|

Main Post

Office, P.O. Box 751

|

www.asyousow.org

|

|

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992

|

Notice of Exempt Solicitation

Pursuant to Rule 14a-103

Name of the Registrant:

Booking Holdings, Inc. (BKNG)

Name of persons relying on exemption: As You Sow

Address of persons relying on exemption: Main Post Office, P.O. Box 751, Berkeley, CA

94701

Written materials are submitted

pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under

the terms of the Rule, but is made voluntarily in the interest of public disclosure and consideration of these important issues.

Booking

Holdings Inc. (BKNG)

Vote Yes: Item #7 – Annual Climate Transition Report

Annual

Meeting: June 3, 2021

CONTACT: Danielle

Fugere| dfugere@asyousow.org

THE RESOLUTION

Resolved: Shareholders request

that the Board of Directors issue a climate transition report, at least 120 days prior to the next annual meeting, and updated annually,

that addresses the scale and pace of its responsive measures associated with climate change.

Supporting Statement: Shareholders

recommend that the transition report, in the board and management’s discretion:

|

|

·

|

Continues to annually quantify the Company’s Scope 1-2 GHG emissions;

|

|

|

·

|

Sets forth a climate transition plan with goals, ambitions, and time frames the Company has or proposes to adopt to reduce GHG emissions

over time, if any;

|

|

|

·

|

Benchmarks its transition plan and progress against peers and scientifically based climate standards (such as the Net Zero Benchmark,

Science Based Targets)

|

|

|

·

|

Discloses any other information that the Board deems appropriate.

|

SUMMARY

Climate-related financial

risks continue to intensify and pose material threats for companies. 2020 set a new record for billion-dollar weather and climate disasters

in the U.S. with a total of $95.8 billion of costs associated with storms, cyclones, wildfire, and drought.1 Beyond physical

risks, companies are exposed to increasingly costly policy, technology, and reputational risks associated with the transition to a low

carbon economy.2 The U.S. Commodity Futures Trading Commissions states that climate change poses a major risk to the stability

of the U.S. financial system and that corporate disclosures of climate-related financial risks are essential to ensure that these risks

are measured and managed effectively.3

_____________________________

1 https://www.ncdc.noaa.gov/billions/summary-stats/US/2020

2 http://blogs.edf.org/climate411/files/2021/02/Mandating_Climate_Risk_Financial_Disclosures.pdf

pg 6

3 https://www.cftc.gov/sites/default/files/2020-09/9-9-20%20Report%20of%20the%20Subcommittee%20on%20Climate-Related%20Market%20Risk%20-%20Managing%20Climate%20Risk%20in%20the%20U.S.%20Financial%20System%20for%20posting.pdf pg

1

|

Main Post

Office, P.O. Box 751

|

www.asyousow.org

|

|

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992

|

RATIONALE FOR A YES VOTE

To address climate-related

financial risks, investors seek clear, consistent, and credible net zero transition plans from companies. BlackRock’s CEO writes

that “there is no company whose business model won’t be profoundly affected by the transition to a net zero economy”

and that investors “are asking companies to disclose a plan for how their business

model will be compatible with a net zero economy”.4 In response to the need to establish robust transition plans,

the Climate Action 100+ initiative, a coalition of 575 investors with over $54 trillion in assets, has developed the Net Zero Company

Benchmark that outlines metrics of climate accountability including Paris-aligned greenhouse

gas (GHG) reduction targets across short, medium, and long term time frames, actions taken by the company to achieving decarbonization

targets, and linking GHG reduction to executive compensation, among others. Major companies are now producing, or plan to produce, climate

transition plans including Unilever, Moody’s, S&P Global, Shells and Nestlé, among others.5

Booking Holdings currently

lacks targets or a clear plan to reduce GHG emissions and align its business with the Paris Agreement’s 1.5 degree Celsius goal.

We urge a “Yes” vote on this proposal.

Booking Holdings has not

established goals to reduce GHG emissions beyond use of carbon offsets. Booking Holdings has failed to set company-wide targets

to reduce the full range of its greenhouse (GHG) emissions in alignment with Paris goals or a climate transition plan to achieve them.

