Balchem Corporation (Nasdaq:BCPC)

reported

as follows (unaudited) for the period ended June 30, 2011.

($000 Omitted Except for Net Earnings per

Share)

|

For the Three Months Ended June

30, |

|

|

|

2011 |

2010 |

|

| |

Unaudited |

| Net sales |

$ 74,687 |

$ 61,458 |

|

| Gross margin |

21,761 |

19,116 |

|

| Operating expenses |

7,702 |

6,675 |

|

| Earnings from operations |

14,059 |

12,441 |

|

| Other income |

293 |

110 |

|

| Earnings before income tax expense |

14,352 |

12,551 |

|

| Income tax expense |

4,780 |

4,212 |

|

| Net earnings |

$ 9,572 |

$ 8,339 |

|

| |

|

|

|

| Basic net earnings per common

share |

$ 0.34 |

$ 0.30 |

|

| Diluted net earnings per common

share |

$ 0.32 |

$ 0.28 |

|

| |

|

|

|

| Shares used in the calculation of diluted net

earnings per common share |

30,232 |

29,534 |

|

|

For the Six Months Ended June

30, |

|

|

2011 |

2010 |

| |

Unaudited |

| Net sales |

$ 147,695 |

$ 121,361 |

| Gross margin |

42,541 |

36,530 |

| Operating expenses |

15,184 |

13,595 |

| Earnings from operations |

27,357 |

22,935 |

| Other income |

371 |

277 |

| Earnings before income tax expense |

27,728 |

23,212 |

| Income tax expense |

9,244 |

7,844 |

| Net earnings |

$ 18,484 |

$ 15,368 |

| |

|

|

| Basic net earnings per common

share |

$ 0.65 |

$ 0.55 |

| Diluted net earnings per common

share |

$ 0.61 |

$ 0.52 |

| |

|

|

| Shares used in the calculation of diluted net

earnings per common share |

30,162 |

29,439 |

Record Quarterly Results for Sales and

Earnings

Record net sales of $74.7 million were achieved for the quarter

ended June 30, 2011, as two of our business segments set quarterly

sales records. This is an increase of 21.5% above the $61.5

million result of the prior year comparative quarter.

Correspondingly, record quarter net earnings were achieved of $9.6

million, an increase of $1.2 million, or 14.8% as compared with the

same period last year. The $9.6 million generated diluted net

earnings of $0.32 per common share versus $0.28 per common share

for the prior year comparable period, an increase of

14.3%.

In this second quarter of 2011, sales of the Animal Nutrition

& Health ("ANH") segment, including specialties, choline and

industrial derivative product sales, totaled a quarterly record

$51.8 million, an increase of 27.3% or $11.1 million from the prior

year comparable quarter. Our global feed grade choline product

sales were up double digit, a result of increased volumes sold from

our North American operations to both domestic and international

customers and increases in selling price, partially offsetting raw

material cost increases. Data from USDA Broiler statistics and

market conditions now project that broiler chick placements and egg

sets will be slightly lower for the second half of 2011, as poultry

integrators continue to see weak prices and demand from the

domestic food service and retail markets served. Export

opportunities are expected to remain stable for this same period.

The ANH specialty ingredients, largely targeted to the

ruminant animal markets, realized approximately 25% sales growth

from the prior year comparable quarter, as regional US and certain

export markets showed improvement in dairy economics, supporting

greater demand for these products. Particularly strong were sales

of Reashure®, Nitroshure™ and Aminoshure-L®, our rumen protected

lysine. Sales of industrial grade products again realized

significant growth from the prior year comparable quarter, and

comprised approximately 35% of the sales in this segment for the

quarter. This improvement came from sales of various choline and

choline derivatives for industrial applications, including natural

gas fracking, as well as intermediate sales of our Italian-produced

methylamines. Earnings from operations for the entire ANH segment

increased approximately 12% to a quarterly record of $6.7 million

as compared to $6.0 million in the prior year comparable quarter.

This quarterly earnings result reflects favorable operating

efficiencies due to an overall 16% volume improvement in sales;

however, unfavorably impacted by increases in petro-chemical

commodities used to manufacture choline. Key raw materials again

rose at a very swift rate during the quarter, outpacing our pricing

initiatives. Additional price increases have been implemented in

the third quarter, as our products are likely to remain affected by

these higher costs for the balance of 2011.

