CalAmp Corp. (NASDAQ: CAMP), a leading

provider of wireless products, services and solutions, today

reported results for its fiscal 2012 second quarter ended August

31, 2011. Key elements include:

- Consolidated revenue of $33.8 million, up 14.6% over prior year

period; wireless datacom revenue of $25.5 million, up 41% over

prior year period

- GAAP net income of $1.4 million, or $0.05 per diluted share;

Adjusted Basis (non-GAAP) net income of $3.0 million, or $0.11 per

diluted share, both at the high end of the Company's guidance

range

- Net debt balance reduced by $1.6 million to $4.0 million at

August 31, 2011

Michael Burdiek, CalAmp's President and Chief Executive Officer,

commented, "Our wireless datacom business continued to experience

strong growth in the second quarter with our mobile resource

management (MRM) business posting record revenues. We have

experienced consistently strong demand for our MRM products and

services with applications in fleet management, vehicle finance,

asset tracking, stolen vehicle recovery and remote car start. In

addition, we believe we are competitively positioned for several

emerging MRM applications such as pay as you drive (PAYD)

insurance."

Mr. Burdiek added, "In wireless networks we made progress on a

number of projects in the public safety and energy sectors,

including a recent win on a smart grid project with one of our tier

one utility metering channel partners. In our Positive Train

Control rail project we achieved a key milestone in the second

quarter by completing the design phase and shipment of pilot units.

Subsequent to the second quarter we began the pre-production phase

of the project and are on track to begin shipments of radios during

the current quarter. Recent contract change orders have increased

the overall value of this project to more than $14 million and we

expect meaningful revenue from this project into the second quarter

of fiscal 2013."

Mr. Burdiek continued, "Our satellite business results were in

line with our expectations. During the second quarter we completed

the transition of our satellite business to a variable cost

operating model, further lowering our breakeven point for this

business. We expect this transition will enhance the operating

flexibility of our satellite business and we expect positive

operating income from our satellite business for the second half of

this fiscal year."

As previously announced, last month the Company renewed and

enhanced its credit facility with Square 1 Bank to reduce its

borrowing cost and provide greater financial flexibility to

capitalize on market growth opportunities. Concurrently, the

Company retired its $5 million 12% subordinated notes that were

scheduled to mature next year. As a result of these actions, the

Company expects to reduce its annual cash interest expense by

approximately $0.5 million.

Fiscal 2012 Second Quarter Results Total

revenue for the fiscal 2012 second quarter was $33.8 million

compared with $29.5 million for the second quarter of fiscal 2011.

The year-over-year increase in consolidated revenue was primarily

due to higher sales in the Company's wireless datacom business

segment. Wireless datacom revenue increased 41% to $25.5 million

from $18.1 million in the same period last year, while satellite

revenue declined to $8.3 million from $11.4 million in the same

period last year. Wireless datacom revenue in the latest quarter

includes $3.0 million generated by the sale of two patents.

Consolidated gross profit for the fiscal 2011 second quarter was

$11.8 million or 35.0% of revenue, compared to gross profit of $7.4

million or 25.0% of revenue for the same period last year. The

increases in gross profit and gross margin percentage in the latest

quarter compared to fiscal 2011 second quarter were due in large

part to the increase in wireless datacom revenue including the $3.0

million patent sale, for which there was no associated cost of

revenue.

Results of operations for the fiscal 2012 second quarter as

determined in accordance with U.S. generally accepted accounting

principles ("GAAP") was net income of $1.4 million, or $0.05 per

diluted share, compared to a net loss of $0.9 million or $0.03 per

diluted share, in the second quarter of last year. In the fiscal

2012 second quarter, in connection with the closing of its French

subsidiary, the Company recorded non-recurring charges of $1.2

million including a non-cash foreign currency translation loss of

$0.8 million. The Company also recorded non-recurring costs and

expenses of approximately $0.35 million related to the transition

of its satellite business. In addition, the Company incurred a

non-cash charge of approximately $0.5 million upon prepaying its

$5.0 million 12.0% subordinated notes for the accelerated write-off

of debt issue costs and discount that would otherwise have been

recognized as interest expense in subsequent quarters.

