BRP Group, Inc. (“BRP Group” or the “Company”) (NASDAQ: BRP), an

independent insurance distribution firm announced its results for

the second quarter ended June 30, 2021.

SECOND QUARTER 2021 HIGHLIGHTS AND SUBSEQUENT

EVENTS

- Revenue increased 133% year-over-year

to $119.7 million

- Pro Forma Revenue(1) grew 115%

year-over-year to $120.2 million

- Organic Revenue Growth(2) was 32%

year-over-year

- “MGA of the Future” revenue grew 52%

year-over-year to $20.0 million

- GAAP net loss of $20.1 million and GAAP

loss per share attributable to BRP Group of $0.22

- Adjusted Net Income(3) of $13.3

million, or $0.14(3) per fully diluted share

- Adjusted EBITDA(4) grew 143% to $20.4

million, compared to $8.4 million in the prior-year period

- Adjusted EBITDA Margin(4) of 17%,

compared to 16% in the prior-year period

- Pro Forma Adjusted EBITDA(5) of $20.5

million and Pro Forma Adjusted EBITDA Margin(5) of 17%

- “MGA of the Future” policies in force

grew by 39,181 to 605,295 at June 30, 2021. Comparatively, in

the second quarter 2020, policies in force grew sequentially by

44,468

- Closed three Partner acquisitions

during the second quarter 2021 that generated total revenue(6) of

approximately $4.6 million for the 12-month period pre-acquisition;

subsequent to June 30, 2021, closed five Partner acquisitions

that generated total revenue(6) of approximately $63.9 million for

the 12-month period pre-acquisition

“The power of our business model and overall

growth strategy was evident in the second quarter, as we more than

doubled revenue on a year-over-year basis to $119.7 million, while

we generated our best quarterly organic growth as a public

company,” said Trevor Baldwin, Chief Executive Officer of BRP

Group. “Our excellent performance was widespread across our

company, including another quarter of strong growth from our ‘MGA

of the Future’ platform as it climbed over the 600,000 mark in

policies in force, and valuable contributions from our recent large

Partnership acquisitions. We also made significant progress in

strengthening our balance sheet and executing on our deep pipeline

of Partnership opportunities, including the acquisition of

RogersGray on July 1, 2021, another of Business Insurance’s Top 100

largest U.S. brokers. We believe we remain in prime position to

generate rapid and sustainable growth and deliver additional

long-term shareholder value.”

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2021, cash and cash

equivalents were $224.5 million and there was $483.0 million of

long-term debt outstanding. The Company had aggregate borrowing

capacity of $380.0 million under its revolving credit facility.

On June 2, 2021, the Company closed a loan

syndication for an upsized $500.0 million senior secured first

lien term loan facility maturing in 2027 with interest at LIBOR

plus 350 bps subject to a LIBOR floor of 50 bps.

On August 6, 2021, the Company entered into Amendment No. 3 to

the JPM Credit Agreement, under which the aggregate principal

amount of the Revolving Facility was increased from $400.0 million

to $475.0 million. The other terms of the Revolving Facility and

the terms of the New Term Loan B remained unchanged.

SIX MONTHS 2021 RESULTS

- Revenue increased 159% year-over-year

to $272.5 million

- Pro Forma Revenue(1) grew 106%

year-over-year to $276.2 million

- Organic Revenue Growth(2) of 23%

year-over-year

- “MGA of the Future” revenue grew 54% to

$37.2 million, compared to $24.2 million in the prior-year

period

- GAAP net income of $10.5 million and

GAAP fully diluted earnings per share attributable to BRP Group of

$0.11

- Adjusted Net Income(3) of $55.8

million, or $0.58(3) per fully diluted share

- Net income margin of 4% in the current

year period

- Adjusted EBITDA(4) grew 226% to $73.1

million, compared to $22.4 million in the prior-year period

- Adjusted EBITDA Margin(4) of 27%,

compared to 21% in the prior-year period

- Pro Forma Adjusted EBITDA(5) of $74.9

million and Pro Forma Adjusted EBITDA Margin(6) of 27%

WEBCAST AND CONFERENCE CALL INFORMATION

BRP Group will host a webcast and conference

call to discuss second quarter 2021 results today at 5:00 PM ET. A

live webcast and a slide presentation of the conference call will

be available on BRP Group’s investor relations website at

ir.baldwinriskpartners.com. The dial-in number for the conference

call is (877) 451-6152 (toll-free) or (201) 389-0879

(international). Please dial the number 10 minutes prior to the

scheduled start time.

A webcast replay of the call will be available

at ir.baldwinriskpartners.com for one year following the call.

ABOUT BRP GROUP, INC.

BRP Group, Inc. (NASDAQ: BRP) is a rapidly

growing independent insurance distribution firm delivering tailored

insurance and risk management insights and solutions that give our

Clients the peace of mind to pursue their purpose, passion and

dreams. We are innovating the industry by taking a holistic and

tailored approach to risk management, insurance and employee

benefits, and support our Clients, Colleagues, Insurance Company

Partners and communities through the deployment of vanguard

resources and capital to drive our growth. BRP represents over

600,000 Clients across the United States and internationally. For

more information, please visit www.baldwinriskpartners.com.

FOOTNOTES

(1) Pro Forma Revenue is a

non-GAAP measure. Reconciliation of Pro Forma Revenue to

commissions and fees, the most directly comparable GAAP financial

measure, is set forth in the reconciliation table accompanying this

release.