The ARC Specialty Products segment generated record quarterly

sales of $12.0 million, an increase of 17.6% from the comparable

prior year quarter. This increase was principally the result of

strong volumes of ethylene oxide for medical device sterilization

and propylene oxide in support of the June 2010 acquisition of the

Aberco business, which targets nut meat and spice fumigation.

Earnings from operations for this segment, at $4.5 million,

improved 25.5% from the prior year comparable quarter due to

operating efficiencies from increased volumes and a favorable

product mix, which were also partially offset by increases in

petro-chemical commodities.

Sales of the Food, Pharma & Nutrition segment were $10.9

million, which was a modest 3.0% improvement over the prior year

comparable quarter. In the quarter, we did realize double digit

growth in sales of our human choline products for nutritional

enhancement. Food sector sales remained strong with steady sales of

encapsulated ingredients for baking, prepared food, preservation

and confection markets. Most notably, sales on a comparative

basis were unfavorably impacted by the previously announced

decision to sell our calcium product line. Earnings from

operations for this segment were $2.8 million which was even with

the prior year quarter, but up 13% sequentially from the first

quarter of 2011.

Consolidated gross margin for the quarter ended June 30, 2011

improved to $21.8 million, as compared to $19.1 million for the

prior year comparable period. Gross margin percentage declined

slightly to 29.1% of sales as compared to 31.1% in the prior year

comparative period, principally due to the previously mentioned raw

material cost increases. We did, however, realize a $2.6 million

increase, which was principally a result of a 15.4% increase in

consolidated sales volumes after giving effect to these cost

increases. We continue to leverage our plant capabilities, driving

efficiencies from core volume growth, broadening product

applications of our human and animal health specialty products into

both the domestic and international markets, as well as

capitalizing logistically on our varied manufacturing and

warehousing capabilities. Enhancing strategic technology and

capacity investments in our manufacturing facilities as required,

facilitates the growing, sustainable demand for certain products.

During the quarter, we successfully completed the de-bottlenecking

of our feed grade choline production capacity in St. Gabriel,

Louisiana and Verona, Missouri, which are both currently producing

at the expected increased levels. Operating (Selling,

R&D, and General and Administrative) expenses at $7.7 million

were up 15.4% from the prior year comparable quarter, particularly

related to increased amortization expense related to the Aberco

acquisition, an increase of employee headcount, other payroll

related expenses and consultancy fees incurred to study acquisition

opportunities. Operating expenses as a percentage of sales,

however, did decline to 10.3% from 10.9% in the prior year quarter

and expenses were only up 3% sequentially.

The company continues to maintain a healthy balance sheet with

diligent working capital controls, particularly effective inventory

and accounts receivable management. The $125 million of net working

capital on June 30, 2011 included a cash balance of $89.7 million,

up from $77.3 million at December 31, 2010, reflecting continued

strong cash flows.

Commenting on these second quarter results, Dino A. Rossi,

Chairman, CEO and President of Balchem said, "The second quarter

results continue to reflect a strong, diversified yet balanced

growth platform. While all three segments did not achieve record

levels, overall volume growth of 15% drove very exciting top line

growth. Escalating raw material costs continue to be a challenge,

but our methodology of actively advising customers about new

pricing is working well. This has led to some margin erosion

near-term, but we continue to aggressively negotiate raw material

sourcing and position to ultimately recapture the previous levels.

The volume growth has helped generate on-going plant efficiencies,

efficiencies required to meet strong growing global demand for our

products. In quarter three, we will be launching a couple of new

enhanced products for ANH Specialties, based on new innovative

process technology. These products were developed in response to

the marketplace need for more bio-available, economically effective

products. Our balance sheet continues to strengthen as we study

strategic opportunities to effectively leverage this asset for the

continued growth of all segments."

Quarterly Conference

Call

A quarterly conference call will be held on Wednesday, August 3,

2011 at 11:00 AM Eastern Time (ET) to review second quarter 2011

results. Dino A. Rossi, Chairman, President and CEO, and Frank

Fitzpatrick, Chief Financial Officer, will host the call. We invite

you to listen to the conference by calling toll-free 1-877-407-8289

(local dial-in 1-201-689-8341), five minutes prior to the scheduled

start time of the conference call. The conference call will be

available for digital replay through Wednesday, August 10, 2011. To

access the replay of the conference call, dial 1-877-660-6853

(local dial-in 1-201-612-7415), and use account #298 and replay ID

#376376. Both account and replay ID numbers are required for replay

access.

