- Current report filing (8-K)

February 01 2010 - 12:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 29, 2010

BEL FUSE INC.

(Exact Name of Registrant as Specified in its Charter)

New Jersey

(State or Other Jurisdiction of Incorporation)

0-11676 22-1463699

----------------------------------- -----------------------------------

(Commission File Number) (IRS Employer Identification No.)

|

206 Van Vorst Street, Jersey City, New Jersey 07302

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (201) 432-0463

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01 Completion of Acquisition or Disposition of Assets.

On January 29, 2010, Bel Fuse Inc., a New Jersey corporation (the

"Registrant"), completed its acquisition of all of the issued and

outstanding capital stock (the "Stock") of Cinch Connectors, Inc. ("Cinch

U.S.") and Cinch Connectors Limited ("Cinch U.K."). Pursuant to a stock

purchase agreement, dated as of December 28, 2009, among the Registrant,

Safran USA, Inc. ("Safran U.S.") and Safran UK Limited ("Safran U.K." and,

together with Safran U.S., the "Sellers"), the Registrant acquired (i) the

Stock of Cinch U.S. from Safran U.S. and (ii) the Stock of Cinch U.K. from

Safran U.K., in exchange for an aggregate purchase price of approximately

$37,500,000.00 in cash plus approximately $1,500,000.00 for the assumption

of certain expenses. The cash portion of the purchase price was funded with

cash on hand. The final purchase price remains subject to certain

adjustments related to working capital. As part of the stock purchase

agreement, the Registrant also indirectly acquired, through its acquisition

of Cinch U.S., approximately 99.9% of the issued and outstanding capital

stock of Cinch Connectors de Mexico, S.A. de C.V. ("Cinch MX" and, together

with Cinch U.S. and Cinch U.K., the "Cinch Companies"), which such capital

stock is owned by Cinch U.S. The other approximately 0.1% of Cinch MX was

transferred from Labinal Investments, Inc., a wholly-owned subsidiary of

Safran U.S., to Bel Ventures Inc., a wholly-owned subsidiary of the

Registrant.

The Cinch Companies manufacture a broad range of interconnect products

for customers in the military and aerospace, high-performance computing,

telecom/datacom, and transportation markets.

The Registrant has issued a press release describing the acquisition

of the Cinch Companies.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

Exhibit 99.1 - Press release dated January 29, 2010.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

BEL FUSE INC.

By: /s/ Colin Dunn

----------------------------------

Name: Colin Dunn

Title: Vice President of Finance

Dated: January 29, 2010

|

EXHIBIT INDEX

Exhibit 99.1 - Press release dated January 29, 2010.

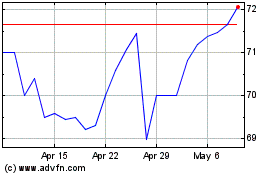

Bel Fuse (NASDAQ:BELFA)

Historical Stock Chart

From Jun 2024 to Jul 2024

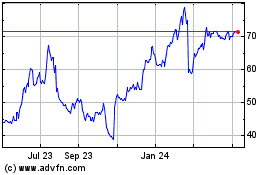

Bel Fuse (NASDAQ:BELFA)

Historical Stock Chart

From Jul 2023 to Jul 2024