(2) Organic Revenue for the

three and six months ended June 30, 2020 used to calculate Organic

Revenue Growth for the three and six months ended June 30, 2021 was

$51.3 million and $105.5 million, which is adjusted to reflect

revenues from Partnerships that reach the 12-month owned mark

during the three and six months ended June 30, 2021. Organic

Revenue is a non-GAAP measure. Reconciliation of Organic Revenue to

commissions and fees, the most directly comparable GAAP financial

measure, is set forth in the reconciliation table accompanying this

release.

(3) Adjusted Net Income and

Adjusted Diluted EPS are non-GAAP measures. Reconciliation of

Adjusted Net Income to net income (loss) attributable to BRP Group,

Inc. and reconciliation of Adjusted Diluted EPS to diluted earnings

(loss) per share, the most directly comparable GAAP financial

measures, are set forth in the reconciliation table accompanying

this release.

(4) Adjusted EBITDA and

Adjusted EBITDA Margin are non-GAAP measures. Reconciliation of

Adjusted EBITDA to net income (loss), the most directly comparable

GAAP financial measure, is set forth in the reconciliation table

accompanying this release.

(5) Pro Forma Adjusted EBITDA

and Pro Forma Adjusted EBITDA Margin are non-GAAP measures.

Reconciliation of Pro Forma Adjusted EBITDA to net income (loss),

the most directly comparable GAAP financial measure, is set forth

in the reconciliation table accompanying this release.

(6) Represents the aggregate

revenues of Partners acquired during the relevant period presented,

for the most recent trailing 12-month period prior to acquisition

by the Company, in each case, at the time the due diligence was

concluded based on a quality of earnings review and not an

audit.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain various

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, which represent BRP

Group’s expectations or beliefs concerning future events.

Forward-looking statements are statements other than historical

facts and may include statements that address future operating,

financial or business performance or BRP Group’s strategies or

expectations. In some cases, you can identify these statements by

forward-looking words such as “may”, “might”, “will”, “should”,

“expects”, “plans”, “anticipates”, “believes”, “estimates”,

“predicts”, “projects”, “potential”, “outlook” or “continue”, or

the negative of these terms or other comparable terminology.

Forward-looking statements are based on management’s current

expectations and beliefs and involve significant risks and

uncertainties that could cause actual results, developments and

business decisions to differ materially from those contemplated by

these statements.

Factors that could cause actual results or

performance to differ from the expectations expressed or implied in

such forward-looking statements include, but are not limited to,

those described under the caption “Risk Factors” in BRP Group’s

Annual Report on Form 10-K for the year ended December 31,

2020 and in BRP Group’s other filings with the SEC, which are

available free of charge on the Securities and Exchange

Commission's website at: www.sec.gov. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated. All forward-looking statements and all

subsequent written and oral forward-looking statements attributable

to BRP Group or to persons acting on behalf of BRP Group are

expressly qualified in their entirety by reference to these risks

and uncertainties. You should not place undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date they are made, and BRP Group does not undertake any

obligation to update them in light of new information, future

developments or otherwise, except as may be required under

applicable law.

CONTACTS

INVESTOR RELATIONS

Bonnie Bishop, Executive DirectorBaldwin Risk

Partners(813) 259-8032 | IR@baldwinriskpartners.com

PRESS

Rachel DeAngelo, Communications ManagerBaldwin

Risk Partners(813) 387-6842 | rdeangelo@baldwinriskpartners.com

BRP GROUP, INC.

Condensed Consolidated Statements of

Comprehensive Income

(Unaudited)

| |

|

For the Three Months Ended June

30, |

|

For the Six Months Ended June

30, |

| (in thousands, except

share and per share data) |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

Commissions and fees |

|

$ |

119,706 |

|

|

|

$ |

51,268 |

|

|

|

$ |

272,534 |

|

|

|

$ |

105,427 |

|

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Commissions, employee compensation and benefits |