Segment

Information

Balchem Corporation consists of three business segments: ARC

Specialty Products; Food, Pharma & Nutrition; and Animal

Nutrition & Health. Through ARC Specialty Products, Balchem

provides specialty-packaged chemicals for use in healthcare and

other industries. The Food, Pharma & Nutrition segment provides

proprietary microencapsulation solutions to a variety of

applications in the human food, pharmaceutical and nutrition

marketplaces. The Animal Nutrition & Health segment

manufactures and supplies products to numerous animal health

markets and certain derivative products into industrial

applications.

Forward-Looking

Statements

This release contains forward-looking statements, which reflect

Balchem's expectation or belief concerning future events that

involve risks and uncertainties. Balchem can give no assurance that

the expectations reflected in forward-looking statements will prove

correct and various factors could cause results to differ

materially from Balchem's expectations, including risks and factors

identified in Balchem's annual report on Form 10-K for the year

ended December 31, 2010. Forward-looking statements are qualified

in their entirety by the above cautionary statement. Balchem

assumes no duty to update its outlook or other forward-looking

statements as of any future date.

| Selected Financial Data |

|

|

|

|

| ($ in 000's) |

|

|

|

|

| |

|

|

|

|

| Business Segment Net

Sales: |

|

|

|

|

| |

Three Months Ended June

30, |

Six Months Ended June 30, |

| |

2011 |

2010 |

2011 |

2010 |

| ARC Specialty Products |

$ 12,026 |

$ 10,222 |

$ 23,319 |

$ 19,890 |

| Food, Pharma & Nutrition |

10,897 |

10,583 |

21,927 |

20,549 |

| Animal Nutrition & Health |

51,764 |

40,653 |

102,449 |

80,922 |

| Total |

$ 74,687 |

$ 61,458 |

$ 147,695 |

$ 121,361 |

| |

|

|

|

|

| Business Segment Earnings

(Loss): |

|

|

|

|

| |

Three Months Ended June

30, |

Six Months Ended June 30, |

| |

2011 |

2010 |

2011 |

2010 |

| ARC Specialty Products |

$ 4,542 |

$ 3,618 |

$ 8,918 |

$ 6,930 |

| Food, Pharma & Nutrition |

2,832 |

2,847 |

5,344 |

4,828 |

| Animal Nutrition & Health |

6,685 |

5,976 |

13,095 |

11,177 |

| Interest and other income |

293 |

110 |

371 |

277 |

| Total |

$ 14,352 |

$ 12,551 |

$ 27,728 |

$ 23,212 |

| Selected Balance Sheet

Items |

|

|

| |

June 30, 2011 |

December 31, 2010 |

| Cash and Cash Equivalents |

$ 89,742 |

$ 77,253 |

| Accounts Receivable |

38,527 |

32,050 |

| Inventories |

18,887 |

15,720 |

| Other Current Assets |

4,304 |

4,629 |

| Total Current Assets |

151,460 |

129,652 |

| |

|

|

| Property, Plant, & Equipment

(net) |

44,894 |

43,388 |

| Other Assets |

53,608 |

55,584 |

| Total Assets |

$ 249,962 |

$ 228,624 |

| |

|

|

| Current Liabilities |

$ 26,924 |

$ 29,508 |

| Long-Term Obligations |

10,559 |

11,649 |

| Total Liabilities |

37,483 |

41,157 |

| |

|

|

| Stockholders' Equity |

212,479 |

187,467 |

| |

|

|

| Total Liabilities and Stockholders'

Equity |

$ 249,962 |

$ 228,624 |

CONTACT: Karin McCaffery, Balchem Corporation

Telephone: 845-326-5635

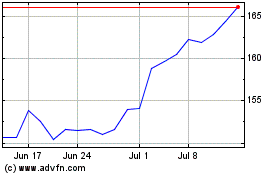

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From May 2024 to Jun 2024

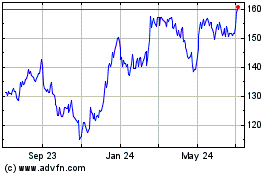

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Jun 2023 to Jun 2024