The primary sources of Booking Holding’s GHG emissions – its data centers – remain largely unaddressed. Bookings reports

that, in 2020, its data centers comprised 70% of its scope 1 and scope 2 operational emissions.6 The Company reports that

it implements energy efficiency programs in its offices and provides incentives where possible, and that its “purchase of renewable

energy reflects what is available for purchase in the electricity grid in the countries where our office spaces and data centers are located.”7 This

work is minimal compared to other technology companies, such as Google8 and Apple9 which have achieved

100 percent renewable electricity in their data centers by actively pursuing the acquisition of renewable electricity sources.

Bookings does not have goals,

ambitions, and time frames to reduce its GHG emissions and has therefore failed to produce an actionable climate transition plan. Booking

Holdings would benefit from developing a robust climate transition plan to effectively decarbonize its business without the use carbon

offsets.

Carbon Neutrality Achieved

Mainly through Carbon Offsets Is Insufficient Climate Action

While the Company recently

reported in its 2020 sustainability report10 that it has become ‘carbon neutral,’ it relies on the purchase

of large amounts of carbon offsets to achieve this neutrality. Such a plan, standing alone, is insufficient without robust future plans

to actively decrease its own emissions.

_____________________________

4 https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

5 https://www.sayonclimate.org/supporters/

6 https://www.bookingholdings.com/wp-content/uploads/2021/03/BKNG-Sustainability-Report-2020-.pdf

7 https://www.bookingholdings.com/corporate-responsibility-2/environment/#:~:text=In%20calendar%20year%202017%2C%20our,representing%2040%25%20of%20our%20impact.

8 https://sustainability.google/progress/projects/announcement-100/

9 https://www.apple.com/newsroom/2018/04/apple-now-globally-powered-by-100-percent-renewable-energy/

10 https://www.bookingholdings.com/wp-content/uploads/2021/03/BKNG-Sustainability-Report-2020-.pdf

|

Main Post

Office, P.O. Box 751

|

www.asyousow.org

|

|

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992

|

In order to make sufficient

global climate progress, it is incumbent upon each company to actively reduce its own carbon footprint where it is technologically feasible

to do so. Neither the Net Zero Benchmark nor the Science Based Targets Initiative (SBTi) allows the use of large amounts of carbon offsets.

As SBTi writes:

. . . the volume

of emissions avoided through the purchase of carbon credits corresponds to an equivalent volume of GHG emissions that is not being reduced

within the value chain of the company and that will continue to accumulate in the atmosphere. In other words, for every ton of CO2 that

is offset with a carbon credit, another ton of CO2 remains unabated within that company’s value chain. Understanding that reaching

net-zero emissions globally requires all sources of emissions to be eliminated or neutralized with an equivalent amount of negative emissions,

this (carbon offsets) strategy is not consistent with reaching a state . . . [of] net-zero emissions at the planetary level.11

The Climate Action 100+ Net

Zero Company Benchmark specifically states that “the use of offsetting or carbon credits should be avoided and limited if at all

applied” and that “offsetting or ‘carbon dioxide removal’ should not be used by companies operating in sectors

where viable decarbonization technologies exist”.12

Shareholders seek action from

Bookings to create a robust climate transition plan that effectively decarbonizes its business without relying primarily on the use of

carbon offsets.

Booking Holdings has failed

to address key climate benchmarking metrics such as the Climate Action 100+ Net Zero Company Benchmark, CDP Climate Change, or the Task

Force on Climate-related Financial Disclosures (TCFD). The Company has not yet reported against the Climate Action 100+ Net Zero

Company Benchmark indicators including providing short, medium, and long term GHG reduction targets. Additionally, the Company has failed

to submit disclosures to CDP Climate Change, a commonly used disclosure framework utilized by many of its peers. Due to lack of disclosure,

Booking Holdings has received an “F” grade from CDP in 2020, 2019 and 2018.13 The Company also fails to report

on the recommended disclosures of TCFD,14 including identifying, assessing, or managing climate-related risks and resilience

in a 2 degree Celsius or lower scenario.