|

89,065 |

|

|

|

39,263 |

|

|

|

178,440 |

|

|

|

73,811 |

|

|

|

Other operating expenses |

|

19,200 |

|

|

|

9,546 |

|

|

|

36,768 |

|

|

|

18,431 |

|

|

|

Amortization expense |

|

10,742 |

|

|

|

4,450 |

|

|

|

21,279 |

|

|

|

8,046 |

|

|

|

Change in fair value of contingent consideration |

|

13,325 |

|

|

|

4,581 |

|

|

|

11,822 |

|

|

|

6,242 |

|

|

|

Depreciation expense |

|

573 |

|

|

|

240 |

|

|

|

1,167 |

|

|

|

405 |

|

|

|

Total operating expenses |

|

132,905 |

|

|

|

58,080 |

|

|

|

249,476 |

|

|

|

106,935 |

|

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

(13,199 |

) |

|

|

(6,812 |

) |

|

|

23,058 |

|

|

|

(1,508 |

) |

|

| |

|

|

|

|

|

|

|

|

| Other expense: |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(5,848 |

) |

|

|

(1,047 |

) |

|

|

(11,491 |

) |

|

|

(1,632 |

) |

|

|

Other expense, net |

|

(1,057 |

) |

|

|

— |

|

|

|

(1,057 |

) |

|

|

— |

|

|

|

Total other expense |

|

(6,905 |

) |

|

|

(1,047 |

) |

|

|

(12,548 |

) |

|

|

(1,632 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

(20,104 |

) |

|

|

(7,859 |

) |

|

|

10,510 |

|

|

|

(3,140 |

) |

|

|

Income tax provision |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12 |

|

|

|

Net income (loss) |

|

(20,104 |

) |

|

|

(7,859 |

) |

|

|

10,510 |

|

|

|

(3,152 |

) |

|

|

Less: net income (loss) attributable to noncontrolling

interests |

|

(10,348 |

) |

|

|

(4,271 |

) |

|

|

5,653 |

|

|

|

(1,032 |

) |

|

|

Net income (loss) attributable to BRP Group, Inc. |

|

$ |

(9,756 |

) |

|

|

$ |

(3,588 |

) |

|

|

$ |

4,857 |

|

|

|

$ |

(2,120 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) |

|

$ |

(20,104 |

) |

|

|

$ |

(7,859 |

) |

|

|

$ |

10,510 |

|

|

|

$ |

(3,152 |

) |

|

|

Comprehensive income (loss) attributable to noncontrolling

interests |

|

(10,348 |

) |

|

|

(4,271 |

) |

|

|

5,653 |

|

|

|

(1,032 |

) |

|

|

Comprehensive income (loss) attributable to BRP Group, Inc. |

|

(9,756 |

) |

|

|

(3,588 |

) |

|

|

4,857 |

|

|

|

(2,120 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share |

|

$ |

(0.22 |

) |

|

|

$ |

(0.18 |

) |

|

|

$ |

0.11 |

|

|

|

$ |

(0.11 |

) |

|

|

Diluted earnings (loss) per share |

|

$ |

(0.22 |

) |

|

|

$ |

(0.18 |

) |

|

|

$ |

0.11 |

|

|

|

$ |

(0.11 |

) |

|

|

Weighted-average shares of Class A common stock outstanding -

basic |

|

44,671,308 |

|

|

|

|

20,426,082 |

|

|

|

44,464,312 |

|

|

|

19,959,828 |

|

|

|

Weighted-average shares of Class A common stock outstanding -

diluted |

|

|

44,671,308 |

|

|

|

|

20,426,082 |

|

|

|

|

46,160,474 |

|

|

|

|

19,959,828 |

|

|

BRP GROUP, INC.

Condensed Consolidated Balance

Sheets

(Unaudited)

| (in thousands, except

share and per share data) |

|

June 30, 2021 |

|

December 31, 2020 |

|

Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

224,479 |

|

|

|

$ |

108,462 |

|

|

|

Restricted cash |

|

51,505 |

|

|

|

33,560 |

|

|

|

Premiums, commissions and fees receivable, net |

|

209,664 |

|

|

|

155,501 |

|

|

|

Prepaid expenses and other current assets |

|

5,156 |

|

|

|

4,447 |

|

|

|

Due from related parties |

|

— |

|

|

|

19 |

|

|

|

Total current assets |

|

490,804 |

|

|

|

301,989 |

|

|

| Property and equipment,

net |

|

11,558 |

|

|

|

11,019 |

|

|

| Other assets |

|

14,885 |

|

|

|

11,084 |

|

|

| Intangible assets, net |

|

547,227 |

|

|

|

554,320 |

|

|

| Goodwill |

|

671,826 |

|

|

|

651,502 |

|

|

|

Total assets |

|

$ |

1,736,300 |

|

|

|

$ |

1,529,914 |

|

|

|

Liabilities, Mezzanine Equity and Stockholders’

Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Premiums payable to insurance companies |

|

$ |

177,578 |

|

|

|

$ |

135,576 |

|

|

|

Producer commissions payable |

|

32,367 |

|

|

|

24,260 |

|

|

|

Accrued expenses and other current liabilities |

|

49,639 |

|

|

|

47,490 |

|

|

|

Due to related parties |

|

65 |

|

|

|

— |

|

|

|

Current portion of long-term debt |

|

5,000 |

|

|

|

4,000 |

|

|

|

Current portion of contingent earnout liabilities |

|

90,160 |

|

|

|

6,094 |

|

|

|

Total current liabilities |

|

354,809 |

|

|

|

217,420 |

|

|

| Revolving lines of credit |

|

20,000 |

|

|

|

— |

|

|

| Long-term debt, less current

portion |

|

477,985 |

|

|

|

381,382 |

|

|

| Contingent earnout

liabilities, less current portion |

|

88,092 |

|

|

|

158,725 |

|

|

| Other liabilities |

|

3,067 |

|

|

|

2,419 |

|

|

|

Total liabilities |

|

943,953 |

|

|

|

759,946 |

|

|

| Commitments and

contingencies |

|

|

|

|

| Mezzanine equity: |

|

|

|

|

|

Redeemable noncontrolling interest |

|

173 |

|

|

|

98 |

|

|

| Stockholders’ equity: |

|

|

|

|

| Class A common stock, par

value $0.01 per share, 300,000,000 shares authorized; 46,583,582

and 44,953,166 shares issued and outstanding at June 30, 2021

and December 31, 2020, respectively |

|

466 |

|

|

|

450 |

|

|

| Class B common stock, par

value $0.0001 per share, 100,000,000 shares authorized; 49,575,871

and 49,828,383 shares issued and outstanding at June 30, 2021

and December 31, 2020, respectively |

|

5 |

|

|

|

5 |

|

|

|

Additional paid-in capital |

|

404,025 |

|

|

|

392,139 |

|

|

|

Accumulated deficit |

|

(19,489 |

) |

|

|

(24,346 |

) |

|

|

Notes receivable from stockholders |

|

(306 |

) |

|

|

(465 |

) |

|

|

Total stockholders’ equity attributable to BRP Group, Inc. |

|

384,701 |

|

|

|

367,783 |

|

|

|

Noncontrolling interest |

|

407,473 |

|

|

|

402,087 |

|

|

|

Total stockholders’ equity |

|

792,174 |

|

|

|

769,870 |

|

|

|

Total liabilities, mezzanine equity and stockholders’ equity |

|

$ |

1,736,300 |

|

|

|

$ |

1,529,914 |

|

|

BRP GROUP, INC.