The Adjusted Basis (non-GAAP) net income for the fiscal 2012

second quarter was $3.0 million, or $0.11 per diluted share,

compared to an Adjusted Basis net loss of $0.2 million, or $0.01

loss per diluted share, for the same period last year. The Adjusted

Basis net income excludes the impact of amortization of intangible

assets, stock-based compensation expense and the non-recurring

foreign currency translation loss of $0.8 million associated with

the shut-down of the Company's French subsidiary, and includes an

income tax provision or benefit that reflects income taxes

paid/payable (or received/receivable) based on the non-GAAP pretax

income (loss) for the period. A reconciliation of the GAAP basis

pretax income (loss) to the Adjusted Basis net income (loss) is

provided in the table at the end of this press release.

Liquidity At August 31, 2011, the Company

had total cash of $4.3 million and total debt of $8.3 million

consisting of $5.3 million drawn under the bank revolver and $3.0

million outstanding under a bank term loan. Net cash provided by

operating activities was $3.1 million during the fiscal 2012 second

quarter, and the unused borrowing capacity on the bank revolver was

$3.7 million at quarter-end.

Business Outlook Commenting on the

Company's business outlook, Mr. Burdiek said, "Based on our most

recent projections, we expect fiscal 2012 third quarter

consolidated revenues in the range of $30 to $34 million, with

wireless datacom revenues, net of the second quarter patents sale,

to be up and satellite revenues to be flat. We anticipate third

quarter GAAP Basis net income per share in the range of $0.02 to

$0.06 per diluted share. The Adjusted Basis (non-GAAP) net income

for the fiscal 2012 third quarter is expected to be in the range of

$0.05 to $0.09 per diluted share."

Mr. Burdiek concluded, "Though there are macroeconomic

uncertainties in the overall business environment, based on our

current backlog and robust pipeline of opportunities, we expect

continued profitable growth in our core wireless datacom business

over the coming quarters. Likewise, prospects for our satellite

business are improving and we expect it to achieve operating

profitability in the second half of the year. On a consolidated

basis, we expect higher net income in the second half of this year

than the amount generated in the first half."

Conference Call and Webcast A conference

call and simultaneous webcast to discuss fiscal 2012 second quarter

financial results and business outlook will be held today at 4:30

p.m. Eastern / 1:30 p.m. Pacific. CalAmp's President and CEO

Michael Burdiek and CFO Rick Vitelle will host the conference call.

Participants can dial into the live conference call by calling

877-941-9205 (480-629-9692 for international callers). An audio

replay will be available through October 6, 2012, by calling

800-406-7325 (303-590-3030 for international callers) and entering

the access code 4472472.

Additionally, a live webcast of the call will be available on

CalAmp's web site at www.calamp.com. Participants are encouraged to

visit the web site at least 15 minutes prior to the start of the

call to register, download and install any necessary audio

software. After the live webcast, a replay will remain available

until the next quarterly conference call in the Investor Relations

section of CalAmp's web site.

About CalAmp CalAmp develops and markets

wireless communications solutions that deliver data, voice and

video for critical networked communications and other applications.

The Company's two business segments are Wireless DataCom, which

serves utility, governmental and enterprise customers, and

Satellite, which focuses on the North American Direct Broadcast

Satellite market. For more information, please visit

www.calamp.com.

Forward-Looking Statements Statements in

this press release that are not historical in nature are

forward-looking statements that involve known and unknown risks and

uncertainties. Words such as "may," "will," "expect," "intend,"

"plan," "believe," "seek," "could," "estimate," "judgment,"

"targeting," "should," "anticipate," "goal" and variations of these

words and similar expressions, are intended to identify

forward-looking statements. Actual results could differ materially

from those implied by such forward-looking statements due to a

variety of factors, including product demand, competitive pressures

and pricing declines in the Company's wireless and satellite

markets, the timing of customer approvals of new product designs,

the length and extent of the global economic downturn that has and

may continue to adversely affect the Company's business, and other

risks or uncertainties that are described in the Company's Report

on Form 10-K for fiscal 2011 as filed on April 28, 2011 with the

Securities and Exchange Commission. Although the Company believes

the expectations reflected in such forward-looking statements are

based upon reasonable assumptions, it can give no assurance that

its expectations will be attained. The Company undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

CAL AMP CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands except per share amounts)

