergers.

Information about the trustees and executive officers of CSL III is

set forth in its annual report on Form 10-K, which was filed with

the SEC on March 12, 2024. Information regarding the persons who

may, under the rules of the SEC, be considered participants in the

solicitation of the CGBD stockholders in connection with the

Mergers will be contained in the Proxy Statement when such document

becomes available. These documents may be obtained free of charge

from the sources indicated above.

No Offer or Solicitation

This press release is not, and under no circumstances is it to

be construed as, a prospectus or an advertisement and the

communication of press release is not, and under no circumstances

is it to be construed as, an offer to sell or a solicitation of an

offer to purchase any securities in CGBD, CSL III or in any fund or

other investment vehicle managed by the Advisors or any of their

respective affiliates.

Contacts:

| Investors: |

Media: |

| Nishil Mehta |

Kristen Greco Ashton |

|

+1-212-813-4918publicinvestor@carlylesecuredlending.com |

+1-212-813-4763kristen.ashton@carlyle.com |

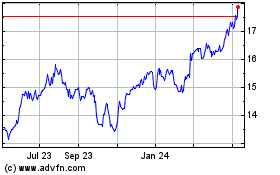

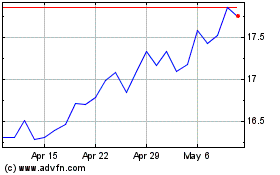

Carlyle Secured Lending (NASDAQ:CGBD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Carlyle Secured Lending (NASDAQ:CGBD)

Historical Stock Chart

From Nov 2023 to Nov 2024