Condensed Consolidated Statements of Cash

Flows

(Unaudited)

| |

|

For the Six Months Ended June 30, |

| (in

thousands) |

|

2021 |

|

2020 |

|

Cash flows from operating activities: |

|

|

|

|

|

Net income (loss) |

|

$ |

10,510 |

|

|

|

$ |

(3,152 |

) |

|

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

22,446 |

|

|

|

8,451 |

|

|

|

Change in fair value of contingent consideration |

|

11,822 |

|

|

|

6,242 |

|

|

|

Share-based compensation expense |

|

8,087 |

|

|

|

3,117 |

|

|

|

Amortization of deferred financing costs |

|

1,443 |

|

|

|

195 |

|

|

|

Change in fair value of interest rate caps |

|

825 |

|

|

|

— |

|

|

|

Payment of contingent earnout consideration in excess of purchase

price accrual |

|

(602 |

) |

|

|

(1,316 |

) |

|

|

Other fair value adjustments |

|

94 |

|

|

|

— |

|

|

|

Changes in operating assets and liabilities, net of effect of

acquisitions: |

|

|

|

|

|

Premiums, commissions and fees receivable, net |

|

(52,357 |

) |

|

|

(9,464 |

) |

|

|

Prepaid expenses and other current assets |

|

(2,254 |

) |

|

|

(334 |

) |

|

|

Due from related parties |

|

84 |

|

|

|

(78 |

) |

|

|

Accounts payable, accrued expenses and other current

liabilities |

|

49,321 |

|

|

|

39,983 |

|

|

|

Net cash provided by operating activities |

|

49,419 |

|

|

|

43,644 |

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

Capital expenditures |

|

(1,756 |

) |

|

|

(2,619 |

) |

|

|

Cash consideration paid for asset acquisitions, net of cash

received |

|

(1,575 |

) |

|

|

(695 |

) |

|

|

Cash consideration paid for business combinations, net of cash

received |

|

(24,276 |

) |

|

|

(224,112 |

) |

|

|

Net cash used in investing activities |

|

(27,607 |

) |

|

|

(227,426 |

) |

|

| Cash flows from financing

activities: |

|

|

|

|

|

Proceeds from issuance of Class A common stock, net of underwriting

discounts |

|

— |

|

|

|

167,346 |

|

|

|

Redemption and repurchase of LLC Units and Class B common

stock |

|

— |

|

|

|

(32,610 |

) |

|

|

Payment of common stock offering costs |

|

— |

|

|

|

(769 |

) |

|

|

Payment of contingent and guaranteed earnout consideration |

|

(828 |

) |

|

|

(665 |

) |

|

|

Proceeds from revolving line of credit |

|

20,000 |

|

|

|

185,637 |

|

|

|

Proceeds from long-term debt |

|

97,914 |

|

|

|

— |

|

|

|

Payments on long-term debt |

|

(1,000 |

) |

|

|

— |

|

|

|

Payments of debt issuance costs |

|

(634 |

) |

|

|

(1,918 |

) |

|

|

Purchase of interest rate caps |

|

(3,461 |

) |

|

|

— |

|

|

|

Proceeds from repayment of stockholder notes receivable |

|

159 |

|

|

|

115 |

|

|

|

Other |

|

— |

|

|

|

11 |

|

|

|

Net cash provided by financing activities |

|

112,150 |

|

|

|

317,147 |

|

|

|

Net increase in cash and cash equivalents and restricted cash |

|

133,962 |

|

|

|

133,365 |

|

|

|

Cash and cash equivalents and restricted cash at beginning of

period |

|

142,022 |

|

|

|

71,071 |

|

|

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

275,984 |

|

|

|

$ |

204,436 |

|

|

NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA, Adjusted EBITDA Margin, Organic

Revenue, Organic Revenue Growth, Adjusted Net Income, Adjusted

Diluted Earnings Per Share (“EPS”), Pro Forma Revenue, Pro Forma

Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin are not

measures of financial performance under GAAP and should not be

considered substitutes for GAAP measures, including commissions and

fees (for Organic Revenue, Organic Revenue Growth and Pro Forma

Revenue), net income (loss) (for Adjusted EBITDA, Adjusted EBITDA

Margin, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA

Margin), net income (loss) attributable to BRP Group, Inc. (for

Adjusted Net Income) or diluted earnings (loss) per share (for

Adjusted Diluted EPS), which we consider to be the most directly

comparable GAAP measures. These non-GAAP financial measures have

limitations as analytical tools, and when assessing our operating

performance, you should not consider these non-GAAP financial

measures in isolation or as substitutes for commissions and fees,

net income (loss), net income (loss) attributable to BRP Group,

Inc. or other consolidated income statement data prepared in

accordance with GAAP. Other companies in our industry may define or

calculate these non-GAAP financial measures differently than we do,

and accordingly these measures may not be comparable to similarly

titled measures used by other companies.

Adjusted EBITDA eliminates the effects of

financing, depreciation, amortization and change in fair value of

contingent consideration. We define Adjusted EBITDA as net income

(loss) before interest, taxes, depreciation, amortization, change

in fair value of contingent consideration and certain items of

income and expense, including share-based compensation expense,

transaction-related expenses related to Partnerships including

severance, and certain non-recurring costs, including those related

to raising capital. We believe that Adjusted EBITDA is an

appropriate measure of operating performance because it eliminates

the impact of expenses that do not relate to business performance,

and that the presentation of this measure enhances an investor’s

understanding of our financial performance.