Three Months Ended Six Months Ended

August 31, August 31,

------------------ ------------------

2011 2010 2011 2010

-------- -------- -------- --------

Revenues $ 33,801 $ 29,490 $ 68,355 $ 55,836

Cost of revenues 21,976 22,122 47,098 42,345

-------- -------- -------- --------

Gross profit 11,825 7,368 21,257 13,491

-------- -------- -------- --------

Operating expenses:

Research and development 2,679 2,779 5,783 5,542

Selling 2,852 2,675 5,444 5,297

General and administrative 3,030 2,200 5,529 4,709

Intangible asset amortization 310 276 662 582

-------- -------- -------- --------

8,871 7,930 17,418 16,130

-------- -------- -------- --------

Operating income (loss) 2,954 (562) 3,839 (2,639)

Non-operating expense, net (1,592) (368) (1,948) (768)

-------- -------- -------- --------

Income (loss) before income taxes 1,362 (930) 1,891 (3,407)

Income tax provision (6) - (15) -

-------- -------- -------- --------

Net income (loss) $ 1,356 $ (930) $ 1,876 $ (3,407)

======== ======== ======== ========

Earnings (loss) per share - basic

and diluted $ 0.05 $ (0.03) $ 0.07 $ (0.13)

======== ======== ======== ========

Shares used in computing earnings

(loss) per share:

Basic 27,524 27,094 27,441 27,038

Diluted 28,310 27,094 28,268 27,038

BUSINESS SEGMENT INFORMATION

(Unaudited, in thousands)

Three Months Ended Six Months Ended

August 31, August 31,

------------------ ------------------

2011 2010 2011 2010

-------- -------- -------- --------

Revenues

Wireless DataCom $ 25,523 $ 18,074 $ 47,560 $ 33,893

Satellite 8,278 11,416 20,795 21,943

-------- -------- -------- --------

Total revenues $ 33,801 $ 29,490 $ 68,355 $ 55,836

======== ======== ======== ========

Gross profit

Wireless DataCom $ 11,380 $ 6,223 $ 19,984 $ 11,553

Satellite 445 1,145 1,273 1,938

-------- -------- -------- --------

Total gross profit $ 11,825 $ 7,368 $ 21,257 $ 13,491

======== ======== ======== ========

Operating income (loss)

Wireless DataCom $ 4,399 $ 497 $ 6,529 $ (136)

Satellite (447) (129) (735) (567)

Corporate expenses (998) (930) (1,955) (1,936)

-------- -------- -------- --------

Total operating income (loss) $ 2,954 $ (562) $ 3,839 $ (2,639)

======== ======== ======== ========

CAL AMP CORP.

CONSOLIDATED BALANCE SHEETS

(In thousands)

August 31, February 28,

2011 2011

----------- ------------

Assets (Unaudited)

Current assets:

Cash and cash equivalents $ 4,256 $ 4,241

Accounts receivable, net 14,523 16,814

Inventories 11,844 9,890

Costs and estimated earnings in excess of

billings on uncompleted contracts 2,203 1,331

Deferred income tax assets 2,073 1,961

Prepaid expenses and other current assets 3,752 3,866

----------- ------------

Total current assets 38,651 38,103

Property, equipment and improvements, net 1,543 1,877

Deferred income tax assets, less current portion 9,758 9,887

Intangible assets, net 3,350 4,012

Other assets 1,078 1,606

----------- ------------

$ 54,380 $ 55,485

=========== ============

Liabilities and Stockholders' Equity

Current liabilities:

Bank working capital line of credit $ 5,274 $ 7,489

Current portion of long-term debt 500 -

Accounts payable 13,618 14,103

Accrued payroll and employee benefits 3,382 3,341

Deferred revenue 5,667 5,796

Other current liabilities 2,515 2,140

----------- ------------

Total current liabilities 30,956 32,869

----------- ------------

Long-term debt 2,500 4,460

Other non-current liabilities 570 554

Stockholders' equity:

Common stock 287 281

Additional paid-in capital 153,204 153,135

Accumulated deficit (133,072) (134,948)

Accumulated other comprehensive loss (65) (866)

----------- ------------

Total stockholders' equity 20,354 17,602

----------- ------------

$ 54,380 $ 55,485

=========== ============

CAL AMP CORP.