Booking Holdings has fallen

behind its peers. Many peer technology companies, including Adobe, PayPal, and Intuit15 have set GHG reduction

goals validated by the Science Based Targets, which ensures company goals are aligned with limiting global warming to 1.5 degrees Celsius.

These company goals also adhere to the Science Based Targets criteria, which do not allow the use of carbon offsets to count toward progress

of science-based GHG reduction targets.16

_____________________________

11 https://sciencebasedtargets.org/resources/files/foundations-for-net-zero-full-paper.pdf

12 https://www.climateaction100.org/wp-content/uploads/2021/03/Climate-Action-100-Benchmark-Indicators-FINAL-3.12.pdf

13 https://www.cdp.net/en/responses?per_page=10&queries%5Bname%5D=Booking+holdings&sort_by=project_year&sort_dir=desc

14 https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf

pg 14

15 https://sciencebasedtargets.org/companies-taking-action?sector=Software%20and%20Services&ambitionToggle=1#table

16 https://sciencebasedtargets.org/resources/files/SBTi-criteria.pdf

|

Main Post

Office, P.O. Box 751

|

www.asyousow.org

|

|

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992

|

RESPONSE TO BOOKING

HOLDINGS BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION

The Company lists a variety

of programs to reduce GHG emissions, yet these programs have minimal reduction impacts and do not significantly address the Company’s

GHG footprint. The Company references a Global Green Team, which is working on aligning green practices such as promoting electricity

conservation in its offices. Additionally, the Company states that it is building a new headquarters in Amsterdam with the aim to be accredited

with a Building Research Establishment Assessment Method (BREEAM) certification for the sustainability performance of its building. These

actions alone do not constitute a comprehensive climate strategy as they do not address the full range of Company emissions and the Company

does not report the expected reduction impact of these efforts in relation to their total GHG footprint.

Booking Holdings states

that creating a climate transition plan would impose significant burdens on the Company and would not provide any meaningful benefit to

stockholders. While resources are required to establish a climate transition plan, the associated costs are minimal compared

to the risks and missed opportunities the Company is exposed to by not proactively addressing climate change. For example, climate change

is likely to cost the world’s largest public companies nearly $1 trillion from 2019 to 2024, but could also generate over $2 trillion

in growing demand from companies delivering low-emissions products.17 Without formulating its overall climate transition

plan, the Company is more likely to experience costs from climate change instead of capitalizing on potential benefits.

Investors are increasingly

recognizing the benefits to companies of creating comprehensive climate transition plans. For example, BlackRock, CalPERS, HSBC, Fidelity

International, and hundreds of other investors have signed on to the Climate Action 100+ initiative calling for companies to report on

a set of climate-related indicators demonstrating how effectively they plan to decarbonize their business.18 The Institutional

Investor Group on Climate Change (IIGCC) is another investor coalition, representing $37 trillion in assets, that recognizes the importance

of climate change and ensuring corporate business strategies are consistent with the goals of the Paris Agreement.19

CONCLUSION

Vote “Yes”

on this Shareholder Proposal to establish an annual climate transition report on Booking Holdings. Bookings has failed to set

clear goals to reduce its GHG emissions footprint in line with Paris goals, failed to align its emissions and reporting with scientifically

based benchmarks, and currently lacks a roadmap for how it plans to transition successfully to a low carbon economy. We urge a “Yes”

vote on this resolution.

--

For questions,

please contact Danielle Fugere, As You Sow, dfugere@asyousow.org

THE FOREGOING INFORMATION

MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT

BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION

TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT

SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

_____________________________

17 https://www.cnn.com/2019/06/04/business/climate-change-cost-companies

18 https://www.climateaction100.org/whos-involved/investors

19 https://www.iigcc.org/our-work/corporate-programme/

4

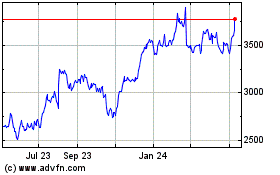

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024