Adjusted EBITDA Margin is Adjusted EBITDA

divided by commissions and fees. Adjusted EBITDA Margin is a key

metric used by management and our board of directors to assess our

financial performance. We believe that Adjusted EBITDA Margin is an

appropriate measure of operating performance because it eliminates

the impact of expenses that do not relate to business performance,

and that the presentation of this measure enhances an investor’s

understanding of our financial performance. We believe that

Adjusted EBITDA Margin is helpful in measuring profitability of

operations on a consolidated level.

Adjusted EBITDA and Adjusted EBITDA Margin have

important limitations as analytical tools. For example, Adjusted

EBITDA and Adjusted EBITDA Margin:

- do not reflect any

cash capital expenditure requirements for the assets being

depreciated and amortized that may have to be replaced in the

future;

- do not reflect

changes in, or cash requirements for, our working capital

needs;

- do not reflect the

impact of certain cash charges resulting from matters we consider

not to be indicative of our ongoing operations;

- do not reflect the

interest expense or the cash requirements necessary to service

interest or principal payments on our debt;

- do not reflect

share-based compensation expense and other non-cash charges;

and

- exclude certain tax

payments that may represent a reduction in cash available to

us.

We calculate Organic Revenue Growth based on

commissions and fees for the relevant period by excluding the first

twelve months of commissions and fees generated from new Partners.

Organic Revenue Growth is the change in Organic Revenue

period-to-period, with prior period results adjusted for Organic

Revenues that were excluded in the prior period because the

relevant Partners had not yet reached the twelve-month owned mark,

but which reach the twelve-month owned mark in the current period.

For example, revenues from a Partner acquired on June 1, 2020 are

excluded from Organic Revenue for 2020. However, after June 1,

2021, results from June 1, 2020 to December 31, 2020 for such

Partners are compared to results from June 1, 2021 to December 31,

2021 for purposes of calculating Organic Revenue Growth in 2021.

Organic Revenue Growth is a key metric used by management and our

board of directors to assess our financial performance. We believe

that Organic Revenue and Organic Revenue Growth are appropriate

measures of operating performance as they allow investors to

measure, analyze and compare growth in a meaningful and consistent

manner.

Adjusted Net Income is presented for the purpose

of calculating Adjusted Diluted EPS. We define Adjusted Net Income

as net income (loss) attributable to BRP Group, Inc. adjusted for

amortization, change in fair value of contingent consideration and

certain items of income and expense, including share-based

compensation expense, transaction-related expenses related to

Partnerships including severance, and certain non-recurring costs

that, in the opinion of management, significantly affect the

period-over-period assessment of operating results, and the related

tax effect of those adjustments.

Adjusted Diluted EPS measures our per share

earnings excluding certain expenses as discussed above and assuming

all shares of Class B common stock were exchanged for Class A

common stock. Adjusted Diluted EPS is calculated as Adjusted Net

Income divided by adjusted dilutive weighted-average shares

outstanding. We believe Adjusted Diluted EPS is useful to investors

because it enables them to better evaluate per share operating

performance across reporting periods.

Pro Forma Revenue reflects GAAP revenue

(commissions and fees), plus revenue from Partnerships in the

unowned periods.

Pro Forma Adjusted EBITDA takes into account

Adjusted EBITDA from Partnerships in the unowned periods and

eliminates the effects of financing, depreciation and amortization.

We define Pro Forma Adjusted EBITDA as pro forma net income (loss)

before interest, taxes, depreciation, amortization, change in fair

value of contingent consideration and certain items of income and

expense, including share-based compensation expense,

transaction-related expenses related to Partnerships including

severance, and certain non-recurring costs, including those related

to raising capital. We believe that Pro Forma Adjusted EBITDA is an

appropriate measure of operating performance because it eliminates

the impact of expenses that do not relate to business performance,

and that the presentation of this measure enhances an investor’s

understanding of our financial performance.

Pro Forma Adjusted EBITDA Margin is Pro Forma

Adjusted EBITDA divided by Pro Forma Revenue. Pro Forma Adjusted

EBITDA is a key metric used by management and our board of

directors to assess our financial performance. We believe that Pro

Forma Adjusted EBITDA is an appropriate measure of operating

performance because it eliminates the impact of expenses that do

not relate to business performance, and that the presentation of

this measure enhances an investor’s understanding of our financial

performance. We believe that Pro Forma Adjusted EBITDA Margin is

helpful in measuring profitability of operations on a consolidated

level.

Adjusted EBITDA and Adjusted EBITDA Margin

The following table reconciles Adjusted EBITDA

and Adjusted EBITDA Margin to net income (loss), which we consider

to be the most directly comparable GAAP financial measure to

Adjusted EBITDA and Adjusted EBITDA Margin:

