UPDATE: ADP 2Q Net Rises 21% On Improved Revenue; New Business Sales Up

January 25 2012 - 12:43PM

Dow Jones News

Automatic Data Processing Inc.'s (ADP) fiscal second-quarter

profit rose 21% as the payroll giant reported more small and

medium-sized businesses are turning to the company for its help in

overseeing human resources tasks.

With a hand in managing payroll for one in six U.S. employees,

ADP is widely recognized by its stamp on worker paychecks. Yet the

company also aims to offer businesses a slew of services beyond

payroll management, including benefits administration and

outsourcing of human resources chores.

After posting results that neatly matched analyst expectations,

Chief Financial Officer Christopher Reidy told Dow Jones Newswires

that some of the company's strongest growth is continuing to come

from the smaller end of the market. Many such firms, he noted, lack

a formal head of human resources or need extra help with compliance

duties.

Meanwhile, sales to larger companies are picking up, although at

a slower pace, he said.

"It's harder to get deals over the finish line," said Reidy.

"We're getting the growth, but it's not coming easily."

For the latest quarter, the company reported combined

new-business sales for employer services and professional employer

organization services--a key forward-looking metric for ADP--rose

14% from a year earlier. That jump prompted the company to raise

its full-year growth target for the gauge to 12%, up from the 8% to

10% growth previously predicted.

For the quarter ended Dec. 31, ADP reported a profit of $375

million, or 76 cents a share, up from a year-earlier profit of

$310.1 million, or 62 cents. Stripping out an 8-cent per-share

benefit related to the sale of a third-party expense management

platform, the company reported a per-share profit of 68 cents for

the quarter, meeting analyst expectations.

ADP also trimmed the high end of its full-year earnings target,

saying it now expects profit growth of 8% to 9% over last year due

to asset sales. The company had previously seen 8% to 10% earnings

growth for the year.

Total revenue in the latest quarter improved 7.4% to $2.58

billion, also matching analyst estimates. Revenue at the company's

employer-services segment, by far its largest, rose 7% to $1.83

billion. Its professional employer organization business, which

offers smaller companies help with human resources tasks, reported

a 16% jump in revenue to $413.8 million.

Gross margin narrowed to 41.2% from 42.6% due mostly to the drag

of low interest rates on the company' reinvestment of client funds.

The company cautioned it expects low interest rates to further

pressure earnings and margins throughout the remainder of its

fiscal year.

The number of employees on ADP's clients' payrolls in the U.S.

rose 2.8% during the period.

Shares were recently off 5 cents to $56.68. The stock is up

roughly 14% over the past 12 months.

-By Mia Lamar, Dow Jones Newswires; 212-416-3207;

mia.lamar@dowjones.com

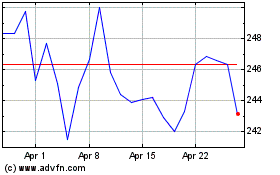

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From May 2024 to Jun 2024

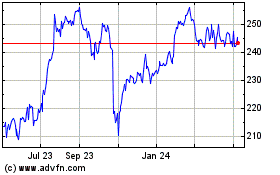

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jun 2023 to Jun 2024