CONSOLIDATED CASH FLOW STATEMENTS

(Unaudited - In thousands)

Six Months Ended

August 31,

------------------

2011 2010

-------- --------

Cash flows from operating activities:

Net income (loss) $ 1,876 $ (3,407)

Depreciation and amortization 1,385 1,253

Stock-based compensation expense 1,099 1,004

Non-cash interest expense 724 268

Write-off of cumulative foreign currency translation

account 801 -

Deferred tax assets, net - 807

Changes in operating working capital (494) 104

Other - 9

-------- --------

Net cash provided by operating activities 5,391 38

-------- --------

Cash flows from investing activities:

Capital expenditures (389) (712)

Collections on note receivable 298 229

-------- --------

Net cash used in investing activities (91) (483)

-------- --------

Cash flows from financing activities:

Proceeds (repayments) of bank line of credit (2,215) 1,898

Proceeds from bank term loan 3,000 -

Repayment of subordinated notes payable (5,000) -

Payment of debt issue costs (63) -

Taxes paid related to net share settlement of vested

equity awards (1,016) (388)

Proceeds from exercise of stock options 9 -

-------- --------

Net cash provided by (used in) financing activities (5,285) 1,510

-------- --------

Net change in cash and cash equivalents 15 1,065

Cash and cash equivalents at beginning of period 4,241 2,986

-------- --------

Cash and cash equivalents at end of period $ 4,256 $ 4,051

======== ========

CAL AMP CORP. NON-GAAP EARNINGS

RECONCILIATION (Unaudited)

"GAAP" refers to financial information presented in accordance

with U.S. Generally Accepted Accounting Principles. This press

release includes historical non-GAAP financial measures, as defined

in Regulation G promulgated by the Securities and Exchange

Commission. CalAmp believes that its presentation of historical

non-GAAP financial measures provides useful supplementary

information to investors. The presentation of historical non-GAAP

financial measures is not meant to be considered in isolation from

or as a substitute for results prepared in accordance with

GAAP.

In this press release, CalAmp reports the non-GAAP financial

measures of Adjusted Basis Net Income (Loss) and Adjusted Basis Net

Income (Loss) Per Diluted Share. CalAmp uses these non-GAAP

financial measures to enhance the investor's overall understanding

of the financial performance and future prospects of CalAmp's core

business activities. Specifically, CalAmp believes that a report of

Adjusted Basis Net Income (Loss) and Adjusted Basis Net Income

(Loss) Per Diluted Share provides consistency in its financial

reporting and facilitates the comparison of results of core

business operations between its current and past periods.

The reconciliation of the GAAP Basis Pretax Income (Loss) to

Adjusted Basis (non-GAAP) Net Income (Loss) is as follows (in

thousands except per share amounts):

Three Months Ended Six Months Ended

August 31, August 31,

-------------------- --------------------

2011 2010 2011 2010

--------- --------- --------- ---------

GAAP basis pretax income (loss) $ 1,362 $ (930) $ 1,891 $ (3,407)

Amortization of intangible

assets 310 276 662 582

Stock-based compensation expense 567 481 1,099 1,004

Write-off of cumulative foreign

currency translation account 801 - 801 -

--------- --------- --------- ---------

Pretax income (loss) (non-GAAP

basis) 3,040 (173) 4,453 (1,821)

Income tax provision (non-GAAP

basis) (a) (6) - (15) -

--------- --------- --------- ---------

Adjusted Basis net income (loss) $ 3,034 $ (173) $ 4,438 $ (1,821)

========= ========= ========= =========

Adjusted Basis net income (loss)

per diluted share $ 0.11 $ (0.01) $ 0.16 $ (0.07)

Weighted average common shares

outstanding on diluted basis 28,310 27,094 28,268 27,038

(a) The non-GAAP income tax provision reflects the income taxes

paid/payable (or received/receivable) based on on the non-GAAP pretax

income (loss) for the period. The Company has net operating loss

carryforwards to offset the pre-tax book income for the three- and six-

month periods ended August 31, 2011.

AT THE COMPANY: Rick Vitelle Chief Financial Officer

(805) 987-9000 AT FINANCIAL RELATIONS BOARD: Marilynn Meek

General Information (212) 827-3773 mmeek@mww.com

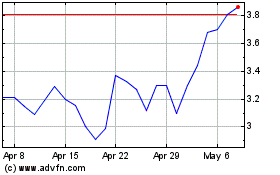

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Aug 2024 to Sep 2024

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Sep 2023 to Sep 2024