| |

|

For the Three Months Ended June

30, |

|

For the Six Months Ended June

30, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Commissions and fees |

|

$ |

119,706 |

|

|

|

$ |

51,268 |

|

|

|

$ |

272,534 |

|

|

$ |

105,427 |

|

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(20,104 |

) |

|

|

$ |

(7,859 |

) |

|

|

$ |

10,510 |

|

|

$ |

(3,152 |

) |

|

| Adjustments to net income

(loss): |

|

|

|

|

|

|

|

|

|

Amortization expense |

|

10,742 |

|

|

|

4,450 |

|

|

|

21,279 |

|

|

8,046 |

|

|

|

Change in fair value of contingent consideration |

|

13,325 |

|

|

|

4,581 |

|

|

|

11,822 |

|

|

6,242 |

|

|

|

Interest expense, net |

|

5,848 |

|

|

|

1,047 |

|

|

|

11,491 |

|

|

1,632 |

|

|

|

Share-based compensation |

|

4,545 |

|

|

|

1,978 |

|

|

|

8,087 |

|

|

3,117 |

|

|

|

Transaction-related Partnership expenses |

|

3,225 |

|

|

|

2,020 |

|

|

|

5,670 |

|

|

3,868 |

|

|

|

Depreciation expense |

|

573 |

|

|

|

240 |

|

|

|

1,167 |

|

|

405 |

|

|

|

Change in fair value of interest rate caps |

|

825 |

|

|

|

— |

|

|

|

825 |

|

|

— |

|

|

|

Capital related expenses |

|

— |

|

|

|

1,000 |

|

|

|

— |

|

|

1,000 |

|

|

|

Severance related to Partnership activity |

|

— |

|

|

|

360 |

|

|

|

— |

|

|

413 |

|

|

|

Income tax provision |

|

— |

|

|

|

— |

|

|

|

— |

|

|

12 |

|

|

|

Other |

|

1,412 |

|

|

|

568 |

|

|

|

2,271 |

|

|

834 |

|

|

|

Adjusted EBITDA |

|

$ |

20,391 |

|

|

|

$ |

8,385 |

|

|

|

$ |

73,122 |

|

|

$ |

22,417 |

|

|

| Adjusted EBITDA Margin |

|

17 |

|

% |

|

16 |

|

% |

|

27 |

% |

|

21 |

|

% |

Organic Revenue and Organic Revenue Growth

The following table reconciles Organic Revenue

to commissions and fees, which we consider to be the most directly

comparable GAAP financial measure to Organic Revenue:

| |

|

For the Three Months Ended June

30, |

For the Six Months Ended June

30, |

| (in thousands, except

percentages) |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Commissions and fees |

|

$ |

119,706 |

|

|

|

$ |

51,268 |

|

|

|

$ |

272,534 |

|

|

|

$ |

105,427 |

|

|

| Partnership commissions and

fees (1) |

|

(51,893 |

) |

|

|

(12,064 |

) |

|

|

(143,108 |

) |

|

|

(34,932 |

) |

|

|

Organic Revenue |

|

$ |

67,813 |

|

|

|

$ |

39,204 |

|

|

|

$ |

129,426 |

|

|

|

$ |

70,495 |

|

|

| Organic Revenue Growth

(2) |

|

$ |

16,482 |

|

|

|

$ |

6,130 |

|

|

|

$ |

23,929 |

|

|

|

$ |

7,584 |

|

|

| Organic Revenue Growth %

(2) |

|

32 |

|

% |

|

19 |

|

% |

|

23 |

|

% |

|

12 |

|

% |

__________

(1) Includes the first twelve

months of such commissions and fees generated from newly acquired

Partners. Amount is reduced by approximately $830,000 for the

timing of certain cash receipts that were fully constrained under

ASC 606 in the post-partnership period for our partnership with

Agency RM, which closed February 1,

2020.(2) Organic Revenue for the three and six

months ended June 30, 2020 used to calculate Organic Revenue Growth

for the three and six months ended June 30, 2021 was $51.3 million

and $105.5 million, which is adjusted to reflect revenues from

Partnerships that reached the twelve-month owned mark during the

three and six months ended June 30, 2021.

Adjusted Net Income and Adjusted Diluted

EPS

The following table reconciles Adjusted Net

Income to net income (loss) attributable to BRP Group, Inc. and

reconciles Adjusted Diluted EPS to diluted earnings (loss) per

share attributable to BRP Group, Inc. Class A common stock:

| |

|

For the Three Months Ended June

30, |

|

For the Six Months Ended June

30, |

| (in thousands, except

per share data) |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Net income (loss) attributable

to BRP Group, Inc. |

|

$ |

(9,756 |

) |

|

|

$ |

(3,588 |

) |

|

|

$ |

4,857 |

|

|

|

$ |

(2,120 |

) |

|

|

Net income (loss) attributable to noncontrolling interests |

|

(10,348 |

) |

|

|

(4,271 |

) |

|

|

5,653 |

|

|

|

(1,032 |

) |

|

|

Amortization expense |

|

10,742 |

|

|

|

4,450 |

|

|

|

21,279 |

|

|

|

8,046 |

|

|

|

Change in fair value of contingent consideration |

|

13,325 |

|

|

|

4,581 |

|

|

|

11,822 |

|

|

|

6,242 |

|

|

|

Share-based compensation |

|

4,545 |

|

|

|

1,978 |

|

|

|

8,087 |

|

|

|

3,117 |

|

|

|

Transaction-related Partnership expenses |

|

3,225 |

|

|

|

2,020 |

|

|

|

5,670 |

|

|

|

3,868 |

|

|

|

Amortization of deferred financing costs |

|

750 |

|

|

|

119 |

|

|

|

1,443 |

|

|

|

195 |

|

|

|

Change in fair value of interest rate caps |

|

825 |

|

|

|

— |

|

|

|

825 |

|

|

|

— |

|

|

|

Capital related expenses |

|

— |

|

|

|

1,000 |

|

|

|

— |

|

|

|

1,000 |

|

|

|

Severance related to Partnership activity |

|

— |

|

|

|

360 |

|

|

|

— |

|

|

|

413 |

|

|

|

Other |

|

1,412 |

|

|

|

568 |

|

|

|

2,271 |

|

|

|

834 |

|

|

| Adjusted pre-tax income |

|

14,720 |

|

|

|

7,217 |

|

|

|

61,907 |

|

|

|

20,563 |

|

|

|

Adjusted income taxes (1) |

|

1,457 |

|

|

|

715 |

|

|

|

6,129 |

|

|

|

2,036 |

|

|

| Adjusted Net Income |

|

$ |

13,263 |

|

|

|

$ |

6,502 |

|

|

|

$ |

55,778 |

|

|

|

$ |

18,527 |

|

|

| |

|

|

|

|

|

|

|

|

| Weighted-average shares of

Class A common stock outstanding - diluted |

|

44,671 |

|

|

|

20,426 |

|

|

|

46,160 |

|

|

|

19,960 |

|

|

|

Dilutive effect of unvested restricted shares of Class A common

stock |

|

1,862 |

|

|

|

365 |

|

|

|

— |

|

|

|

344 |

|

|

|

Exchange of Class B shares (2) |

|

49,600 |

|

|

|

45,466 |

|

|

|

49,694 |

|

|

|

44,503 |

|

|

| Adjusted dilutive

weighted-average shares outstanding |

|

96,133 |

|

|

|

66,257 |

|

|

|

95,854 |

|

|

|

64,807 |

|

|

| |

|

|

|

|

|

|

|

|

| Adjusted Diluted EPS |

|

$ |

0.14 |

|

|

|

$ |

0.10 |

|

|

|

$ |

0.58 |

|

|

|

$ |

0.29 |

|

|

| |

|

|

|

|

|

|

|

|

| Diluted earnings (loss) per

share |

|

$ |

(0.22 |

) |

|

|

$ |

(0.18 |

) |

|

|

$ |

0.11 |

|

|

|

$ |

(0.11 |

) |

|

|

Effect of exchange of Class B shares and net income attributable to

noncontrolling interests per share |

|

0.01 |

|

|

|

0.06 |

|

|

|

— |

|

|

|

0.06 |

|

|

|

Other adjustments to earnings per share |

|

0.37 |

|

|

|

0.23 |

|

|

|

0.53 |

|

|

|

0.37 |

|

|

|

Adjusted income taxes per share |

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

(0.06 |

) |

|

|

(0.03 |

) |

|

| Adjusted Diluted EPS |

|

$ |

0.14 |

|

|

|

$ |

0.10 |

|

|

|

$ |

0.58 |

|

|

|

$ |

0.29 |

|

|

___________(1) Represents corporate income

taxes at assumed effective tax rate of 9.9% applied to adjusted

pre-tax income.(2) Assumes the full exchange of

Class B shares for Class A common stock pursuant to the Amended LLC

Agreement.

Pro Forma Revenue

The following table reconciles Pro Forma Revenue

to commissions and fees, which we consider to be the most directly

comparable GAAP financial measure to Pro Forma Revenue:

| |

|

For the Three Months Ended June

30, |

For the Six Months Ended June

30, |

| (in

thousands) |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Commissions and fees |

|

$ |

119,706 |

|

|

$ |

51,268 |

|

|

$ |

272,534 |

|

|

$ |

105,427 |

|

| Revenue for Partnerships in

the unowned period (1) |

|

489 |

|

|

4,553 |

|

|

3,714 |

|

|

28,478 |

|

|

Pro Forma Revenue |

|

$ |

120,195 |

|

|

$ |

55,821 |

|

|

$ |

276,248 |

|

|

$ |

133,905 |

|

___________

(1) The adjustments for the

three months ended June 30, 2021 reflect commissions and fees

revenue for Only Medicare Solutions, Seniors’ Insurance Services of

Washington, Inc. and Mid-Continent Companies, Ltd./Mid-Continent

Securities Ltd. as if the Company had acquired the Partners on

January 1, 2021. The adjustments for the three months ended June

30, 2020 reflect commissions and fees revenue for Insurance Risk

Partners, LLC, Southern Protective Group, LLC, Pendulum, LLC,

Rosenthal Bros., Inc. and Trinity Benefit Advisors, Inc./Russ

Blakely & Associates, LLC as if the Company had acquired the

Partners on January 1, 2020. The adjustments for the six months

ended June 30, 2021 reflect commissions and fees revenue for

LeaseTrack Services LLC/Effective Coverage LLC, Medicare Help Now,

Only Medicare Solutions, Seniors’ Insurance Services of Washington,

Inc. and Mid-Continent Companies, Ltd./Mid-Continent Securities

Ltd. as if the Company had acquired the Partners on January 1,

2021. The adjustments for the six months ended June 30, 2020

reflect commissions and fees revenue for AgencyRM LLC, VibrantUSA

Inc., Insurance Risk Partners, LLC, Southern Protective Group, LLC,

Pendulum, LLC, Rosenthal Bros., Inc. and Trinity Benefit Advisors,

Inc./Russ Blakely & Associates, LLC as if the Company had

acquired the Partners on January 1, 2020. This unaudited pro forma

information should not be relied upon as being indicative of the

historical results that would have been obtained if the

acquisitions had occurred on that date, nor the results that may be

obtained in the future.

Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA

Margin

The following table reconciles Pro Forma

Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin to net income

(loss), which we consider to be the most directly comparable GAAP

financial measure to Pro Forma Adjusted EBITDA and Pro Forma

Adjusted EBITDA Margin:

| |

|

For the Three Months Ended June

30, |

For the Six Months Ended June

30, |

| (in

thousands) |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Pro Forma Revenue |

|

$ |

120,195 |

|

|

|

$ |

55,821 |

|

|

|

$ |

276,248 |

|

|

$ |

133,905 |

|

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(20,104 |

) |

|

|

$ |

(7,859 |

) |

|

|

$ |

10,510 |

|

|

$ |

(3,152 |

) |

|

|

Net income (loss) for Partnerships in the unowned period (1) |

|

76 |

|

|

|

(319 |

) |

|

|

1,571 |

|

|

9,296 |

|

|

| Pro Forma Net Income

(Loss) |

|

(20,028 |

) |

|

|

(8,178 |

) |

|

|

12,081 |

|

|

6,144 |

|

|

| Adjustments to pro forma net

income (loss): |

|

|

|

|

|

|

|

|

|

Amortization expense |

|

10,773 |

|

|

|

5,446 |

|

|

|

21,530 |

|

|

10,903 |

|

|

|

Change in fair value of contingent consideration |

|

13,325 |

|

|

|

4,581 |

|

|

|

11,822 |

|

|

6,242 |

|

|

|

Interest expense, net |

|

5,848 |

|

|

|

1,570 |

|

|

|

11,491 |

|

|

3,075 |

|

|

|

Share-based compensation |

|

4,545 |

|

|

|

1,978 |

|

|

|

8,087 |

|

|

3,117 |

|

|

|

Transaction-related Partnership expenses |

|

3,225 |

|

|

|

2,020 |

|

|

|

5,670 |

|

|

3,868 |

|

|

|

Depreciation expense |

|

573 |

|

|

|

240 |

|

|

|

1,167 |

|

|

405 |

|

|

|

Change in fair value of interest rate caps |

|

825 |

|

|

|

— |

|

|

|

825 |

|

|

— |

|

|

|

Capital related expenses |

|

— |

|

|

|

1,000 |

|

|

|

— |

|

|

1,000 |

|

|

|

Severance related to Partnership activity |

|

— |

|

|

|

360 |

|

|

|

— |

|

|

413 |

|

|

|

Income tax provision |

|

— |

|

|

|

— |

|

|

|

— |

|

|

12 |

|

|

|

Other |

|

1,412 |

|

|

|

568 |

|

|

|

2,271 |

|

|

834 |

|

|

| Pro Forma Adjusted EBITDA |

|

$ |

20,498 |

|

|

|

$ |

9,585 |

|

|

|

$ |

74,944 |

|

|

$ |

36,013 |

|

|

| Pro Forma Adjusted EBITDA

Margin |

|

17 |

|

% |

|

17 |

|

% |

|

27 |

% |

|

27 |

|

% |

___________

(1) The adjustments for the

three months ended June 30, 2021 reflect commissions and fees

revenue for Only Medicare Solutions, Seniors’ Insurance Services of

Washington, Inc. and Mid-Continent Companies, Ltd./Mid-Continent

Securities Ltd. as if the Company had acquired the Partners on

January 1, 2021. The adjustments for the three months ended June

30, 2020 reflect commissions and fees revenue for Insurance Risk

Partners, LLC, Southern Protective Group, LLC, Pendulum, LLC,

Rosenthal Bros., Inc. and Trinity Benefit Advisors, Inc./Russ

Blakely & Associates, LLC as if the Company had acquired the

Partners on January 1, 2020. The adjustments for the six months

ended June 30, 2021 reflect commissions and fees revenue for

LeaseTrack Services LLC/Effective Coverage LLC, Medicare Help Now,

Only Medicare Solutions, Seniors’ Insurance Services of Washington,

Inc. and Mid-Continent Companies, Ltd./Mid-Continent Securities

Ltd. as if the Company had acquired the Partners on January 1,

2021. The adjustments for the six months ended June 30, 2020

reflect commissions and fees revenue for AgencyRM LLC, VibrantUSA

Inc., Insurance Risk Partners, LLC, Southern Protective Group, LLC,

Pendulum, LLC, Rosenthal Bros., Inc. and Trinity Benefit Advisors,

Inc./Russ Blakely & Associates, LLC as if the Company had

acquired the Partners on January 1, 2020. This unaudited pro forma

information should not be relied upon as being indicative of the

historical results that would have been obtained if the

acquisitions had occurred on that date, nor the results that may be

obtained in the future.

COMMONLY USED DEFINED TERMS

The following terms have the following meanings

throughout this press release unless the context indicates or

requires otherwise:

|

bps |

|

Basis points |

| |

|

|

| Clients |

|

Our

insureds |

| |

|

|

|

Colleagues |

|

Our

employees |

| |

|

|

| GAAP |

|

Accounting

principles generally accepted in the United States of America |

| |

|

|

| LIBOR |

|

London

Interbank Offered Rate |

| |

|

|

|

Partners |

|

Companies

that we have acquired, or in the case of asset acquisitions, the

producers |

| |

|

|

|

Partnerships |

|

Strategic

acquisitions made by the Company |

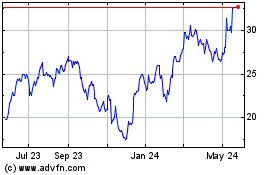

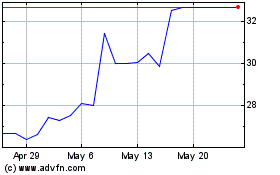

Baldwin Insurance (NASDAQ:BRP)

Historical Stock Chart

From May 2024 to Jun 2024

Baldwin Insurance (NASDAQ:BRP)

Historical Stock Chart

From Jun 2023 to Jun 2024